-

MetaTrader 4 Brokers

The top MT4 brokers in AU

-

MetaTrader 5 Brokers

The best MT5 brokers in AU

-

TradingView Brokers

The best TradingView brokers

-

cTrader Brokers

The top cTrader brokers in AU

-

Forex Trading Apps

Trade on the go from your phone

-

Copytrading Brokers

Copy professional traders

-

All Trading Platforms

Find a platform that works for you

Last Updated On May 9, 2023

75-90% of retail traders lose money trading Forex and CFDs. You should consider whether you understand how CFDs and leveraged trading work and if you can afford the high risk of losing your money. We may receive compensation when you click on links to products we review. Please read our advertising disclosure. By using this website you agree to our Terms of Service.

Our verdict on Alpari

With a range of accounts on the MT4 and MT5 platforms, Alpari caters well to professional traders who are prepared to pay high minimum deposits for low ongoing trading costs. However, Alpari offers a limited number of tradable assets, which may leave some traders dissatisfied.

Alpari offers four live accounts on the MT4 and MT5 trading platforms. The Pro Account has spreads starting at 0.4 pips on the EUR/USD and no commission, making it one of the lowest-cost accounts in the industry. However, this is in exchange for a minimum deposit of 25,000 USD, putting it out of the reach of most traders. Alpari also offers an ECN account with a minimum deposit of 500 USD, and spreads of 0.4 pips with a commission of 3 USD (round turn), which may also appeal to experienced traders.

Alpari’s CFD offering is limited compared to other brokers, with 22 indices, 4 metals, 3 commodities, 10 share CFDs, and 4 cryptocurrencies, but it has over 60 Forex pairs for trading. One drawback for beginner traders considering opening an account at Alpari is the lack of educational and market analysis materials, forcing traders to self-educate elsewhere.

| 🏦 Min. Deposit | USD 5 |

| 🛡️ Regulated By | FSC |

| 💵 Trading Cost | USD 17 |

| ⚖️ Max. Leverage | 1000:1 |

| 💹 Copy Trading | Yes |

| 🖥️ Platforms | MT4, MT5 |

| 💱 Instruments | Commodities, Forex, Indices, Metals, Shares |

Overall Summary

Account Information

Trading Conditions

Company Details

Pros

- Wide range of assets

- Great platform choice

- Low minimum deposit

Cons

- Limited education

- Limited market analysis

- Expensive withdrawals

Is Alpari Safe?

Yes, Alpari is a safe broker for Australians to trade with. It maintains regulation from the Financial Services Commission of Mauritius, the Financial Services Authority of the Seychelles, and is also incorporated in Saint Vincent and the Grenadines.

Alpari Group has been a global FX and CFD broker since 1998 and according to its website, has over two million customers worldwide. Alpari maintains regulation from the Financial Services Commission of Mauritius and the Financial Services Authority of Seychelles. It is also incorporated in Saint Vincent and the Grenadines. See below for more details:

- Alpari International has been regulated by the Financial Services Commission of Mauritius (License C113012295) under the name Exinity Limited since 2013. Exinity Limited (www.forextime.com) is regulated by the Financial Services Commission of the Republic of Mauritius with an Investment Dealer License bearing license number C113012295.

- Alpari Limited, Suite 305, Griffith Corporate Centre, Kingstown, Saint Vincent and the Grenadines, is incorporated under registered number 20389 IBC 2012 by the Registrar of International Business Companies, registered by the Financial Services Authority of Saint Vincent and the Grenadines.

- FT Invest Ltd is regulated by the Financial Services Authority of Seychelles with Securities Dealer license number SD026.

Australians will be trading under the subsidiary, Alpari International, regulated by the Financial Services Commission (FSC) of Mauritius. Although not considered one of the best international regulators, the FSC mandates that Alpari segregates all client funds from its operating capital in top-tier banks and adheres to strict financial standards. It also ensures that Alpari provides Australian traders with negative balance protection so that they can never lose more than is in their trading accounts.

Alpari has also been a member of The Financial Commission since 2013. Based in Hong Kong, the Financial Commission is an independent international body specialising in the resolution of disputes between Forex brokers and traders. The fund provides investor protection up to 20,000 EUR per case, placing it on par with similar funds offered by EU-based regulators.

