-

MetaTrader 4 Brokers

The top MT4 brokers in AU

-

MetaTrader 5 Brokers

The best MT5 brokers in AU

-

TradingView Brokers

The best TradingView brokers

-

cTrader Brokers

The top cTrader brokers in AU

-

Forex Trading Apps

Trade on the go from your phone

-

Copytrading Brokers

Copy professional traders

-

All Trading Platforms

Find a platform that works for you

ThinkMarkets Broker Review

Last Updated On February 26, 2024

75-90% of retail traders lose money trading Forex and CFDs. You should consider whether you understand how CFDs and leveraged trading work and if you can afford the high risk of losing your money. We may receive compensation when you click on links to products we review. Please read our advertising disclosure. By using this website you agree to our Terms of Service.

Our verdict on ThinkMarkets

ThinkMarkets is a multi-award-winning brokerage company with its headquarters found in the UK and Australia. The FCA (UK) and ASIC (Australia) are two of the most well-known regulatory authorities that oversee the company. The broker provides easy-to-use platforms with a wide variety of tradable assets and tools, making it suitable for both novice and expert traders. However, on the Standard account, trading costs on ThinkMarkets are higher than competitors’ costs.

ThinkMarkets offers trading on a wider range of tradable assets than other brokers, including Forex, indices, commodities, crypto pairs, and 3600+ share CFDs. The ThinkMarkets Standard Account, with no minimum deposit requirement, has high trading costs compared to other brokers, at 12 USD per lot EUR/USD. On the other hand, the 500 USD minimum deposit ThinkZero account delivers better pricing at 8 USD per lot EUR/USD, which may interest more experienced traders.

ThinkMarkets offers support for the MT4, MT5, and in-house ThinkTrader platforms, and traders have access to some of the best trading tools in the industry, including Trading Central, Zulutrade, and a VPS hosting service. Trading Central is offered free of charge to account holders. The Zulutrade copy-trading service requires a subscription of 30 USD per month, and the VPS service has a subscription fee unless traders trade over 15 lots per month.

The ThinkMarkets education package is a good place to start for beginners. Daily market commentary is missing from the website, but real-time news from FX Wire Pro is integrated into the ThinkTrader platform, along with advanced order management, risk management tools, charts, and more.

| 🏦 Min. Deposit | AUD 0 |

| 🛡️ Regulated By | FCA, ASIC, FSA-Seychelles, CySEC |

| 💵 Trading Cost | USD 11 |

| ⚖️ Max. Leverage | 30:1 |

| 💹 Copy Trading | Yes |

| 🖥️ Platforms | MT4, MT5, ThinkTrader |

| 💱 Instruments | Commodities, Cryptocurrencies, Stock CFDs, ETFs, Forex, Futures, Indices, Metals |

Overall Summary

Account Information

Trading Conditions

Company Details

Pros

- Low minimum deposit

- Well regulated

- Great platform choice

Cons

- Limited market analysis

- Non-transparent spreads

Is ThinkMarkets Safe?

Yes, ThinkMarkets is a safe broker for Australians to trade with. It is locally regulated by ASIC, and also maintains regulation from top international authorities, including the FCA of the United Kingdom, CySEC in Europe, and the FSA of Seychelles.

Founded in 2010, ThinkMarkets offers multi-asset trading across the globe from twin headquarters in Melbourne, Australia and London. ThinkMarkets is the brand name of TF Global Markets, which is regulated by ASIC in Australia, the FCA in the UK, CySEC in Europe, the FSA in Japan, the FSA in Seychelles, and the FSCA in South Africa:

- TF Global Markets (Aust) Limited is authorised and regulated by the Australian Securities and Investments Commission (ASIC), AFSL number 424700.

- TF Global Markets (UK) Limited is authorised and regulated by the Financial Conduct Authority (FCA), FRN 629628.

- TF Global Markets (South Africa) Pty Ltd is authorised and regulated by the FSCA, FSP No 49835.

- Think Capital Limited is registered in Bermuda, with company number 51879.

- TF Global Markets (Europe) Ltd is authorized and regulated by the Cyprus Securities and Exchange Commission (CySEC) with license no. 215/13.

- TF Global Markets (Japan) Limited is authorized and regulated by the Japanese Financial Services Agency (FSA-Japan) under license 0250.

- TF Global Markets Int Limited is authorized and regulated by the Financial Services Authority with FRN SD060.

