-

MetaTrader 4 Brokers

The top MT4 brokers in AU

-

MetaTrader 5 Brokers

The best MT5 brokers in AU

-

TradingView Brokers

The best TradingView brokers

-

cTrader Brokers

The top cTrader brokers in AU

-

Forex Trading Apps

Trade on the go from your phone

-

Copytrading Brokers

Copy professional traders

-

All Trading Platforms

Find a platform that works for you

BDSwiss Broker Review

Last Updated On July 22, 2023

75-90% of retail traders lose money trading Forex and CFDs. You should consider whether you understand how CFDs and leveraged trading work and if you can afford the high risk of losing your money. We may receive compensation when you click on links to products we review. Please read our advertising disclosure. By using this website you agree to our Terms of Service.

Our verdict on BDSwiss

BDSwiss is an offshore broker with a basic but intuitive mobile app and excellent education and market analysis. Unfortunately, its trading costs are generally above the industry average and the only trading account with relatively low fees required a 5000 USD minimum deposit.

With no ASIC regulation, BD Swiss can offer leverage of 1:500 for Forex trading. But there are always trust and safety concerns when using an offshore broker. Another downside is the lack of AUD trading accounts: Any AUD deposits are converted to USD, GBP or EUR, and profits will have to be converted again when withdrawn. Not a huge issue for some, but then BDSwiss also has quite high withdrawal fees for bank transfers. Taken together, this may put some traders off.

Alongside its mobile app, BDSwiss also supports the MT4 and MT5 trading platforms and offers trading on Forex, commodities, shares, indices, and 26 cryptocurrencies.

| 🏦 Min. Deposit | USD 10 |

| 🛡️ Regulated By | FSC, FSA-Seychelles, FSCA, MISA |

| 💵 Trading Cost | USD 13 |

| ⚖️ Max. Leverage | 500:1 |

| 💹 Copy Trading | Yes |

| 🖥️ Platforms | MT4, MT5, BDSwiss WebTrader |

| 💱 Instruments | Commodities, Cryptocurrencies, Stock CFDs, Forex, Indices |

Overall Summary

Account Information

Trading Conditions

Company Details

Pros

- Tight spreads

- Good for beginners

- Excellent education and market analysis

Cons

- High inactivity fees

- Limited number of assets

BDSwiss Key Features

| 🏦 Min. Deposit | USD 100 |

| 🛡️ Regulated By | CySEC, FSC, FSA |

| 💵 Trading Cost | USD 15 |

| ⚖️ Max. Leverage | 500:1 |

| 💹 Copy Trading | Yes |

| 🖥️ Platforms | MT4, MT5 |

| 💱 Instruments | Forex, Stock CFDs, Indices, Commodities, Cryptocurrencies |

Is BDSwiss Safe?

The lack of ASIC regulation is a concern, but BDSwiss offers all clients negative balance protection and segregates client funds from its own.

FSA Mauritius Regulation: Australian clients will be trading with BDS Markets, a subsidiary of BD Swiss regulated by the Financial Services Commission (FSC) Mauritius. The level of protection offered by the FSC is poor compared to ASIC and CFD brokers registered with the FSC are not required to restrict leverage (Australians can receive leverage of up to 500:1). Most worryingly, Australian traders will have little recourse in the event of a dispute with BD Swiss.

Safety Features: At BDSwiss all client funds are placed in segregated tier one bank accounts and are offered negative balance protection. If a client falls into a negative trading balance, BDSwiss will adjust the total negative amount so that the client does not suffer any loss. Additionally, BDSwiss’ other subsidiaries are regulated by some top-tier authorities, including CySEC in Europe, and the parent company is regularly audited by external audit firms.

Company Details:

BDSwiss’ Trading Instruments

BDSwiss has a good range of trading instruments compared to other offshore brokers, including 900+ shares and 26 cryptocurrencies.

Because BDSwiss is not regulated by ASIC, it can offer high leverage to retail traders across all its trading instrument classes.

- Forex: BDSwiss has over 50 currency pairs available for trading which is around the industry average. These include majors (EUR/USD, GBP/USD, and USD/JPY), minors (NZD/CAD, EUR/JPY, and USD/ZAR), and exotics. The leverage on Forex pairs is up to 500:1.

- Share CFDs: BDSwiss offers 141 share CFDs on MT4 and the BDSwiss trading app, which is limited compared to other large international brokers. However, traders can find a far larger selection of over 900 shares and ETFs on the MT5 platform.