Overall, because of its long history of responsible behaviour, FSC regulation, strict internal processes, and the fact that Alpari participates in a compensation scheme, we consider Alpari a trustworthy broker for Australians to trade with.

Trading Fees

Alpari’s trading fees are higher than average on its instant execution accounts, but competitive on its market execution accounts.

Alpari offers four live accounts, including two commission-free instant execution accounts, a market execution ECN account with a commission per lot, and a commission-free pro account with no commissions and extremely tight spreads, but with a very high minimum deposit requirement.

Alpari’s accounts were assessed to compare the costs to those of other forex brokers. The costs were evaluated based on the trading fees on one lot (100 000 USD) on the EUR/USD, including the spreads and commission.

When making this calculation, we used one lot of EUR/USD as a benchmark as it is the most commonly traded currency pair and it usually has the tightest spread.

Trading Cost Formula: Spread x Trade Size + Commission = Cost in Secondary Currency (USD):

Alpari derives most of its revenue from spreads and commissions. As you can see from the table above, the trading costs on the commission-free Micro and Standard MT4 Accounts are 17 USD and 12 USD, respectively. The trading costs on most other brokers’ entry-level accounts tend to be around 10 USD, making these rather expensive options.

However, the commission-based ECN Account has a minimum spread of 0.4 pips in exchange for a round turn commission of 3.00 USD, making it one of the most competitive offers available. Alpari’s Pro Account, a commission-free account with spreads that start at 0.4 pips on the EUR/USD makes it one of THE lowest cost accounts in the industry, but with a minimum deposit of 25,000 USD, it will be inaccessible to most traders.

Swap Fees

Another cost to consider are the swap fees for holding a position open overnight. A swap is the interest paid on leveraged positions. When trading a currency, you are borrowing one currency to purchase another. The swap interest fee is calculated based on the difference between the two interest rates of the traded currencies.

For example, Alpari charges a swap fee of 1.0.1 on a short position and -0.67 on a long position.

Overall, Alpari’s trading fees are higher than average on its instant execution accounts, but extremely competitive on its market execution accounts, however, these require high minimum deposits.

Alpari’s Non-trading Fees

Alpari’s non-trading fees are average compared to other similar brokers.

Some of the most overlooked trading costs are the non-trading fees that are charged by brokers. These fees can significantly affect your profitability and so should be carefully scrutinised.

Alpari does not charge fees for deposits, but it charges relatively high withdrawal fees, depending on the method (click here for more on Alpari’s deposits and withdrawals). for example, a fee of 2 EUR/ 3 USD/ 2 GBP is charged for withdrawals via debit cards/credit cards.

Alpari also charges an inactivity fee of 5 USD per month after six months of account dormancy, which is well below that of its competitors that charge at least twice that much after only half the time.

Opening an Account at Alpari

Opening a trading account at Alpari is a fully digital process and is hassle-free compared to other brokers.

All Australian traders can open an account at Alpari but will need to meet all the minimum deposit amounts to do so; these are:

-

Forex Micro Account: 5 USD

-

Forex Standard Account: 100 USD

-

Forex ECN Account: 500 USD

-

Forex Pro Account: 25,000 USD

Creating an account is straightforward, the process is fully digital, and accounts are usually ready within one to two business days.

How to open an account at Alpari:

-

First, click on “Register.”

-

Alpari’s intake form requires clients to fill in their personal details, including name, country of residence, email address, and to provide a telephone number so that Alpari can send a verification PIN code.

-

Clients are then required to fill in their financial information, employment status and answer questions about their trading knowledge.

-

Clients are required to choose their preferred trading account, trading account currency (click here for more on Alpari’s base currencies), level of leverage, and choose a trading account password.

-

Accounts are immediately available for trading, and traders can make a deposit.

-

In order to withdraw funds, Alpari requires individuals to submit a copy of their National ID or Passport with the signature page, as well as a copy of a recent utility bill or bank statement.

-

Documents can be scanned or sent through as a high-quality digital camera picture.

-

We advise you to read Alpari’s risk disclosure, customer agreement, and terms of business before you start trading.