- TF Global Markets (Aust) Ltd is a registered Financial Service Provider (FSP623289) and holds a Derivative Issuer License issued by the Financial Markets Authority of New Zealand.

Australians will be trading under the subsidiary, TF Global Markets (Aust) Limited, authorised and regulated by the Australian Securities and Investments Commission (ASIC). One of the world’s top regulators, ASIC ensures that all ThinkMarkets client funds are held in segregated accounts and that ThinkMarkets offers its traders negative balance protection, ensuring that clients cannot lose more than is in their trading account. Additionally, under this regulation, leverage is capped at 30:1 on major currency pairs, and it prohibits ThinkMarkets from offering bonuses and promotions.

While the additional protection offered by ASIC regulation is welcome, some Australian traders may find the low leverage levels and lack of bonuses at ThinkMarkets restrictive. The only way around these restrictions is to trade with another broker, which of course then means accepting the risk attached to higher leverage.

ThinkMarkets have won several awards over the years for their services, highlights being:

- Best CFD Provider – UK 2021 (COLWMA Awards)

- Best Value Broker – Asia 2020 (Global Forex Awards)

- 2021 Second Best CFD Provider (Intellidex Awards)

- 2021 Third Most Improved Broker (Intellidex Awards)

- Best Forex Trading Platform – Africa 2021 (Global Forex Awards)

- Best Forex Trading Experience 2017

- Best Forex Trading Innovation 2017 at the UK Forex Awards.

Overall, because of its strong international and local regulation, wide industry acclaim, and long history of responsible behaviour, we consider ThinkMarkets a safe broker to trade with.

Trading Fees

ThinkMarkets Forex trading fees are average compared to other brokers.

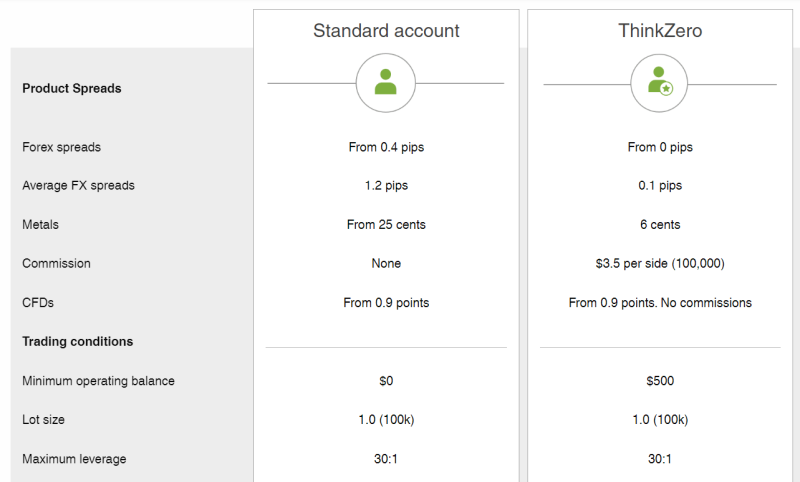

Unlike other brokers that offer a range of account types with lower spreads linked to higher minimum deposits, ThinkMarkets offers only two market-execution accounts. The Standard Account has the trading costs included in the spread while the ThinkZero Account offers tighter spreads and a small commission per trade. It also offers the ThinkMarkets Pro account for professional traders that meet certain eligibility criteria. For more detail on ThinkMarkets’ trading accounts, click here.

ThinkMarkets’ accounts were assessed to compare the costs to those of other brokers. The costs were evaluated based on the trading fees on one lot (100 000 USD) on the EUR/USD, including the spread and commission.

When making this calculation, we used one lot of EUR/USD as a benchmark as it is the most commonly traded currency pair and it usually has the tightest spread.

ThinkMarkets has not made average spreads and data on individual currency pairs available, which is unusual for a large broker. That said, minimum spreads are low – 0.4 pips on the Standard Account and 0 pips on the ThinkZero Account – though traders will only experience these in times of high liquidity. Additionally, average spreads are published as 1.2 pips on the Standard Account. For the purposes of this review, the calculations were made based on the average spreads published on the site, and will be updated as ThinkMarkets adds more transparent data to the website.

Trading Cost Formula: Spread x Trade Size + Commission = Cost in Secondary Currency (USD):

As you can see from the table above, ThinkMarkets offers one Standard Account with no minimum deposit requirement and the ThinkZero Account with a minimum deposit requirement of 500 USD.

