-

MetaTrader 4 Brokers

The top MT4 brokers in AU

-

MetaTrader 5 Brokers

The best MT5 brokers in AU

-

TradingView Brokers

The best TradingView brokers

-

cTrader Brokers

The top cTrader brokers in AU

-

Forex Trading Apps

Trade on the go from your phone

-

Copytrading Brokers

Copy professional traders

-

All Trading Platforms

Find a platform that works for you

Go Markets Broker Review

Last Updated On May 9, 2023

75-90% of retail traders lose money trading Forex and CFDs. You should consider whether you understand how CFDs and leveraged trading work and if you can afford the high risk of losing your money. We may receive compensation when you click on links to products we review. Please read our advertising disclosure. By using this website you agree to our Terms of Service.

Our verdict on Go Markets

We are aware of multiple complaints about problems withdrawing profits from GO Markets. We advise traders to find another approved broker until we have verified these claims.

A well-regulated Australian broker, GO Markets offers two low-cost trading accounts, a huge range of financial instruments, and excellent trading tools on the MT4 and MT5 platforms.

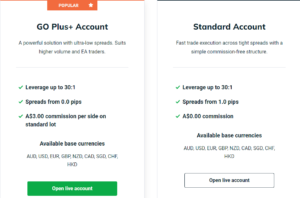

GO markets traders can choose between two accounts, both with competitive trading costs. The commission-free Standard Account has spreads that start at 1.0 pips (EUR/USD), while the GO Plus+ Account offers spreads of 0 pips in exchange for a commission of 6 AUD/4 USD (round turn). Both accounts have a reasonable minimum deposit of 200 AUD, making them accessible to beginner traders. Traders can choose from over 3600 financial instruments, including 49 Forex pairs and all 2400+ shares listed in the ASX.

Offering full support for MT4, MT5, and its in-house share trading platform, GO Markets provides an extensive suite of trading tools, including a free VPS service, Autochartist, Trading Central, and myfxbook. Traders will also benefit from responsive and knowledgeable multilingual customer service and a great selection of education and market analysis materials.

Overall, a technological innovator, GO Markets works hard to keep low-latency trading, plenty of choice, reliable customer support, and stable platforms at the core of its offering.

| 🏦 Min. Deposit | AUD 200 |

| 🛡️ Regulated By | ASIC, CySEC, FSA-Japan, FSC |

| 💵 Trading Cost | USD 4 |

| ⚖️ Max. Leverage | 30:1 |

| 💹 Copy Trading | No |

| 🖥️ Platforms | MT4, MT5 |

| 💱 Instruments | Commodities, Cryptocurrencies, Stock CFDs, Forex, Indices, Metals, Bonds, Shares |

Overall Summary

Account Information

Trading Conditions

Company Details

Pros

- Fast and free withdrawals

- Wide range of assets

- Excellent market analysis

- Innovative trading tools

Cons

- High minimum deposit

- No swap-free account option

Is GO Markets Safe?

Yes, GO Markets is a safe broker for Australians to trade with. It maintains regulation from some of the world’s top regulators, including ASIC of Australia, CySEC in Cyprus, the Financial Services Authority of Seychelles, and the FSC of Mauritius.

Regulation: Founded in 2006, GO Markets’ Australian clients will be onboarded through the Asutralian Securities and Investment Commission (ASIC), known as one of the world’s best regulators.

Safety Features: GO Markets clients in Australia will have a leverage limit of 30:1 for Forex trading and will be provided negative balance protection, meaning that traders can never lose more money than they have in their trading accounts. ASIC regulations ensure that GO Markets keeps its operational funds segregated from client accounts, but also prevent GO Markets from offering promotions or bonuses.

While the additional protection offered by ASIC regulation is welcome, some Australian traders may find the low leverage levels and lack of bonuses at GO Markets restrictive. The only way around these restrictions is to trade with a broker which does not have ASIC regulation, which of course then means less protection.