Overall, Alpari’s account-opening process is fully digital and hassle-free – new traders will be especially happy that they can start trading right away without having to wait for account verification.

Alpari’s Account Types

Like most other brokers, Alpari offers four live accounts with higher minimum deposits linked to tighter spreads and better trading conditions, making them suitable for beginners and more experienced traders.

Alpari has two instant execution Standard Accounts and two market execution ECN Accounts. The ECN Accounts are more suited to experienced traders, with higher minimum deposits, low ongoing trading costs, and access to the MT5 platform. The Standard accounts have lower minimum deposits, and while no commissions are charged, spreads are wider than average.

Alpari’s accounts are suitable for beginners and more experienced traders. We define beginner traders as inexperienced traders who have never traded before or have been trading for less than a year. Beginners often do not want to risk trading large sums of money, and will generally not be able to trade full-time during the workweek.

Alpari’s Micro Account has a minimum deposit requirement of 5 USD, and allows trading in smaller trade volumes (micro-lots) making it accessible to beginner traders.

In general, experienced traders tend to prefer accounts with higher minimum deposits and tighter spreads. Alpari’s ECN accounts would be more suitable for experienced traders. The Forex ECN Account has a minimum deposit requirement of 500 USD and spreads starting at 0.4 pips (EUR/USD) in exchange for a round turn commission of 3 USD. The minimum deposit on the Pro Account is 25,000 USD, but spreads start at just 0.4 pips (EUR/USD) and no commissions are charged, making it one of the lowest-cost trading accounts in the industry.

Alpari offers support for the MT4 and MT5 trading platforms, in addition to its proprietary copy trading system, and allows all trading strategies, including hedging, and scalping. Leverage is floating except on the Micro Account and swap-free accounts are available across all account types (though restricted to the MT4 platform). Demo accounts are available but not for the Micro Account or ECN Pro Account. See below for more details:

Standard Accounts

There are two standard accounts at Alpari and both use instant order execution, and are only available on the MT4 platform. Spreads are generally wider than market execution accounts, but no commission is charged, and both are available as swap-free accounts.

Standard Account – This account type requires a 100 USD/EUR/GBP minimum deposit. Spreads start at 1.2 pips (EUR/USD), which is wider than the spreads on other brokers’ entry-level accounts, and the margin call is set at 60%. With this account, you will be able to trade 61 Forex pairs as well as spot metals and spot CFDs. Leverage is floating, but the upper limit is 1:1000, which is risky and could see accounts wiped out. If you are a new trader, we would recommend setting your leverage much lower.

Micro Account – This is an entry-level account, with a minimum deposit of only 5 USD/EUR/GBP. Spreads are wide, starting at 1.7 pips (EUR/USD), and the margin call is set at 50%. You are limited to trading only 25 Forex pairs (no exotics) and spot metals. Leverage is fixed at 1:400, which is still quite high, so be aware of this before you start trading. The real advantage of this account is the tiny minimum deposit, and the ability to trade in micro-lots, but if you can afford it, we would recommend opening the Standard Account instead, as spreads are tighter.

ECN Accounts

The two ECN accounts at Alpari use market execution and the Forex ECN account supports MT5 as well as MT4, though the MT5 platform will not support Islamic/swap-free accounts. As with all ECN accounts, spreads are much tighter.

ECN Account – This account requires a minimum deposit of 500 USD/EUR/GBP and offers spreads starting from 0.4 pips (EUR/USD). The commission is 1.5 USD/lot per side and leverage is floating from 1:1000. If you use this account on the MT4 platform, you will also be able to trade a limited number of cryptocurrencies. Should traders decide to trade on the MT5 platform, the number of assets will be limited, for example, there are 33 currency pairs available, instead of the 56 available on MT4, but it will give you access to everything MT5 has to offer (economic calendar, built-in chat function, market depth, more indicators and signals, deeper back-testing, etc.)

Pro Account – This account is made for professional traders only and requires a minimum balance of 25,000 USD/GBP/EUR at all times. No commission is charged on trades and spreads are as low as 0.4 pips. Leverage is floating with an upper limit of 1:300, and the margin call is set at 120%. The only real downside to this account is that it is no supported on the MT5 platform.

