-

MetaTrader 4 Brokers

The top MT4 brokers in AU

-

MetaTrader 5 Brokers

The best MT5 brokers in AU

-

TradingView Brokers

The best TradingView brokers

-

cTrader Brokers

The top cTrader brokers in AU

-

Forex Trading Apps

Trade on the go from your phone

-

Copytrading Brokers

Copy professional traders

-

All Trading Platforms

Find a platform that works for you

While there are roughly 180 official currencies globally, not all currencies are traded on the Forex market. In fact, only a select few are more frequently traded than the others which means that 95% of all daily transactions in the Forex market include these common currencies:

- US Dollar (USD)

- Euro (EUR)

- British Pound (GBP)

- Japanese Yen (JPY)

- Swiss Franc (CHF)

- Australian Dollar (AUD)

- New Zealand Dollar (NZD)

- Canadian Dollar (CAD)

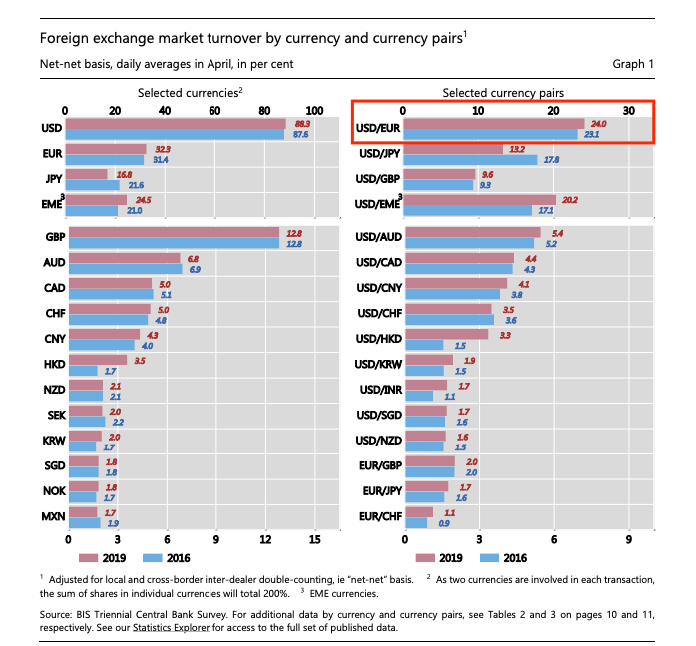

In April 2019, 88.3% of currency transactions include the USD as it is the world’s leading reserve currency. This is up from 87.6% in the same period of 2016.

Categories of Currency Pairs

There are three major categories of currency pairs:

- Major currency pairs

- Minor currency pairs, also known as cross-rate currency pairs.

- Exotic currency pairs

The major currency pairs are the most common trading pairs and are known for creating the best trading opportunities. For that reason, we will not cover the minor or exotic currency pairs in this article.

Major Currency Pairs

The major currency pairs consist of seven currency pairs, each of which contains the USD. They are the most traded currency pairs where the majority of traders are continually analysing the charts for trading signals. If you are new to trading, it is advised you should limit your focus to one of these currency pairs.

The advantages of trading the majors all stem from the amount of liquidity available which is generated by traders continually buying and selling these currencies. The advantages derived from this are:

- The majors have competitive spreads that are kept low because of the highly liquid market.

- Higher market liquidity means there is less risk of significant price gaps forming.

- Less slippage execution on trades.

Major currency pairs are also are easier to trade than the lesser common pairs for a couple of reasons.

To understand what moves the currency market, you need to know that it depends on the specific pair you want to trade. However, one thing for sure is that

There is a considerable amount of price action (movement) in the major currency pairs, which means price charts contain a number of opportunities for profit. Once you have learned a couple of strategies and studied chart patterns, it will be easier to predict the future movement of the pairs.

There are various economic drivers for each of the currency pairs. For example, if you like to trade commodities like oil, you might focus more on currency pairs which are linked to oil trading like the Canadian Dollar (CAD). The Canadian economy relies on oil exports, so the USD/CAD will be impacted and driven by the changes in oil prices.

Central banks are essential and prominent influencers on currency movements, and more often than not, they are the primary driver for currency exchange rates. Most of the central bank decisions and economic reports are scheduled for release well in advance, so developing a trading plan and keeping an economic calendar available will greatly improve your trading experience.

EUR/USD

The EUR/USD is considered to be one of the best currency pairs to trade. Approximately 24% of all Forex transactions involve EUR/USD, which is up from 23.1% in 2016.

Source: BIS Triennial Central Bank Survey 2019 (pg. 5)

The EUR/USD exchange rate is most influenced by the two most powerful central banks in the world: the Fed and the ECB. The US Federal Reserve has a significant influence on currency pairs involving the US dollar.

When the Federal Reserve Board release notes from the meetings, including but not limited to interest rate policy statements, all USD crosses tend to experience major movements. You will find the dates and times for all announcements and data releases on all economic calendars.

The European Central Bank (ECB) releases information in a similar fashion to the Fed, and the release of meeting notes can create major market events for FX trading. For example, when the ECB started easing monetary policy in 2014, the EUR/USD exchange rate fell in the subsequent years. Any changes in the central bank’s monetary policy can be a significant driver of currency exchange rates.

