-

MetaTrader 4 Brokers

The top MT4 brokers in AU

-

MetaTrader 5 Brokers

The best MT5 brokers in AU

-

TradingView Brokers

The best TradingView brokers

-

cTrader Brokers

The top cTrader brokers in AU

-

Forex Trading Apps

Trade on the go from your phone

-

Copytrading Brokers

Copy professional traders

-

All Trading Platforms

Find a platform that works for you

| 🏦 Min. Deposit | AUD 50 |

| 🛡️ Regulated By | FCA, ASIC, CySEC, FSA-St-Vincent |

| 💵 Trading Cost | USD 13 |

| ⚖️ Max. Leverage | 30:1 |

| 💹 Copy Trading | Yes |

| 🖥️ Platforms | MT4, TradeStation |

| 💱 Instruments | Bonds, Commodities, Cryptocurrencies, Energies, Stock CFDs, Forex, Indices, Metals |

Last Updated On February 6, 2024

75-90% of retail traders lose money trading Forex and CFDs. You should consider whether you understand how CFDs and leveraged trading work and if you can afford the high risk of losing your money. We may receive compensation when you click on links to products we review. Please read our advertising disclosure. By using this website you agree to our Terms of Service.

Our verdict on FXCM

FXCM may appeal to high-volume traders who appreciate a wide platform choice and an extensive suite of advanced trading tools. However, its fixed leverage, high trading costs, high currency conversion fees, and high interest rates on accounts that go into a negative balance may deter some traders.

A well-regulated broker, FXCM offers an average number of financial instruments compared to other brokers, including Forex, commodities, indices, share CFDs, and cryptocurrencies. FXCM’s single account has a minimum deposit of 50 USD and average spreads of 1.3 pips (EUR/USD), which is wider than other brokers. Clients with a notional trading volume of more than 10 million USD per month are eligible for rebates, dedicated customer support, free VPS services, and free access to multiple APIs.

FXCM ‘s range of trading platforms includes MT4, various advanced speciality platforms, and FXCM’s award-winning proprietary platform, Trading Station. It also offers numerous trading tools, including various API tools, TradingView, Zulutrade, and a host of FXCM apps.

| 🏦 Min. Deposit | AUD 50 |

| 🛡️ Regulated By | FCA, ASIC, CySEC, FSA-St-Vincent |

| 💵 Trading Cost | USD 13 |

| ⚖️ Max. Leverage | 30:1 |

| 💹 Copy Trading | Yes |

| 🖥️ Platforms | MT4, TradeStation |

| 💱 Instruments | Bonds, Commodities, Cryptocurrencies, Energies, Stock CFDs, Forex, Indices, Metals |

Overall Summary

Account Information

Trading Conditions

Company Details

Pros

- Well regulated

- Great platform choice

- Excellent education

- Innovative trading tools

Cons

- Limited demo account

Is FXCM Safe?

Yes, FXCM is a safe broker for Australians to trade with. It maintains regulation from ASIC in Australia, the FCA of the UK, the FSCA of South Africa, and CySEC of Cyprus.

FXCM has been a global FX and CFD broker since 1999. Headquartered in London, FXCM is regulated by numerous top-tier authorities, including the Financial Conduct Authority (FCA) UK, the Australian Securities and Investments Commission (ASIC), the Cyprus Exchange and Securities Commission (CySEC), the Financial Sector Conduct Authority (FSCA) South Africa.

See below for a list of FXCM’s registered companies:

- Stratos Trading Pty. Ltd has been regulated by ASIC, license: 309763, since 2007.

- Stratos Markets Ltd has been regulated in the United Kingdom by the FCA, license: 217689, since 2003.

- Stratos South Africa (Pty) Limited has been regulated by the FSCA in South Africa, FSP No 46534, since 2016.

- Stratos Europe Ltd is authorised and regulated by the CySEC under license number 392/20.

- Stratos Global LLC is incorporated in St Vincent and the Grenadines, which does not regulate Forex brokers or otherwise provide licences to financial service providers.

Australian traders will be trading under the subsidiary Stratos Trading Pty Ltd, which is regulated by ASIC. One of the world’s best regulators, ASIC, ensures that FXCM segregates all client funds from the company’s operating capital. Australian traders are also afforded negative balance protection, which means that retail clients will never lose more than the total funds invested in their trading account. Additionally, under ASIC regulation, leverage is restricted to 30:1, and FXCM is prevented from offering its traders bonuses and promotions.