Demo accounts – Demo accounts are only available for the Standard and ECN account options. Virtual funds can be topped up on request and demo accounts do not expire unless no trading takes place for over 14 days, in which case it is deleted. However, traders can open a new demo account should this occur.

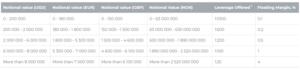

Leverage requirements

Before you begin your trading journey, it’s very important that you understand Alpari International’s margin requirements. Based on the margin requirement for the specific account, you can also calculate the maximum leverage you’ll be able to wield whilst trading. Having a clear picture of the right margin requirements prior to your trade allows you to apply good risk management. Not enough funds in your account could prompt a margin call which, in turn, could lead to the closing of a position and account wipeouts. The margin requirements on demo accounts mimic those on the live accounts.

For example, the following margin requirements apply to Forex:

Overall, Alpari offers a range of accounts with higher minimum deposits linked to lower ongoing trading costs and increasing account benefits, which are suitable for beginners and more experienced traders.

Deposits and Withdrawals

Alpari offers a wide variety of deposit and withdrawal methods, but its withdrawal fees are higher than other similar brokers.

A well-regulated broker, Alpari ensures that all Anti-Money Laundering rules and regulations are followed. As such, all non-profit funds are returned to the original deposit source. No matter your deposit method, the withdrawal of all profits must be made by bank transfer to a bank account in your name.

Alpari offers a number of deposit and withdrawal methods, including credit cards/debit cards, bank transfers, and e-wallets such as Bitcoin, Skrill, Neteller, Webmoney, and Perfect Money.

Deposits are generally processed instantly, except for bank transfers, which can take up to 3 – 5 days, and withdrawals are processed within 24 hours. No fees are charged for deposits, but a withdrawal fee may apply, depending on the method. Of particular note is the fee for bank wire transfers, which costs 30 EUR per transaction.

See below for more details:

Overall, Alpari provides various payment methods, and its processing times are quicker than other similar brokers. The main drawback is that fees are charged on most withdrawal types.

Base Currencies (Trading account Currencies)

Alpari offers a limited number of base currencies compared to its competitors, and it does not offer AUD accounts.

At Alpari, you can only choose from four base currencies: USD, EUR, GBP, and NGN. NGN is only available for Nigerian residents.

This is a disadvantage for Australians who will likely have bank accounts denominated in AUD and will thus have to pay conversion fees. Conversion fees can make trading very expensive and are usually not presented on the fee report but affect your profitability.

For traders that trade in large volumes (more than 10 lots a month), it is better to open an account denominated in USD, especially for trading on assets such as the EUR/USD. This is because when trading a USD quoted currency pair with another currency account, there will be a small conversion fee for every trade made.

Alpari’s Trading Platforms

With both MT4 and MT5 on offer, Alpari’s platform support is average compared to other Forex brokers.

Alpari offers support for MT4 – the most popular trading platform globally – and MT5 – the latest version of the industry standard. In addition to the desktop applications, Alpari also offers MT4 and MT5 WebTerminal, which are browser-based versions of the platforms, along with mobile and tablet versions of both iterations. The advantages of using MT4 are numerous, but most centre around the community support and the number of users that the tool boasts.

The new and updated version of MT5 boasts state-of-the-art features including options for hedging, while MT4 is slightly less advanced and more suited to traders who are new to the markets. MT5 also has a built-in news feed and an economic calendar, and trades can be made on a chart.

Metatrader 4

Developed by MetaQuotes in 2002, MT4 is still the most popular CFD trading platform in the world. Although the platform’s interface is now dated, MT4 is still widely recognised for its fast execution speeds, wide range of charting tools, algorithmic trading, and customisability. Other features of MT4 include:

-

Supports the creation, modification, and utilisation of automated trading strategies.

-

Supports MQL4 programming language.

-

Algorithmic trading, which allows any trading strategy to be formalised and implemented as an Expert Advisor.

-

Allows traders to develop their own custom indicators.

-

Superior charting tools in nine timeframes

-

31 graphical objects

-

30 built-in indicators

-

9 timeframes

-

Three order execution types.

