-

MetaTrader 4 Brokers

The top MT4 brokers in AU

-

MetaTrader 5 Brokers

The best MT5 brokers in AU

-

TradingView Brokers

The best TradingView brokers

-

cTrader Brokers

The top cTrader brokers in AU

-

Forex Trading Apps

Trade on the go from your phone

-

Copytrading Brokers

Copy professional traders

-

All Trading Platforms

Find a platform that works for you

CMC Markets Broker Review

| 🏦 Min. Deposit | AUD 5 |

| 🛡️ Regulated By | ASIC, FCA, MAS, BaFin |

| 💵 Trading Cost | USD 7 |

| ⚖️ Max. Leverage | 30:1 |

| 💹 Copy Trading | No |

| 🖥️ Platforms | MT4, CMCmarkets |

| 💱 Instruments | Commodities, Cryptocurrencies, Stock CFDs, ETFs, Forex, Indices |

Last Updated On August 21, 2023

75-90% of retail traders lose money trading Forex and CFDs. You should consider whether you understand how CFDs and leveraged trading work and if you can afford the high risk of losing your money. We may receive compensation when you click on links to products we review. Please read our advertising disclosure. By using this website you agree to our Terms of Service.

Our verdict on CMC Markets

Founded in 1989, CMC Markets is a well-known Forex and CFD broker with a high trust rating and a strong presence in Australia. It has local ASIC regulation, and a local Australian office and offers accounts denominated in AUD.

CMC Markets offers two live accounts with no minimum deposit requirements – a low-cost commission-free account with spreads starting at 0.7 pips on the EUR/USD and a commission-based account with spreads of 0.1 pip and commissions of 0.005% (which amounts to 50 USD per lot traded), which is extremely high.

Trading is offered on both MT4 and its powerful, innovative proprietary platform that features numerous technical and fundamental analysis tools. CMC Markets also offers excellent education and market analysis materials to get new traders started, and although customer service is offered 24/5, it does not provide a live chat feature, which is a serious oversight by this broker.

| 🏦 Min. Deposit | AUD 5 |

| 🛡️ Regulated By | ASIC, FCA, MAS, BaFin |

| 💵 Trading Cost | USD 7 |

| ⚖️ Max. Leverage | 30:1 |

| 💹 Copy Trading | No |

| 🖥️ Platforms | MT4, CMCmarkets |

| 💱 Instruments | Commodities, Cryptocurrencies, Stock CFDs, ETFs, Forex, Indices |

Overall Summary

Account Information

Trading Conditions

Company Details

Pros

- Offers a selection of over 12

- 000 trading instruments

- Features competitive spreads from 0.7 pips on major pairs on its commission-free accounts

- No minimum deposit requirement

- Supports MT4 and the proprietary Next Generation platform which delivers a superior mobile trading experience

- Regulation by leading authorities such as ASIC

- FCA

- FMA

- and BaFin

Cons

- Commission-based accounts are subject to high fees potentially affecting profitability

- The absence of live chat support may hinder prompt assistance

- Some withdrawal methods have fees adding to the total trading costs

CMC Markets

Yes, CMC Markets is a safe broker. It is one of the best-regulated brokers in the industry, with oversight from eight major regulators, including the local regulator, ASIC. It is also listed on the London Stock Exchange and offers traders negative balance protection. On this basis, it receives a trust score of 5/5.

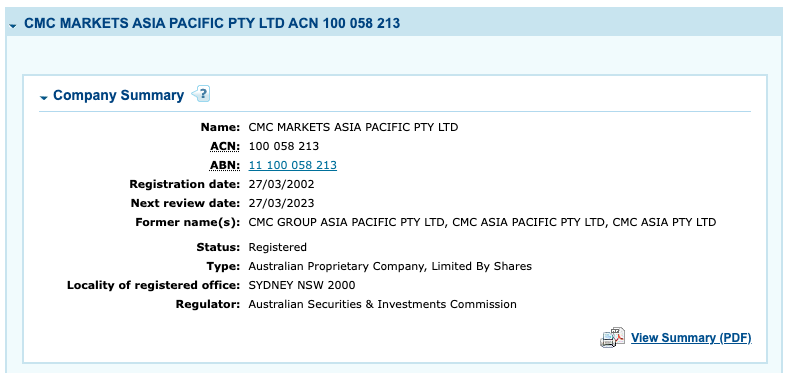

Local ASIC Regulation: Australian residents will be trading with CMC Markets Asia Pacific Pty Ltd which is regulated by ASIC – Australia’s globally respected financial regulator.