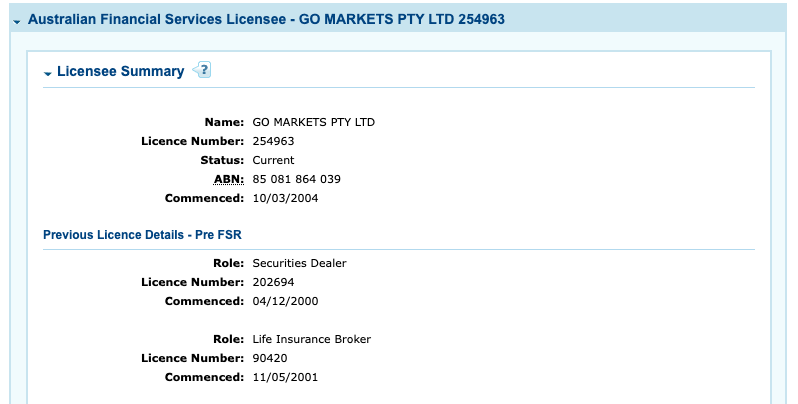

We confirmed the licence on ASIC’s register. See the licence below:

Company Details:

GO Markets’ Trading Instruments

We were impressed that GO Markets offers a much wider range of tradable instruments than other similar brokers.

GO Markets recently (in 2022) added a range of bonds, cryptocurrencies, and ASX shares that weren’t previously available on its platform. See below for details on the number of instruments and associated leverage:

- Forex: GO Markets has 49 currency pairs available for trading, a broader range than most other brokers. These include majors (EUR/USD, GBP/USD, and USD/JPY), minors (NZD/JPY, GBP/JPY, and USD/ZAR), and exotics.

- Share CFDs: GO Markets offers 1200+ share CFDs, a broader range than other large international brokers. The selection available includes some of the major US, UK, Hong Kong, Australian, and European Exchanges.

- Indices: There are 15 indices available for trading at GO Markets, which is around the average available at other similar brokers. The most popular indices are those that combine the shares of some of the largest and globally acknowledged companies.

- Commodities: GO Markets offers trading on 8 commodities, which is average compared to other brokers. Most brokers offer around 5 – 10 commodities. Commodities include metals such as gold and silver, and energies such as oil.

- Shares: Australian traders can choose from all the shares listed on the ASX – over 2400 instruments – an excellent range compared to other brokers. GO Markets aslo provides a specialized share trading platform for share trading.

- Bonds or Treasuries: GO Markets offers 5 bonds for trading, including the US T-Note 10 YR Futures, the US T-Note 5 YR Futures, EURO BUNd Futures, Japanese Government Bond (JGB) Futures, and UK Gilt Futures.

- Cryptocurrencies: The addition of cryptocurrencies is a good move on the part of GO Markets, considering how popular this asset class has become. Traders can choose from 10 cryptos, including Bitocin, Ethereum, and Litecoin, among others.

Overall, the number of assets available at GO Markets should be enough to satisfy most traders.

GO Markets Accounts and Trading Fees

Although GO Markets only offers two live accounts, its trading fees and minimum deposits are lower than other similar brokers.

Trading Fees: GO Markets accounts have minimum deposit requirements of 200 AUD, making them accessible to most traders. Spreads on its commission-free Standard Account start at 1 pip (EUR/USD) which is average for the industry, and 0 pips (EUR/USD) on its GO-Plus+ Account in exchange for a commission of 3 AUD/2 USD per side, which is low.

As you can see from the table above, the trading costs on the GO Plus+ Account are lower than the costs on the Standard Account, which has the trading fees included in its variable spreads. Spreads tighten or widen depending on market volatility and trading volume.

Accounts:

Standard Account

The Standard Account is the dealing desk, commission-free account option, created with the beginner in mind. Spreads start at 0.00 pips on this account, and it requires a minimum deposit of 200 AUD.

GO Plus+ Account

The GO Plus+ account is designed for the professional trader, but also requires a minimum deposit of 200 AUD. A commission of 6 AUD/4 USD round turn per lot is charged, and spreads are tight, starting at 0.0 pips (EUR/USD).

GO Markets’ Mobile Trading

With support for MT4, MT5, and the GO Markets Share Trading platforms, GO Markets’ platform support is excellent compared to other similar brokers.

MT4 and MT5 are only available on Android devices* while the GO Markets Share trading platform is available for both Android and iOS. These platforms integrate with the broker in the same way as the desktop versions of the software, so all trading activity is synced.

GO Markets Share Trading Platform

The share trading platform provides traders with all the tools to manage their accounts and trade shares online. The simple, secure system lets users buy or sell stocks easily with just one click. We liked the fact that traders can also view up-to-date market data from within the app, including upcoming floats and dividends. It has great watchlist features that allow investors to track certain sectors over time, Heat Maps which show how specific stocks are performing, and offers a number of trading tools.

MT4 and MT5

Traders should be aware that there is some loss in functionality when compared to the desktop trading platforms, including reduced time frames and fewer charting options, but traders can close and modify existing orders, calculate profit and loss, and trade on the charts.

Other Trading Platforms

Like its mobile trading platforms, traders can use MT4, MT5, and the share trading platform.

