-

MetaTrader 4 Brokers

The top MT4 brokers in AU

-

MetaTrader 5 Brokers

The best MT5 brokers in AU

-

TradingView Brokers

The best TradingView brokers

-

cTrader Brokers

The top cTrader brokers in AU

-

Forex Trading Apps

Trade on the go from your phone

-

Copytrading Brokers

Copy professional traders

-

All Trading Platforms

Find a platform that works for you

Admiral Markets Broker Review

Last Updated On August 21, 2023

75-90% of retail traders lose money trading Forex and CFDs. You should consider whether you understand how CFDs and leveraged trading work and if you can afford the high risk of losing your money. We may receive compensation when you click on links to products we review. Please read our advertising disclosure. By using this website you agree to our Terms of Service.

Our verdict on Admirals

A trustworthy global online broker, Admirals is regulated by some top-tier authorities, including Australia’s ASIC. It offers a range of low-cost accounts and has an excellent suite of trading tools. However, traders may be disappointed in the high currency conversion fees for accounts denominated in other currencies.

Admirals offers support for the MT4 and MT5 trading platforms in addition to Admirals’ sleek mobile app that is intuitive and easy to set up. It boasts excellent trading conditions on four live accounts, with spreads that start at 0.5 pips (EUR/USD) on its commission-free accounts, and commissions of 6 USD (round turn) on its Zero Accounts in exchange for spreads of 0.1 pips (EUR/USD), which is highly competitive.

Admirals offers trading on over 3200 CFDs and over 4000 stocks and is home to the MetaTrader Supreme Edition, a plugin that offers technical analysis on virtually every financial instrument.

Overall, with local ASIC regulation, some of the lowest trading fees in the industry, a huge choice of financial instruments, and excellent trading tools, Admirals will appeal to many Australian traders.

| 🏦 Min. Deposit | AUD 100 |

| 🛡️ Regulated By | ASIC, CySEC, FCA, FSCA |

| 💵 Trading Cost | USD 8 |

| ⚖️ Max. Leverage | 30:1 |

| 💹 Copy Trading | Yes |

| 🖥️ Platforms | MT4, MT5, MT Supreme |

| 💱 Instruments | Bonds, Commodities, Cryptocurrencies, Stock CFDs, ETFs, Forex, Indices, Metals |

Overall Summary

Account Information

Trading Conditions

Company Details

Pros

- Well regulated

- Excellent education

- Wide range of assets

Cons

- Expensive withdrawals

Is Admirals Safe?

Admirals boasts regulation from some of the world’s top regulators, including Australia’s local regulator, ASIC.

ASIC Regulation: Australian residents will be onboarded through the subsidiary, Admirals Pty Ltd, which is authorised and regulated by the Australian Securities and Investment Commission (ASIC).

Safety Features: Considered one of the best regulators in the world, under ASIC regulation:

- All client money is kept fully segregated from Admirals’ own assets in top-tier credit institutions.

- Traders are afforded negative balance protection.

However, ASIC restricts leverage to 30:1 and prohibits Admirals from offering bonuses and promotions, which some Australian traders may find restrictive.

Company Details:

Admirals’ Financial Instruments

The choice of financial assets offered by Admirals is wider than other similar brokers, with over 3200 share CFDs, 3500 stocks, and 375 ETFs.

See below for Admirals’ range of instruments and corresponding leverage:

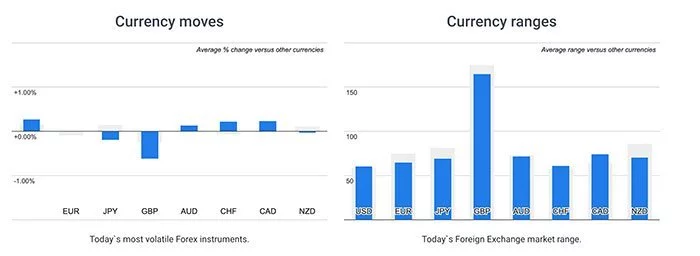

- Forex: Admirals has over 50 currency pairs available for trading which is around the industry average. These include majors (EUR/USD, GBP/USD, and USD/JPY), minors (NZD/CAD, EUR/JPY, and USD/ZAR), and exotics.

- Share CFDs: Admirals offers 3204 share CFDs, which is more numerous than other large international brokers. The selection available includes some of the major US, UK, and European Exchanges.

- Indices: There are 43 indices available for trading at Admirals, which is more than is available at other similar brokers. The most popular indices are those that combine the shares of some of the largest and globally acknowledged companies.

