-

MetaTrader 4 Brokers

The top MT4 brokers in AU

-

MetaTrader 5 Brokers

The best MT5 brokers in AU

-

TradingView Brokers

The best TradingView brokers

-

cTrader Brokers

The top cTrader brokers in AU

-

Forex Trading Apps

Trade on the go from your phone

-

Copytrading Brokers

Copy professional traders

-

All Trading Platforms

Find a platform that works for you

A Forex order is an instruction from the trader to a broker that indicates the way a trader wants to enter or exit a trade. There are five basic order types are:

- Market Order

- Limit Order

- Stop Entry Order

- Stop Loss Order

- Trailing Stop Order

Common Order Types

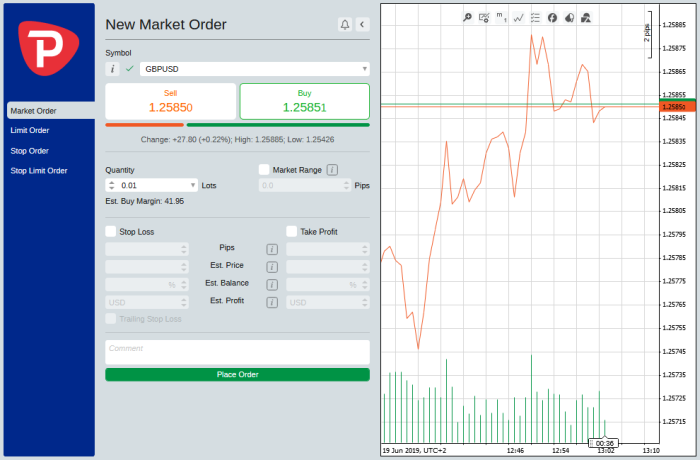

Market Order

The most basic type of order, a market order gives your broker the instruction to buy or to sell immediately, at the best available market price. To create a market order it is usually as easy as clicking buy on your trading platform. at may be different from the last price quoted before the trade executed.

Market Order GBPUSD – Pepperstone cTrader

What are Slippage and Requotes?

The main disadvantage of a market order is slippage. Slippage occurs when the price that the order gets filled at is different from the price quoted – this usually occurs in volatile markets. For example, the bid (or sell) price for GBP/USD is shown as 1.2570 and the ask (or buy) price is at 1.2574, but the market is exceptionally volatile. In normal conditions, if you wanted to buy GBP/USD your order would be filled at 1.2574 – but, due to slippage, your order is delayed and is filled at 1.2576.

This is termed as negative slippage as the slippage has gone against you in terms of potential profit. Positive slippage can also occur – in this case if your order had been filled at 1.2572 rather than the original 1.2574, thereby giving you a slightly better position than you had anticipated.

It’s important to note that some brokers will offer a requote instead of automatically filling your market order. Let’s take the negative slippage example above: In the case of a requote, the broker would revert to you asking if you wish to continue with your market order at 1.2576. At this point, your market entry has been substantially delayed and the price may have changed considerably. Slippage and requotes can be frustrating but, unfortunately, they are a relatively common occurrence when placing market orders. Before trading, do check with your broker whether they offer requotes when slippage occurs. It’s also a good idea to do your own research on Forex discussion forums for an idea of how often a broker suffers from slippage. It is worth noting that market maker brokers suffer less from slippage than ECN/STP brokers.

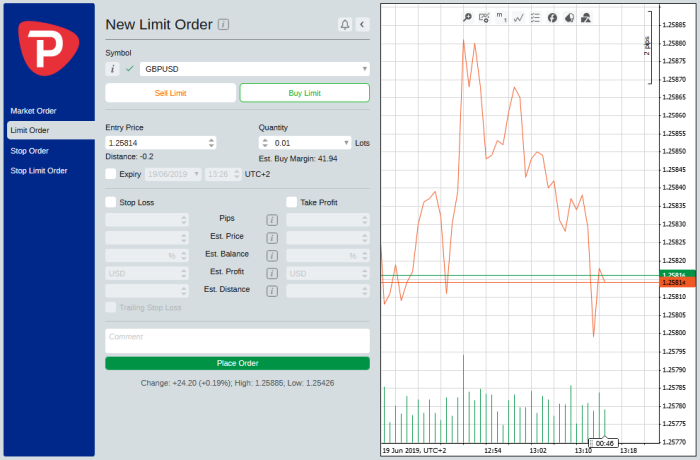

What is a Limit Order?

A limit order gives the broker the instruction to buy or sell at a specific price – it is usually placed to buy below the market or sell above the market.