Trading costs are a little higher than average on the Standard Account – most good brokers’ entry-level accounts have a trading cost of 9 USD per lot of EUR/USD traded. However, with no real minimum deposit requirements to speak of, this is still a good account for beginner traders.

Trading costs improve significantly the ThinkZero Account, but the minimum deposits here are much higher, at 500 USD

Spreads are variable at ThinkMarkets, meaning that they will get wider or tighter depending on trade volume and market volatility – the spreads in the table above are average spreads. It’s also important to note that there are material differences between using the MT4, MT5, and ThinkTrader platforms. For more on ThinkMarkets’ trading platforms, click here.

Swap Fees

The other main trading cost to consider is the overnight swap fee. This is charged on trades held open overnight and is derived from the difference between the interest rates of the two currencies being traded. Unfortunately, ThinkMarkets’ swap rates are not published on its website. Traders can access the swap rates from within the trading terminal by following these simple steps:

- Click ‘View’ on the top menu

- Select ‘Symbols’

- Select which currency pair you want to see the swaps for, and click ‘Properties’

- You can now see the long and short swap rates in the pop-up window

Swap debits/credits are calculated as follows:

Current long/short rate * number of lots = swap debit/credit in second currency

For example:

If your account currency is USD, and you hold 2.5 lots short of EUR/GBP:

-1.08 * 2.5 = -2.70 EUR, converted to USD = -4.13 USD

Overall, ThinkMarkets’ are higher than average on its Standard Account and lower than average on the ThinkZero Account.

ThinkMarkets’ Non-trading Fees

ThinkMarkets’ non-trading fees are lower than other similar brokers.

Some of the most overlooked trading costs are the non-trading fees that are charged by brokers. These fees can significantly affect your profitability and so should be carefully scrutinised.

Unlike other brokers that charge fees for deposits, withdrawals, and on inactive accounts, ThinkMarkets does not charge any non-trading fees. However, according to customer service, ThinkMarkets may apply an inactivity fee in the future.

Overall, these are some of the lowest non-trading fees in the industry.

How to Open an Account at ThinkMarkets

The account-opening and verification process at ThinkMarkets is fully digital and accounts are ready within 48 hours, which is about the industry average.

All Australian residents are eligible to open an account at ThinkMarkets, as long as they meet the minimum deposit requirements. These are:

- Standard Accounts: 0 USD

- ThinkZero Accounts: 500 USD

- From the ThinkMarkets homepage, you will have to click on the ‘Create Account’ tab where you will be directed to register an account. Traders can choose between registering a live or demo account.

- ThinkMarkets’ registration form requires traders to fill in their country of residence, and choose the product type they would like to trade – either shares or CFDs.

- Next, traders are required to fill in their Australian ID number and tax number.

- Traders will then have to fill in their personal details, including name, email address, and date of birth, and choose a password.

- Traders will then be able to choose their platform (MT4, MT5, or the ThinkMarkets’ platform).

- The next step requires completing one’s financial details, including employment status, and financial status.

- Verification usually takes less than 48 hours and ThinkMarkets will need:

- Proof of Identification – ThinkMarkets accepts all government-issued identification documents such as Passport, national ID card, driving license, or other government-issued ID.

- Proof of Address – Proof of residence/address document must be issued in the name of the account holder within the last 6 months and must contain a trader’s full name, current residential address, issue date, and issuing authority.

Overall, ThinkMarkets’ account-opening process is fully digital and hassle-free and accounts are ready for trading within 48 hours.

ThinkMarkets Accounts

ThinkMarkets’ offers two accounts, which is average compared to other similar brokers, and its accounts are suitable for beginners and more experienced traders.

ThinkMarkets offers two general accounts, a Standard Account with wider spreads and the ThinkZero Account – an ECN account with tight spreads and commission per trade. The Standard Account is suitable for beginners, with no minimum deposit requirements.

We define beginner traders as inexperienced traders who have never traded before or have been trading for less than a year. Beginners often do not want to risk trading large sums of money, and will generally not be able to trade full-time during the workweek.

ThinkMarkets’ ThinkZero Account is suitable for more experienced traders. Experienced traders tend to prefer accounts with higher minimum deposits and tighter spreads. The ThinkZero Account has a minimum deposit requirement of 500 USD, but spreads start at 0 pips on the EUR/USD in exchange for a reasonable commission of 7 USD (round turn).