GO Markets Share Trading Platform

The Share Trading Platform is available on a browser. It has the same features as the mobile version, and you can trade over 2400 shares.

Metatrader 4 (MT4)

We found that like most brokers, the GO Markets MT4 platform is the standard version with 24 graphical objects and 30 built-in indicators. MT4 is popular for its algorithmic trading abilities and is fully customisable.

MetaTrader 5

MetaTrader 5 is a powerful trading platform with Market Depth and a separate system for accounting orders and trades. The platform supports all types of trade orders, including market, pending, and stop orders, as well as trailing stops. It allows you to open up to 100 charts in 21 time frames and access over 80 technical indicators and analytic tools.

Overall, although GO Markets’ only offers the Metatrader suite of platforms for trading CFDs, which are not as beginner-friendly as the proprietary platforms offered at other brokers, MT4 and MT5 are considered some of the best third-party platforms in the industry.

Trading Platform Comparison:

Deposit & Withdrawal Fees

GO Markets offers an average range of payment methods compared to other brokers, but it charges no fees for deposits or withdrawals. We were also impressed at the huge number of trading account currencies available at GO Markets.

In line with Anti-Money Laundering policies, funds can only be returned to a bank account in the same name as your GO Markets account.

Trading Account Currencies: Accounts can be denominated in the following base currencies: AUD, USD, GBP, EUR, NZD, SGD, CAD, CHF, HKD, AED, ZAR, THB, MYR, IDR, CNY, BHD, and PLN. This is a much wider range than other similar brokers. While most Australian traders will want to have their trading accounts denominated in USD, some traders may want to have multiple accounts with different base currencies so as not to pay conversion fees when trading. The wide range of base currencies available at GO Markets allows for traders to do this and is welcomed.

Deposits and Withdrawals: GO Markets does not charge any deposit or withdrawal fees, but withdrawals to non- Australian banking institutions may be subject to bank fees from any intermediary bank involved in the transaction. Deposits are processed instantly and withdrawal forms received before 1 pm AEST will be processed on the same day. Payment methods include local bank transfers, debit cards/credit cards, and various online and e-wallet transfers. See below for more details on deposit and withdrawal methods:

Apparently, GO Markets offers other payment methods, including PayGuru, PayTrust88, and XPAY, but these are not published on the website.

Opening an Account at GO Markets

The account opening process at GO Markets is as per the industry standard – the process is fully digital, and accounts are ready for trading within one business day.

Australians are eligible to open an account at GO Markets if they meet the minimum deposit requirement of 200 AUD.

GO Markets offers both corporate and individual accounts, but we will outline the process for opening an individual account:

- Click on “Open Live Account” at the top right-hand corner of the page. You will be directed to register an account with your name, email address, date of birth, and telephone number. You will also be asked to select your trading platform.

- The next step requires filling in your residential address and selecting your preferred base currency, trading account, employment status, and financial status.

- GO Market requires at least two documents to accept you as an individual client:

-

- Proof of Identification – GO Markets accepts all government-issued identification documents such as Passport, national ID card, driving license, or other government-issued ID.

- Proof of Address – Proof of residence/address document must be issued in the name of the GO Markets’ account holder within the last 6 months. It must contain a trader’s full name, current residential address, issue date, and issuing authority.

- Proof of Identification – GO Markets accepts all government-issued identification documents such as Passport, national ID card, driving license, or other government-issued ID.

- To be accepted as an individual client, GO Markets requires traders to agree to the following documents:

- GO Markets Disclosure Statement

- GO Markets Terms and Conditions

- GO Markets Privacy Policy

- Lastly, to enable GO Markets to verify your identity, it may disclose personal information such as your name, date of birth, and address to a credit reporting agency (CRA) to assess whether that personal information matches information held by the CRA.

Once the above information is verified, traders can log in to their trading accounts and begin trading.

Overall, GO Markets’ account-opening process is fully digital and hassle-free, but the account-opening process may be delayed if client information deviates from what is on record at the CRA.

Trading Tools

GO Markets’ offers an excellent range of trading tools compared to most other brokers.

GO Markets offers a wide range of trading tools, including Metatrader Genesis, Autochartist, Myfxbook, a_Quant, a VPS hosting service, and Trading Central.

Autochartist

Autochartist is one of the most widely used MT4 charting tools among the GO client base. Autochartist removes the complex and time-consuming process of analysing charts for patterns by scanning and monitoring the markets on your behalf. It sends audio and visual alerts when emerging and completed patterns are identified. Traders gain access to this chart pattern recognition software when opening and funding a live trading account with 500 USD or more.

