-

MetaTrader 4 Brokers

The top MT4 brokers in AU

-

MetaTrader 5 Brokers

The best MT5 brokers in AU

-

TradingView Brokers

The best TradingView brokers

-

cTrader Brokers

The top cTrader brokers in AU

-

Forex Trading Apps

Trade on the go from your phone

-

Copytrading Brokers

Copy professional traders

-

All Trading Platforms

Find a platform that works for you

Pepperstone Broker Review

Last Updated On February 6, 2024

75-90% of retail traders lose money trading Forex and CFDs. You should consider whether you understand how CFDs and leveraged trading work and if you can afford the high risk of losing your money. We may receive compensation when you click on links to products we review. Please read our advertising disclosure. By using this website you agree to our Terms of Service.

Our verdict on Pepperstone

One of our highest-rated brokers, Pepperstone has been regulated by ASIC since 2010 and is globally renowned for its low trading costs and choice of trading platforms. Pepperstone keeps costs low with some of the tightest spreads we’ve seen, starting at 1.00pips (EUR/USD) on its Standard Account. For those who prefer classic ECN trading, the Razor Account has low commissions and spreads averaging just 0.10 pips on the EUR/USD. Neither account has a required minimum deposit.

Despite the low costs, we are disappointed with Pepperstone’s complicated commission structure. But more experienced traders will appreciate Pepperstone’s trading platform options, including MT4, MT5, cTrader, Tradingview, and their newly added in-house platform. All are available on desktop and mobile devices. Pepperstone’s education section is not the most extensive we’ve seen, but it is competent and well-structured, making it a good place to start for beginner traders.

| 🏦 Min. Deposit | AUD 100 |

| 🛡️ Regulated By | ASIC, CySEC, BaFin, CMA |

| 💵 Trading Cost | USD 10 |

| ⚖️ Max. Leverage | 30:1 |

| 💹 Copy Trading | Yes |

| 🖥️ Platforms | MT4, MT5, cTrader, TradingView |

| 💱 Instruments | Commodities, Cryptocurrencies, Stock CFDs, ETFs, Forex, Indices, Metals |

Overall Summary

Account Information

Trading Conditions

Company Details

Pros

- Well regulated

- Tight spreads

- Great platform choice

- Wide range of assets

Cons

- Limited market analysis

Is Pepperstone Safe?

With a long history of responsible behaviour and local and international regulation, Pepperstone is a safe broker for Australians to trade with.

ASIC Regulated: Australian traders will be trading with the Australian subsidiary of Pepperstone, which is licenced and regulated by the Australian Securities and Investment Commission (ASIC).

Safety Features: In early 2021, ASIC tightened its restrictions on CFD trading to protect traders better. Pepperstone clients in Australia will have a leverage limit of 30:1 for Forex trading and have negative balance protection, so they can never lose more money than they have in their trading accounts. ASIC regulations also prevent Pepperstone from offering promotions or bonuses.

With over a decade of responsible behaviour toward its clients, a large international customer base, regulation from some of the strictest authorities in the world, and a long list of awards, Pepperstone is considered a reliable and safe Forex broker.

Company Details:

Pepperstone’s Financial Instruments

On top of 100 Forex pairs, Pepperstone has cryptocurrency pairs and currency indices that are hard to find at other brokers. But we were disappointed to find that Pepperstone has fewer shares to trade than most other large brokers.

Pepperstone offers a similar range of instruments as other brokers but offers a wider range of Forex pairs and cryptocurrencies, including the ETH/BTC cross-pair. Due to ASIC regulations, maximum leverage on all assets is low, though this will be the same for all ASIC-regulated brokers.

Full List of Instruments:

Forex: Pepperstone offers 100 currency pairs for trading, more than most other Forex brokers, but ASIC regulations limit Forex leverage to 30:1.

Share CFDs: Pepperstone offers 1000+ share CFDs, including 600+ US stocks as well as a selection of UK, German and Australian blue chips. Note that share CFDs are only available on the MT5 platform. Leverage on share CFDs is up to 5:1.

Commodities: Pepperstone offers 17 commodities, including gold, silver, platinum, petroleum, natural gas, and softs such as coffee, cocoa, and orange juice. The maximum leverage on commodities is 10:1.

Indices: Pepperstone offers trading on 28 indices, including the likes of the NASDAQ, FTSE100, DAX30, Hang Seng and even the Johannesburg Stock Exchange. Leverage is up to 20:1 on indices.

Cryptocurrencies: Pepperstone has 18 crypto pairs, including ETH/BTC cross, and 3 crypto baskets available for trading. Leverage on cryptocurrency trading is limited to 2:1, but crypto trading is available 7 days a week.