-

Four types of pending orders

Metatrader 5

MT5 is more powerful and faster than MT4, especially when it comes to back-testing functionality for automated trading algorithms. MT5 also has a built-in news feed, market depth indicator, economic calendar, and trades that can be made on charts. Additional features of MT5 include:

-

21 timeframes

-

38 technical indicators

-

44 graphical objects

-

Six pending order types

-

Multi-threaded strategy tester

-

Economic Calendar

-

MT5 allows traders to chat with other traders directly on the platform.

The benefit of brokers offering third-party platforms such as MT4 and MT5 is that traders can use the platforms should they choose to migrate to another broker. However, MT4 and MT5 are often not as user-friendly as platforms that are developed in-house.

Note that MT4 and MT5 are only available on Windows PCs.

Mobile Trading

Alpari’s mobile trading platforms are average compared to other Forex brokers.

MT4 and MT5 are freely available on both Android and IOS mobile phones and tablets. The advantage of using the MetaTrader platform is the cross-device and multi-broker functionality, making it easier to change brokers or use multiple brokers.

Alpari’s MT4 and MT5 apps allow traders to work from anywhere, with nine timeframes, 30 indicators, and interactive currency charts. Functionality to close and modify existing orders, calculate profit/loss in real-time, and tick chart trading further empowers traders while on the move.

Trading Tools

Alpari’s trading tools are severely limited compared to other similar brokers.

Alpari offers virtually no trading tools to help traders make better decisions, however, it offers a copy trading service.

Alpari CopyTrade allows you to copy the trading positions of other traders, which Alpari calls Strategy Managers. This is especially useful for new traders who want to start profiting from the market while they are still learning, as you don’t need any advanced knowledge of forex trading to get started. Strategy Managers usually have a wealth of experience in the markets, with tried-and-tested strategic trading decisions. Once you decide whom to follow, you can subscribe to their trades and pay them a percentage of whatever profits you make.

Overall, although Alpari offers an excellent copy trading service, it lacks other analysis tools, such as Autochartist, Trading Central, and Trading View that are often available at other brokers.

Alpari’s Financial Instruments

Alpari’s CFD offering lags behind many of its competitors. This holds true for its stock CFD offering, in addition to the number of commodities on offer. It also lacks products such as futures, bonds, and ETFs.

Alpari offers trading on multiple assets, including forex, commodities, indices, metals, and cryptocurrencies (click here for more on CFD trading). See below for more details:

-

Forex pairs: Alpari offers 60 Forex pairs to trade, including majors, minors, and exotics. This is around the average number of pairs offered by most brokers. Maximum leverage is 1:1000 but limited to 400:1 on the Micro Account.

-

Spot Metals: Alpari offers five silver and gold crosses with the EUR, USD, and GBP. This is an average selection of metals compared to other brokers. Maximum leverage is 1:500 on spot metals.

-

Spot Indices: Alpari offers 22 spot indices, including the UK100, Dax30, AUS200, and the Wall Street 30 (Mini). This is a broad range of indices compared to other brokers. Maximum leverage is 1:500 on spot indices.

-

Stock CFDs: FXTM offers 10 stock CFDs to trade, including Apple, Amazon, Berkshire Hathaway, and Microsoft, among others. This is extremely limited compared to what is offered by other similar brokers. Maximum leverage is up to 1:500.

-

Commodities: Alpari offers three of the most common spot commodities to trade, including UK Brent, US Crude, and US Natural Gas. Maximum leverage is 1:200.

-

Cryptocurrencies: Alpari offers four crypto-fiat crosses for trading, including Bitcoin, Ethereum, Ripple, and Litecoin. Maximum leverage is higher than is seen at other brokers, up to 100:1.

Overall, Alpari’s range and depth of trading instruments are limited compared to many other brokers.

Alpari For Beginners

Alpari has a brief but helpful education section but no analysis to speak of, apart from what is included in the platforms.

Educational Material

Alpari International offers a short educational section which will be very useful for beginners with little experience trading. Unfortunately, there are no video tutorials or webinars on offer at the moment, although Alpari dedicates a page on its website to webinars.

The written material available is mainly composed of a Beginners Guide to Forex Trading. This includes an explanation of the main concepts involved in Forex trading and a glossary of the most commonly used terms. It’s capped off with an introduction to the different types of charts used by traders.

