For over a decade, FxScouts has been reviewing forex brokers and providing in-depth analyses. Our extensive research and unique testing methodology ensures that all broker reviews are accurate and fair, with hundreds of thousands of data points generated annually. Since 2012, we’ve tested over 180 brokers across global and Australian markets. Our team of professionals are frequently cited in global and regional media, shaping market conversations and trends.

-

MetaTrader 4 Brokers

The top MT4 brokers in AU

-

MetaTrader 5 Brokers

The best MT5 brokers in AU

-

TradingView Brokers

The best TradingView brokers

-

cTrader Brokers

The top cTrader brokers in AU

-

Forex Trading Apps

Trade on the go from your phone

-

Copytrading Brokers

Copy professional traders

-

All Trading Platforms

Find a platform that works for you

75-90% of retail traders lose money trading Forex and CFDs. You should consider whether you understand how CFDs and leveraged trading work and if you can afford the high risk of losing your money. We may receive compensation when you click on links to products we review. Please read our advertising disclosure. By using this website you agree to our Terms of Service.

- FP Markets - Best MT4 Broker in Australia

- Pepperstone - Best MT4 Broker with ECN Execution

- AvaTrade - Best Commission-Free MT4 Account

- IG - Best Regulated MT4 Broker

- markets.com - ASIC-Regulated and Tight Spreads

- Tickmill - MT4 Broker with Lowest ECN Commission

- Axi - Best MT4 Customisation

- BlackBull Markets - Best MT4 Trading Conditions

- Fusion Markets - Best Copy Trading Solutions

Best MT4 Forex brokers for 2024

Broker | Broker Score | Official Site | Min. Deposit | Max. Leverage (Forex) | MetaTrader 4 (MT4) | Beginner Friendly | Cost of Trading | EUR/USD - Standard Spread | EUR/USD - Raw Spread | Regulated By | Total CFDs | Currency Pairs | Compare |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 4.40 /5 Read Review | Visit Broker > 79% of retail CFD accounts lose money | AUD 100 | 30:1 | Yes | Excellent | USD 7 | 0.10 pips | 0.10 pips |      | 10162 | 70 | |

| 4.61 /5 Read Review | Visit Broker > 89%74- of retail CFD accounts lose money | AUD 100 | 30:1 | Yes | Excellent | USD 10 | 1.00 pips | 0.17 pips |        | 1275 | 100 | |

| 4.59 /5 Read Review | Visit Broker > 76% of retail CFD accounts lose money | AUD 100 | 30:1 | Yes | Excellent | USD 9 | 0.90 pips | 0.90 pips |       | 872 | 55 | |

| 4.69 /5 Read Review | Visit Broker > 71% of retail CFD accounts lose money | AUD 0 | 30:1 | Yes | Excellent | USD 6 | 0.60 pips | 0.85 pips |         | 19295 | 80 | |

4.68 /5 Read Review | Visit Broker > 70.3% of retail CFD accounts lose money | AUD 100 | 30:1 | Yes | Excellent | USD 7 | 0.70 pips | 0.60 pips |      | 1009 | 56 | ||

| 4.58 /5 Read Review | Visit Broker > 71% of retail CFD accounts lose money | USD 100 | 30:1 | Yes | Excellent | USD 6 | 0.00 pips | 0.10 pips |       | 209 | 62 | |

| 4.44 /5 Read Review | Visit Broker > 75.6% of retail CFD accounts lose money | AUD 0 | 30:1 | Yes | Excellent | USD 10 | 1.00 pips | 0.00 pips |       | 188 | 70 | |

4.28 /5 Read Review | Visit Broker > N/A of retail CFD accounts lose money | USD 0 | 500:1 | Yes | Excellent | USD 8 | 0.80 pips | 0.18 pips |   | 26115 | 70 | ||

4.33 /5 Read Review | Visit Broker > 89% of retail CFD accounts lose money | USD 0 | 30:1 | Yes | Excellent | USD 4.50 | 0 pips | 0 pips |    | 252 | 85 |

How to compare MT4 Brokers

When comparing MT4 brokers, it is important to pay special attention to a few factors that will significantly impact your trading costs and trading experience. To compare MT4 Forex brokers, we always consider the following:

Account Types: Most Forex brokers with MT4 in Australia have multiple account types, but some of their account types will not support MT4 as a trading platform option. Always ensure that the account that you want to use supports MT4.