Currency Index CFDs: Currency indices track the value of a currency against a basket of other currencies. This differs from a currency pair in that there must be more than one other currency that the main currency is being measured against. Currency indices available include the USD index, EUR index, and JPY index. The maximum leverage is 10:1.

Accounts and Trading Fees

Pepperstone has two accounts with very low trading costs compared to other brokers, and neither trading account has a required minimum deposit. Commissions on the Razor Account were difficult to determine as they’re calculated differently on each of the three trading platforms.

Trading Fees: Neither the Standard Account nor the Razor Account has a required minimum deposit, though we recommend starting with a minimum of 200 AUD to avoid margin calls. Trading costs on both accounts are much lower than most other brokers.

Account Trading Costs:

As you can see from the table above, the trading costs on Pepperstone’s Standard Account are built into the spread and are slightly lower than the costs on the Razor Account, which has a small commission that changes depending on which trading platform you use. Commissions are also affected by the base currency of your account on the MT4 and MT5 platforms and what currency pair you are trading on the cTrader platform.

Pepperstone Standard Account

This commission-free trading account has no minimum deposit requirement. Costs are included in the spreads, which average at 1.00pips on the EUR/USD. This account is one of the lowest-cost trading accounts in the world and is especially good for beginner traders who do not want to spend time calculating commission costs.

Pepperstone Razor Account

Pepperstone’s raw spread account is the Razor Account and has no required minimum deposit. Spreads average at 0.10 pips on the EUR/USD – which is the lowest average spread we have found at ANY broker – and a commission is charged per lot traded. Commissions change depending on your trading platform, the base currency of your account, and your trading volume.

Razor Account Commissions

MT4 and MT5: Commissions on the MT4 and MT5 Razor Accounts are charged in the base currency of your account. We noticed how cheap the commissions are for traders with an AUD base currency when we opened our account. Given that (as of May 2022) the USD/AUD is currently at 1.41, the commission cost per lot with an AUD base currency is the equivalent of 4.98 USD – a saving of around 2 USD per lot when compared to an account with a USD base currency.

cTrader: The commission structure for cTrader Razor Accounts is based purely on what currency pair you are trading. The cTrader Razor Account commission is always 0.007% (round turn) of the base currency that’s being traded. So, if you’re trading 100,000 USD/CHF, the commission will be 3.50 USD to open the trade and 3.50 USD to close the trade.

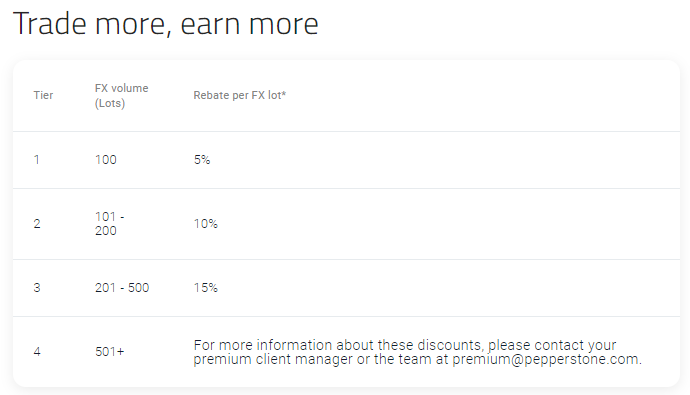

Active Trader Program

Trading commissions can be further reduced by becoming a member of Pepperstone’s Active Trader Program. The Active Trader Program has several advantages for high-volume traders, including discounted commissions, a free VPS service, and priority customer support. The commission discount with the Active Trader Program features 4 tiers as follows:

For more information about tier 4 of the Active Trader Program, traders should contact Pepperstone customer support.

Deposits and Withdrawals

Pepperstone’s deposit and withdrawal fees are average compared to other brokers, though Pepperstone does lack transparency when it comes to funding methods and costs.

As a well-regulated broker, Pepperstone ensures that all Anti-Money Laundering rules and regulations are followed, and as such, all non-profit withdrawals are returned to the deposit source.

Accepted Deposit Currencies: Accounts can be opened in a range of base currencies, including USD, EUR, GBP, AUD, CHF, JPY, NZD, SGD, HKD, and CAD. Pepperstone charges a currency conversion fee for transfers in currencies other than Pepperstone’s accepted base currencies. Currency conversions are charged at the current spot rate, minus a conversion fee of up to 1 percent. This should not be a problem for Australian traders with AUD trading accounts, but for those wishing to open a USD account, it is something to be aware of.