Overall, because of its strong international regulation, segregation of client funds, and history of responsible behaviour, we consider FXCM a safe broker to trade with.

FXCM’s Trading Fees

FXCM‘s trading fees are higher than other similar brokers.

Unlike other brokers that offer a range of accounts with higher minimum deposits linked to tighter spreads, FXCM offers one commission-free Standard account with wide spreads and an Active Trader programme. In order to become an active trader, clients must qualify to become professional traders. They must also meet the minimum combined notional volume of USD 10 Million on a monthly basis.

Unfortunately, FXCM has not made the average spreads and data on individual currency pairs available, which is unusual for a large broker.

FXCM’s accounts were assessed to compare the costs to those of other forex brokers. The costs were evaluated based on the trading fees on one lot (100 000 USD) on the EUR/USD, including the spreads and commission.

When making this calculation, we used one lot of EUR/USD as a benchmark as it is the most commonly traded currency pair and it usually has the tightest spread.

Trading Cost Formula: Spread x Trade Size + Commission = Cost in Secondary Currency (USD):

As per the table above, FXCM offers one live account with trading costs included in its variable spreads. This means that the spread will fluctuate and get wider or tighter depending on trading volume and market volatility. Overall, at 13 USD per lot traded, FXCM’s trading costs are higher than the industry average. The trading costs on the EUR/USD at other good brokers tend to be around 9 USD per lot traded.

Swap Fees

Another important cost to consider is the swap rate charged on positions held overnight. Interest is paid (or received) for each night a position is held. When trading a currency, you are borrowing one currency to purchase another. The swap interest fee is calculated based on the difference between the two interest rates of the traded currencies. Unfortunately, FXCM does not publish the swap fees on its website.

The formula for financing cost is as follows:

[Closing Price of the Index * [(the relevant 1-month LIBOR or SONIA rate/100) +- FXCM’s Markup]/Number of Days] * Trade SizeNote that the financing markup for long positions on CFDs is +3% and for short positions is -3% for US Libor instruments and -2.5% for other instruments.

To account for holding a position into the weekend, there is a 3X rollover on Wednesdays for XAU/USD and XAG/USD and 3X rollover on Fridays for other CFD products. Additionally, there is no rollover on holidays, but an extra days’ worth of rollover before the holiday.

Overall, the trading costs and swap fees at FXCM are higher than other brokers.

Non-trading Fees

FXCM’s non-trading fees are significantly higher than other similar brokers.

Some of the most overlooked trading costs are the non-trading fees that are charged by brokers. These fees can significantly affect your profitability and so should be carefully scrutinised.

While FXCM does not charge deposit or account fees, it charges high withdrawal fees on some payment methods and an inactivity fee. For example, a withdrawal fee of 40 USD is charged for bank wire transfers to client accounts outside the US or UK.

An inactivity fee of 50 USD per year is charged after 12 months of inactivity, and once the account balance becomes zero, the account will be closed.

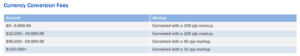

Currency conversion fees are also charged at a rate of between a 10 to 150 pip mark-up, depending on trading volume. See below for details:

Overall, these are some of the highest non-trading fees in the industry, and clients should be aware of these costs before opening an account with FXCM.

Opening an Account at FXCM

The account-opening process at FXCM is fully digital, but the process is slower than at other brokers.

Australian traders are eligible to open an account at FXCM, but need to meet the minimum deposit requirement of 50 USD.

FXCM offers individual, joint, and corporate accounts, but we will focus on opening an individual account:

1. Click on the “Open Account” button on the home page.

2. Traders are required to select their country of residence and trading platform (click here for more on FXCM’s trading platforms).

3. Traders are then directed to FXCM’s secure server to complete the online application. this requires filling in one’s name, email address, and selecting their preferred base currency (click here for more on FXCM’s base currencies). Traders are also required to fill in their contact information, employment status, and financial status.

4. The next step requires creating a password and agreeing to FXCM’s terms of service.

5. Lastly, traders are required to upload documents to verify one’s identity and residency. You can upload a copy of your ID/passport for verifying your identity, and a bank statement/utility bill for verifying your residency.

