For over a decade, FxScouts has been reviewing forex brokers and providing in-depth analyses. Our extensive research and unique testing methodology ensures that all broker reviews are accurate and fair, with hundreds of thousands of data points generated annually. Since 2012, we’ve tested over 180 brokers across global and Australian markets. Our team of professionals are frequently cited in global and regional media, shaping market conversations and trends.

-

MetaTrader 4 Brokers

The top MT4 brokers in AU

-

MetaTrader 5 Brokers

The best MT5 brokers in AU

-

TradingView Brokers

The best TradingView brokers

-

cTrader Brokers

The top cTrader brokers in AU

-

Forex Trading Apps

Trade on the go from your phone

-

Copytrading Brokers

Copy professional traders

-

All Trading Platforms

Find a platform that works for you

75-90% of retail traders lose money trading Forex and CFDs. You should consider whether you understand how CFDs and leveraged trading work and if you can afford the high risk of losing your money. We may receive compensation when you click on links to products we review. Please read our advertising disclosure. By using this website you agree to our Terms of Service.

- IG - Best Regulated Broker

- BlackBull Markets - Lowest commission accout

- Axi - Best ECN broker on MT4

- CMC Markets - Best Trading Conditions

- ThinkMarkets - Best Range of Trading Platforms

Best Forex Brokers New Zealand 2024

Broker | Broker Score | Official Site | Min. Deposit | Max. Leverage (Forex) | FMA Regulated | Beginner Friendly | EUR/USD - Standard Spread | Cost of Trading | EUR/USD - Raw Spread | Total CFDs | Currency Pairs | Platforms | Compare |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 4.69 /5 Read Review | Visit Broker > 71% of retail CFD accounts lose money | AUD 0 | 30:1 | Yes | Excellent | 0.60 pips | USD 6 | 0.85 pips | 19295 | 80 | MT4, L2 Dealer, ProRealTime | |

4.28 /5 Read Review | Visit Broker > N/A of retail CFD accounts lose money | USD 0 | 500:1 | Yes | Excellent | 0.80 pips | USD 8 | 0.18 pips | 26115 | 70 | MT4, MT5, WebTrader | ||

| 4.44 /5 Read Review | Visit Broker > 75.6% of retail CFD accounts lose money | AUD 0 | 30:1 | Yes | Excellent | 1.00 pips | USD 10 | 0.00 pips | 188 | 70 | MT4 | |

| 4.53 /5 Read Review | Visit Broker > 76% of retail CFD accounts lose money | AUD 5 | 30:1 | Yes | Excellent | 0.70 pips | USD 7 | 0.70 pips | 12146 | 350 | MT4, CMCmarkets | |

4.43 /5 Read Review | Visit Broker > 71.89% of retail CFD accounts lose money | AUD 0 | 30:1 | No | Excellent | 1.10 pips | USD 11 | 0.00 pips | 4150 | 46 | MT4, MT5, ThinkTrader |

Until recently, Forex brokers operating in New Zealand were not subject to strict regulatory oversight. In 2014, the Financial Markets Authority (FMA) introduced a voluntary licensing regime for Forex brokers, but it continued to receive many complaints from traders, the most common being that clients had difficulty withdrawing their funds from offshore brokers. As a result, in 2017, it mandated that all Forex brokers in New Zealand must be licenced by the FMA. This allows the FMA to enforce regulations and protect New Zealand consumers. Having said that, Forex traders from New Zealand can legally trade with offshore brokers, but they have little protection in the event of a dispute with the broker.

How we Reviewed the Best Brokers in New Zealand for 2024

When choosing the brokers listed above, we rated them based on over 200 metrics, focusing on the following key features:

- We chose brokers that were regulated by the FMA and double-checked their registration on the FMA’s official website.

- We only selected transparent brokers with a high trust rating and those with broker scores above 4 out of 5 stars.

- All the brokers listed are transparent with their fees, have some of the lowest trading costs in the industry, and have fast trade execution. We opened a live account and compared the trading fees on each instrument to other brokers.

- We checked the number of tradable instruments available at each broker to ensure that they offered a good range.

- We ensured that the brokers offered a good choice of user-friendly, reliable platforms like MT4, MT5, cTrader, TradingView, or their own web-based platforms.

- We ensured that the brokers offered beginner traders a coherent and well-structured trading course alongside a demo account.

- We assessed the brokers’ market analysis, ensuring that they offered well-curated up-to-date materials.