- Indices: There are only 10 indices available for trading at BDSwiss.

- Commodities: BDSwiss only offers trading on 6 commodities, including metals such as gold and silver and energies such as oil.

- ETFs: BDSwiss offers over 80 ETF CFDs from the world’s leading exchanges to trade with direct market access exclusively on its InvestPLUS Account. All ETFs are set to BUY only.

- Cryptocurrencies: BDSwiss offers trading on over 26 cryptocurrencies, including Bitcoin, Ethereum, Litecoin, and Ripple, which is an impressive offering compared to what is available at other brokers.

Accounts and Trading Fees

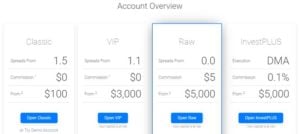

We were disappointed to find that trading fees at BDSwiss are generally higher than other similar brokers. The one exception is the Raw Account, but this requires a minimum deposit of 5000 USD.

Account Trading Costs:

As you can see from the table above, costs are higher than average at BDSwiss. The average cost for trading one lot of EUR/USD among similar brokers is about 9 USD per lot. This is only achievable on the Raw Account, which has a minimum deposit requirement of 5,000 USD.

Classic Account

The minimum deposit on the commission-free Classic Account is 10 USD, with variable spreads starting at 1.30 pips on the EUR/USD (which is wider than the industry average). Traders have access to Autochartist and the BD Swiss trading academy.

VIP Account

The minimum deposit on the VIP Account is 3,000 USD, and spreads are average at best, starting at 1.1 pips on the EUR/USD. In addition to the tighter spreads, the VIP Account comes with access to several trading and educational tools, including AutoChartist, a personal account manager, and VIP access to built-in trend analysis tools.

Raw Account

The Raw Account is a professional account offering raw spreads in exchange for a higher minimum deposit of 5000 USD. Spreads are down to 0 pips on major pairs at times, though they average at 0.3 pips on the EUR/USD. A reasonable commission of 5 USD/lot round turn is charged on Forex pairs. Because of the nature of this account, an Islamic (swap-free) option is not available.

InvestPLUS Account

The InvestPLUS Account is a direct market access (DMA) account that allows clients to trade on over 1,000 shares and ETFs. The minimum deposit on this account is 5,000 USD/EUR/GBP (or equivalent). Leverage is limited to 5:1, and a commission of 0.1% per unit is charged. Like the Raw Account, this account cannot be converted into an Islamic Swap-free Account.

Spreads and Commission Compared:

Deposit & Withdrawal fees

Like most brokers, BDSwiss charges no deposit fees but we were charged high withdrawal fees for bank transfers. Further investigation found that withdrawal fees are also applied to any withdrawals lower than 20 EUR.

Deposit and Account Currencies: At BDSwiss, traders can only choose from three account currencies: USD, GBP, and EUR. We opened a USD trading account, and our AUD deposit was converted to USD before we could trade. The exchange range wasn’t terrible, but it was frustrating considering how many other brokers offer AUD trading accounts.

Deposit/Withdrawal Methods and Costs: Due to Anti-Money Laundering policies, deposits and withdrawals at BDSwiss cannot be made to/from third-party accounts. See below for a list of BDSwiss payment methods:

- Bank Wire Transfer: Deposits are free, but BDSwiss charges a fixed fee of 10 EUR (or equivalent) for bank wire withdrawals below 100 EUR (or equivalent). Deposits and withdrawals are processed within one day, but may take four to seven days to reach the account.

- Credit Cards/Debit Cards: Payments are via Visa and Mastercard. Deposits are instant and free – BDSwiss covers all receiving costs. Withdrawals are processed within 24 hours and are free.

- eWallets (Skrill, Neteller, Astropay): Deposits are instant and free. Withdrawals are processed within 24 hours and are free too.

- Bitcoin: Deposits are instant and free. Withdrawals are processed within 24 hours and are free.

Minimum Withdrawal: For international bank transfers, the minimum withdrawal amount is 50 EUR (or equivalent) after the deduction of fees. For amounts that remain below the required 50 EUR, an alternative withdrawal method must be used. For all other withdrawals amounting to 20 EUR or less, BDSwiss reserves the right to charge a fixed withdrawal fee of 10 EUR (or equivalent).

BDSwiss Mobile Trading Apps

The BDSwiss mobile trading app is basic but easy to use and is available on iOS and Android devices. BDSwiss also offers mobile versions of MT4 and MT5.