Regulation: Most MT4 brokers in Australia are regulated by the Australian Securities and Investment Commission (ASIC). ASIC-regulated brokers have strict limitations on leverage and cannot offer trading bonuses but are audited regularly and must provide negative balance protection to all traders. Trading with offshore brokers (who are often registered in Seychelles, Mauritius, or the British Virgin Islands) will mean higher leverage limits, but fewer protections.

Execution Method and Execution Speed: MT4 brokers will use either instant execution, STP execution or market execution. Trading with instant execution or STP execution means you will be trading against your broker: When you lose money, they will profit and vice versa. Market execution can have slower execution speeds, but you will be trading with a third party and not your broker. Fast execution is especially important if you intend to use scalping strategies or automated trading.

Trading Costs: Be sure to check the trading costs of your MT4 account. Your trading account’s execution method in particular can affect your trading costs. Instant execution and STP execution accounts will usually have the trading costs included in the spread, while market execution accounts often have a commission attached. When you choose your MT4 account, be sure to verify the costs against what was advertised. If you intend to keep your trading positions open overnight be sure to check out your broker’s swap rates too.

MT4 Tools and Plugins: The occasional broker offers plugins and tools for the platform. Axi offers Psyquation and Autochartist to clients for free, while Admirals has built the MT4 Supreme Edition. These additions to the platform change the trading experience and add additional benefits to the trading platform.

Education, Analysis and Customer Support: Most MT4 brokers in Australia will offer Forex education and market research. Beginner traders who want to use MT4 will require a broker with good general education as well as more specific MT4 guides and tips. The better a broker’s research and analysis the more likely you are to find good trading opportunities. MT4 can be tricky to install and customize. Some brokers will offer their assistance, which can be helpful for beginners. Be aware that some brokers have limited customer service hours, especially on weekends, so look for a broker whose customer service hours suit you.

FP Markets – Best MT4 Broker in Australia

FP Markets is an Australian broker with ASIC regulation with the trading conditions derived from an ECN pricing model to make it the best MT4 provider in Australia. With a minimum deposit of 100 AUD, Australian traders get access to spreads as low as 0.0 pips on the EUR/USD and trading execution speeds under 40 milliseconds.

As well as offering full a feature-rich MT4 experience, including advanced charting tools, numerous technical indicators, real-time price charts, market news and insights, and a suite of automated trading options, FP Markets also offers raw pricing with no price manipulation, no dealing desk and no requotes.

The FP Markets MT4 Traders Toolbox is a suite of 12 online trading tools that combine MT4’s robust trading infrastructure with valuable market insights and trade assistance applications. Gain access to real-time price activity and trend direction with the Correlations Trader or use the Correlation Matrix, which provides a great overview of all the different currency pairs and how they are correlated. Tick charts, session maps, and trade assistance tools such as the Trade Terminal help identify market volatility and leverage it through day trading. The Excel RTD is the ultimate reporting tool as it inserts real-time data into Excel, which traders can then use to send trading commands to the trading platform.

Pepperstone – Best MT4 Broker with ECN Execution

A world-renowned Australian broker, Pepperstone offers MT4 support, ASIC regulation and two simple accounts with ECN execution. Most orders are executed in less than 30 milliseconds, ideal for scalpers and clients who run MT4’s expert advisors. The Standard MT4 Account is commission-free, and spreads on the EUR/USD starts at 1.00 pips. The Razor MT4 Account charges a 7 USD round turn commission, but the average spread on the EUR/USD is 0.10 pips – about as close as traders can get to zero spread as possible.

The Pepperstone MT4 trading experience comes with live quotes, real-time charts, in-depth news, and analytics. Pepperstone also offers a package of Smart Trader Tools for MT4, a suite of 28 expert advisors and indicators to improve trade execution and management. Also, all MT4 users will get access to Autochartist – a powerful pattern recognition plugin that automatically identifies trading opportunities based on price trends.

AvaTrade – Best Commission-Free MT4 Account

AvaTrade is a globally renowned market maker with the best commission-free trading conditions available on the MT4 platform. AvaTrade MT4 offers low spreads across Forex, commodities, and a range of other CFDs. Max leverage is 1:30, and spreads are very tight for a 100 USD minimum deposit and no commission – as low as 0.7 pips on the EUR/USD.

AvaTrade supports all native features of MT4, such as nine timeframes, EA functionality and 30 built-in indicators. AvaTrade also has the Guardian Angel system. This personalised trading feedback tool helps traders refine their decision-making and includes support for automated trading platforms like ZuluTrade and DupliTrade and free Trading Central for all MT4 clients.