Overall, FXCM’s account-opening process is fully digital, but it takes longer than usual for the support team to verify one’s account.

FXCM’s Account Types

FXCM offers one live account, which is limited compared to other brokers, but its account is suitable for beginner traders.

A market maker, FXCM offers trading on multiple assets, including Forex, cryptocurrencies, indices, commodities, shares Forex baskets, and share baskets (click here for more on FXCM’s financial instruments).

FXCM offers a single live commission-free account for Forex and CFD trading. However, with higher minimum deposits, traders get access to the Active Trader Programme, where traders receive monthly rebates based on their trading volume. Traders must qualify for professional trader status in order to become Active Traders.

FXCM offers support for the MT4 and the Trading Station platform, in addition to Zulutrade, and allows all trading strategies, including hedging, scalping, and copy trading. FXCM also offers Islamic swap-free accounts.

FXCM’s Standard Account has a minimum deposit requirement of 50 USD, making it accessible to beginner traders.

We define beginner traders as inexperienced traders who have never traded before or have been trading for less than a year. Beginners often do not want to risk trading large sums of money, and will generally not be able to trade full-time during the workweek.

In general, experienced traders tend to prefer accounts with higher minimum deposits and tighter spreads, but this is not available at FXCM. However, traders who trade in high volumes may be interested in participating in the Active Trader Programme which offers rebates and more account benefits, but this requires a notional monthly trading volume of over 10 million USD and professional trader status.

Due to ASIC regulations, Australian traders can access leverage of up to 30:1 on Forex and 10:1 on indices and commodities. See below for account details:

FXCM offers an unlimited demo account and a single live account, which can be upgraded to a ‘Professional’ account.

Standard Account

The Standard Account is a commission-free account with a minimum deposit of 50 USD, FX leverage of up to 30:1, and CFD leverage up to 10:1. Spreads are slightly wider than other similar brokers, averaging at 1.3 pips on the EUR/USD, but no commissions are charged. Traders also have the option of becoming Professional Traders.

Professional Account

Pro trader is an account status achieved by fulfilling the following criteria:

- The trader has carried out transactions, in significant size, on the relevant market at an average frequency of 10 per quarter over the previous four quarters;

- Has a financial portfolio exceeding 2,5 million AUD; and

- Has worked in the financial sector for at least one year in a professional position, which requires knowledge of the products to be traded.

Professional traders are offered leverage of up to 400:1 on major pairs, and 200:1 on other CFDs. Pro traders are also offered tighter spreads based on trading volume, but this must be discussed with your account manager. Note that professional traders are not afforded negative balance protection.

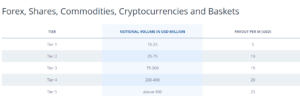

Active Trader Account

Active Trader status is achieved by maintaining a trading volume of over 10 million USD, which can be achieved with a minimum deposit amount of 25,000 USD (in combination with leverage). Benefits of the Active Trader programme include rebates of between 5 – 25 USD per million traded. See below for details:

Active traders also receive dedicated customer support, two free expedited withdrawal requests per month, free access to multiple APIs, complimentary VPS hosting (dependent on the tier), and free access to high-end institutional derived FX data through an eFXplus premium subscription.

Demo Account

FXCM offers a demo account that is loaded with 5000 USD in virtual money and expires after 30 days of inactivity. Traders can practice trading on FXCM’s platforms, including Trading Station and MT4.