- We also contacted each broker’s customer service team. We checked out their availability, favouring those with 24/7 support via many channels (email, phone, and live chat), and those that were efficient, responsive, and knowledgeable.

Our team of experts has examined each broker meticulously, ensuring that we only recommend the best in the industry. You can read our review process here.

These are the top FMA-regulated Forex brokers in New Zealand for 2024, as determined by our review process.

IG – Best Regulated Broker

| 🏦 Min. Deposit | AUD 0 |

| 🛡️ Regulated By | ASIC, BaFin, MAS, CFTC |

| 💵 Trading Cost | USD 6 |

| ⚖️ Max. Leverage | 30:1 |

| 💹 Copy Trading | Yes |

| 🖥️ Platforms | MT4, L2 Dealer, ProRealTime |

| 💱 Instruments | Bonds, Commodities, Cryptocurrencies, Digital 100s, Stock CFDs, ETFs, Forex, Indices, Interest Rates |

- World’s largest broker by revenue

- Listed on the LSE and a member of the FTSE 250

- Offers over 17,000 financial instruments to trade

Who is IG for?

IG caters to both new and experienced traders by offering accounts with different features. Beginners will appreciate the zero-minimum deposit account and access to educational resources, while experienced traders benefit from advanced platforms with lower trading costs and a huge range of tradable assets.

Why we like IG

We like that IG is one of a handful of brokers regulated by the FMA and that it’s listed on the London Stock Exchange. It also has low-cost trading accounts with no minimum deposit requirements, a great range of trading platforms, and world-class education and market analysis materials.

Drawbacks

It’s difficult to find any drawbacks at IG. The only issue that New Zealand traders may have is that it charges a currency conversion fee of 0.5% for trades denominated in anything other than the New Zealand Dollar (NZD). However, this will be similar to many other brokers.

Overall, IG is an excellent all-round broker, regulated by the world’s top authorities, including the New Zealand FMA, and is listed on the LSE. It offers a great range of trading platforms and tools, and commission-free accounts with no minimum deposit requirements and low spreads. Traders can choose between over 17,000 financial instruments to trade – one of the largest ranges in the industry, and we love IG’s community Forums, technical analysis, blogs, and market updates through IGTV.

BlackBull Markets – Lowest commission account

- Founded in New Zealand and regulated by the FMA

- Great range of trading accounts with low spreads

- Extremely fast trade execution

Who BlackBull is for

Blackbull Markets offers a range of accounts, one of which caters to beginner traders (with a 0 minimum deposit requirement), and two ECN accounts with high minimum deposits and low spreads, for more experienced traders.

What we like about BlackBull

Founded in New Zealand in 2014, BlackBull Markets caters well to its New Zealand clientele. It has local FMA regulation and local customer support, available 24/7, and offers NZD trading accounts. Traders can choose between over 26,000 financial instruments to trade and a great range of trading platforms and low-cost trading accounts.

Drawbacks

Although deposits are free, BlackBull Markets has more expensive withdrawal fees than other similar brokers. A fee of 5 USD is charged across all payment methods, which is fairly high, especially for those who make regular withdrawals. It also has very high minimum deposits on two of its accounts.

Our Verdict

Overall, BlackBull Markets is a good choice for New Zealand traders. It caters to traders of all experience levels, has low-cost trading accounts, an excellent range of trading platforms and tools, fast execution, and good education and market analysis. The only drawbacks are its high withdrawal fees and high minimum deposits on two accounts.

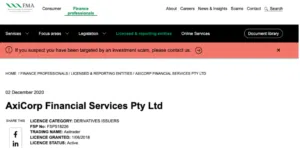

Axi – Best ECN broker on MT4

| 🏦 Min. Deposit | AUD 0 |

| 🛡️ Regulated By | FCA, CySEC, ASIC, DFSA |

| 💵 Trading Cost | USD 10 |

| ⚖️ Max. Leverage | 30:1 |

| 💹 Copy Trading | Yes |

| 🖥️ Platforms | MT4 |

| 💱 Instruments | Commodities, Cryptocurrencies, Stock CFDs, Forex, Indices, Metals, WTIs |

- Excellent range of trading tools

- Three low-cost trading accounts with no minimum deposit requirements

- Regulated by the New Zealand FMA

Who Axi is for

Axi is for MT4 traders looking for low-cost trading accounts with no minimum deposit requirements and an excellent range of trading tools.