IG – Best Regulated MT4 Broker

| 🏦 Min. Deposit | AUD 0 |

| 🛡️ Regulated By | ASIC, BaFin, MAS, CFTC |

| 💵 Trading Cost | USD 6 |

| ⚖️ Max. Leverage | 30:1 |

| 💹 Copy Trading | Yes |

| 🖥️ Platforms | MT4, L2 Dealer, ProRealTime |

| 💱 Instruments | Bonds, Commodities, Cryptocurrencies, Digital 100s, Stock CFDs, ETFs, Forex, Indices, Interest Rates |

IG is possibly the best regulated and most trusted MT4 broker in the world. Regulated by ten national authorities, including the FSCA, FCA, ASIC, MAS, and FINMA, IG is also publicly traded on the London Stock Exchange and has a full banking license. IG offers tight spreads, full MT4 support, and excellent education and market analysis.

IG’s version of MT4 takes the platform to another level with its package of free add-ons and indicators. Highlights include a Trade Terminal, Stealth Orders, a Correlation Matrix as well as a dozen indicators. Also, all IG clients get access to Autochartist for free. This powerful automated technical analysis tool scans the markets for opportunities that you may have missed. All these features are available with tight spreads, with the EUR/USD averaging 0.86 pips but sometimes as low as 0.6 pips, and commission-free trading.

Markets.com – ASIC-Regulated and Tight Spreads

Markets.com is an ASIC-regulated Market Maker broker, offering a wide range of assets, including shares, ETFs, Indices, commodities, Forex, cryptocurrencies, and bonds. Beginner traders will also likely be pleased with their comprehensive education section, as well as a wide scope of excellent tools for research and analysis.

Markets.com provides support for the basic version of MT4 via web, desktop or apps for iOS and Android via one live commission-free account, with a minimum deposit requirement of 100 AUD. It also boasts excellent trading conditions with spreads starting as low as 0.6 pips on the EUR/USD and leverage is available up to 30:1.

Tickmill – MT4 Broker with Lowest ECN Commission

An MT4-only broker and a regular winner of trading conditions awards, Tickmill offers tight spreads and commission on both ECN and traditional accounts, both of which offer copy trading. While Tickmill does not offer traders huge complexity, it does many of the basics with excellence, charging a low 4 USD per lot commission on its Pro Account.

MT4 is the only platform supported at Tickmill, which offers STP market executed trades in 0.1 seconds on 62 currency pairs and CFDs on stock indices, metals, and bonds, without any dealing desk interference. While a Classic Account is available with no commission charged, the tight spreads and low commission on the ECN account are industry-leading, making it hard to find a lower commission MT4 broker with ECN execution.

Axi – Best MT4 Customisation

| 🏦 Min. Deposit | AUD 0 |

| 🛡️ Regulated By | FCA, CySEC, ASIC, DFSA |

| 💵 Trading Cost | USD 10 |

| ⚖️ Max. Leverage | 30:1 |

| 💹 Copy Trading | Yes |

| 🖥️ Platforms | MT4 |

| 💱 Instruments | Commodities, Cryptocurrencies, Stock CFDs, Forex, Indices, Metals, WTIs |

Built by traders, for traders, Axi is an Australian ASIC and FCA regulated ECN broker with full MT4 support, great trading tools, and excellent customisation options. By only supporting the MT4 platform, Axi offers the most customisable MT4 experience in the world. Axi offers a range of tools for MT4, but one of the highlights is its MT4 NexGen plugin.

MT4 NexGen offers a sentiment indicator, a correlation trader, a more intuitive terminal window, and an automated trade journal. Apart from MT4 NexGen, traders at Axi have access to a range of tools. These include AutoChartist, the powerful automated technical analysis tool, and PsyQuation, an AI diagnostic that tracks your trading style and coaches you into more profitable trades. VPS hosting is also available, along with various trading algorithms to install on your MT4.

BlackBull Markets – Best MT4 Trading Conditions

For Australian traders looking for a professional-grade ECN/STP broker with support for MT4, BlackBull Markets ticks many boxes. Equinix servers ensure fast market execution and reduce slippage, and its singular focus on the MT4 platform ensures the best trading conditions for experienced and pro traders.

BlackBull Markets offers three account types, the ECN Standard, ECN Prime and ECN Institutional, where the maximum leverage on all accounts is 500:1. The ECN Standard Account has no minimum deposit and no commission, with a minimum spread of 0.8 pips. However, the ECN Prime Account has a minimum deposit of 2000 USD, spreads start at 0.1 pips, and the commission of 6 USD on the Prime Account is one of the lowest available.