Deposit and Withdrawal Fees

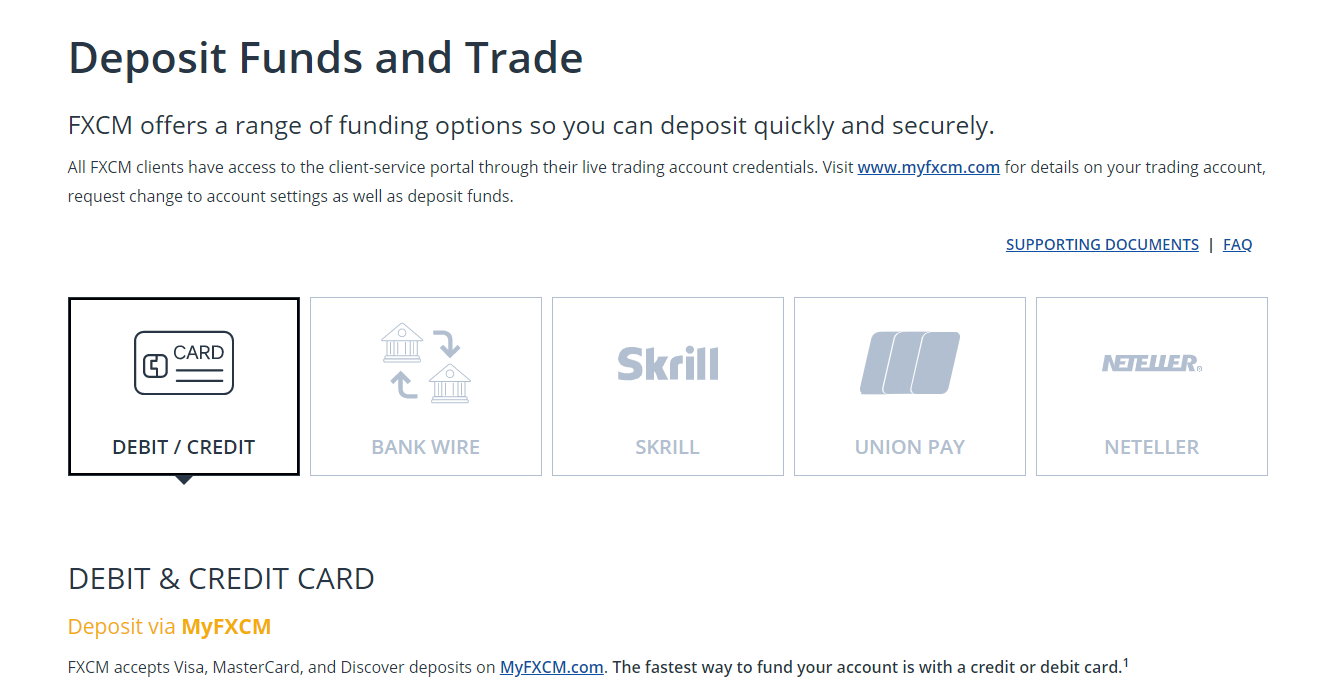

FXCM offers a range of funding and withdrawal methods, but processing times are slower than other brokers, and high fees are charged for withdrawal via bank transfer.

A well-regulated broker, FXCM ensures that all Anti-Money Laundering rules and regulations are followed, and as such, all withdrawals are returned to the deposit source.

Australians can deposit and withdraw funds either by credit/debit card, Skrill, Neteller, or via an EFT/Bank Wire Transfer. FXCM does not charge administration fees for deposits via credit card, debit card, and bank transfer. There are also no withdrawal fees for credit or debit card transfers, but bank wire withdrawals incur a fee of 40 USD.

Deposits via bank transfer can take several business days to land in a trading account, while credit card/debit card and e-wallet transfers are instant.

Withdrawal by bank transfer takes 3 – 5 days to be processed, and credit/debit cards and e-wallets are processed within 24 hours.

How do you withdraw money from FXCM?

- Log in to your account through myfxcm.com

- Once logged in, click on ‘Withdraw Funds’

- Select your preferred withdrawal method

- Specify the amount you wish to withdraw

- Re-enter your password for security reasons and review your withdrawal

See below for more details:

Overall, FXCM charges high withdrawal fees on bank transfer withdrawals, and its processing times are slower than other similar brokers.

Base Currencies (Trading Account Currencies)

FXCM offers fewer base currencies than other large international brokers, and it charges high currency conversion fees.

FXCM only offers accounts denominated in USD, AUD, and NZD to Australian traders. This is an advantage for Australian traders who will likely have bank accounts denominated in AUD, and who will be able to avoid paying currency conversion fees on deposits and withdrawals. Currency conversion fees can make trading expensive and affect profitability.

Still, for traders that trade in high volumes (over 10 lots per month), it is better to open a USD-based account at a digital bank, because currency conversion fees will apply for trading on assets like the EUR/USD. Digital banks usually offer bank accounts in several currencies with great currency exchange rates as well as free or cheap international bank transfers.