- Commodities: Admirals offers trading on 28 commodities, which is a much broader range than is commonly available at other brokers. Most other brokers offer between 5 and 10 commodities. Commodities include metals such as gold and silver, energies such as oil, and softs such as sugar, cocoa, and cotton.

- Bonds: Like other brokers, Admirals offers trading on two bonds, namely the 10-year Germany Bund Futures CFD and the 10-year US Treasury Note Futures CFD.

- ETFs: Admirals offers trading on 375 ETFs, which is a wider range than is offered by other similar brokers.

- Cryptocurrencies: Admirals offers 42 cryptocurrencies for trading, a huge selection compared to other similar brokers. Spreads are wider than for Forex, but this in line with industry norms.

Overall, Admirals offers a much broader range of tradable instruments than other brokers and really outshines its competitors in its commodity, share CFD, and ETF offerings.

Admirals’ Accounts and Trading Fees

Admirals is unusual amongst brokers in that it offers four different account types, with trading conditions that vary depending on the platform chosen.

Trading Costs: All Admirals’ accounts have a minimum deposit of 100 AUD, which is around the industry average. Trading costs on the Trade MT4/MT5 accounts are around 5 USD per lot traded, while the trading costs on the MT4/MT5 Zero Accounts are around 7 USD per lot traded. These trading costs are some of the lowest in the industry.

Admirals also offers an investment account for real stock trading, but the focus of this review will be on CFD trading.

See below for more details:

Admirals Account Trading Costs:

Trade.MT5

The Trade.MT5 Account has a minimum deposit requirement of 100 AUD, leverage up to 30:1, and no commissions are charged for Forex trading. Spreads start at 0.80 pips for the EUR/USD, and it is available as an Islamic swap-free account.

Zero.MT5

With a minimum deposit requirement of 100 AUD, the Zero.MT5 account has spreads starting at 0.0pips on the EUR/USD, and a commission of between 1.8 and 3 USD is charged per lot per side (see below for commission structure).

Trade.MT4

The minimum deposit on this account is also 100 AUD. Spreads start at 0.5 pips (EUR/USD) on this account, and no commissions are charged. Note that there are no Islamic swap-free options on this account.

Zero.MT4

The minimum deposit is 100 AUD on this account, leverage is up to 30:1, and spreads start at 0.0 pips on the EUR/USD. A commission of between 1.8 and 3 USD is charged per side per lot traded, dependent on the trading volume (see below for commission structure). This account does not offer Islamic swap-free options.

Commission Structure

A commission is charged per lot on Zero.MT4 & Zero.MT5 accounts. This is a commission for a single side trade. Commission for a round turn trade (opening and closing) is doubled and is fully charged at the opening of the order. The following table shows the commission structure in AUD:

Overall, Admirals’ trading costs and minimum deposit requirements are lower than other similar brokers, and it offers trading on a wide range of assets, making it appealing to both beginners and experienced traders alike.

Deposits and Withdrawals

Admirals offers a limited number of funding options compared to most other brokers. Additionally, deposit and withdrawal fees are high for currencies other than those supported by Admirals, and its processing times are slow.

As a well-regulated broker, Admirals does not process payments to third parties. All withdrawal requests from a trading account must go to a bank account or a source in the trader’s name.

Trading Account Currencies: Admirals offers a wide range of trading account currencies through its ASIC subsidiary, including AUD, EUR, GBP, USD, and SGD. Deposits to trading accounts can be made in most national currencies, which are subsequently converted into AUD, EUR, GBP, USD, and SGD, or other applicable currencies.

In order to protect your capital from currency fluctuation, you can have multiple trading accounts in different currencies at the same time. This gives traders an opportunity to transfer funds from one account to another through a convenient internal transfer straight from the Trader’s Room (available on Admirals’ mobile app).

Deposits and Withdrawals: Deposits can be made via credit cards/debit cards, e-wallets (Skrill and Neteller), and bank transfers. Credit cards/debit cards are processed instantly, but deposits via wire transfer can take 3 bank days to reflect. No commissions are charged on deposits or withdrawals, but should the base currency of a client’s trading account differ from the base currency of the transferred funds, the amount transferred will be converted to the base currency of the client’s trading account, and a 0.3% fee will be charged. For those transferring funds via e-wallets in a different base currency, the first 5 transfers will be free, and thereafter 1% of the amount will be charged.

Withdrawals are only available via wire transfer, with a processing time of 1-3 business days. A fee of 3 USD (or equivalent) is charged for domestic transfers and up to 20 USD for international transfers.

