-

MetaTrader 4 Brokers

The top MT4 brokers in AU

-

MetaTrader 5 Brokers

The best MT5 brokers in AU

-

TradingView Brokers

The best TradingView brokers

-

cTrader Brokers

The top cTrader brokers in AU

-

Forex Trading Apps

Trade on the go from your phone

-

Copytrading Brokers

Copy professional traders

-

All Trading Platforms

Find a platform that works for you

A Swap, interest or rollovers are all terms synonymous, and can be used interchangeably in the world of Forex trading. A Swap rate is an interest rate that your broker either credits or debits from your account balance whenever you keep a position open overnight. The Swap amount is the interest paid at the time of the rollover.

Every day the Forex currency market rolls over at about the 5 PM EST. This rollover happens at the New York session closing. At rollover time, your broker will roll your trades over to the next day. You may have noticed a difference in your account balance when you carried a trade from one day into the next day. This change is due to a swap your broker did on your behalf. The swap fee will be either credited or debited at the end of each day when a position is held open overnight. The exception is that on Wednesdays you’re paid or debited 3 times more than the previous trading days. This is to make up for the weekends where no trading takes place.

How is the swap rate calculated?

Whenever you open a trade, you’re simultaneously buying or selling the base currency and the counter-currency. The swap rate is calculated by the difference between the interest rate of the base currency and the interest rate of the counter currency. This is also referred to as the interest rate differential. As you open a trade in your trading platform, one of the columns will be the swap.

Every central bank around the world sets an interest rate for loans in their currency. If you’re buying the currency with a higher interest rate, then your broker will credit you with the swap rate. In this case, you have a positive interest rate. But, if you’re buying the currency with a lower interest rate, then your broker will debit the swap rate. This means you will lose money from your account balance because of the interest paid to them.

Swap rate calculation example

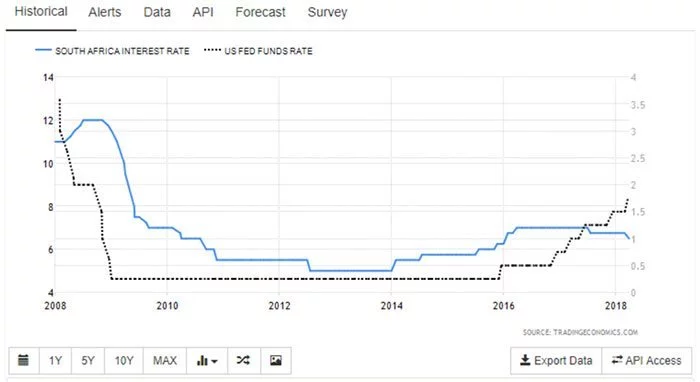

As an example, the US Federal Reserve has 1.75% interest rate while the South African Reserve Bank has its benchmark interest rate at 6.25%. This means the SARB has higher interest rates than the US Federal reserve bank.

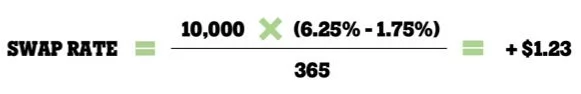

If you buy the USD/ZAR currency pair, you’re going to pay the interest rate or the swap. This is because you’re buying the lower interest rate currency and at the same time selling the higher interest rate currency. Check your broker’s swap rates or to use a forex swap calculator to calculate money gained or lost. If you want to determine the swap rate for yourself, we need to know the short-term interest rate of each of the two currencies and how many contracts we have bought. Let’s assume we hold a short 10,000 USD/ZAR position. In this case, the daily swap rate is calculated using the following formula:

This means that for each day you’re holding your short USD/ZAR position your account will be credited with approximately $1.23 each night.

Currency Swaps and Carry Trades

Because you carry one trade from one day to the next sometimes, as the name suggests, we can refer to swap as the carry trade. A carry trade is when you buy a high-interest currency against a low-interest currency. This way you make a profit on the interest rate alone. In this case, we buy the high yielding currency as the broker will pay the interest difference between the two currencies. As long as you are trading in the interest positive direction. Besides the interest differential gains, you can also profit from the exchange rate fluctuation. This is if you’re trading in the direction of carry interest and if the exchange rates appreciate. There is a high incentive, especially for hedge fund managers who are chasing yield, to take part in the carry trade.

Conclusion

The swap is the interest that you either earn or that you pay for holding a position overnight. Generally, you’ll not earn or pay anything if you don’t hold that trade through 5 PM EST. However, some brokers choose to charge traders right away on a minute by minute basis. Check with your Forex broker to see how they charge on swaps. In reality, every Forex broker sets its own swap rates and these rates will always be slightly different than the benchmark interest rates.

Stay updated

This form has double opt in enabled. You will need to confirm your email address before being added to the list.