-

MetaTrader 4 Brokers

The top MT4 brokers in AU

-

MetaTrader 5 Brokers

The best MT5 brokers in AU

-

TradingView Brokers

The best TradingView brokers

-

cTrader Brokers

The top cTrader brokers in AU

-

Forex Trading Apps

Trade on the go from your phone

-

Copytrading Brokers

Copy professional traders

-

All Trading Platforms

Find a platform that works for you

Quotes, pips and spreads are common Forex trading terms that are used to describe different aspects of currency pairs. In this article we will look at these important elements of Forex trading in more detail and what we actually mean when we use these terms.

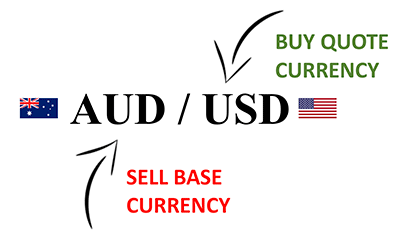

Currency pairs are written as a combination of two 3 letter codes to describe the two currencies in the pair. AUD/USD is the Australian Dollar and United States Dollar currency pair.

What are Quotes in Forex Trading?

When opening a trade on the Forex market, the trader is buying one currency and selling another simultaneously. Because we cannot buy one currency without selling the other, all currency values are quoted in pairs (e.g. AUD/USD or USD/EUR)

The currency on the left represents the base currency while the currency on the right represents the counter currency which is also referred to as the quote currency.

Example: If the AUD/USD is 0.7500, it means it takes 0.7500 US dollars to buy one Australian Dollar. The value of the Base currency is always 1.

If the value of AUD/USD increases, it means the Base currency has strengthened, and the Quote currency has weakened. If the value of AUD/USD decreases, it says the Base currency has weakened while the Quote currency has strengthened.

What is Pip in Forex Trading?

A Pip stands for “Percentage in Point” and represents the smallest unit of price change in any given currency pair.

Most currency pairs are valued to the 4th decimal place. In these cases, one pip is one unit of this 4th decimal place, which is 1/100th of 1%. Occasionally, some brokers will quote you prices in five decimal places, where the 5th decimal is called a pipet or fractional pip.

Example: If the AUD/USD exchange rate is currently valued at 0.7515, and if tomorrow the exchange rate is at 0.7450, therefore there was a fall of 0.0065 (0.7515 – 0.740). If a change of 0.0001 is 1 pip, then a change of 0.0065 represents 65 pips. Therefore, we can say the AUD/USD exchange rate fell by 65 pips. Much easier.

Not all currency pairs are priced at the 4th decimal place, an example of this being the Japanese Yen, which is priced to the second decimal place. When we describe the currency pairs regarding pips, we are just talking about a unit of conversion.

What are Spreads in Forex Trading?

Upon logging into your trading account, the quote window will show both bid and ask quotes for currency pairs. The right is the buy price, and the left side is the sell price. This two-way quote system is used for pricing all currency pairs.

The spread is the difference between the price at which you can buy (Ask) and the price at which you can sell (Bid). The spread is measured in the numbers of pips between the ask price and bid price and the size of the bid-ask spread is the transaction cost.

Example: If the current bid price of the AUD/USD is 0.7610 and the current offer price is 0.7611 this means the spread is 1 pip.

The spread is one of two ways a Forex broker makes money – the other is by charging commission on your trades.

Direct Quote vs Indirect Quote

There are two types of quotes: a direct quote and an indirect quote. If the second currency or the quoted currency of a currency pair is the domestic currency, then we’re dealing with a direct quotation system.

If the first currency or the base currency of a currency pair is the domestic currency, then we’re dealing with an indirect quotation system.

For example, if we’re looking at the Australian Dollar as being the domestic currency and the US Dollar as the foreign currency then:

- A direct quote would be USD/AUD

- While an indirect quote would be AUD/USD.

For example, if the Australian Dollar is the domestic currency, an indirect quote would be 0.7800 AUD/USD which means that with 1 AUD, you can purchase 0.78 USD. The direct quote (USD/AUD) will be the inverse (1/0.7800) or 1.2820 USD/AUD which means that with 1 USD you can purchase 1.2820 AUD.

Forex Cross Currency

A Forex cross currency is a currency pair traded in Forex that doesn’t include the US Dollar in the quotation system. The most popular currency crosses include the following pairs: EUR/GBP, EUR/JPY, and GBP/JPY.

The cross currency pairs were released to help individuals who wanted to exchange their money directly without having first to convert it to USD. When trading these crosses take note that they are less liquid and more volatile, which means that you can also make more money trading these pairs.

Stay updated

This form has double opt in enabled. You will need to confirm your email address before being added to the list.