See below for more details:

- Bank transfer: Deposits take 3 days to be processed but are free. There is no maximum deposit amount. Withdrawals take up to 3 – 5 days to be processed, and there is one free withdrawal request a month.

- Credit card/Debit card: Deposits are instant and free. Withdrawals cannot be made via credit/debit cards.

- e-Wallets (Skrill/Neteller): The first 5 deposits and withdrawals will be free, and thereafter 1% of the amount will be charged.

Overall, the non-trading fees associated with deposits and withdrawals at Admirals, especially when trading in currencies other than those supported by the company are high. Additionally, Admirals’ processing times are slower than other similar online brokers, and it offers a limited number of funding methods.

Admirals’ Mobile Apps

Admirals’ mobile trading platforms are above average when compared to other similar brokers.

Admiral Markets’ Trading App

Developed entirely in-house, the Admirals app is available on both Android and iOS.

Features: We found that the Admirals’ trading app has a clean interface and is easy to use. It has a sophisticated dashboard and intuitive home screen that allows you to add instruments to your watchlists, view market analysis materials, and contact customer support from within the app. It also has excellent search functionality and it’s simple to place orders, set price alerts, and view live prices and charts. Admirals has also updated its charts, and traders can tap with one finger to check the price for a selected period or tap with two fingers to check the price difference for a selected range:

Conveniently, we were also able to deposit and withdraw funds and upload and scan our documents.

MT4/MT5 Mobile Applications

Both trading platforms are available on both Android and iOS mobile devices and tablets. Beginner traders should be aware that there is some loss in functionality when compared to the desktop trading platforms, including reduced timeframes and fewer charting options. In addition, spotty connections can reduce the overall trading experience. Generally, it is better to be at your desktop to conduct day-to-day trading and use a mobile device to keep an eye on the markets or close open positions.

The Admirals MT4 and MT5 apps allow traders to work from anywhere, with functionality to close and modify existing orders, calculate profit/loss in real-time, and tick chart trading to further assists traders while on the move.

Overall, Admirals’ mobile trading support is better than that of other brokers, with support for the MT4/MT5 apps in addition to its own mobile app.

Other Trading Platforms

The MT4 and MT5 trading platforms are available as downloads for your computer and as a Webtrader in your browser.

MT4 and MT5

The benefit of Admirals offering third-party platforms such as MT4 and MT5 is that traders can take their own customised version of the platform with them should they choose to migrate to another broker. Additionally, thousands of plugins and tools are available for both the MetaTrader platforms.

While MT4 has great customisability, the platform feels outdated, and some of the features can be hard to find. MT5 is more powerful and faster than MT4 when it comes to back-testing functionality for automated trading algorithms. It also has a built-in news feed, market depth indicator, economic calendar, and trades can be made on the charts.

Trading Platforms Comparison:

Trading Tools

Admirals trading tools are superior compared to those offered by other similar brokers. The MetaTrader Supreme Edition is one of the best MetaTrader plugins on the market. Integrated into the Metatrader Supreme Edition is Trading Central and a number of other useful tools. It also offers a VPS service.

Admirals has partnered with Trading Central to integrate its indicators (Forex Featured Ideas and Technical Insight) into the MetaTrader Supreme Edition. These two highly customisable tools provide pattern recognition and technical analysis for almost all financial instruments. A VPS service is also offered to clients who maintain an equity amount of 5000 EUR (or equivalent) in their trading accounts.

MetaTrader Supreme Edition

Trading Central

A third-party tool, Trading Central’s professional analysts use the most advanced technical analysis tools in the industry to gather the most comprehensive and in-depth market information. This tool essentially supports traders without the technical know-how in making trading decisions. This dynamic product suite is available to traders through the MetaTrader Supreme Edition. Trading Central is considered one of the best trading tools in the industry, and Admirals does well to offer this tool to its clients.

Global Opinion Toolset

Also included in the MetaTrader Supreme Edition is the Global Opinion toolset. These tools scan and contextualise millions of financial news stories and social media posts daily, giving traders a dynamic view of market sentiment. They can drastically reduce the length of time traders need to spend on daily research by flagging-up the best assets to trade and warning of changes in the market that may impact trade success.

Mini-Terminal

Additionally, a new mini-terminal facilitates trade management by making commonly-used trading features more accessible than in the native version of the software. A mini-chart feature also lets traders see multiple time frames and chart types in a single chart.

An additional Trade Terminal feature helps traders manage multiple orders concurrently, using the same advanced trade management features of the mini-terminal.