Trading Central

Trading Central is a collection of programs that offer actionable investment support with 24-hour multi-asset coverage, technical and fundamental analysis, and back-tested trading strategies. Actionable market news can be delivered to you through WebTV or email, and trading strategies can be built from within the platform. Trading Central is available for free for all GO Markets’ clients.

VPS

VPS services ensure that trades are never disrupted by technological or connectivity issues, such as load-shedding or internet service failure, which is a benefit to algorithmic traders who need to be connected to a server 24/7 to maximise uptime. With a GO Markets VPS, you can optimise the MT4 & MT5 trading platforms’ features and capabilities. A service fee of 30 USD will be charged for the service, but the fee will be waived should the client trade a minimum of 5 lots per calendar month.

MetaTrader Genesis

MT4 & 5 Genesis is a comprehensive suite of MetaTrader trading tools to enhance the power of the standard MetaTrader platform. Benefits of using the MetaTrader Genesis tool include:

- Access to a professional suite of MetaTrader add-ons.

- Use of the sophisticated order management system.

- Access to trading alerts.

Myfxbook

Myfxbook is a cross-broker copy trading tool for traders of all experience levels and is used by 90,000 traders worldwide. It is similar to using EAs, but instead of following an algorithmic pattern, traders can mirror the trades of other Forex traders. By connecting a GO Markets Standard Trading Account to Myfxbook, traders can take advantage of this system. Myfxbook also provides its users with a broad range of statistics and analytics.

a-Quant

a-Quant aggregates millions of data points and uses machine learning algorithms for regime detection, sentiment analysis, clustering, co-integration, and Hidden Markov Models development. a_Quant essentially produces high probability trading signals of certain risk/reward characteristics on various trading instruments.

Daily Strategies is a signal service created for FX Traders. It produces large numbers of signals for high-frequency trading of major FX currency pairs. a-Quant generates 9-12 signals per day on average, for the 10 most popular FX currency pairs. These can be delivered straight to your inbox.

Overall, GO Markets offers a comprehensive range of useful trading tools to help traders make better trading decisions.

Trading Tools Comparison:

GO Markets for Beginners

GO Markets provides a reasonable selection of education materials but better educational materials can be found at other ASIC-regulated ECN brokers. GO Markets also provides a good selection of market analysis materials produced by a team of in-house market analysts.

Education Material

GO Markets’ educational materials are good, but not the best as other brokers in the space.

GO Markets offers downloadable handbooks, a structured Forex course, educational videos, and technical instructional videos to assist with the MetaTrader software.

- Handbooks: GO Markets provides two downloadable hand books covering Forex trading – one for beginners and another for more advanced traders. The beginner book covers basic terminology, chart reading, and trader psychology. The advanced eBook requires registration and covers technical analysis and trading strategies.

- Videos: The hand books complement the videos, and while a few of the videos are available for public consumption, traders will need to register an account to view its extensive video library.

- Courses: A two-part structured Forex course in the form of a webinar is open to the public and only requires that you register your name and email. One of the courses covers the Forex market and trade entries and exits. The second course covers technical analysis, how to read charts, using technical indicators to understand data, developing a profitable trading plan, and advanced order types.

- MT4/MT5 Tutorials: There are also 18 technical MT4/MT5 videos to assist traders with everything from setting up charts and layout on the platform, to placing the first trade on the market.

- Demo Account: GO Markets offers a free demo account that allows traders to practice trading on all its CFD instruments, with real-time spreads on the MT4 and MT5 platforms. Traders receive 50,000 USD in virtual funds that can be topped up on request. Demo accounts are a great way for beginners to practice trading risk-free before opening a live account. Unfortunately, demo accounts for non-live account users only last 30 days.

Education Overview:

Analysis Material

GO Markets regularly publishes news and analysis on its website. These include a daily review at the close of the US markets, a weekly look at major talking points in the week ahead, frequent blog posts on important financial topics, tips for trading improvement, an interactive economic calendar, and a regular podcast featuring experts in the Forex market.

All of the analysis and news is available for free, even if you are not a registered customer of GO Markets.

Customer Support

Support is available 24/5, which is in line with the Forex trading week, via email, live chat, and phone (with local numbers in Australia, China, and the United Kingdom). GO Markets also has a Quick Support tool that allows their technical support team to remotely access your desktop and fix any issues with your platform/software.

For the purposes of this review, we found the customer service responsive, knowledgeable, and able to answer most of our questions.