For example, GBP/USD is currently trading at 1.2590 and falling – you want to buy when it reaches 1.2540. You set a buy limit order at 1.2540 and your broker will automatically fill your order once the pair drops below this level. There are two main advantages to a limit order:

- You can be assured that your order will be placed at an exact price (with no negative slippage or requote)

- You can set your limit order and close your trading platform – allowing you to continue with your day

While a limit order prevents negative slippage, there is an inherent risk of your order not being filled if the price does reach the limit you have specified. Typically a limit order has also an expiration date attached to it. This means that your order will only be triggered if the limit is reached before the expiration date.

When to use a Limit Order?

If the AUD/USD is trading at 0.7650 and you want to buy on a retracement to 0.7600 use a buy limit order. Ideally, a limit order works best in a ranging market. If the price of AUDUSD was currently in a channel, and if you are going to buy at the support level and sell at the resistance level you could use a limit order as well.

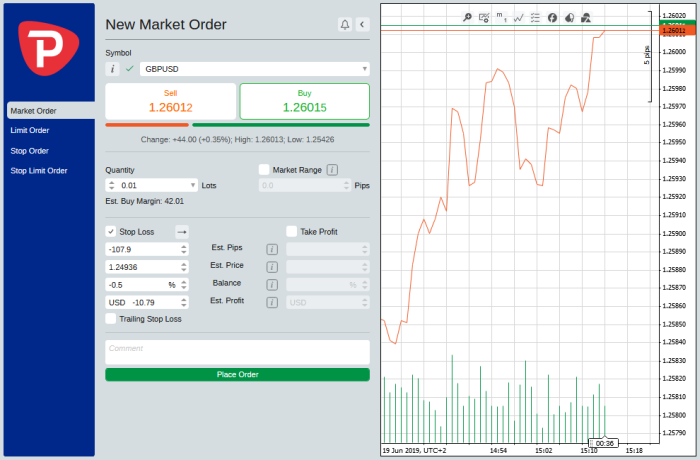

What is a Stop Loss Order?

The other type of stop order is a stop loss order. Stop loss orders are used to limit potential trade losses and are indispensable for any serious trader. When you enter the market with a stop loss order you will be asked to set a stop loss by a specified number of pips from your entry point. You can set a stop loss order in both long and short positions – if you are in a long position, it is a sell stop order and if you are in a short position, it is a buy stop order. Stop Loss Orders will remain in effect until your position is automatically closed or you cancel the order.

Stop Loss Order GBPUSD Pepperstone cTrader

When to use a Stop Loss Order?

Use a stop loss order any time you are going to be away from your desk with an open trade, it’s a great habit to cultivate and will save you money in the long-term. The Forex market is notoriously unpredictable, even the most experienced trader will make losses on trades, and stop loss orders are important for the times you are wrong. When you are inevitably wrong, a stop loss order will protect your account balance, especially if you are away from your trading desk when the market turns on you. On average, Forex traders win more trades than they lose – but they also lose more money on their losses than they make on their wins and this inevitably leads to a zero account balance. If you use stop loss orders judiciously you can make your losses less severe and lock down an average net gain.

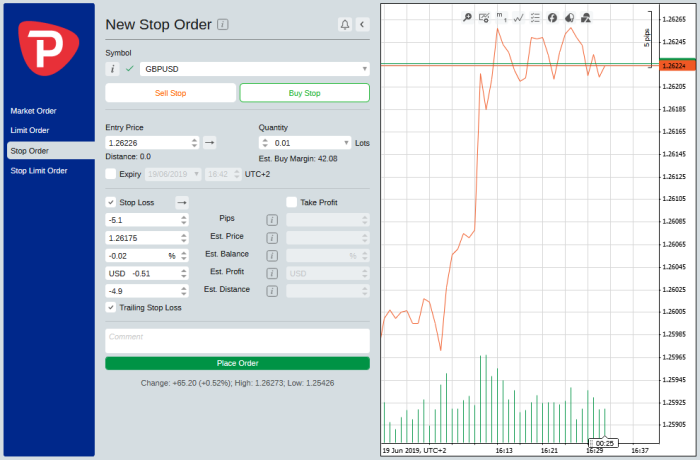

What is a Trailing Stop Order?

A trailing stop order is a stop loss order that allows the stop loss level to move with your positions as it improves. The point of a trailing stop is to increase the locked in profit as the market moves in your favour, without any need for intervention.