Fusion Markets – Best Copy Trading Solutions

Founded in 2017 in Melbourne, Fusion Markets is an ASIC-regulated broker with exceptionally low trading costs, MT4 support, and no minimum deposit requirements. Alongside an excellent range of market analysis materials, Fusion Markets also offers no less than three different copy-trading solutions.

Its own Fusion+ copy trading platform is only available in a proprietary trading platform, but it also offers Duplitrade and Myfxbook Autotrade – one of the largest Forex social trading communities in the world.

In terms of traditional trading, Fusion Markets is one of the lowest-cost brokers in the world. EUR/USD spreads start at 0 pips on its Zero Account with a very low commission of 4.5 AUD. The only drawbacks are a relatively limited number of CFDs (though 85 Forex pairs, many more than most brokers) and no education to speak of, so beginners will have to educate themselves elsewhere.

What is MetaTrader 4 (MT4)?

MetaTrader 4 is the most popular Forex trading platform in the world and has been for the last fifteen years. It is a third-party trading platform that connects a trader to a broker so they can trade Forex and other CFDs.

MT4 was built by MetaQuotes – a Russian software company – in 2005, and it revolutionised the retail Forex industry. MT4 offered retail Forex traders an institutional-grade trading platform so anyone with an internet connection was on equal footing with professional Forex traders. 15 years later, MT4 is still the industry standard for several reasons:

- MT4 is a high-speed and customisable trading platform, complete with a charting suite where charts can be overlaid with indicators from MT4’s library.

- MT4 allows users to build or buy expert advisors (EAs), indicators, and other algorithmic trading tools using MQL4 and use them to automate their trading.

- MT4’s algorithms and customisable charts allow retail traders to analyse market movements with precision and speed. Trades can then be made in an instant due to the platform’s execution speed.

- MT4 is available on mobile, tablet, in a web browser and as a downloadable application.

Is MT4 a Broker?

No, MetaTrader 4 is not a broker. It is a trading platform, which can be connected to a Forex broker to trade Forex and other CFDs. MT4 is a third-party trading platform, which means that you own the licence to the software, and you can use it with multiple brokers. MT4 is also free to download and use.

Which brokers have MT4?

These are all regulated brokers we have reviewed that support MT4 sorted by overall score.

Broker | Broker Score | MetaTrader 4 (MT4) | ASIC Regulated | Global Regulators | Min. Deposit | Total # CFDs | No. of FX Pairs | Cost of Trading | Raw Account Name | Fees | Raw EUR/USD | Raw GBP/USD | Raw USD/JPY | Compare |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 4.69 /5 Read Review | Yes | Yes |         | AUD 0 | 19295 | 80 | USD 6 | Live Account | Fees Included in Spread | 0.85 pips | 1.40 pips | 0.94 pips | |

4.68 /5 Read Review | Yes | Yes |      | AUD 100 | 1009 | 56 | USD 7 | Markets.com | Fees Included in Spread | 0.60 pips | 1.20 pips | 0.70 pips | ||

| 4.61 /5 Read Review | Yes | Yes |        | AUD 100 | 1275 | 100 | USD 10 | cTrader Razor | From 7 USD / lot - Razor Account | 0.17 pips | 0.59 pips | 0.26 pips | |

| 4.59 /5 Read Review | Yes | Yes |       | AUD 100 | 872 | 55 | USD 9 | Retail | Fees Included in Spread | 0.90 pips | 1.60 pips | 1.10 pips | |

| 4.58 /5 Read Review | Yes | No |       | USD 100 | 209 | 62 | USD 6 | Raw | 6 USD/lot | 0.10 pips | 0.30 pips | 0.10 pips | |

| 4.56 /5 Read Review | Yes | Yes |     | AUD 200 | 1744 | 64 | USD 8 | RAW - MetaTrader | 7 USD / lot - Raw Spread Account | 0.02 pips | 0.23 pips | 0.14 pips | |

4.53 /5 Read Review | Yes | Yes |     | AUD 100 | 846 | 55 | USD 10 | Raw | 7 USD / lot | 0.06 pips | 0.73 pips | 0.23 pips | ||

| 4.45 /5 Read Review | Yes | Yes |      | AUD 5 | 1554 | 57 | USD 6 | XM Ultra Low | Fees Included in Spread | 0.60 pips | 0.60 pips | 0.60 pips | |

| 4.44 /5 Read Review | Yes | Yes |       | AUD 0 | 188 | 70 | USD 10 | MT4 Pro Account | 7 USD / lot - PRO account | 0.00 pips | 0.10 pips | 0.10 pips | |