Trading Platforms

FXCM’s trading platform support is excellent compared to other brokers.

FXCM supports a wide range of trading platforms, including the industry-standard platform MetaTrader 4, its award-winning proprietary platform Trading Station, and other specialty platforms.

Trading Station

Winner of the award for Best Proprietary FX Platform 2012 from Forex Magnates, this award-winning platform has continued to impress FXCM customers.

The features are similar to MT4, including EA integration, micro-lot trading, custom indicators, strategy optimisation, strategy backtesting, and advanced charting. But in contrast to MT4, Trading Station is easy to use and requires less setup. That said, MT4 is still used by many other brokers, so traders who may switch brokers in the future might prefer to use industry-standard software. Other features of Trading Station include:

- A news calendar is integrated into the platform.

- Education and research accessible through the platform

- Customised trading analytics

- A wide range of charts

MetaTrader 4

MetaTrader 4 is still the industry standard even though its successor, MetaTrader 5, has been available for some time. MetaTrader 4 has been around since 2005, and most ECN and STP brokers offer its support.

The advantages of using MT4 are numerous, but most centre around the community support and the number of users that the tool boasts. Support is available for MT4 from FXCM customer support, and you will also find a wealth of guidance online.

Setting up MT4 is more involved than with Trading Station, but should you wish to change broker or operate multiple accounts at different brokers simultaneously, MT4 is a better platform choice. Other features of MT4 include:

- A built-in library of more than 50 indicators and tools to streamline the analysis process.

- An impressive array of analytical tools, available in nine timeframes for each financial instrument.

- Live price streaming on live accounts and demo accounts 128-bits encryption for secure trading

- Algorithmic trading, which allows any trading strategy to be formalised and implemented as an Expert Advisor.