Trailing Stop Loss Order – Broker: Pepperstone, Platform: cTrader

Let’s say that you place a trailing stop order to buy GBP/USD at 1.2624, with a trailing stop of 20 pips. To start with, your stop loss will be set at 1.2604. But if the price improves to 1.2654, your trailing stop would move up to 1.2634 – thereby locking in a 10 pip profit. It is very important to remember that your trailing stop will stay at the new price level if the market moves against you. In the example above, once the market has moved against you by 20 pips your position will be automatically closed.

Less Common Order Types

These orders generally have very specific uses and some are two orders working together. Most of these orders are not generally available from brokers on standard trading platforms and will either require a specialised broker or the installation of Expert Advisors (EAs) on your platform.

Good ‘Till Cancelled Order (GTC)

A GTC order is a type of automated order that instructs the broker to enter the market at a pre-specified price. This instruction will remain live with the broker until the trader cancels it – there is generally no expiry date on this type of order, though some brokers will automatically cancel unfilled GTC orders after 90 days. This type of order, though rarely used, can be useful if you don’t trade Forex regularly and want to enter the market at a certain price point.

End of Day (EOD) Order

An End of Day order is an instruction to a broker to enter the market at a specified price, but this instruction will automatically expire at the end of the day. As the Forex market is 24 hours, the definition of “end of day” varies from broker to broker, but it is commonly fixed at 1700 EST.

One-Cancels-the-Other Order (OCO)

An OCO Order is part of a group of order types called contingent orders. These are actually two or more orders that are linked, with a secondary order (or a set of secondary orders) ‘contingent’ on the activation of a primary order. An OCO order is a pair of linked automated orders. As the name suggests, an OCO order ensures that only one of these linked orders is placed – if either of the two orders are executed, the remaining order is cancelled. OCO orders are useful if you expect the price to breakout above or below resistance levels but are unsure which direction it will go. An example of an OCO order would be two stop orders:

- A buy stop order placed 20 pips above the current price

- A sell stop order 20 pips below the current price

When one of these stop orders is filled the other is then cancelled. OCO orders can be used to hedge your trades in a number of different scenarios, though educate yourself appropriately before using them in a live environment. Most platforms do not support OCO orders natively, and you will probably have to install an EA to place one.

One-Triggers-the-Other Order (OTO)

Another type of contingent order, an OTO order is also a sequence of linked automated orders; but in this case, the secondary order/s, instead of being cancelled as in an OCO order, are activated once the primary order is filled. An OTO order is useful when you want to set profit taking and stop loss levels even before you have opened a trade. Let’s say AUD/USD is currently trading at .6870 and there are indications that once it passes 0.7000 there will be a reversal, but only down to .6900. In order to automate your orders to follow your prediction, you can create an OTO order with a primary sell limit order at .7000 and a secondary buy limit order at .6900. You could also add a stop loss on both orders to protect your trades. With OTO orders it is very important to remember that secondary orders will only be activated if the primary order is filled.

Conclusion

Most of the time, you will only need the common order types listed here, but once you have more trading experience you will find the more complex order types are very useful for managing your risk effectively, even in straightforward trading scenarios. It’s worth keeping in mind that there are even more order types than those listed above – for further reading you can look into OTOCO orders and If/Then orders types. These are more complex still and require a perfect understanding of their function before use. A couple of points worth making:

- Make sure you fully understand how an order type works before you use it on a live account. Use it in a demo account until you are completely comfortable with the way it functions.

- Always check with your broker to see what fees will be applied to your account if you hold a position for longer than a day, or over the weekend.

The best practice is to keep your orders simple while you are learning and slowly ramp up the complexity as you start to feel more comfortable.

Stay updated

This form has double opt in enabled. You will need to confirm your email address before being added to the list.

Session expired

Please log in again. The login page will open in a new tab. After logging in you can close it and return to this page.

If I trade GBP: USD is there a double rate of exchange involved? GBP : USD and AUD to GBP – double the risk one wanted and the other I didn’t ?

Hi Mark, if your account currency is AUD and you want to trade the GBP/USD then yes, you will be exposed to the AUD/GBP exchange rate as well as the risk involved in any GBP/USD trade you open. Usually, a broker will give you a good spot exchange rate for the AUD/GBP exchange so it shouldn’t impact your trading capital too much. The real risk involved is if you intend to keep a GBP/USD trade open for a long period (weeks/months). When you close your trade the GBP will be converted back to your account currency (AUD) and any changes in the GBP/AUD rate will obviously reflect in your profit or loss. Please discuss this directly with your broker for further clarification – they may have risk mitigation measures in place.