4.43 /5 Read Review | Yes | Yes |     | AUD 0 | 4150 | 46 | USD 11 | ThinkZero | 7 USD / lot - ThinkZero Account | 0.00 pips | 0.00 pips | 0.00 pips | ||

| 4.40 /5 Read Review | Yes | Yes |      | AUD 100 | 10162 | 70 | USD 7 | RAW | 6 USD / lot - RAW Accounts | 0.10 pips | 0.20 pips | 0.10 pips | |

4.39 /5 Read Review | Yes | No |      | AUD 100 | 2241 | 70 | USD 14 | FxPro cTrader | 9 USD / lot | 0.40 pips | 1.00 pips | 0.60 pips | ||

4.37 /5 Read Review | Yes | No |     | USD 10 | 237 | 53 | USD 13 | Zero-Spread | 6 USD / lot - Zero-Spread account | 0.00 pips | 0.60 pips | 0.30 pips | ||

| 4.37 /5 Read Review | Yes | No |     | AUD 10 | 1803 | 62 | USD 15 | Advantage | From 4 USD / ECN Accounts | 0.00 pips | 0.20 pips | 0.30 pips | |

4.37 /5 Read Review | Yes | No |    | USD 25 | 249 | 52 | USD 6 | Fees Included in Spread | 0.60 pips | 1.10 pips | 1.20 pips | |||

4.35 /5 Read Review | Yes | Yes |      | AUD 50 | 900 | 46 | USD 6 | Raw | 6 USD / lot - ECN Account | 0.00 pips | 0.50 pips | 0.40 pips | ||

| 4.33 /5 Read Review | Yes | Yes |     | AUD 5 | 254 | 37 | USD 7 | ECN | 6 USD / lot - ECN Account | 0 pips | 0.20 pips | 0.30 pips | |

4.33 /5 Read Review | Yes | Yes |    | USD 0 | 252 | 85 | USD 4.50 | Zero | 4.5 AUD / lot (EUR/USD) | 0 pips | 0.24 pips | 0.11 pips | ||

4.33 /5 Read Review | Yes | Yes |      | USD 100 | 2006 | 130 | USD 12 | Fees Included in Spread | 0.20 pips | 0.50 pips | 0.50 pips | |||

4.28 /5 Read Review | Yes | Yes |      | AUD 100 | 3996 | 82 | USD 8 | Zero.MT5 | 1.8 - 3 USD per lot | 0.10 pips | 0.60 pips | 0.30 pips | ||

4.28 /5 Read Review | Yes | No |   | USD 0 | 26115 | 70 | USD 8 | Prime | 6 USD / lot - ECN Prime | 0.18 pips | 0.66 pips | 0.44 pips | ||

4.28 /5 Read Review | Yes | Yes |    | AUD 100 | 415 | 50 | USD 20 | Fees Included in Spread | 2.00 pips | 2.00 pips | 2.00 pips | |||

| 4.28 /5 Read Review | Yes | Yes |      | AUD 50 | 306 | 45 | USD 13 | Active Trader | None | 1.30 pips | 0.60 pips | 0.30 pips | |

4.25 /5 Read Review | Yes | Yes |       | USD 0 | 425 | 45 | USD 10 | Core | 4 USD / lot | 0.20 pips | 0.20 pips | 0.20 pips | ||

4.25 /5 Read Review | Yes | No |   | USD 5 | 146 | 80 | USD 7 | Standard | 6 USD / Lot | 0.10 pips | 0.40 pips | 0.10 pips | ||

| 4.21 /5 Read Review | Yes | No |   | USD 15 | 181 | 43 | USD 15 | PrimusPRO | 8 - 10 USD / lot - PRO Account | 0.30 pips | 1.50 pips | 0.80 pips | |

4.12 /5 Read Review | Yes | No |       | USD 100 | 310 | 70 | USD 12 | Raw | 8 USD / lot - Raw Account | 0.10 pips | 0.40 pips | 0.20 pips | ||

4.08 /5 Read Review | Yes | Yes |   | AUD 50 | 2489 | 63 | USD 10 | ProZero | Fees Included in Spread | 0.30 pips | 1.60 pips | 1.20 pips | ||

4.05 /5 Read Review | Yes | Yes |     | AUD 5 | 1202 | 36 | USD 6 | Standard | Fees Included in Spread | 0.60 pips | 0.80 pips | 0.70 pips | ||