Safety Features: In early 2021, ASIC tightened its restrictions on CFD trading to better protect traders. As a result, CMC Markets clients in Australia will have a leverage limit of 30:1 for Forex trading and will be provided negative balance protection, meaning that traders can never lose more money than they have in their trading accounts. In addition, ASIC regulations ensure that CMC Markets keeps its operational funds segregated from client accounts, but also prevent CMC Markets from offering promotions or bonuses.

History: CMC Markets is widely recognised as a pioneer in CFD trading. The company was founded in London in 1989 and launched the world’s first online Forex trading platform in 1996. It opened an office in Sydney in 2002, and CMC Markets Asia Pacific has been licenced by ASIC (AFSL: 238054) since 2004. The parent company (CMC Markets plc) has been listed on the London Stock Exchange since 2016, adding further regulatory oversight

Company Details:

We confirmed each of the licences and regulations on the regulator’s online register. See below for details of CMC Markets ASIC-regulated entity:

CMC Markets’ Financial Instruments

We were impressed by CMC Markets’ range of financial instruments, which includes over 330 Forex pairs and 10,500 shares, among others.

Broad Range of Instruments: CMC Markets offers over 12,000 CFD trading instruments on all trading accounts. Besides Forex pairs, CMC Markets offers indices, shares, share baskets, commodities, cryptocurrencies, bonds, treasuries, and ETF trading.

- Forex pairs: CMC Markets offers over 330 Forex pairs to trade, including majors, minors, and exotics such as USD/ZAR and ZAR/JPY. This is the largest forex offering found at any broker.

- Commodities: CMC Markets offers trading on 136 commodities, including metals, energies, agriculture, and commodity indices, and again, is one of the broadest offerings in the industry.

- Shares: CMC Markets excels in its share CFD offering, and professional traders looking for a specific instrument will be satisfied.CMC Markets offers over 10,000 share CFDs to trade, including popular US tech companies, multinational energy companies, and more.

- Share Baskets: CMC Markets also offers trading on 18 share baskets in addition to its CFD range. Having analysed trends driving the market, CMC Markets has grouped shares into topical buckets such as Driverless Cars or Renewable Energy, allowing traders to trade CFDs across a theme with a single position.

- Indices: CMC Markets offers cash and futures contracts on over 80 international indices, including the NASDAQ, S&P500, FTSE100, and the Nikkei. This is a broad range of indices compared to other brokers.

- Treasuries: CMC Markets offers CFD trading on over 50 bonds, which is also impressive, considering that other brokers only allow trading on between 3 – 5 bonds. Treasury CFDs include US Bonds, European Bonds, and Rates.

- ETFs: Exchange Traded Funds have rapidly gained in popularity in recent years, and CMC Markets offers spot contracts on 1,000 of the most traded ETFs in the world, which is substantially higher than what is offered at other brokers.

- Cryptocurrencies: Cryptocurrency trading is one of CMC Markets’ most popular asset classes, and though cross-cryptocurrency trading is not available, many pairs are available with competitive spreads. USD crypto pairs offered are Bitcoin, Bitcoin Cash, Ethereum, Litecoin, Neo, Ripple, Dash, Monero, EOS, Stellar, Cardano, and Tron. Note that crypto trading is unavailable for traders regulated under the FCA subsidiary.

Overall, CMC Markets excels in its range of tradable assets, offering the broadest range and depth of assets available at any other brokers. This is a great advantage for professional traders who may be looking for a specific asset.