Why we like Axi

Axi is one of the few good brokers regulated by the New Zealand FMA. It offers three low-cost trading accounts with no minimum deposit requirements, and its singular focus on MT4 allows it to offer the best ECN MT4 experience with the help of the MT4 NexGen plugin. It also offers a range of trading tools, and has excellent education for beginners.

Drawbacks

Traders who trade on other trading platforms may be disappointed by the limited range of trading platforms and instruments to trade, but Forex traders can choose between 70 forex pairs. Additionally, Axi’s market analysis is infrequently updated, but traders have access to third-party news providers such as Autochartist and TradingCentral.

Our Verdict

Axi only offers support for the MT4 platform, which may be an immediate turnoff for some traders, but its singular focus allows it to offer the best ECN MT4 experience with the help of the MT4 NexGen plugin that includes an advanced sentiment indicator, a correlation trader, a more intuitive terminal window, and an automated trade journal. Apart from MT4 NexGen, traders at Axi have access to a range of tools, including AutoChartist, Trading Central, and VPS hosting. The ECN trading conditions come from Axi’s pricing model, which connects to over 20 liquidity sources, so traders experience less slippage and requotes than with a broker with a singular source. Spreads on the Pro Account start at 0 pips with a 7 USD per lot commission, and the leverage maximum is 1:500 for non-European and Australian traders. The only other issue traders may have is the limited number of financial instruments.

CMC Markets – Best Trading Conditions

| 🏦 Min. Deposit | AUD 5 |

| 🛡️ Regulated By | ASIC, FCA, MAS, BaFin |

| 💵 Trading Cost | USD 7 |

| ⚖️ Max. Leverage | 30:1 |

| 💹 Copy Trading | No |

| 🖥️ Platforms | MT4, CMCmarkets |

| 💱 Instruments | Commodities, Cryptocurrencies, Stock CFDs, ETFs, Forex, Indices |

- Lowest trading costs

- Innovative proprietary platform with excellent technical and fundamental analysis features

- Extremely well-regulated

Who CMC Markets is for

CMC Markets’ accounts cater to both beginners and more experienced traders – there are no minimum deposit requirements and its trading costs are some of the lowest in the industry. It also has an enormous range of financial instruments to trade, and its education and market analysis caters to traders of all experience levels.

Why we like CMC Markets

CMC Markets is regulated by the FMA and numerous other top-tier regulators, and its commission-free account has some of the lowest trading fees in the industry. It has excellent education for beginner traders and its market analysis is frequently updated. It also has a user-friendly and feature-rich trading platform.

Drawbacks

While CMC Markets’ inhouse platform is one of the best in the industry, the only other trading platform on offer is MT4. Traders familiar with third-party platforms such as MT5, cTrader, or TradingView may be disappointed. It also has no live chat feature, which is a disadvantage for clients who may want their questions answered immediately.

Our Verdict

FMA-regulated, CMC Markets’ is an excellent all-round broker. It has a low-cost trading account, with a low minimum deposit, it offers a huge range of financial instruments to trade, including over 330 Forex pairs, and a user-friendly, feature-rich trading platform, alongside MT4. Deposits and withdrawals are free, and traders can deposit in NZD – an advantage for traders from New Zealand who can avoid currency conversion fees. It also has great education and market analysis materials. Its main drawbacks are the lack of platform support and that customer support is only available via email and telephone.

ThinkMarkets – Best Range of Trading Platforms

- Great range of trading platforms – MT4, MT5, ThinkPortal, and ThinkTrader

- Excellent regulation – from the FMA and other top-tier regulators

- Low-cost Think Zero Account with spreads down to 0 pips (EUR/USD) and a 7 USD commission

Who ThinkMarkets is for

Regulated by the FMA and ASIC, ThinkMarkets appeals to experienced traders who value a broad range of tradable assets, a great choice of trading platforms, and an extensive suite of trading tools.

Why we like ThinkMarkets

ThinkMarkets is FMA-regulated and traders from New Zealand can open accounts in NZD and avoid currency conversion fees. It has a great range of trading platforms, excellent trading tools, and a great Razor account with spreads down to 0 pips (EUR/USD) in exchange for a commission of only 7 USD (roundturn), and a huge range of assets to trade.

Drawbacks

The only drawback at ThinkMarkets is that the trading fees on its Standard Account are slightly higher than other brokers, starting at 1.1 pips (EUR/USD).