4.03 /5 Read Review | Yes | No |     | GBP 1 | 878 | 49 | USD 8 | ECN | 6 USD / lot - ECN Account | 0.20 pips | 0.40 pips | 0.40 pips | ||

| 4.02 /5 Read Review | Yes | Yes |     | AUD 200 | 193 | 63 | USD 18 | VIP (MT4) | Fees Included in Spread | 0.70 pips | 1.30 pips | 1.00 pips | |

| 3.97 /5 Read Review | Yes | No |   | USD 50 | 262 | 56 | USD 19 | ECN | 10 USD / lot - ECN Account | 0.20 pips | 0.20 pips | 0.10 pips | |

3.93 /5 Read Review | Yes | No |        | USD 50 | 430 | 66 | USD 14 | Classic | 3 USD / lot | 1.30 pips | 1.80 pips | 2.10 pips | ||

3.88 /5 Read Review | Yes | No |  | USD 0 | 104 | 71 | USD 6 | None | 0.60 pips | 0.80 pips | 0.80 pips | |||

3.87 /5 Read Review | Yes | No |   | USD 50 | 151 | 50 | USD 15 | VIP | Fees Included in Spread | 1.50 pips | 1.60 pips | 1.50 pips | ||

3.87 /5 Read Review | Yes | Yes |        | AUD 50 | 20108 | 50 | USD 14 | Multibank Pro | 3 USD / lot | 0.80 pips | 1.10 pips | 1.00 pips | ||

| 3.64 /5 Read Review | Yes | Yes |     | USD 50 | 285 | 83 | USD 22 | STP/ECN Absolute Zero | On select STP/ECN Accounts | 0.00 pips | 0.00 pips | 0.00 pips | |

3.63 /5 Read Review | Yes | No |   | USD 10 | 79 | 33 | USD 20 | Zero | 0,007% / Trade - Zero Account | 0.30 pips | 0.40 pips | 0.20 pips | ||

3.61 /5 Read Review | Yes | No |      | USD 0 | 164 | 48 | USD 13 | ICM Zero | 7 USD / lot - Zero Account | 1.30 pips | 1.80 pips | 1.30 pips | ||

| 3.52 /5 Read Review | Yes | No |   | USD 500 | 311 | 42 | USD 7 | Retail Account | 5 USD / lot | 0.20 pips | 0.80 pips | 0.40 pips | |

3.52 /5 Read Review | Yes | No |    | USD 100 | 2215 | 55 | USD 19 | Gold | Fees Included in Spread | 3.00 pips | 3.00 pips | 3.00 pips |

How do I get started with MT4?

The quickest way to get started with MetaTrader 4 is to download it yourself. You can download it directly from the MetaTrader website or from any Australian MT4 broker. If you download it directly from the MetaTrader website you will be asked to open a free demo account, which will allow you to test the features of the trading platform.

All Australian MT4 brokers will offer demo accounts too – and you should always use one before opening a live account, especially if you are new to MetaTrader. The best MT4 brokers will offer detailed educational resources for the trading platform, including video tutorials and downloadable PDF guides.

What is the Difference Between MT4 and MT5?

MT5 is the newer version of MetaTrader, released in 2010, though it still lags behind MT4 in terms of popularity. The first significant change is that MT5 has native support for trading exchange-traded assets like shares, futures and ETFs, whereas MT4 does not – though most MT4 brokers have since added this capability to their MT4 systems.

The second major change is MT5’s new scripting language, MQL5, which allows for more accurate backtesting of Expert Advisors (EAs). It is important to note that EAs built for MT4 will not run in MT5 (and vice versa) due to the incompatibility of their scripting languages.

MT5 also boasts a cleaner interface and comes with an integrated news feed, a sentiment tracker, and more charting capabilities. MT5 is finally seeing support from the trading industry, with some MetaTrader brokers abandoning MT4 in favour of the newer version.

Is MT4 for Forex Trading Only?

MT4 was initially founded as a Forex-only trading solution, but these days you can trade all CFDs with it. While MT4 was not originally designed to trade stock CFDs, some brokers have since added this capability. That said, don’t be surprised to see that some MT4-only brokers offer no stock CFDs at all – or a very limited selection.

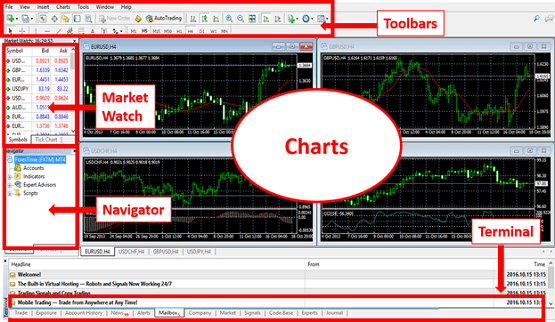

What are MT4 Charts?