CMC Markets Trading Costs

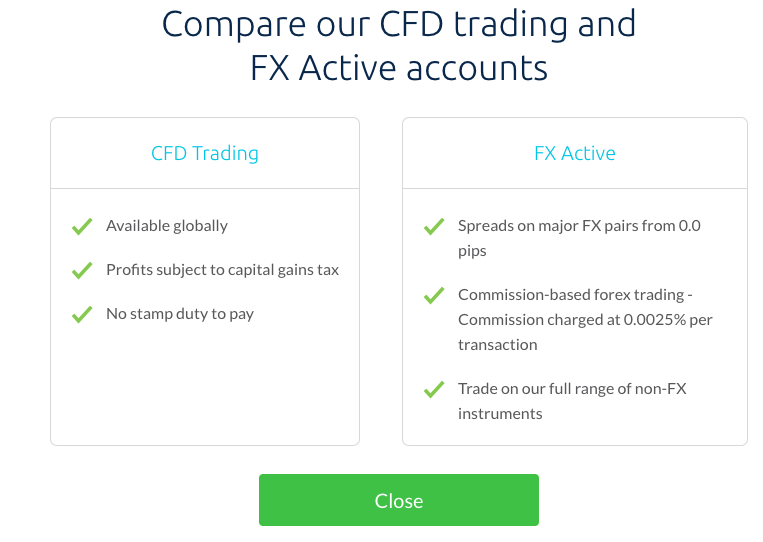

We were pleased to find that CMC Markets offers three account types, which is average for the industry, including a commission-free account, a commission-based account, a spreadbetting account. However, trading fees on its commission-based account are high.

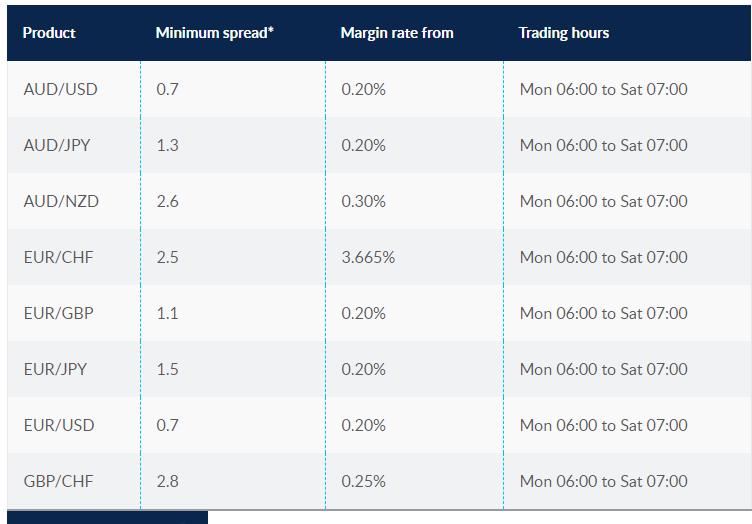

Trading Fees: CMC Markets’ accounts have no minimum deposit requirements, making them accessible to all traders. Its commission-free account has spreads that start at 0.7 pips on the EUR/USD, which is tighter than other similar brokers. Its commission-based account has spreads that start at 0.1 pips on the EUR/USD, a commission of 0.0025% on opening a trade, and the same commission for closing a trade. This commission is one of the highest commissions in the industry, and traders will struggle to be profitable using this account.

Account Trading Costs:

As you can see from the table, the trading costs are built into the spread, which is variable and gets wider or tighter depending on trade volume and market volatility.

The average cost of trading one lot of EUR/USD on CMC Markets’ commission-free account is 7 USD, which is lower than other similar brokerages – the average trading cost at other market makers is around 9 USD per lot. However, with a trading cost of 50 USD on its commission-based account, traders will struggle to be profitable.

See below for account details:

CMC Markets is a market maker with an automated dealing desk, negating some of the conflict of interest inherent in the market maker model. In addition to its standard account, it offers a commission-based account and a spread betting account.

Standard Commission-free Account

The commission-free account has no minimum deposit requirements and spreads of 0.7 pips (EUR/USD) which is significantly tighter than other brokers. There are also no commissions for Forex trading.

Commission-based Account

The commission-based account has spreads starting at 0.1 pips (EUR/USD) in exchange for a commission of 0.0025%. This translates to a charge of 25 USD for opening a position and 25 USD for closing a position when trading on one lot of EUR/USD. These are some of the highest fees in the industry.

Professional Account

CMC Markets offers a professional account to traders that meet certain eligibility criteria. A professional client has waived some FCA protections afforded to retail clients, such as negative balance protection and restrictions on high-risk products, and they are afforded leverage of up to 500:1. Clients must fulfil at least two out of the three following eligibility criteria to become a professional trader:

- Clients have placed 10 relevant trades of a significant size per quarter in the last year.