Accompanying the Beginner’s Guide is an introduction to trading strategies, which is useful for familiarising yourself with the ideas and terms used when developing a trading plan.

Analysis Material

Alpari supports the newest iteration of the popular MetaTrader platform, MetaTrader 5 (MT5). MT5 has a built-in economic calendar to keep track of important events in the financial world and live a market depth tracker, which is an excellent way to keep track of other traders’ moves in the market. However, most other brokers offer daily insights written by their team of in-house analysts, which is unavailable at Alpari.

Customer support

Like most brokers, Alpari offers 24-hour support from Monday to Friday. But, unusually, Alpari also offers customer support from 12:00 – 20:00 (all hours GMT+2/3) on weekends. This is very welcome and something we wish more brokers would do. Help is available via live chat, Telegram, phone, email, and the myAlpari hub.

Please note that the Deposit/Withdrawal customer service team only works from 02:00 – 20:00 during the week and from 13:00 – 17:00 on Saturday.

For the purposes of this review, we found the customer service responsive and well-informed.

Evaluation Method

We value transparency and openness in the way we review the partners. To bring transparency to the forefront, we have published our review process that includes a detailed breakdown of the Alpari offering. Central to that process is the evaluation of the reliability of the broker, the platform offering of the broker, and the trading conditions offered to clients, which are summarised in this review. Each one of these is graded, and an overall score is calculated and assigned to the broker.

Alpari Risk Statement

Trading Forex is risky, and each broker is required to detail how risky the trading of Forex CFDs is to clients. Alpari would like you to know that:

Contracts for Difference (‘CFDs’) are complex financial products and not suitable for all investors. CFDs, are leveraged products that mature when you choose to close an existing open position. By investing in CFDs, you assume a high level of risk and can result in the loss of all of your invested capital.

Overview

Alpari is a large international broker with a long history in the industry. Though there is little educational material currently available and analysis is thin, the trading conditions and account options are second to none. This is backed up by excellent and responsive customer support and support for the industry-leading MT4 and MT5 platforms.

Editorial Team

Chris Cammack

Head of Content

Chris joined the company in 2019 after ten years experience in research, editorial and design for political and financial publications. His background has given him a deep knowledge of international financial markets and the geopolitics that affects them. Chris has a keen eye for editing and a voracious appetite for financial and political current affairs. He ensures that our content across all sites meets the standards of quality and transparency that our readers expect.

Alison Heyerdahl

Senior Financial Writer

Alison joined the team as a writer in 2021. She has a medical degree with a focus on physiotherapy and a bachelor’s in psychology. However, her interest in forex trading and her love for writing led her to switch careers, and she now has over eight years experience in research and content development. She has tested and reviewed 100+ brokers and has a great understanding of the Forex trading world.

Ida Hermansen

Financial Writer

Ida joined our team as a financial writer in 2023. She has a degree in Digital Marketing and a background in content writing and SEO. In addition to her marketing and writing skills, Ida also has an interest in cryptocurrencies and blockchain networks. Her interest in crypto trading led to a wider fascination with Forex technical analysis and price movement. She continues to develop her skills and knowledge in Forex trading and keeps a close eye on which Forex brokers offer the best trading environments for new traders.

Vanessa Marcos

Financial Writer

Vanessa joined the team in 2023. Born and raised in southern Portugal, she has a BA in Journalism and a Master’s in Literary Theory, both from Lisbon University. Since 2011, she has worked in social media, copywriting, content management, ghost-writing, and SEO. Vanessa loves to write, and although she is a generalist in digital marketing, she always draws on her creativity in her work. She is constantly researching new subjects and finds the analytical depth of Forex trading fascinating.

Compare Brokers

Find out how Alpari stacks up against other brokers.

Stay updated

This form has double opt in enabled. You will need to confirm your email address before being added to the list.

Session expired

Please log in again. The login page will open in a new tab. After logging in you can close it and return to this page.

What is the difference between Alpari.org and Alpari.com??

Hi Robert, the only real difference is the regulatory status. Alpari.org is regulated in Mauritius and Alpari.com is registered in St Vincent and the Grenadines. We recommend using Alpari.org as the Mauritius FSC provides a better regulatory environment.