- Customisable alerts

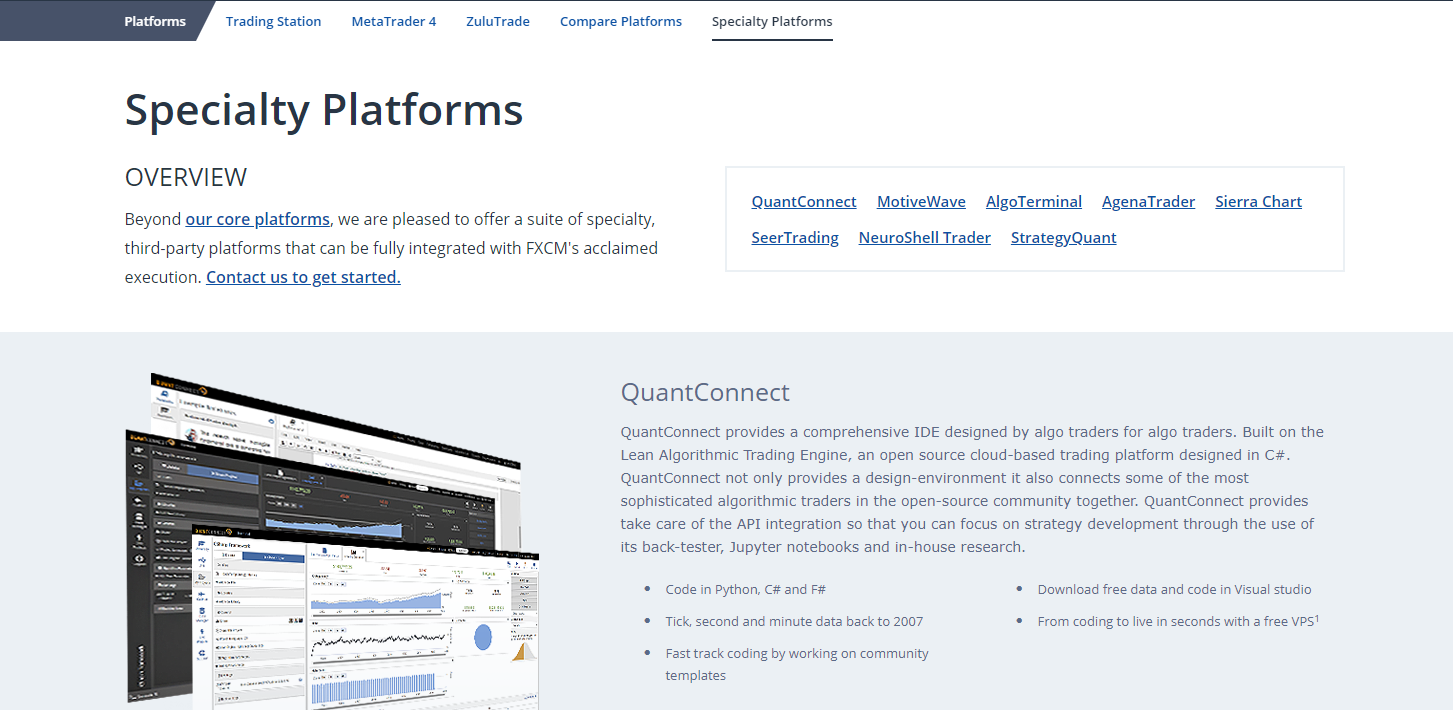

Specialty Platforms

FXCM supports a number of specialty platforms for experienced traders.

- QuantConnect – An algorithmic trading platform with API integration.

- MotiveWave – A platform for technical traders with advanced tools.

- AgenaTrader – A powerful platform for professional traders.

- Sierra Chart – A professional platform with numerous 3rd party tool connections.

- SeerTrading – An algorithmic trading platform with strong back-testing capabilities.

- NeuroShell Trader – A technical trading platform for building custom strategies for manual and automated trading.

- StrategyQuant – A machine-learning automated trading platform.

Overall, the range of platforms available at FXCM should satisfy most traders.

Mobile Apps

FXCM‘s mobile trading support is better than other brokers.

FXCM offers traders easy access to the Forex market with the Trading Station and MT4 mobile platforms, available on Android and iOS.

Trading Station

The Trading Station mobile platform allows trades to be placed and managed on the go through its simple, well-designed, and intuitive interface. The mobile platform boasts the same functionality as the desktop version of the platform, making it easy to open and close trades, view charts, and various technical analysis data.

MT4

Traders should be aware that there is some loss in functionality when compared to the desktop trading platform, including reduced time frames and fewer charting options, but traders can close and modify existing orders, calculate profit and loss, and trade on the charts.

Trading Tools

FXCM offers a wide range of trading tools to help traders make better trading decisions.

FXCM is unique in the number of algorithmic trading tools available and a strong set of premium signals, a Technical Analyzer, Trading Analytics, and social trading via Zulutrade. Additional major toolsets at FXCM are apps, VPS hosting, and API tools to build custom applications for algorithmic trading.

Zulutrade

Clients can also follow top traders through the Zulutrade platform for 30 USD/month. A social trading platform, trades are executed with FXCM’s competitive spreads, and 25% of profits are paid to the trader if they earn a successful return on investment. Clients can trade shares, forex, CFDs, and cryptocurrencies on Zulutrade. Zulutrade selects its traders using advanced algorithms and a dedicated trading desk.

FXCM Apps

FXCM Apps include different expert advisors, apps, and indicators, some of which are free. The FXCM App Store has add-ons for all the supported platforms and is broken down into the following areas.

- MT4 Expert Advisors and Automated Strategies

- Indicators

- Scripts and Add-ons

- Standalone Apps

Importantly, a client can claim a 100 USD coupon for the FXCM App Store with the A-to-Z Education Program, allowing clients to get started with premium applications.

API Trading

The API trading toolset is a way for traders to build their own applications and use the APIs offered by FXCM to connect those applications to different data sources. These connections are required to build smarter algorithmic trading applications. FXCM offers four free APIs, each connecting directly to FXCM’s trading server: a REST API, FIX API, Java API, and a ForexConnect API.

fxcmpy Python Package

The fxcmpy Python Package enables application builders to use a REST API in their applications, creating algorithmic trading strategies.

VPS Hosting

FXCM offers two VPS solutions, charged at 30 USD or a currency equivalent per month. Traders who exceed 500K USD notional trading volume for three consecutive months will have the fee reimbursed.

VPS hosting allows traders to run automated algorithmic strategies, including expert advisors 24 hours a day 7 days a week on a virtual machine. VPS services have the advantage of never suffering connectivity issues and have extremely low latency due to their proximity to major international exchanges.