- Clients have a financial instrument portfolio exceeding 500,000 AUD.

- Clients have worked in the financial sector for at least one year.

CMC Markets Deposit and Withdrawal Fees

CMC Markets offers an average range of funding methods, and while deposits are free, it charges for some withdrawal methods.

A well-regulated broker, CMC Markets ensures that all Anti-Money Laundering rules and regulations are followed, and as such, all withdrawals are returned to the deposit source.

Base Currencies: The base currencies available at CMC Markets include USD, GBP, EUR, AUD, CAD, PLN, SGD, NOK, NZD, and SEK. Having accounts denominated in AUD is good for Australian traders who will likely have AUD bank accounts. Australian traders will therefore be able to avoid paying conversion fees unless trading on instruments with other base currencies, such as the EUR/USD.

In this case, CMC Markets will charge a Currency Conversion Fee for all trades on instruments denominated in a currency different from the currency of a trader’s account. The Currency Conversion Fee is up to 0.5% of the trade’s realised net profit and loss, which is higher than fees charged by other brokerages.

Deposits and Withdrawals: You can fund your account using a credit or debit card or by transferring funds from your bank account. CMC Markets does not accept cheques or cash deposits. See below for more details:

- Bank transfers: Deposits are free and can take several days to reflect. International bank transfers are charged a 15 EUR fee for withdrawals.

- Credit Cards/Debit Cards (Visa/Maestro): Credit and debit card deposits are instant and free. A 1% fee is charged for withdrawals by credit card and 0.6% on debit cards, which take a day to process.

- eWallets (Neteller/Skrill): Deposits and withdrawals are instant and free.

We tested a deposit via credit card transfer, which was deposited instantly. We were also impressed to find that our withdrawal was processed within 24 hours.

Overall, CMC Markets offers an average range of funding methods compared to most other brokers, and while its deposits are free, certain withdrawal methods are expensive. However, deposits and withdrawals are processed faster than other brokers.

CMC Markets Mobile Trading Platforms

CMC Markets offers an excellent mobile trading experience compared to other market makers.

CMC offers support for MT4 and the Next Generation mobile trading apps for Android and IOS. We tested the Next Generation platform using an iPhone 11:

Next Generation Mobile

We were surprised at how much the Next Generation mobile application resembles the web browser version of the platform. It is cleanly designed and comes packed with multiple research tools, powerful charts, excellent drawing tools, pre-defined watch lists for scanning, integrated news, and educational content. We also really liked the customisable dashboard with a range of notification types, a live market calendar, and in-app support.

|  |

Overall, the Next Generation mobile app provides a superior trading experience compared to other proprietary apps on the market and is more beginner-friendly than the MT4 mobile app.

MT4 Mobile

The CMC Markets MT4 app allows traders to work from anywhere, with functionality to close and modify existing orders, calculate profit/loss in real-time, and tick chart trading to further assist traders while on the move.

Beginner traders should be aware that there is some loss in functionality when compared to desktop trading platforms, including reduced timeframes and fewer charting options. In addition, spotty connections can reduce the overall trading experience. Generally, it is better to be at your desktop to conduct day-to-day trading and use a mobile device to keep an eye on the markets or close open positions.

Overall, CMC Markets’ mobile trading experience surpasses that of other brokers.

Other Trading Platforms

With support for MT4 and its own proprietary trading platform, CMC’s platform offering is average compared to most other brokers.

CMC Markets supports both its award-winning, proprietary trading platform (Next Generation) and the industry-standard MetaTrader 4 (MT4). The advantage of brokers offering third-party platforms such as MT4 is that traders can take their own customised versions with them should they decide to migrate to another broker. Additionally, CMC Markets offers its own platform (Next Generation), which is more beginner-friendly than MT4 and offers some excellent analysis features.

Next Generation

Next Generation is available via browser and mobile app and is built to cater to traders of all experience levels. It has an intuitive interface, executes trades with high speeds, and unlike most other proprietary platforms, is highly customisable. Other features of the platform include:

- 80 technical indicators

- 70 chart patterns

- 12 chart types and allows trading directly from the chart

- An Economic Calendar and Reuters Newsfeed are both built-in and available in the mobile app.