BDSwiss’ Mobile App

In our testing, we found the BDSwiss mobile app to be a standard trading app aimed at beginners. It allows basic trading, research, and account management functionality but not much else. Traders can open/close/edit positions, add stops to open positions and delete working orders. Research and analysis are available on real-time charts, and automated alerts can be used to identify trading opportunities.

Deposits and withdrawals can be made within the app and customer support is available via live chat 24/5.

The BDSwiss trading app is more user-friendly than the standard MT4 mobile application and it synced with our MT4 account easily. But more experienced traders will want the customisation options and advanced order types available on the MT4 and MT5 apps.

MT4/MT5 Mobile Trading App

BDSwiss offers support for MT4 and MT5 mobile trading apps for Android and iOS. Traders should be aware that there is some loss in functionality when compared to the desktop trading platforms, including reduced time frames and fewer charting options, but traders can close and modify existing orders, calculate profit and loss, and trade on the charts.

Other Trading Platforms

BDSwiss WebTrader

The BDSwiss WebTrader is available in browsers on both Mac and PC. It synchronises with the BDSwiss app and the downloadable version of MT4, but not MT5. Translated into more than 24 languages, the BDSwiss WebTrader is designed to accommodate traders’ needs from around the globe.

The BDSwiss WebTrader has a range of tools, including indicators, and an order window that automatically calculates position size, leverage, and required margin. However, the platform lacks many of the features available on MT4 and MT5 such as automated trading and does not cater for third-party tools.

MT4 and MT5

The main benefit of using third-party platforms such as MT4 and MT5 is that traders can keep their own customised versions of the platforms should they choose to migrate to another broker. Both MT4 and MT5 are available for Windows, Android, iOS, and web browser.

Trading Platform Comparison:

Opening an Account at BDSwiss

The account opening process at BDSwiss is fully digital, fast, and hassle-free compared to other brokers.

All Australian traders are eligible to open an account at BDSwiss, as long as they meet the minimum deposit requirements of each account.

Creating an account is straightforward, the process is fully digital, and accounts are usually ready within one day. BDSwiss notes the online application process takes less than 49 seconds to complete. BDSwiss offers joint and individual accounts, but we will focus on opening an individual account:

How to open an account at BDSwiss:

- New traders will have to click on the “Sign Up” button at the top of the page where they will be directed to register an account.

- BDSwiss’ intake form requires clients to fill in their personal details (including name, country of residence, email address, birth date, and level of education).

- BDSwiss needs at least two documents to accept you as an individual client:

- Proof of Identification – BDSwiss accepts all government-issued identification documents such as Passport, national ID card, driving license, or other government-issued ID. The document must be valid and must contain a trader’s full name, date of birth, a clear photograph, issue date, and if it has to have an expiry date, that should be visible as well. A passport is the preferred proof of identity, as it is the document that will be the quickest for the BDSwiss Back Office team to process. If the document has two sides, then scans of the front and back sides must be uploaded.

- Proof of Address – Proof of residence/address document must be issued in the name of the BDSwiss account holder within the last 3 months and must contain a trader’s full name, current residential address, issue date, and issuing authority. BDSwiss accepts any bills that are issued by a financial institution, a utility company, a government agency, or a judicial authority.

- Once this step is complete, traders are asked to complete two questionnaires that will help BDSwiss assess the state of their finances and trading knowledge. While most brokers don’t include this step in the account-opening process, it is a responsible move in an industry that is often accused of an irresponsible approach to consumer protection.

- After the application is approved, traders can login and fund their accounts

- We advise you to read BDSwiss’ risk disclosure, customer agreement, and terms of business before you start trading.

Overall, BDSwiss account-opening process is quick, efficient, and accounts are generally ready for trading within one business day.

Trading Tools

BDSwiss offers an average range of trading tools compared to other similar brokers.

BDSwiss’ trading tools include Autochartist and BDSwiss’ in-house Trend Analysis tool that integrates with the web trader platform. These tools are offered free of charge to all BDSwiss registered clients.

Autochartist

Autochartist is an automated analysis tool offered for free to all BDSwiss registered users. Autochartist monitors 250+ CFDs 24 hours a day and automatically alerts traders on key trading opportunities and forming trends with the highest probability of hitting the forecast price. Some of Autochartist’s key features are:

- Chart pattern recognition

- Fibonacci pattern recognition

- Key level analysis

- Pattern quality indication

Autochartist is one of the best technical analysis tools on the market, and BDSwiss does well to offer this tool to its clients.