Funding Methods and Fees: Pepperstone offers a range of fee-free deposit and withdrawal options; however, a fee of 20 USD is charged by Pepperstone for international bank transfers; and withdrawals through Skrill or Neteller cost 1 USD.

Pepperstone’s Mobile Trading Apps

Pepperstone provides an excellent range of mobile trading apps, recently adding its proprietary app to its offerings. MT4, MT5, cTrader and Tradingview are also available for download as well.

All of Pepperstone’s trading platforms are available on both Android and iOS mobile devices and tablets. Beginner traders should be aware that there is some loss in functionality when compared to the desktop trading platforms, and poor mobile connections seriously impact trading.

Pepperstone App

The newly launched Pepperstone app comes with one-click trading, as well as technical indicators and risk management features to help traders make informed decisions. You can also build customised watchlists or follow public ones, access multiple charting options and analyses, or contact customer support for help. Instruments for trading include forex, commodities, indices and cryptocurrencies.

cTrader App

cTrader is one of our favourite trading platforms, and Pepperstone is one of a handful of brokers that supports it. Its clean design makes it easy for beginners to pick up, but it also has the advanced order types and automation options required by more experienced traders. The Pepperstone cTrader app keeps most of the best parts of the desktop version, including the complete range of order types, price alerts, trade analysis, and symbol watchlists. It also integrates seamlessly with TradingView, an advanced charting tool:

TradingView

TradingView is free of charge for traders who open a live account. It is an excellent tool for researching, charting, and screening any instrument. Additional features of Pepperstone’s TradingView tool include:

- 50+ intelligent charting tools

- Over 100,000 custom user-built indicators and scripts

- Synchronised layout for multiple charts

Traders should note that TradingView is only available on the Razor Account.

MT4 and MT5 Apps

The Pepperstone MT4 and MT5 apps allow traders to work from anywhere, with nine timeframes, 30 indicators, and interactive currency charts. Functionality to close and modify existing orders, calculate profit/loss in real-time, and tick chart trading further assists traders while on the move.

Pepperstone’s Other Trading Platforms

With MT4, MT5, cTrader, Tradingview and the newly added proprietary platform available, Pepperstone offers support for more trading platforms than most brokers.

Pepperstone offers traders MetaTrader 4 (MT4), MetaTrader 5 (MT5), cTrader, and Tradingview, as well as their own in-house trading platform. The third-party platforms offer Expert Advisors, automated trading support, and copy trading functionality, currently unavailable with the Pepperstone in-house platform.

All platform choices are free to use, all can be downloaded to your PC or Mac, and all have web versions of the platform. Traders who want more EAs to use, and don’t mind the dated interface, should consider using one of the MetaTrader products. cTrader is often a favourite for beginner traders as it requires less setup, has a more modern interface, and offers more advanced order types. TradingView is a modern trading platform with advanced functionality and superb charting abilities.

The newly added proprietary platform is a good choice for beginners – it’s modern, easy to use and comes with all the basic functionalities needed, such as technical indicators, risk management and multiple charting options.

Trading Platform Comparison:

Opening an Account at Pepperstone

Opening an account at Pepperstone is a fully digital process but does require a suitability assessment that many other brokers do not carry out.

All Australians are eligible to open a trading account at Pepperstone but will have to follow the fully digital four-step application process. Once the process is complete, Pepperstone aims to approve applications within 4-8 hours.

How to open an account at Pepperstone:

- Create your login via the Pepperstone website; you will be asked for your email address and asked to choose a password.

- The second step is to take the Pepperstone suitability test. This short questionnaire is used by Pepperstone customer service to assess whether trading CFDs is appropriate for you. While most brokers omit this step in the account-opening process, it is a responsible move in an industry that is often accused of an irresponsible approach to consumer protection.

- The third step is to confirm your identification. Pepperstone will need two ID documents from you; the easiest way to provide these documents is to take a photo of them with a mobile phone:

- A photo ID (passport, driver’s license, or Australian ID card) and;

- A secondary ID (a bank or utility statement with your full name and address dated in the last three months).

- Important: Pepperstone will not accept ID documents that are black and white images, scanned copies, blurry or damaged.

- Once your application is approved, you can log in and fund your account in your chosen base currency.

Pepperstone’s account opening process is fast, generally hassle-free, and fully digital compared to other similar brokers. The only issue that some traders may have is the suitability assessment test, though this is a responsible move on Pepperstone’s part that protects the funds of those unsuited to high-risk investments.

Pepperstone Trading Tools

Pepperstone’s trading tool options are better than most brokers, with free Autochartist for all traders and Smart Trader Tools for MT4 and MT5.