The only real downside to the Next Generation platform is that it does not feature automated trading.

MetaTrader 4 (MT4)

The MT4 trading platform is the most widely used Forex trading platform and at CMC Markets you can also use it to trade commodities and indices.

While you won’t receive many of the features available with Next Generation, you will be able to use your customised expert advisers.

While MT4 has great customizability, the platform feels outdated, and some of the features may be hard to find. In addition, only the basic orders are available, including Market, Limit, Stop, and Trailing Stop.

Overall, CMC Markets offers an average selection of platforms compared to other brokers, but the Next Generation is user-friendly and offers a number of impressive trading features.

Platform Overview:

Opening an Account at CMC Markets

The account-opening process at CMC Markets is fully digital, and accounts are ready within one to two days, which is around the industry average.

All Australian residents are eligible to open an account at CMC Markets.

CMC Markets offers corporate, joint, and individual accounts, but we will focus on opening an individual account:

- Select your country of residence, then provide an email address and a password.

- CMC will send you a confirmation code via email; enter this code to proceed.

- Choose the account type (see below for CMC Markets’ account types) and preferred base currency.

4. Fill in your personal details and financial background.

5. Next, you will have to upload documents to verify your identity and residency. CMC Markets requires at least two documents to accept you as an individual client:

-

- Proof of Identification – CMC Markets accepts all government-issued identification documents such as Passport, national ID card, driving license, or other government-issued ID. The document must be valid and must contain a trader’s full name, date of birth, a clear photograph, issue date, and if it has to have an expiry date, that should be visible as well. If the document has two sides, then scans of the front and back sides must be uploaded.

- Proof of Address – Proof of residence/address document must be issued in the name of the CMC Markets’ account holder within the last 6 months and must contain a trader’s full name, current residential address, issue date, and issuing authority.

Once your account is verified, you can go ahead and make your first deposit.

We advise you to read CMC Markets’ risk disclosure, customer agreement, and terms of business before you start trading.

Overall, the account-opening process at CMC Markets is hassle-free, and accounts are ready for trading within one to two business days.

CMC Markets Trading Tools

CMC Markets’ trading tools are average compared to other brokers – the only available tools are those that integrate with the Next Generation.

Client sentiment

The client sentiment feature shows the percentage of CMC Markets clients who have bought versus those who have sold for a particular asset, so you can gauge other clients’ expectations. You can also see the monetary value of these positions as a percentage.

Pattern recognition scanner

The Pattern recognition scanner scans over 120 assets every 15 minutes for emerging and completed chart patterns. When patterns are complete, a price projection box is generated to highlight potential price action movement.

Module linking

This feature allows you to group different modules so that when you change the product shown in one module, all the other grouped modules automatically update to display the new product. In addition, grouped modules can be linked to Reuters’ market news, client sentiment, charts, and order tickets for fast analysis.

Guaranteed Stop-Loss Order (GSLO)

Like many of its peers, CMC Markets offers Guaranteed Stop-Loss Orders (GSLOs). These orders guarantee the stop-loss order price will be honored, but CMC Markets charges a premium for using GSLOs, displayed in the trade ticket window. Most brokers charge for GSLOs. If not triggered, CMC Markets refunds 100% of the cost automatically.

Overall, CMC Markets’ trading tools are average compared to other brokers. While the tools available on the Next Generation trading platform are good, it doesn’t offer any third-party tools typically seen at other brokers – such as a VPS service or technical tools such as Autochartist.

Trading Tools Overview:

CMC Markets Educational Content

The educational content available is multi-format, comprehensive, and more useful for beginners than at most other brokers.

All of CMC Markets’ educational material is free for all visitors to the website.

Because CMC Markets is a multi-asset broker, much of the educational material is grouped under the umbrella term CFD Trading- especially the Video Trading Guides.

That said, there is a standalone Forex section titled Learn Forex Trading. Here you will find:

- Forex Trading Explained: A collection of articles for complete beginners covering the basic concepts and terminology of Forex trading.

- Forex Trading Strategies: A collection of articles covering the basics of technical and fundamental trading.

- Trading Smart eBooks: A small library of eBooks covering subjects such as economic data, day trading, identifying trends, risk management, pattern recognition and trendlines.