The time of the day also plays an influential role in the EUR/USD price behaviour. Generally, the most active trading hours for EUR/USD is between the London open at 8:00 GMT and the US close around 22:00 GMT. Also, the New York opening session at 1:00 GMT can be great trading opportunities. Avoid trading during the Asia session when there is less volatility for this pair.

USD/JPY

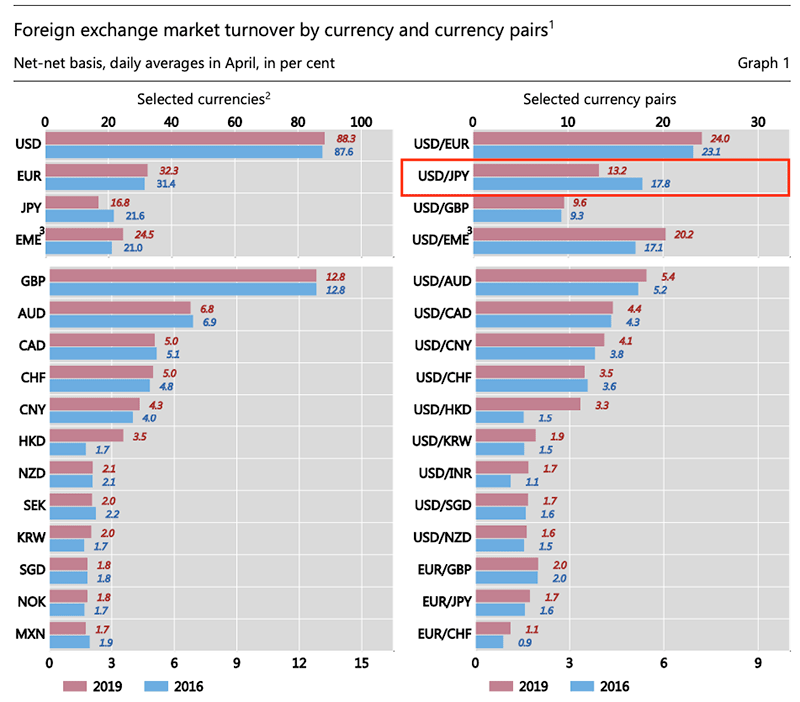

In April of 2019, the USD/JPY was the second most traded currency pair, representing 13.2% of all Forex transactions. This is down from 17.8% in 2016.

Source: BIS Triennial Central Bank Survey 2019 (pg. 5)

The Bank of Japan (BOJ) is one of the biggest drivers for the USD/JPY exchange rate. Unlike other currencies, the Japanese Yen crosses present excellent trading opportunities, even during the Asia session because it is during this time that the BOJ is usually trading in the market. The Asia session starts at 1:00 GMT and closes at 10:00 GMT.

GBP/USD

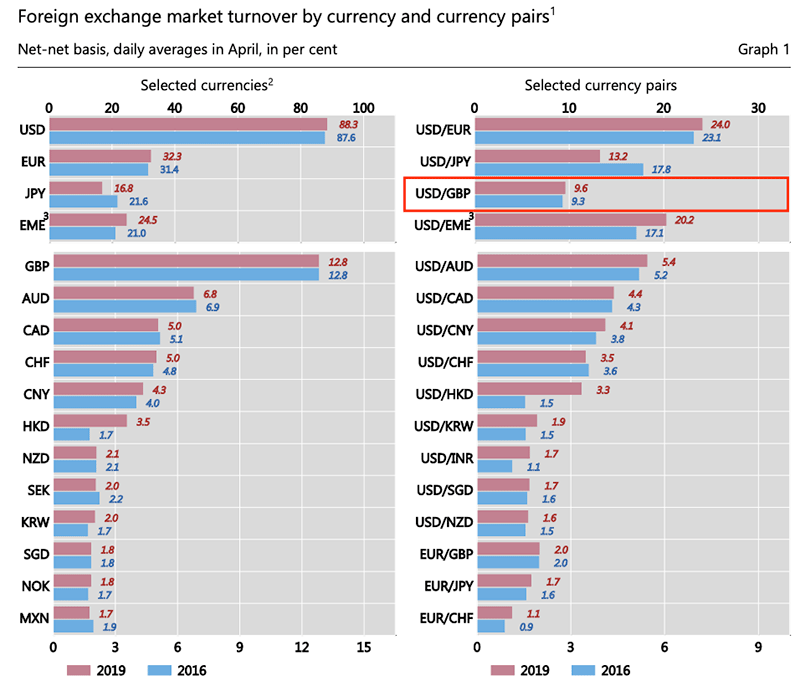

The third most traded currency pair is the GBP/USD, which accounts for 9% of all daily Forex transactions.

Source: BIS Triennial Central Bank Survey 2019 (pg. 5)

The Bank of England (BOE) is responsible for maintaining a fair GBP/USD exchange rate. The London market open tends to have the most significant impact on the price action and will set the tone and direction for the rest of the day.

Conclusion

If you were to choose to trade only three currencies, develop a trading plan that sticks with the three major currency pairs: EUR/USD, USD/JPY and GBP/USD. Avoid trading minor currency pairs and obscure pairs as they are less liquid and more prone to erratic behaviour, thus less technical and higher risk of trading.

It is important to make trades that you are able to monitor, and where you understand the country’s central bank’s monetary policy. Many traders make a living from just trading one currency pair, and you can do this as well. You only need to master one currency pair and don’t need to worry about what’s happening with the rest.

Stay updated

This form has double opt in enabled. You will need to confirm your email address before being added to the list.