ThinkMarkets allows hedging, scalping, and copy trading, and both accounts are available as Demo Accounts and Islamic Accounts. Three platforms are supported (MT4, MT5, and the proprietary ThinkTrader) and currency pairs, indices, commodities, share CFDs, and cryptocurrency pairs are available to trade.

ThinkMarkets is very proud of its trading infrastructure, with twin Equinix trading servers located in Hong Kong and London allowing for trade execution within milliseconds. This state-of-the-art technology allows ThinkMarkets to deliver an uptime of 99.99% and provides traders with the fastest execution speeds available, ideal for automated trading. See below for account details:

Standard Account – The Standard Account is a commission-free trading account with variable spreads and no minimum operating balance, average spreads on major pairs are 1.10 pips but can fall to 0.4 pips at times. Leverage on this account is 30:1 and all three of ThinkMarket’s supported platforms are available. Standard Account holders have free access to Trading Central and live webinars.

ThinkZero Account – The ThinkZero Account offers tighter spreads – starting at 0 pips but averaging 0.1 pips on major pairs – but charges an industry-standard commission of 7 USD (round turn) per trade. The minimum operating balance on this account is 500 USD and the ThinkTrader platform is unsupported – meaning you will have to use MT4 or MT5. Like the Standard Account, leverage is also set at 30:1 but ThinkZero Account holders have access to free Trading Central, live webinars and a personal account manager.

ThinkMarkets Pro – ThinkMarkets provides a Pro or wholesale account that offers access to higher leverage up to 500:1 and exclusive offers. Australian clients have to meet one of the eligibility criteria below to access this account:

- Net assets worth at least A$2.5million OR traders have a minimum gross income for each of the last 2 financial years of A$250,000.

-

Traders have to provide evidence that they have traded CFDs and/ or FX at least 25 times with a minimum total notional value of at least A$250,000 in 4 quarters over the previous 2 years AND have a minimum annual income of A$100,000 or net assets of at least A$500,000, OR have at least 12 months experience in a professional capacity in the financial services sector and which requires direct knowledge of leveraged trading.

Deposits and Withdrawals

ThinkMarkets offers a decent range of payment methods, and withdrawals and deposits are free.

ThinkMarkets operates a “return to source” policy, meaning that withdrawals must be made via the same method and the same account as the original deposit.

Accepted deposit methods include credit/debit cards such as Visa and Mastercard, bank wire, and e-wallets (Neteller and Skrill). You may also be able to fund your trading account using your crypto wallet.

Additional deposit methods may be available depending on your country of residence. For example, if your account is held with ThinkMarkets’ Australian entity, you will also be able to deposit funds using bitpay, BPay, Paypal, and Poli.

Deposits and withdrawals at ThinkMarkets can be made in a number of currencies which vary depending on the chosen payment provider. When creating an account, the base currencies available are AUD, CHF, EUR, GBP, JPY, CAD, ZAR, SGD, USD, and NZD but this is dependent upon which ThinkMarkets entity your account is opened with. Additional deposit methods may be available depending on your country of residence.

While ThinkMarkets does not charge any deposit or withdrawal fees, the company reserves the right to impose fees on any withdrawal request originating from a trading account with minimal trading activity. Please contact ThinkMarkets support for more information on this. Additionally, ThinkMarkets does not absorb the merchant fees charged by the various payment providers.

See below for more information:

Overall, ThinkMarkets offers a decent range of funding methods, deposits and withdrawals are free, and processing times are reasonable.

Base Currencies (Trading Account Currencies)

ThinkMarkets offers ten base currencies, which is more than most other brokers, and it offers accounts denominated in AUD.

ThinkMarkets allows accounts to be denominated in AUD, USD, EUR, GBP, NZD, JPY, SGD, CHF, CAD, and ZAR

This means that for Australians with bank accounts denominated in AUD, conversion fees will not be applied for deposits and withdrawals. However, it may still be better for traders that trade in large volumes (more than 10 lots a month) to open an account denominated in USD at a digital currency bank, especially for trading on assets such as the EUR/USD. This is because when trading a USD quoted currency pair with an AUD account, there will be a small conversion fee for every trade made.

ThinkMarkets Trading Platforms

ThinkMarkets’ trading platform selection is better than most other brokers, with MT4, MT5, and its own proprietary trading platform.