Trend Analysis

The Trend Analysis tools are exclusively available on BDSwiss’ web trader platform.

Developed in partnership with AutoChartist exclusively for BDSwiss traders, Trend Analysis is a unique tool that enables traders to spot some of the biggest trading opportunities directly on BDSwiss’ WebTrader. Traders can view emerging and recently completed trends for hundreds of assets, in addition to pattern overlays and projected price trends applied live on a chart.

Overall, BDSwiss trading tools are slightly limited compared to what is offered by other large international brokers, but the tools it does offer are some of the best in the industry.

BDSwiss for Beginners

BDSwiss offers excellent educational material for beginner and intermediate-experience traders, including structured training courses, daily webinars, and frequent live seminars.

Market analysis is also excellent and detailed, with market news and insightful daily analysis offered by the BDSwiss team.

Demo Account

The demo account is a USD 10,000 live market playground to practice trading and analysis. The demo account never expires, allowing traders to make a full evaluation of BDSwiss and its trading platforms.

Educational Material

Education is where BDSwiss has clearly invested time and effort, and they have created an outstanding selection of materials for beginners.

Trading Academy: BDSwiss offers a comprehensive Trading Academy for those looking for structured courses. The Trading Academy is split into beginner, intermediate and advanced sections, though in truth, the advanced section is more suited to those with intermediate knowledge. Perhaps the better and more advanced educational material from BDSwiss comes in the form of weekly strategy webinars and frequent live seminars held at BDSwiss’ local offices around the world.

The Educational videos consist of five to six lessons with a quiz to summarize the content. It provides a great introduction to trading. Topics include CFD Trading, The Basics of Forex Trading, and Order Types, among others.

BDSwiss also provides a Forex Glossary in addition to a number of ebooks that are well-written and in-depth.

Webinars: Webinars are free to non-clients and only require signup to participate. BDSwiss also offers Trading Talks is a 10-course recurring educational webinar that is held every two weeks. Once completed, webinars are added to the video library and combined with other educational videos about aspects of trading and market analysis.

Overall, the education provided by BDSwiss far surpasses that of most other international brokers.

Analysis Material

BDSwiss provides an award-winning market research section that is curated by some of the best analysts in the world.

Professional Market Commentary: BDSwiss’ market analysis is curated by a team of renowned markets analysts and professional traders that provide 24/5 market news coverage and actionable financial commentary. Recognised by the global industry community, its Research Team is frequently featured in world-leading publications and is viewed as a reliable, one-stop information hub of insightful market analyses.

Telegram Channel: BDSwiss’ Telegram channel, which consists of a Free basic version accessible by anyone, and the VIP version which is exclusive to premium account holders (VIP and Raw Account), provides real-time Trading Alerts, volatility alerts, and upcoming live-trading webinars.

Free World-Class Analysis: All analytical material, including webinars and forecasting reports, is available free of charge, and most of the video content is uploaded to YouTube. The analysis quality is world-class and will be of value to both technical and fundamental traders.

Lastly, the Daily Videos give traders insight into how to approach researching marketing opportunities and trader psychology. We particularly recommend the Daily Market Preview, conducted by BDSwiss’ Head of Investment Research, Marshall Gittler.

Customer Support

Award-winning customer support is available 24/5 via live chat, email, messenger services, and telephone – though telephone support requires calling a European number, and you will be charged accordingly.

Overall, we found the customer service responsive, polite, and able to answer all of our questions.

Regulation and Industry Recognition

BDSwiss is well-regulated by many top-tier authorities, including the Cyprus Securities and Exchange Commission (CySEC), the Mauritius Financial Securities Commission (FSC), the Federal Financial Supervisory Authority (BaFin) of Germany, and the Financial Services Authority (FSA) of Seychelles. See below for more details:

- BDSwiss has been regulated by CySEC (license 199/13) since 2013

- BDS Markets is authorised and regulated as an Investment Dealer by the Mauritius FSC on 06/12/2016 (License No. C116016172)

- BDSwiss GmbH (Registration No. HRB 160749B) is the BaFin-registered Tied Agent of BDSwiss Holding Ltd in Germany.

- BDS Ltd is authorized and regulated by the Financial Services Authority (FSA) Seychelles under license number SD047.