Our Verdict

ThinkMarkets is an FMA-regulated broker with a huge range of financial instruments, a great range of trading platforms and trading tools, including VPS hosting. It offers three accounts, none of which have a minimum deposit requirement, the standout being the Think Zero Account with spreads down to 0 pips (EUR/USD) in exchange for a commission of 7 USD (roundturn). Its education and market analysis are comprehensive, well-structured, and in-depth, and it offers 24/7 customer support, available via live chat, phone, and email.

Is Forex Trading Legal in New Zealand?

Yes. Forex trading is legal in New Zealand. Though it is not illegal for New Zealanders to use a Forex broker that is not regulated by the FMA, traders should be wary about using offshore brokers. Even if the broker is regulated by reputable offshore authorities, such as the FCA of the UK or ASIC of Australia, New Zealand traders will not have the protections afforded to them by trading with an FMA-regulated broker.

What is the New Zealand Financial Markets Authority (FMA)?

The FMA regulates New Zealand’s financial markets. Its role encompasses a broad regulatory mandate to ensure fair, efficient, and transparent financial markets in New Zealand, which includes monitoring financial service providers, including Forex brokers, to ensure they meet obligations and treat customers fairly.

To do so, it aligns its regulations with international standards, ensuring that New Zealand’s financial market operates at a level comparable to other major global markets. The FMA mandates that:

- Forex brokers provide fair trading conditions, accurate pricing, and transparent fee structures.

- Brokers separate client funds from operational funds, ensuring traders’ money is not used for the broker’s business activities. This protects client funds even if the broker faces financial difficulties.

- Brokers provide all traders with negative balance protection, ensuring they cannot lose more than their initial deposit.

- They must provide client fund protection, including higher margin close-out percentages and belong to a compensation scheme that pays up to 200,000 NZD in case of broker bankruptcy.

- Unlike brokers in the UK or Australia that have a leverage limit of 30:1, Forex brokers regulated by the FMA can offer leverage of up to 500:1, further adding to their appeal.

- Brokers must be completely transparent and are required to disclose pertinent information to traders, such as potential risks, fees, and any conflicts of interest.

- Brokers must undergo regular audits and assessments to ensure compliance with financial standards and operational integrity.

FMA Warnings

The FMA also regularly publishes consumer alerts regarding companies and purported representatives operating in New Zealand that are unlicensed. This database is fully searchable and we find it very user-friendly.

It is also worthwhile checking your chosen broker against this database to be doubly sure that there are no outstanding warnings against them.

How do I check if my broker is FMA-regulated?

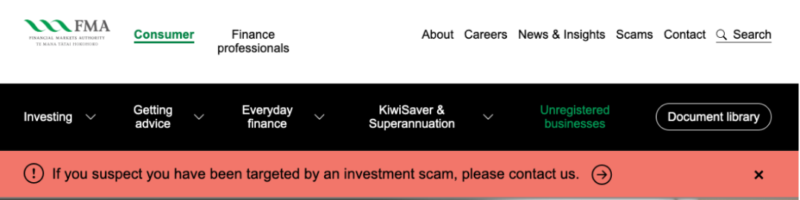

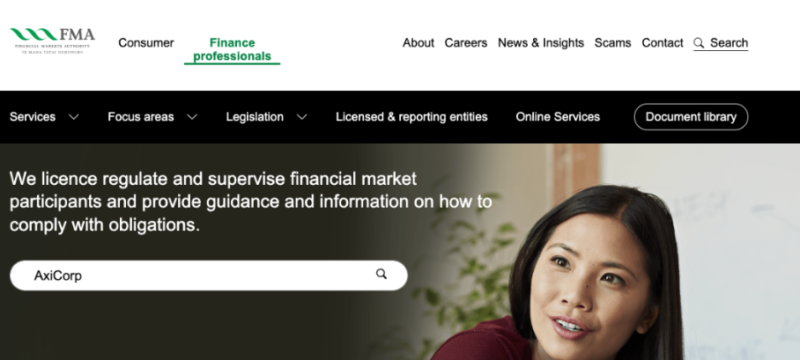

To check if a broker is regulated by the FMA, consumers can look for the broker’s FMA license number on their website, usually found in the footer or a dedicated regulation section. It’s crucial to cross-check this number against the official FMA website to confirm the broker’s regulatory status:

- Click on the tab “Finance professionals” and then “Licensed & reporting entities.”

- Type the name of the Forex broker into the search bar below:

- If the Forex broker is indeed regulated by the FMA, the results will display the broker’s licence number, which you can compare to that on the broker’s website. It will also display the licence category, when the licence was issued, and whether the licence is active.

Can the FMA help me in a dispute with my broker?