Alongside ThinkMarkets proprietary ThinkTrader platform, it also offers support for MT4 and MT5, the two most popular trading platforms in the Forex industry. In addition to the desktop applications, available on Windows and Mac, ThinkMarkets also offers MT4 and MT5 WebTerminal, which are browser-based versions of the platforms, along with mobile and tablet versions of both iterations.

ThinkTrader

ThinkMarkets’ proprietary platform grew out of the company’s acquisition of Trade Interceptor, an award-winning trading platform in its own right. Available for mobile, tablet, web,and desktop ThinkTrader offers in-app deposits and withdrawals, real-time news from FX Wire Pro, and one-click multiple order closing. It also features over 125 indicators and 50 chart types and includes the TrendRisk scanner to assist traders in finding opportunities over different timeframes. The ThinkMarkets platform is also easy to use and set up, making it a good choice for beginner traders.

MetaTrader 4

Having established itself as the industry-leading platform, Metatrader 4 (MT4) is the most reliable and popular platform in existence. Its intuitive interface and user-friendly environment provide essential tools and resources for successful online trading. It is also widely recognised for its fast execution speeds, range of charting tools, algorithmic trading, and customisability. MT4 is available in over 31 languages.

Other features of MT4 include:

- Supports the creation, modification, and utilisation of automated trading strategies.

- Supports MQL4 programming language.

- Algorithmic trading, which allows any trading strategy to be formalised and implemented as an Expert Advisor.

- Allows traders to develop their own custom indicators

- Superior charting tools in nine timeframes

- 31 graphical objects

- 30 built-in indicators

- 9 timeframes

- Three order execution types

- Four types of pending orders

While MT4 has great customizability, the platform feels outdated, and some of the features may be hard to find. In addition, only the basic orders are available, including Market, Limit, Stop, and Trailing Stop.

MetaTrader 5

The MT5 trading platform is being adopted by more Forex brokers all the time, it has a more modern interface, allows for an unlimited number of charts to be used, shows Depth of Market, and has a built-in Economic Calendar. It also has a larger number of pending order types than MT4 and features an embedded chat system. In addition, the MQL5 scripting language is more efficient than its precursor and MT5 has more advanced charting tools than MT4.

The benefit of brokers offering third-party platforms such as MT4 and MT5 is that traders can use the platforms should they choose to migrate to another broker. However, MT4 and MT5 are often not as user-friendly as ThinkMarkets’ proprietary platform.

ThinkMarkets’ Mobile Apps

ThinkMarkets’ mobile trading support is better than other similar brokers.

All the trading platforms supported by ThinkMarkets are available as mobile and tablet downloads – allowing traders to keep track of their open positions while on the move.

MT4/MT5

MT4 and MT5 are freely available on both Android and IOS mobile phones and tablets. The advantage of using the MetaTrader platform is the cross-device and multi-broker functionality, making it easier to change brokers or use multiple brokers.

ThinkMarkets’ MT4 and MT5 apps allow traders to work from anywhere, with nine timeframes, 30 indicators, and interactive currency charts. Functionality to close and modify existing orders, calculate profit/loss in real-time, and tick chart trading further empowers traders while on the move.

ThinkTrader Mobile

The ThinkTrader mobile app is also available for Android and iOS. It has the same functionality as the desktop version of the platform, including in-app deposits and withdrawals, real-time news, and one-click multiple order closing. Traders can also access 80 indicators and 50 chart types, including the TrendRisk scanner. Other features of the ThinkTrader mobile app include:

- Quad screen display

- Multi Deal closure

- Cloud-Based Alerts

- Multitouch Functionality

ThinkMarkets’ Trading Tools

ThinkMarkets’ trading tools are excellent compared to other similar brokers.

ThinkMarkets offers a number of useful trading tools, including TrendRisk, Trading Central, a VPS service, and the Zulutrade app for social trading.

TrendRisk

ThinkMarkets has developed the TrendRisk Scanner trading feature which was created to continuously scan all markets in order to provide traders with new trading possibilities. It shows the target price and direction, as well as the expected timeframe and risk & reward

ratio.

Clients can open a position on a specified market in both the mobile and desktop versions of TrendRisk Scanner, and the system will establish its own Stop Loss and Take Profit limits for you, but don’t forget that you can change or delete them before and after you place the trade.