Tick Chart Trader

Tick Chart Trader allows clients to trade tick charts fast and accurately. An additional Indicator Package with the latest indicator technology delivers more chart information and trading signals within the trading tool.

Trading Simulator

Finally, a trading simulator is available to backtest strategies on historical price data. Until this feature was conceived, traders were limited to testing strategies with a demo account in real-time. The trading simulator enables traders to test multiple strategies on the same data set to find the optimal strategy for different market situations.

VPS

Admirals offers a VPS (Virtual Private Server) service for traders who deposit more than 5000 EUR in their trading accounts. VPS hosting allows traders to run automated algorithmic strategies, including expert advisors 24 hours a day 7 days a week on a virtual machine. VPS services have the advantage of never suffering connectivity issues and have extremely low latency due to their proximity to major international exchanges.

Overall, Admirals offers a much more comprehensive set of trading tools than is available at other similar brokers.

Admirals for Beginners

Admirals has invested heavily in helping new traders find their feet, offering an extensive library of educational articles, tutorials, and webinars. For clients looking for active support Trading Central provides chart analysis and analyst recommendations.

Educational Material

Admirals offers an excellent educational repository that is suited to traders of all experience levels.

The educational material available through Admirals is extensive and varied. Split into different sections, Admirals offers a structured course, a knowledge base, an overview of risk management, and frequent webinars.

Admirals also provides a free, structured Forex and CFD trading course called Forex 101, designed to help beginners learn how to trade. It is a collection of nine online lessons split into beginner, intermediate and advanced stages, and all lessons are taught by professional traders. The course covers everything from setting up MT4 to managing risk and is an excellent resource for new traders.

Admirals also provide expert-led webinars. Webinar topics include commentary on the upcoming week or educational webinars like Mastering the 4Ms of Trading, which help traders develop trading skills and build confidence.

Overall, Admirals’ education section is comprehensive, in-depth, and caters to both beginners and more advanced traders.

Education Comparison:

Analysis Material

Admirals market research materials are comprehensive and well-structured and compare well to other large international brokers.

- Trading News: The Trader`s Blog, which is open to all clients, provides daily economic news and context or analysis to help traders find new opportunities through insightful and practical market information. Other articles include a more in-depth analysis of a specific subject.

- Market Heat Map: The Market Heat Map is a real-time visual method of following asset price movements and obtaining daily trading data from the FX and CFD markets. This tool highlights the most volatile assets, and thus presents various trading opportunities.

- Market Sentiment: The Market Sentiment tool is a visual interpretation of aggregated data from multiple service providers showing the relationship between open long and short positions. Market sentiment data is useful to help understand macro trends and the mood of the trading collective. This information is especially useful for traders holding positions for long periods.

- Premium Analytics: Launched in September 2019, Premium analytics was launched with free access for demo and live accounts. With it, premium data feeds are used to deliver the best information to traders. This video (33 minutes) is a full tour of the product.

- Weekly Podcast: Admirals delivers a weekly podcast that covers the most engaging and informative trading news and analysis possible. New podcasts will be available every Monday, covering the economic news and events of the past and coming week, as well as offering market analysis and trading strategies.

- Forex calendar, or economic calendar: A list of scheduled events that could affect the currency markets.

Customer Support

Admirals’ customer support team is available during business hours, five days a week, via live chat, email, and phone in 23 different languages. Drop-in appointments are also available at any of their office locations.

Furthermore, remote support for technical issues related to MetaTrader or the MetaTrader Supreme Edition is available to clients during business hours.

For the purposes of this review, we found the customer service responsive, knowledgeable, and polite.

Safety and Industry Recognition

Recognition: Founded in 2001 and headquartered in the UK and Estonia, Admirals is regulated by the Financial Conduct Authority (FCA), the Cyprus Securities and Exchange Commission (CySEC), the Australian Securities and Investments Commission (ASIC), and the Jordan Securities Commission (JSC). See below for a list of Admirals’ registered companies:

- Admirals UK Ltd is registered in the United Kingdom under Companies House – registration number 08171762. Admirals UK Ltd is authorised and regulated by the Financial Conduct Authority (FCA) – registration number 595450.

- Admirals Cyprus Ltd is registered in Cyprus – with company registration number 310328 at the Department of the Registrar of Companies and Official Receiver. Admirals Cyprus Ltd authorised and regulated by the Cyprus Securities and Exchange Commission (CySEC), license number 201/13.