Trading View

Trading View is free of charge for traders who open a live account. It is an excellent tool for researching, charting, and screening any instrument. Additional features of FXCM’s’ TradingView tool include:

- 50+ intelligent charting tools

- Over 100,000 custom user-built indicators and scripts

- Synchronised layout for multiple charts

FXCM Plus

With a minimum deposit of 50 AUD traders get access to FXCM Plus, which has all the trading tools you need to enhance your trading experience:

- Trading Signals – These easy-to-follow trading signals can help you decide when to buy, when to sell, and where to set your stops and limits. Signals are generated and updated in real-time 24 hours a day, 5 days a week.

- Technical Analyzer – Discover critical technical levels on charts (three levels of support, three levels of resistance). Stay informed of important indicator crossovers like moving averages, MACD, and RSI. And view significant candlestick patterns on charts.

- Trading Analytics – How good are you at managing your trading risk? What time of day are you most successful? FXCM’s Trading Analytics can help you answer these questions. Trading Analytics offers a simple but powerful way to visually find mistakes in your trading, recognize your best trading habits, and improve your overall trading performance.

Overall, FXCM offers a broad range of trading tools to help traders make better trading decisions.

FXCM’s Financial Instruments

FXCM offers a limited range of tradable assets compared to other large international brokers.

FXCM’s’ range of financial instruments for CFD trading (click here for more details on CFD trading), include Forex, share CFDs, commodities, cryptocurrencies, and indices.

-

Forex: FXCM offers 45 currency pairs available for trading which is average compared to other CFD brokers, including majors (EUR/USD, GBP/USD, and USD/JPY) and minors (NZD/CAD, EUR/JPY, and USD/ZAR), and exotics.

-

Share CFDs: FXCM offers 219 share CFDs, an average range compared to other similar brokers. The selection available includes some of the major US, UK, and European Exchanges.

-

Indices: Limited compared to other brokerages, there are only 15 indices available for trading at FXCM. The most popular indices are those that combine the shares of some of the largest and globally acknowledged companies.

-

Commodities: FXCM offers trading on only 12 commodities, which is average compared to other brokers. Commodities include metals such as gold and silver, energies such as natural gas and oil, and agriculture such as cotton and wheat.

-

Cryptocurrencies: FXCM offers 7 cryptocurrencies for trading, including Bitcoin, Ethereum, Litecoin, and Ripple, an average range compared to other brokers.

One drawback is that traders cannot manually change the leverage levels of the various products. Traders should therefore proceed extremely cautiously, because even though trading with leverage can amplify one’s profits, it can also amplify one’s losses.

Overall, FXCM offers a limited range of tradable instruments compared to other large international brokers, and traders cannot manually change the leverage levels of each instrument.

FXCM For Beginners

One of the major advantages of FXCM for beginner traders is the quality of the educational material they offer.

Education Material

FXCM’s educational materials surpass those of other brokers.

FXCM’s educational section comprises various trading guides, video tutorials, a section on the traits of successful traders, and a free online live classroom.

- New to Forex – This is a detailed, yet easy to read, breakdown of how Forex trading works and a tour of the major aspects to be aware of when trading. This covers Quotes, Pips, Spread, Leverage, and Margins – not in detail, but enough for real beginners to understand the terms.

- Traits of Successful Traders – This is a list of best practices used by successful traders and is essential reading for new traders. This covers the importance of a Stop Loss, the effective use of Leverage, and Trading Hours.

- Webinars – This one should be obvious from the title. Here you can catch the live webinars (every weekday at 18.00 AEST for the London Open, 23.30 AEST for the US Open, and every Wednesday at 17.00 AEST for a look at the Crypto week ahead) as well look through the library of past webinars on subjects such as Algo Trading, Using Fibonacci’s in Your Trading and Automated Trading.

- Video Library – This is the full library of FXCM’s videos. Many of these cover more prosaic topics such as Deposits and Withdrawals, or how to use the Accounts Window but this is also an excellent resource for almost any aspect of Forex trading. Some of the more useful videos are Trading from the Charts, Complex OCO Orders, Low-Volatility Trading, and Price Action. I cannot overstate how important this section is for new traders. Additionally, you don’t even have to be an FXCM customer to take advantage of the video library.

In addition to the above, all live accounts have access to FXCM’s proprietary Trading Analytics tool. This tool is designed to highlight the areas in which you can improve your trading.