Trading Central

A tool that provides a technical market analysis from third-party industry experts. Trading Central’s top-notch indicators can help guide client trades through an easy-to-access platform. It is intuitive, scans the market for opportunities 24/7, and provides a comprehensive analysis and constant notification alert system.

VPS (Virtual Private Server) Hosting

Available on both MT4 and MT5, ThinkMarkets offers a free VPS service to traders who trade a minimum of 15 round turn lots on Forex in a calendar month. Services are provided by ForexVPS and Beeks VPS. Traders also get a 15% discount on Beeks VPS on opening a live account with ThinkMarkets. Traders will have to contact the service providers directly to find out about pricing.

VPS services ensure trades are never disrupted by technological or connectivity issues, such as internet service failure, which is a benefit to algorithmic traders who need to be connected to a server 24/7 to maximise uptime. Other benefits of the VPS service include:

- 24/6 VPS email support

- 24/7 Redundant power to your VPS

- 24/7 Redundant internet connectivity to your VPS

- Low latency connectivity to FP Markets trading servers for precision trading

- Uninterrupted EA trading

Zulutrade

Zulutrade, a third-party platform, is a peer-to-peer social trading application where traders can choose among thousands of registered traders from 192 countries. Traders are ranked using “ZuluRank” according to a number of different metrics, including their overall performance, stability, maturity, exposure, and minimum equity required. ZuluTrade charges a 30 USD monthly subscription. ZuluTrade customers will be charged directly by ZuluTrade via credit card, PayPal, or other. On the whole, Zulutrade is an excellent social trading platform, particularly for beginners who are new to the trading space.

Overall, ThinkMarkets offers a host of useful trading tools, which will benefit both beginners and more experienced traders.

ThinkMarkets Financial Instruments

ThinkMarkets offers a broader range of tradable assets compared to its competitors.

IC Markets offers CFD trading on Forex, indices, shares, commodities, ETFs, Futures, and cryptocurrencies, (click here for more on CFD trading):

-

Forex pairs: ThinkMarkets offers 46 Forex pairs to trade, including majors, minors, and exotics such as USD/ZAR and ZAR/JPY. This is around the average offered by its closest competitors.

-

Commodities: ThinkMarkets offers trading on 11 commodities, including metals, energies, and agriculture, which is around the average offered by most other brokers.

-

Stock CFDs: ThinkMarkets’ stock CFD offering is average compared to most of its competitors, with 3672 stock CFDs available to trade, including popular US tech companies, ASX stocks, those listed on the NASDAQ and NYSE, and more. Unlike most other brokers, ThinkMarkets also lists some of the key constituents of the JSE such as Adcock Ingram, Barloworld, and the Absa Group.

-

Indices: ThinkMarkets offers cash and futures contracts on over 23 international indices, including the NASDAQ, S&P500, FTSE100, and the Nikkei. This is an average range of indices compared to other brokers.

-

Futures: ThinkMarkets offers trading on 11 global futures, including the BRENT, GER30, US30, and WTI, which is average compared to most other brokers.

-

ETFs: Exchange Traded Funds have rapidly gained in popularity in recent years, and ThinkMarkets offers spot contracts on 352 of the most traded ETFs in the world.

-

Cryptocurrencies: ThinkMarkets offers trading on 27 cryptos, a wider range than is typically available at other brokers, including Bitcoin, Bitcoin Cash, Ethereum, Dash, and XRP. Spreads on these currencies are variable and are significantly higher than Fiat currencies but in line with other brokers.

Overall, ThinkMarkets provides a broader range of tradable instruments than most other brokers, which should leave most professional traders satisfied.

ThinkMarkets for Beginners

Beginner traders will find ThinkMarkets a relatively welcoming experience with a well-structured education section available for traders with different levels of experience and frequent market analysis. One drawback is that demo accounts on MT4 and MT5 will expire after 90 days of inactivity, but ThinkTrader demo accounts never expire.

Educational Material

ThinkMarkets educational materials are excellent compared to other brokers.

Education at ThinkMarkets is split into three tutorials: Beginner, Intermediate and Advanced – unfortunately, these tutorials are only available after signing up with ThinkMarkets, though you will not need to make a deposit in order to access them.

The Beginner section covers the basic aspects of Forex CFD trading such as leverage and margin and introduces traders to the MT4 platform. The Intermediate section covers trading plans, candlesticks, order types, and chart patterns – all essential skills for successful traders. Finally, the Advanced section covers technical and fundamental analysis, Fibonacci ratios, and support and resistance levels, among others – again, concepts that we consider essential for successful trading.