In terms of industry recognition, BDSwiss outshines many of its competitors. Recent awards include:

- Best FX Education & Research Provider 2021 (World Finance Awards)

- Best Mobile Trading Platform Europe 2021 (Global Banking and Finance Awards)

- Best Trading Conditions 2019 and Best Trading Conditions 2020 awards (World Finance Awards) and Best FX & CFD Provider 2020 at the International Investor Awards.

- Best Trade Execution 2019 (Global Forex Awards)

- Best Trading App 2019 (Mobile Star Awards).

Our sister site, TradeForexSA, also awarded BDSwiss the award for Best Market Research Provider 2020, citing BDSwiss’s “exceptionally detailed and thoughtful market analysis for traders of all experience levels.”

Overall, because of its history of responsible behaviour, storing international regulation, strict auditing processes, and wide industry acclaim, we consider BDSwiss a trustworthy broker.

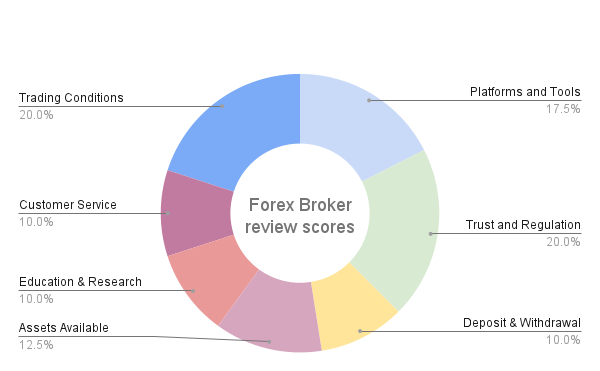

Evaluation Method

We value transparency and openness in the way we review the partners. To bring transparency to the forefront, we have published our review process. Central to that process is the evaluation of the reliability of the broker, the platform offering of the broker, and the trading conditions offered to clients, which are summarised in this review. Each one of these is graded, and an overall score is calculated and assigned to the broker.

BDSwiss Disclaimer

Trading Forex is risky, and each broker is required to detail how risky the trading of Forex CFDs is to clients. BDSwiss would like you to know that: Trading in Forex/ CFDs and Other Derivatives is highly speculative and carries a high level of risk. 0 of retail investor accounts lose money when trading CFDs with this provider.

Overview

A well-regulated broker, Bswiss offers trading on multiple instruments, including Forex, commodities, indices, shares, and 26 crypto pairs, which is a wider range than most other brokers. Trading costs are higher than average on two of its three accounts, but improve significantly on the Raw Account, in exchange for a high minimum deposit requirement. BDSwiss also offers support for a wide range of trading platforms, including MT4, MT5, its own proprietary platform, and an award-winning mobile application, alongside a world-class repository of educational and market analysis materials and excellent customer service.

Editorial Team

Chris Cammack

Head of Content

Chris joined the company in 2019 after ten years experience in research, editorial and design for political and financial publications. His background has given him a deep knowledge of international financial markets and the geopolitics that affects them. Chris has a keen eye for editing and a voracious appetite for financial and political current affairs. He ensures that our content across all sites meets the standards of quality and transparency that our readers expect.

Alison Heyerdahl

Senior Financial Writer

Alison joined the team as a writer in 2021. She is the Senior Editor for FXScouts. She has a medical degree with a focus on physiotherapy and a bachelor’s in psychology. However, her interest in forex trading and her love for writing led her to switch careers. She has a passion for Forex trading and over a decade of editorial experience researching Forex and the financial services industry, producing high-quality content. She hosts a weekly podcast, “Let’s Talk Forex,” alongside her colleague, Chris, and has produced over 100 Forex educational videos for the FXScouts YouTube channel. She also writes weekly technical analyses and has tested and reviewed over 100 Forex brokers.

Ida Hermansen

Financial Writer

Ida joined our team as a financial writer in 2023. She has a degree in Digital Marketing and a background in content writing and SEO. In addition to her marketing and writing skills, Ida also has an interest in cryptocurrencies and blockchain networks. Her interest in crypto trading led to a wider fascination with Forex technical analysis and price movement. She continues to develop her skills and knowledge in Forex trading and keeps a close eye on which Forex brokers offer the best trading environments for new traders.

Compare Brokers

Find out how BDSwiss stacks up against other brokers.

Stay updated

This form has double opt in enabled. You will need to confirm your email address before being added to the list.