Smart Trader Tools for MetaTrader4/5

At Pepperstone, MT4 and MT5 traders can benefit from this dedicated suite of 28 tools, expert advisors, and indicators. Smart Trader Tools help traders manage their risk, control all trades from a single terminal and view the correlations between currency pairs and other CFDs. The full set of tools includes sophisticated alarms and broadcast facilities, with up-to-date market data and functions integrated within the MetaTrader interfaces.

Autochartist

Free for all Pepperstone clients, Autochartist is an award-winning automated technical analysis tool that plugs into MT4, MT5, and cTrader and scans all available CFD markets for trading opportunities. Autochartist’s advanced pattern recognition engine identifies the strongest potential trading opportunities and predicts future price movements.

API Trading

Pepperstone supports trading via its Application Programming Interface (API). This technology is ideal for those using trading systems or developing their own custom-built system. It allows an increased ability to see the depth of market and access to multiple liquidity providers.

Discounted VPS Services

Via two third-party companies (ForexVPS and New York City Servers), Pepperstone offers a discounted VPS (Virtual Private Server) service for traders using the MT4 and MT5 platforms. VPS hosting allows traders to run automated algorithmic strategies, including expert advisors, 24 hours a day, 7 days a week on a virtual machine.

Both ForexVPS and New York City Servers have dedicated 24/5 customer support teams to help new users set up and install EAs and indicators directly to the virtual machines. VPS services have the advantage of never suffering connectivity issues and have extremely low latency due to their proximity to major international exchanges.

Pepperstone Social Trading

While Pepperstone does not offer a dedicated social trading platform, it offers support for both the Metatrader Signals marketplace and Duplitrade, a popular third-party trading strategy marketplace that allows you to automate your trading by following proven expert traders.

While MetaTrader Signals can be followed by anyone using the Metatrader platform, the Duplitrade copy trading system is only accessible through Pepperstone with a 5000 AUD (or equivalent) minimum deposit.

Pepperstone’s Education

Pepperstone’s education section is better than most other ECN brokers but falls short of the best education available at some of the large market maker brokers.

Demo Account: Pepperstone offers an unlimited demo account allowing prospective traders to practice trading in real-time. New traders can also explore the full suite of customisable tools and features that the MT4, MT5, and cTrader platforms offer to enhance trading performance.

Educational Resources: Pepperstone offers various educational resources, including free trading guides, articles on how to trade Forex and CFDs, various courses, and videos. Its guides cater to beginner, intermediate, and advanced traders. It also hosts regular webinars, and archives of previous webinars are available for free on its website. Trading guides cover topics such as ‘the Psychology of Placing Your First Trade,’ Forex Trading Basics and how Forex trading works, and introductions to various trading strategies. It also offers MetaTrader4 and Forex trading courses.

Webinars: Weekly webinars pick up where the structured education stops, with more detailed strategy sessions led by expert traders. The webinar subjects vary from trading strategies to technical and fundamental analyses. Note that one has to register a Pepperstone account to access the live webinars.

Education Comparison:

Pepperstone’s Market Research and Analysis

Pepperstone’s market analysis is less frequent than many other large international brokers, but the quality is excellent and available in both video and text.

Analysis Blog: The in-house Pepperstone research team runs a regular blog covering both fundamental and technical analyses. The research provides information on market-moving events outside of conventional news sources. The research team also provides a ‘Daily Fix’ – a day-to-day analysis of events affecting the markets.

FX Evolution Webinars: Market analysis and trade ideas are available in both video and text form and the quality is invariably high and useful for traders of all experience levels. In addition, Pepperstone has partnered with FX Evolution to deliver fortnightly webinars on a range of topics based on both technical and fundamental analysis.

Research Comparison:

Pepperstone Customer Support

Pepperstone’s award-winning 24/7 customer service is available to help answer questions should you need assistance with either technical or account-based queries.

Customer support is available in many different languages, including English, Spanish, Portuguese, French, Arabic, Russian, Greek, Hungarian, and Chinese, via email, telephone, and live chat. For the purposes of this review, we found the customer service responsive, polite, and knowledgeable.

Regulation and Industry Recognition

Regulation: Pepperstone is regulated by the Australian Securities and Investments Commission (ASIC), the UK’s Financial Conduct Authority (FCA), the Cyprus Securities and Exchange Commission (CySEC), the Dubai Financial Services Authority (DFSA), the Capital Markets Authority (CMA) of Kenya, the Securities Commission of the Bahamas (SCB), and the Federal Financial Supervisory Authority (BaFin) of Germany. See below for a list of Pepperstone registered companies:

- Pepperstone Group Limited is ASIC regulated with licence number 414530.