- Video Trading Guides: A collection of videos covering strategies and concepts in CFD trading. Though these aren’t specific to Forex trading, all the subjects covered are applicable.

In addition, there is a dedicated platform and software tutorial section – important for beginner traders who want to get trading as quickly as possible.

CMC also offers regular webinars with Trade With Precision, a third-party training company. Webinars cover subjects such as: How to use technical analysis, Finding opportunities, and Possible trade entry and exit points – an upcoming Webinar series titled Ultimate Trading Bootcamp looks promising for beginner traders. All of the webinars are free with registration.

The only downside to the educational section at CMC is the poor organisation; it can be challenging to find exactly what you want – especially in the video section – and much of the Forex material is grouped with CFDs in general.

Overall, the education section is competent, in-depth, and caters to traders of all experience levels, but it is not well-structured, making it difficult to find exactly what you’re looking for.

Education Overview:

CMC Markets Analysis and Research

CMC Markets has a competent in-house research team and has partnered with several third-party analysis companies to provide more useful market analysis than is available at most other brokers.

CMC Markets is top of the class regarding analysis and research, and all analysis is comprehensive, in-depth, and provided by both its in-house analysts and third-party companies. See below for more details:

- Economic Calendar: Fully interactive with impressive depth – it also features a powerful country comparison function for a wide range of economic indicators and has fully customisable date fields.

- Daily (sometimes hourly) research and fundamental analysis from in-house analysts and third parties (such as Trade With Precision or Morningstar). Articles can be filtered by region and asset class. The reports are regularly updated, including quantitative research and important details from annual financial statements.

- The Week Ahead: A weekly video featuring top stories to keep an eye on for the week ahead is also available on YouTube.

- CMC Markets APAC YouTube Channel: A repository of all of the video content output from CMC Markets in Australia and the wider Asia Pacific region.

- Five Minutes a Day Trading: An excellent video and article series that follows senior CMC analysts as they trade for five minutes daily on a popular Forex asset for over a month. This is a good way to relay analytical content while educating the audience and is particularly useful for beginners.

- In-Built News: If you are using CMC’s Next Generation trading platform, the Economic Calendar and news/analysis are built-in to the software so you can keep up to date while trading.

- Thomson Reuters’ Newsfeed: Also built into the Next Generation platform, the newsfeed is provided by a third-party company, Reuters’, and includes updates on politics and on the biggest listed companies in various markets, among others.

All of the in-house analysts are active on Twitter and frequently post updates featuring their own personal take on events and market price action.

Between the analytical and fundamental tools and the quality of market research on offer – in audio, text, and video format – from both in-house and third-party experts, CMC Markets’ market analysis is considerably more useful than most other brokers.

CMC Markets Customer Support

CMC Markets offers 24/5 customer support via email and phone. Its offices are located around the world, and as such, its telephone support is available in many languages.

One major oversight is the fact that there is no live chat feature. This prolongs response times and makes traders reluctant to contact CMC Markets, especially when having to phone an international number.

Overall, CMC Markets’ customer support is substandard compared to what is offered at other similar brokers.

Safety and Industry Recognition

Regulation: CMC Markets is regulated by many top-tier regulators, including the Financial Conduct Authority (FCA) in the UK, the Bundesanstalt für Finanzdienstleistungsaufsicht (BaFin) in Germany, the Australian Services Exchange (ASX), the Dubai Financial Services Authority (DFSA), the Investment Industry Regulatory Organization of Canada (IIROC), the Financial Markets Authority (FMA) of New Zealand, and the Monetary Authority of Singapore (MAS). See below for a list of registered companies:

- CMC Markets UK Plc is authorised and regulated by the Financial Conduct Authority (FCA), registration number 173730.

- CMC Markets Germany GmbH is a company licensed and regulated by the Bundesanstalt für Finanzdienstleistungsaufsicht (BaFin) under registration number 154814.

- CMC Markets Stockbroking Limited, Participant of the Australian Securities Exchange, Sydney Stock Exchange and Chi-X Australia – regulated by the Australian Securities and Investment Commission (ASIC) ABN 69 081 002 851, AFSL: 238054.

- CMC Markets Singapore Pte. Ltd. is regulated by the Monetary Authority of Singapore (MAS), Reg. No./UEN 200605050E.