- Admirals Pty Ltd registered Office: Level 10,17 Castlereagh Street Sydney NSW 2000. Admirals Pty Ltd (ABN 63 151 613 839) holds an Australian Financial Services Licence (AFSL) to carry on financial services business in Australia, limited to the financial services covered by its AFSL – 410681.

- Admirals AS Jordan Ltd is authorised and regulated to conduct investment business by the Jordan Securities Commission (JSC) in the Hashemite Kingdom of Jordan, registration number 57026.

- Admirals SA (Pty) Ltd is registered in South Africa with the Companies and Intellectual Property Commission (CIPC) – registration number – 2019 / 620981 / 07. Admirals SA (Pty) Ltd is an authorised financial services provider (FSP51311) registered at the Financial Sector Conduct Authority. The registered office for Admirals SA (Pty) Ltd is: Unit OG/N1, 33 Scott Street, Waverley, Johannesburg, Gauteng, 2090.

Awards

Admirals have won many industry awards over the years, the most recent being Best Forex Platform 2019 (ADVFN International Financial Awards), and Best CFD Broker 2019 (DKI’s 2019 CFD Broker Customer Survey). While awards in recent years have focused on the broad strength of Admirals as a brokerage, it is often recognised for its commitment to trading technology, user experience, and customer service.

Overall, with a long track record of responsible behavior, strict internal processes, and strong international regulation, we consider Admirals a safe broker to trade with.

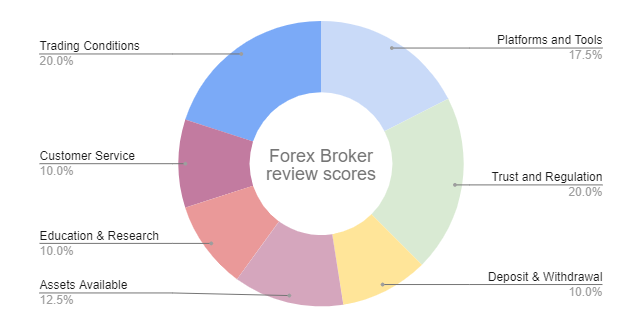

Evaluation Method

We value transparency and openness in the way we review the partners. To bring transparency to the forefront, we have published our review process. Central to that process is the evaluation of the reliability of the broker, the platform offering of the broker and the trading conditions offered to clients, which are summarised in this review. Each one of these is graded, and an overall score is calculated and assigned to the broker.

Admiral Markets Risk Statement

According to regulation, brokers are required to be transparent with Forex traders about the complexity of financial products and also disclose the extent to which traders can lose their money. Admiral Markets wants you to know: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 76% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Conclusion

Admirals is a leading global online broker. It boasts excellent trading conditions, including tight spreads, low minimum deposits, and low commissions on both the MT4 and MT5 platforms. With excellent regulation, comprehensive trading tools, and world-class educational and market analysis materials, Admirals has developed a reputation for being one of the top Forex and CFD brokers for good reason. The only drawback of an otherwise excellent all-round offering is the high non-trading fees charged by Admirals.

Editorial Team

Chris Cammack

Head of Content

Chris joined the company in 2019 after ten years experience in research, editorial and design for political and financial publications. His background has given him a deep knowledge of international financial markets and the geopolitics that affects them. Chris has a keen eye for editing and a voracious appetite for financial and political current affairs. He ensures that our content across all sites meets the standards of quality and transparency that our readers expect.

Alison Heyerdahl

Senior Financial Writer

Alison joined the team as a writer in 2021. She is the Senior Editor for FXScouts. She has a medical degree with a focus on physiotherapy and a bachelor’s in psychology. However, her interest in forex trading and her love for writing led her to switch careers. She has a passion for Forex trading and over a decade of editorial experience researching Forex and the financial services industry, producing high-quality content. She hosts a weekly podcast, “Let’s Talk Forex,” alongside her colleague, Chris, and has produced over 100 Forex educational videos for the FXScouts YouTube channel. She also writes weekly technical analyses and has tested and reviewed over 100 Forex brokers.

Ida Hermansen

Financial Writer

Ida joined our team as a financial writer in 2023. She has a degree in Digital Marketing and a background in content writing and SEO. In addition to her marketing and writing skills, Ida also has an interest in cryptocurrencies and blockchain networks. Her interest in crypto trading led to a wider fascination with Forex technical analysis and price movement. She continues to develop her skills and knowledge in Forex trading and keeps a close eye on which Forex brokers offer the best trading environments for new traders.

Compare Brokers

Find out how Admirals stacks up against other brokers.

Stay updated

This form has double opt in enabled. You will need to confirm your email address before being added to the list.