Alongside these tutorials, ThinkMarkets also has a technical analysis section of commonly used indicators for MT4 and MT5 – something we wish more brokers would offer to new traders, a section of educational articles, and a Trading Glossary devoted to the terminology of CFD trading.

ThinkMarkets also offers weekly live webinars, run by industry experts. Traders merely have to register a name and email address to attend webinars.

Analysis Material

ThinkMarkets’ market analysis materials are limited compared to other similar brokers.

Market research and analysis are slightly disappointing. Alongside a basic Economic Calendar, ThinkMarkets has a Market News section featuring a stream of market analysis. This analysis is updated every few days and is of high quality, though we would like to see daily market updates across the major pairs. In this section, you can also find a Sentiment Indicator for the major pairs and links to the ThinkMarkets Twitter account, though at the time of writing this seems to have not been updated in some time.

ThinkMarkets also publishes special reports, although this occurs very infrequently.

Customer Support

ThinkMarkets customer support is excellent compared to other brokers.

Customer support is available 24/7. Support is available via phone, email, and live chat and phone numbers are also available for the Australian, UK, Italian, South African, and Spanish offices.

For the purposes of this review, we found the Customer Support at ThinkMarkets to be responsive, polite, and resourceful.

Evaluation Method

We value transparency and openness in the way we review the partners. To bring transparency to the forefront, we have published our review process that includes a detailed breakdown of the ThinkMarkets offering. Central to that process is the evaluation of the reliability of the broker, the platform offering of the broker and the trading conditions offered to clients, which are summarised in this review. Each one of these is graded, and an overall score is calculated and assigned to the broker.

Risk Statement

Trading Forex is risky, and each broker is required to detail how risky the trading of Forex CFDs is to clients. ThinkMarkets would like you to know that: Derivative products are leveraged products and can result in losses that exceed initial deposits. Please ensure you fully understand the risks and take care to manage your exposure and seek independent advice if necessary. When trading or investing in shares and ETFs, the value of such shares and ETFs can fall and rise, which means you could receive less than you originally paid. Please consider the risks involved before you trade or invest. Past performance is not a guarantee of future results.

Overview

ThinkMarkets has a relatively decent product line-up, with support for the most common trading platforms and decent trading conditions on its two accounts. ThinkMarkets also offers excellent trading tools, mostly available for free, which will help traders make better trading decisions.

The education section, though requiring signup, will be helpful for beginner traders but the market analysis section is lacking compared to ThinkMarket’s international peers. Overall, ThinkMarkets is a solid if unexciting Forex broker, but we would like to see more transparency on its average spreads and possible withdrawal charges.

Editorial Team

Chris Cammack

Head of Content

Chris joined the company in 2019 after ten years experience in research, editorial and design for political and financial publications. His background has given him a deep knowledge of international financial markets and the geopolitics that affects them. Chris has a keen eye for editing and a voracious appetite for financial and political current affairs. He ensures that our content across all sites meets the standards of quality and transparency that our readers expect.

Alison Heyerdahl

Senior Financial Writer

Alison joined the team as a writer in 2021. She is the Senior Editor for FXScouts. She has a medical degree with a focus on physiotherapy and a bachelor’s in psychology. However, her interest in forex trading and her love for writing led her to switch careers. She has a passion for Forex trading and over a decade of editorial experience researching Forex and the financial services industry, producing high-quality content. She hosts a weekly podcast, “Let’s Talk Forex,” alongside her colleague, Chris, and has produced over 100 Forex educational videos for the FXScouts YouTube channel. She also writes weekly technical analyses and has tested and reviewed over 100 Forex brokers.

Ida Hermansen

Financial Writer

Ida joined our team as a financial writer in 2023. She has a degree in Digital Marketing and a background in content writing and SEO. In addition to her marketing and writing skills, Ida also has an interest in cryptocurrencies and blockchain networks. Her interest in crypto trading led to a wider fascination with Forex technical analysis and price movement. She continues to develop her skills and knowledge in Forex trading and keeps a close eye on which Forex brokers offer the best trading environments for new traders.

Compare Brokers

Find out how ThinkMarkets stacks up against other brokers.

Stay updated

This form has double opt in enabled. You will need to confirm your email address before being added to the list.