Safety and Industry Recognition

Regulation: Founded in 2006 and headquartered in Melbourne, GO Markets is regulated by the Australian Securities and Investments Commission (ASIC), the Cyprus Securities and Exchange Commission (CySEC), the Seychelles Financial Services Authority (FSA), and the Financial Services Commission (FSC) of Mauritius.

- GO Markets Pty Ltd is authorised and regulated by ASIC, afsl licence number: 254963.

- GO Markets Pty Ltd (MU) is a Global Business Company (Company No.170969), authorised and regulated by the Financial Services Commission (FSC) of Mauritius as an Investment Dealer (Discount Broker) Licence No.GB 19024896.

- GO Markets is authorised and regulated by CySEC, Licence Number: 322/17

- GO Markets is authorized and regulated by the Seychelles Financial Services Authority, Securities Dealer Licence Number SD043.

- GO Markets MENA DMCC (DMCC653535) is a Trade Member of Dubai Gold and Commodities Exchange (Member 777) and UAE Securities & Commodities Authority, Licence No.20200000013.

Awards

GO Markets has won numerous awards, including Best Forex Fintech Broker 2022 (Global Forex Awards), Most Trusted Forex Broker – Europe (Global Forex Awards), Best Forex Trading Support – Asia 2022 (Global Forex Awards), Best Customer Service 2019-2020 (Investment Trends), and Best Educational Materials/Programs 2019 – 2020 (Investment Trends).

Overall, based on its long track record of responsibility, the wide industry acclaim, and the high level of regulatory oversight, it is clear that GO Markets desires to provide a safe and secure trading experience for Australian traders.

Evaluation Method

We value transparency and openness in the way we review the partners. To bring transparency to the forefront, we have published our review process which includes a detailed breakdown of the Go Markets offering. Central to that process is the evaluation of the broker’s reliability, the broker, the platform offering of the broker, and the trading conditions offered to clients, summarised in this review. Each one of these is graded, and an overall score is calculated and assigned to the broker.

GO Markets Risk Statement

According to regulation, brokers are required to be transparent with Forex traders about the complexity of financial products and also disclose the extent to which traders can lose their money. GO Markets wants you to know that Trading Forex and Derivatives carries a high risk of losing substantially more than your initial investment. Also, you do not own or have any rights to the underlying assets. The effect of leverage is that both gains and losses are magnified. You should only trade if you can afford to carry these risks. Trading Derivatives may not be suitable for all types of investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Overview

GO Markets is a well-regulated market maker broker with an ECN account that offers a vast range of tradable instruments on the MT4 and MT5 trading platforms. It also has a specialized share trading platform available for trading on over 2400 shares. GO Markets’ most notable feature is the number of trading tools on offer, including a VPS hosting service, Autochartist, Trading Central, MT4/MT5 Genesis, and a-Quant – providing numerous daily trading signals. Trading conditions are average on GO Markets’ Standard Account but are highly competitive on its GO Plus+ account, with spreads of 0 pips in exchange for a reasonable commission of 6 USD (round turn).

Editorial Team

Chris Cammack

Head of Content

Chris joined the company in 2019 after ten years experience in research, editorial and design for political and financial publications. His background has given him a deep knowledge of international financial markets and the geopolitics that affects them. Chris has a keen eye for editing and a voracious appetite for financial and political current affairs. He ensures that our content across all sites meets the standards of quality and transparency that our readers expect.

Alison Heyerdahl

Senior Financial Writer

Alison joined the team as a writer in 2021. She is the Senior Editor for FXScouts. She has a medical degree with a focus on physiotherapy and a bachelor’s in psychology. However, her interest in forex trading and her love for writing led her to switch careers. She has a passion for Forex trading and over a decade of editorial experience researching Forex and the financial services industry, producing high-quality content. She hosts a weekly podcast, “Let’s Talk Forex,” alongside her colleague, Chris, and has produced over 100 Forex educational videos for the FXScouts YouTube channel. She also writes weekly technical analyses and has tested and reviewed over 100 Forex brokers.

Ida Hermansen

Financial Writer

Ida joined our team as a financial writer in 2023. She has a degree in Digital Marketing and a background in content writing and SEO. In addition to her marketing and writing skills, Ida also has an interest in cryptocurrencies and blockchain networks. Her interest in crypto trading led to a wider fascination with Forex technical analysis and price movement. She continues to develop her skills and knowledge in Forex trading and keeps a close eye on which Forex brokers offer the best trading environments for new traders.

Compare Brokers

Find out how Go Markets stacks up against other brokers.

Stay updated

This form has double opt in enabled. You will need to confirm your email address before being added to the list.