When you first open MT4 you will be greeted with the screen above. Like all trading platforms, charts are the main focus in MT4, and this is where most of your attention will be spent. The MT4 charts will show you the current and historical prices of up to four different asset classes at the same time. Charts are the most valuable tool traders have for analysing the movements of Forex pairs and other CFDs.

In MT4, each chart can be fully customised. Traders can choose between Candlesticks, Bar Charts or Line Charts and each chart can be colour-coded and saved as a template.

What Charting Tools Does MT4 have?

Aside from customising the appearance of charts in MT4, there are a number of key charting features and tools that traders can use to enhance their trading experience.

Zooming: Each chart can be zoomed horizontally and vertically, to close in on a specific time period or set of bars.

Period Changes: MT4 allows traders to use nine different data periods, from 1 minute to 1 month. Some technical indicators and line studies will only be helpful when used with certain data periods, so this capability is especially important for technical analysis.

Objects: Also called graphical objects, these are lines, shapes and arrows that are imposed over charts to assist with technical analysis. Common graphical objects include support/resistance lines, trendlines, as well as Fibonacci, Gann, and Andrews’ tools. Objects will not be removed when the time period changes.

Indicators: Indicators are technical analysis tools that can identify market trends and help traders predict future price movements of an asset. MT4 comes with a number of the most common indicators already installed, but more can be added from the MetaTrader Market. Like graphical objects, indicators can be superimposed over the chart and will not be removed if the time period is changed.

Does MT4 Support Copytrading?

Yes, MT4 can support copy trading in a few different ways. The most common method is through MT4 trading signals. Trading signals in MetaTrader 4 allow traders to automatically copy other traders in real-time. Many successful traders provide their Forex trades in public access either for free or for a reasonable fee, these are known as signal providers.

MetaTrader 4’s signal service is easily accessible. You will need an active trading account and an MQL5.com account. Once you have both you will be able to access the signal providers database. From this database, you can see the names of the signal providers, how long they have been active, and other important information like total profit, the number of followers and maximum drawdown.

MetaTrader 4 can also be used in conjunction with popular copy trading solutions such as myFxBook, Duplitrade and ZuluTrade. These third-party copy-trading solutions have a carefully curated selection of traders to follow, therefore decreasing the risk of following a loss-making signal provider. Be aware that these other services have an additional cost.

Does MT4 Support Automated Trading?

Yes, MT4 does support automated trading. Aside from copy trading through the MT4 signal service, traders can automate their trading via Expert Advisors (EAs) and technical indicators. This type of automated trading is also called algorithmic trading, as the EAs are algorithms built specifically for trading.

It’s important to recognise the difference between EAs and indicators. EAs fully automate your trading and will trade for you within the parameters of the algorithm. Indicators will only analyse the market, allowing you to decide whether to trade or not based on the information given. EAs can be turned on and off easily from within MT4.

EAs and indicators can be downloaded and purchased from inside MT4, in the Market tab of the trading platform. Some EAs are free, others can be purchased outright or rented on a monthly or yearly basis.

In addition to the MetaTrader Market, thousands of free EAs and indicators can also be found in the MT4 Code Base.

How to Automate Trading in MT4 Using at EA?

Once an EA has been purchased or downloaded from the Market or Code Base, it’s a simple process to start automating your trading with it. First, you will need to find the location of the EA on your computer and copy it to the Experts folder in your MetaTrader 4 folder (usually on the C drive of your computer).

Launch the main MT4 application, and then look for the Expert Advisors section, which should be located under the Navigator tab on the left side of the main screen. Then click on the + icon and select the EA, which should now be visible. Once it has been selected you can drag it onto the charts to ensure that it’s active.

Can I Build My Own EAs?

Yes, anyone can build an EA using the MQL4 integrated programming language. MQL4 is a high-level object-oriented programming language based on the concepts of the popular С++ programming language.

What Are the Risks of Using an EA for Automated Trading?

Before you start using an EA with a live account, it should always be used with a demo account until you are happy with its performance. Most EAs will come with a short guide from the developer explaining how best to use it, and it’s important to understand this information completely before use.

Even though performance can be difficult to evaluate over a short time period, practice with a demo will be useful as a guide to the future. Even the best MT4 EA can’t take fundamental events such as geopolitical variables into account when automating your trades.

It’s also important to consider lot size when using an EA, you should never trade more than your account balance and risk management strategy will allow.