This tool can help you:

- Visually find mistakes in your trading

- Recognize your best trading habits

- Improve your trading performance

- Find out what time of day you are most successful

- How good you are at managing your trading risk.

Overall, the educational materials available are comprehensive, in-depth, and cater to traders of all experience levels.

Analysis Material

FXCM provides excellent insights through various third-party tools.

FXCM’s market analysis comprises news delivered by third-party providers, including Trading Central. It also has a detailed economic calendar, Market Data Signals, and a Market Scanner.

Like other brokers, FXCM offers a complementary economic calendar and daily economic news containing some light analysis. However, FXCM takes its analytical offering one step further with Market Data Signals and the Market Scanner – tools to help traders uncover potential trading opportunities in the market.

The Market Data Signals, which are also posted to the FXCM Markets Data Twitter account, are a collection of technical signals ranging from indicator data to asset pricing and market impact.

The Market Scanner helps traders uncover potential trading opportunities based on preferred indicators and timeframes. Some traders prefer to trade a limited set of currency pairs, while others will enjoy trading unique patterns using specific indicators over longer or shorter timeframes. In this way, the Market Scanner is a unique tool for technical traders. Still, it is important to note that it does not consider a trader’s personal circumstances and trading objectives; therefore it should not be considered investment advice. As always, be aware that past performance is not indicative of future results.

Customer Support

Support is available 24/5 via live chat, phone, email, and drop-in. FXCM’s Australian office is located at Level 13, 333 George Street Sydney, NSW 2000, Australia. Support is available in 19 languages, and FXCM’s phone support is available for free for residents of 42 countries.

For the purposes of this review, we found the live chat and phone support responsive, and we received answers to our emails within one day. Additionally, the customer support was well-informed and provided extra reading material where relevant.

Evaluation Method

We value transparency and openness in the way we review the partners. To bring transparency to the forefront, we have published our review process that includes a detailed breakdown of the FXCM offer. Central to that process is the evaluation of the reliability of the broker, the platform offering of the broker, and the trading conditions offered to clients, which are summarised in this review. Each one of these is graded, and an overall score is calculated and assigned to the broker.

FXCM Risk Statement

Trading Forex is risky, and FXCM Australia Pty Limited would like you to know that: “CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 70% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.”

Overview

A well-regulated broker, FXCM offers trading on an average number of tradable assets compared to other brokers, but at 13 USD, trading costs are higher than other similar brokers. FXCM excels in its platform choice, selection of trading tools, and quality of educational materials on offer. However, traders should be aware of the high non-trading costs, including withdrawal, inactivity, and high currency conversion fees.

Editorial Team

Chris Cammack

Head of Content

Chris joined the company in 2019 after ten years experience in research, editorial and design for political and financial publications. His background has given him a deep knowledge of international financial markets and the geopolitics that affects them. Chris has a keen eye for editing and a voracious appetite for financial and political current affairs. He ensures that our content across all sites meets the standards of quality and transparency that our readers expect.

Alison Heyerdahl

Senior Financial Writer

Alison joined the team as a writer in 2021. She is the Senior Editor for FXScouts. She has a medical degree with a focus on physiotherapy and a bachelor’s in psychology. However, her interest in forex trading and her love for writing led her to switch careers. She has a passion for Forex trading and over a decade of editorial experience researching Forex and the financial services industry, producing high-quality content. She hosts a weekly podcast, “Let’s Talk Forex,” alongside her colleague, Chris, and has produced over 100 Forex educational videos for the FXScouts YouTube channel. She also writes weekly technical analyses and has tested and reviewed over 100 Forex brokers.

Ida Hermansen

Financial Writer

Ida joined our team as a financial writer in 2023. She has a degree in Digital Marketing and a background in content writing and SEO. In addition to her marketing and writing skills, Ida also has an interest in cryptocurrencies and blockchain networks. Her interest in crypto trading led to a wider fascination with Forex technical analysis and price movement. She continues to develop her skills and knowledge in Forex trading and keeps a close eye on which Forex brokers offer the best trading environments for new traders.

Compare Brokers

Find out how FXCM stacks up against other brokers.

Stay updated

This form has double opt in enabled. You will need to confirm your email address before being added to the list.