- Pepperstone Limited is regulated under registration number 684312 by the FCA.

- Pepperstone Markets Limited is licensed and regulated by the Securities Commission of The Bahamas, license number SIA-F217.

- Pepperstone EU Limited is regulated by CySEC, licence number 388/20.

- Pepperstone Financial Services (DIFC) Limited is regulated by the DFSA under license number F004356.

- Pepperstone Markets Kenya Limited is regulated by the CMA Kenya under licence number 128.

- Pepperstone GmbH is regulated by BaFin, Germany, under registration number 151148.

Industry Recognition: Pepperstone has won many awards in the industry, substantiating its credentials as a safe broker. Some recent awards include:

- Best Forex Broker 2021 (Daytrading.com)

- Best Tailored Professional Trading Conditions 2019/2020 (Professional Trader)

- Best Trading Performance Tools 2020 (Professional Trader)

- Best Global Forex ECN Broker Award 2019 (Global Forex Awards)

- Best Forex Trading Support – Europe 2019 (Global Forex Awards).

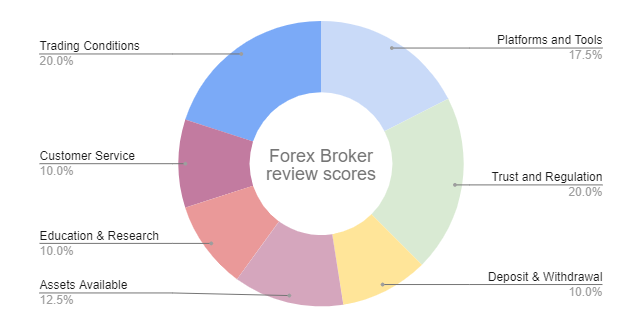

Evaluation Method

We value transparency and openness in the way we review the partners. To bring transparency to the forefront, we have published our review process. Central to that process is the evaluation of the broker’s reliability, the broker’s platform offering, and the trading conditions offered to clients, which are summarised in this review. Each one of these is graded, and an overall score is calculated and assigned to the broker.

Pepperstone Risk Statement

Trading Forex is risky, and each broker is required to detail how risky the trading of Forex CFDs is to clients. Pepperstone would like you to know that: Trading CFDs and FX carries significant risk and is not suitable for everyone. You have no interest in the underlying asset. Refer to our PDS, TMD, and other legal docs on our website. Pepperstone Group Limited, AFSL 414530. 81.4% of Pepperstone Limited’s retail investor accounts lose money when trading CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Overview

Pepperstone is an internationally recognised FCA and ASIC regulated broker with high-speed trading execution and an offering for beginners that most NDD brokers don’t have. With all three of the major third-party trading platforms and very low spreads compared to most other brokers, Pepperstone’s clients have both the best available technology and the best available trading conditions that have earned Pepperstone its reputation. Pepperstone should be a top choice for Australian Forex traders looking for a low-cost and reliable NDD broker with good education and market analysis sections, and a decent selection of trading tools.

Editorial Team

Chris Cammack

Head of Content

Chris joined the company in 2019 after ten years experience in research, editorial and design for political and financial publications. His background has given him a deep knowledge of international financial markets and the geopolitics that affects them. Chris has a keen eye for editing and a voracious appetite for financial and political current affairs. He ensures that our content across all sites meets the standards of quality and transparency that our readers expect.

Alison Heyerdahl

Senior Financial Writer

Alison joined the team as a writer in 2021. She is the Senior Editor for FXScouts. She has a medical degree with a focus on physiotherapy and a bachelor’s in psychology. However, her interest in forex trading and her love for writing led her to switch careers. She has a passion for Forex trading and over a decade of editorial experience researching Forex and the financial services industry, producing high-quality content. She hosts a weekly podcast, “Let’s Talk Forex,” alongside her colleague, Chris, and has produced over 100 Forex educational videos for the FXScouts YouTube channel. She also writes weekly technical analyses and has tested and reviewed over 100 Forex brokers.

Ida Hermansen

Financial Writer

Ida joined our team as a financial writer in 2023. She has a degree in Digital Marketing and a background in content writing and SEO. In addition to her marketing and writing skills, Ida also has an interest in cryptocurrencies and blockchain networks. Her interest in crypto trading led to a wider fascination with Forex technical analysis and price movement. She continues to develop her skills and knowledge in Forex trading and keeps a close eye on which Forex brokers offer the best trading environments for new traders.

Compare Brokers

Find out how Pepperstone stacks up against other brokers.

Stay updated

This form has double opt in enabled. You will need to confirm your email address before being added to the list.