What is EA Backtesting in MT4?

Backtesting is using historical data in MT4 to see how an EA would have performed in the past. While this does not guarantee the success of an EA in live trading, it does give you an idea of how the EA will function over a certain time period. This is especially useful if you backtest using a particularly volatile period, where the EA’s function would be disturbed by political or financial events outside of its purview.

Should You Use MT4?

If you are just starting your trading career you may want to consider moving straight to MT5 or cTrader instead. But if you have been using MT4 and you are happy with it then keep on using it.

MT4 is old, and MetaQuotes is actively trying to get Forex brokers to switch to MT5. MT4 is still the industry standard, but it will eventually be replaced. MT5 and cTrader also have more built-in functionality and have a more modern, cleaner layout.

But if you have been using MT4 for some time, then your version is probably heavily customised. Algos built for MT4 will not function in MT5 or cTrader, so any customisations you have made will be lost.

MT4 will eventually be replaced, but its popularity means that is not going to happen anytime soon. But if you want to move to a more modern platform, or you are just starting out then you should check out MT5 or cTrader.

Conclusion

MetaTrader 4 is central for so many traders in their development towards becoming professional traders. It will be here for many years to come and will continue to help new traders launch a trading career. If you’re trying to get the most out of your charts and focus without the distraction of fancy tools, then it remains a candidate to satisfy 90% of all your trading needs.

MT4 is the most popular Forex trading platform in the world and has been for the last fifteen years. The launch of MT4 in 2005 changed the retail Forex industry almost overnight. It offered retail Forex traders an institutional-grade tool: Anyone with an internet connection was now on equal footing with professional Forex traders. 15 years later, MT4 is still the industry standard for several reasons:

- MT4 is the lowest-latency and a highly customisable trading platform, complete with a cutting-edge charting suite offering market charts overlaid with indicators from MT4’s library.

- MT4 allows users to build or buy expert advisors (EAs), indicators, and other algorithmic trading tools using MQL4.

- MT4’s algorithms and customisable charts allow retail traders to analyse market movements with precision and speed. Trades can then be made in an instant due to the platform’s execution speed.

- MT4 is available on mobile, tablet, in a web browser and as a downloadable application.

This versatility makes MT4 the world’s leading trading platform.

Forex Risk Disclaimer

Trading Forex and CFDs is not suitable for all investors as it carries a high degree of risk to your capital: 75-90% of retail investors lose money trading these products. Forex and CFD transactions involve high risk due to the following factors: Leverage, market volatility, slippage arising from a lack of liquidity, inadequate trading knowledge or experience, and a lack of regulatory protection. Traders should not deposit any money that is not considered disposable income. Regardless of how much research you have done or how confident you are in your trade, there is always a substantial risk of loss. (Learn more about these risks from the Australian regulator, ASIC or the UK’s regulator, the FCA).

Our Rating & Review Methodology

Our overall Forex Rankings report and Directory of CFD Brokers to Avoid are the result of extensive research on over 180 Forex brokers. These resources help traders find the best Forex brokers – and steer them away from the worst ones. These resources have been compiled using over 200 data points on each broker and over 3000 hours of research. Our team conducts all research independently: Testing brokers, gathering information from broker representatives and sifting through legal documents. Learn more about how we rank brokers.

Editorial Team

Chris Cammack

Head of Content

Chris joined the company in 2019 after ten years experience in research, editorial and design for political and financial publications. His background has given him a deep knowledge of international financial markets and the geopolitics that affects them. Chris has a keen eye for editing and a voracious appetite for financial and political current affairs. He ensures that our content across all sites meets the standards of quality and transparency that our readers expect.

Alison Heyerdahl

Senior Financial Writer

Alison joined the team as a writer in 2021. She has a medical degree with a focus on physiotherapy and a bachelor’s in psychology. However, her interest in forex trading and her love for writing led her to switch careers, and she now has over eight years experience in research and content development. She has tested and reviewed 100+ brokers and has a great understanding of the Forex trading world.

Ida Hermansen

Financial Writer

Ida joined our team as a financial writer in 2023. She has a degree in Digital Marketing and a background in content writing and SEO. In addition to her marketing and writing skills, Ida also has an interest in cryptocurrencies and blockchain networks. Her interest in crypto trading led to a wider fascination with Forex technical analysis and price movement. She continues to develop her skills and knowledge in Forex trading and keeps a close eye on which Forex brokers offer the best trading environments for new traders.

Stay updated

This form has double opt in enabled. You will need to confirm your email address before being added to the list.