- CMC Markets Middle East Limited is authorised and regulated by the DFSA, registration number 3039.

- CMC Markets Canada Inc is authorised and regulated by the IIROC, registration number 2448409.

- CMC Markets NZ Limited is authorised and regulated by the FMA, Company Registration Number 1705324.

Awards

Over the last two years, CMC Markets has won over 50 awards, recognising its quality of service and innovative technology. Recent awards include:

- Best Telephone Customer Service, Best Email Customer Service & Best Education Materials/Programmes (Investment Trends 2020)

- Best Overall Satisfaction, Best Platform Features, Best Mobile/Tablet App, Rated Highest for Charting (Investment Trends 2019).

- Best In-House Analysts 2019 (Professional Trader Awards)

- Highest Overall Client Satisfaction, Best Platform Features, Best Customer Service, Best Educational materials/programs, and Best Value for Money (Investment Trends Australia 2018).

Overall, with its long history of responsible behaviour, a public listing on the London Stock Exchange, and high level of regulatory oversight, we consider CMC Markets a safe broker to trade with.

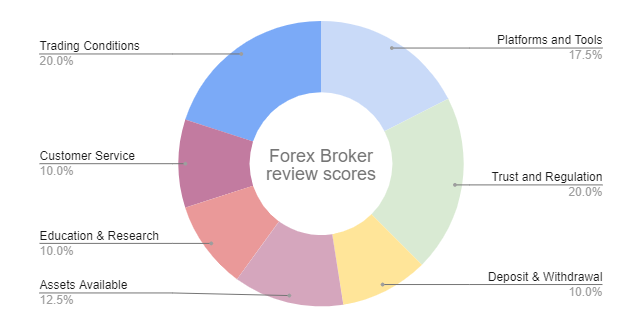

Evaluation Method

We value transparency and openness in the way we review the partners. To bring transparency to the forefront, we have published our review process. Central to that process is the evaluation of reliability, the platform offering, and the trading conditions offered to clients, which are summarised in this review. Each one of these is graded, and an overall score is calculated and assigned.

CMC Markets Disclaimer

Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 70% of retail investor accounts lose money when spread betting and/or trading CFDs with CMC Markets. You should consider whether you understand how spread bets and CFDs work and whether you can afford to take the high risk of losing your money.

Overview

CMC Markets is a large, international, well-regulated broker with two live accounts that boast competitive spreads and no minimum deposits on the industry’s largest range of financial assets. However, traders should be aware of the high commissions on the commission-based account.

CMC Markets offers full support for MT4 and its award-winning proprietary platform, Next Generation, which has a broad range of advanced order management, technical analysis tools, and a built-in Reuters news feed.

Editorial Team

Chris Cammack

Head of Content

Chris joined the company in 2019 after ten years experience in research, editorial and design for political and financial publications. His background has given him a deep knowledge of international financial markets and the geopolitics that affects them. Chris has a keen eye for editing and a voracious appetite for financial and political current affairs. He ensures that our content across all sites meets the standards of quality and transparency that our readers expect.

Alison Heyerdahl

Senior Financial Writer

Alison joined the team as a writer in 2021. She is the Senior Editor for FXScouts. She has a medical degree with a focus on physiotherapy and a bachelor’s in psychology. However, her interest in forex trading and her love for writing led her to switch careers. She has a passion for Forex trading and over a decade of editorial experience researching Forex and the financial services industry, producing high-quality content. She hosts a weekly podcast, “Let’s Talk Forex,” alongside her colleague, Chris, and has produced over 100 Forex educational videos for the FXScouts YouTube channel. She also writes weekly technical analyses and has tested and reviewed over 100 Forex brokers.

Ida Hermansen

Financial Writer

Ida joined our team as a financial writer in 2023. She has a degree in Digital Marketing and a background in content writing and SEO. In addition to her marketing and writing skills, Ida also has an interest in cryptocurrencies and blockchain networks. Her interest in crypto trading led to a wider fascination with Forex technical analysis and price movement. She continues to develop her skills and knowledge in Forex trading and keeps a close eye on which Forex brokers offer the best trading environments for new traders.

Compare Brokers

Find out how CMC Markets stacks up against other brokers.

Stay updated

This form has double opt in enabled. You will need to confirm your email address before being added to the list.