It is important to note that the FMA will not be able to assist traders if they have a dispute with a Forex broker.

However, Forex brokers regulated by the FMA must be members of the Financial Service Providers Register (FSPR), and all members of the FSPR must belong to a dispute resolution scheme (DRS). These schemes will assist traders in finding a resolution. All Forex brokers will be members of one of the following:

- Financial Services Complaints Limited – An independent not-for-profit dispute resolution service that resolves complaints about financial service providers.

- Financial Dispute Resolution – operated by FairWay Resolution, it seeks to find fair dispute resolutions for the complainant and broker.

How do I complain about a Forex broker?

If you need to complain about a Forex broker, you should first take your complaint to the company and follow their official complaints procedure. If your complaint is not resolved satisfactorily, your next step is to complain to their dispute resolution scheme. A condition of being licensed by the FMA is that brokers must belong to a dispute resolution scheme.

Why is FMA Regulation Important for New Zealanders?

Regulation is essential for protecting your money and ensuring a fair and transparent trading experience.

When trading Forex, you want to be confident that your broker is operating legally and ethically and that your funds are being handled safely. Regulated Forex brokers must adhere to strict standards set by regulatory bodies, which include requirements for capital adequacy, segregation of client funds, and ongoing reporting and compliance. This means that your funds are protected and your trading experience is fair.

Unregulated brokers are not held to the same standards. This can lead to a higher risk of fraud or unethical practices, which can result in financial losses for traders. Choosing a regulated Forex broker gives you peace of mind and security, knowing that your investments are protected.

Scam Brokers and Reporting Regulatory Violations

If you believe you have been scammed by your broker, you can check if the scammer is named on the FMA’s warning list and contact them to formally investigate the case.

We also have a report a scam broker form which we use to gather information so that we get the word out. Your personal details will not be shared externally. If you are unsure about the reliability of your Forex broker, you can check our list of brokers to avoid.

Conclusion

Though the new regulatory environment in New Zealand has led to a short-term decrease in the number of international brokers operating in the country, it has also led to a significantly safer market for retail traders.

We find that the FMA is a very transparent and responsible regulator, and as New Zealand gains a reputation as a reliable and secure country for Forex trading, we strongly believe that the industry will expand in the future.

Forex Risk Disclaimer

Trading Forex and CFDs is not suitable for all investors as it carries a high degree of risk to your capital: 75-90% of retail investors lose money trading these products. Forex and CFD transactions involve high risk due to the following factors: Leverage, market volatility, slippage arising from a lack of liquidity, inadequate trading knowledge or experience, and a lack of regulatory protection. Traders should not deposit any money that is not considered disposable income. Regardless of how much research you have done or how confident you are in your trade, there is always a substantial risk of loss. (Learn more about these risks from the Australian regulator, ASIC or the UK’s regulator, the FCA).

Our Rating & Review Methodology

Our overall Forex Rankings report and Directory of CFD Brokers to Avoid are the result of extensive research on over 180 Forex brokers. These resources help traders find the best Forex brokers – and steer them away from the worst ones. These resources have been compiled using over 200 data points on each broker and over 3000 hours of research. Our team conducts all research independently: Testing brokers, gathering information from broker representatives and sifting through legal documents. Learn more about how we rank brokers.

Editorial Team

Chris Cammack

Head of Content

Chris joined the company in 2019 after ten years experience in research, editorial and design for political and financial publications. His background has given him a deep knowledge of international financial markets and the geopolitics that affects them. Chris has a keen eye for editing and a voracious appetite for financial and political current affairs. He ensures that our content across all sites meets the standards of quality and transparency that our readers expect.

Alison Heyerdahl

Senior Financial Writer

Alison joined the team as a writer in 2021. She has a medical degree with a focus on physiotherapy and a bachelor’s in psychology. However, her interest in forex trading and her love for writing led her to switch careers, and she now has over eight years experience in research and content development. She has tested and reviewed 100+ brokers and has a great understanding of the Forex trading world.

Ida Hermansen

Financial Writer

Ida joined our team as a financial writer in 2023. She has a degree in Digital Marketing and a background in content writing and SEO. In addition to her marketing and writing skills, Ida also has an interest in cryptocurrencies and blockchain networks. Her interest in crypto trading led to a wider fascination with Forex technical analysis and price movement. She continues to develop her skills and knowledge in Forex trading and keeps a close eye on which Forex brokers offer the best trading environments for new traders.

Stay updated

This form has double opt in enabled. You will need to confirm your email address before being added to the list.