-

MetaTrader 4 Brokers

The top MT4 brokers in AU

-

MetaTrader 5 Brokers

The best MT5 brokers in AU

-

TradingView Brokers

The best TradingView brokers

-

cTrader Brokers

The top cTrader brokers in AU

-

Forex Trading Apps

Trade on the go from your phone

-

Copytrading Brokers

Copy professional traders

-

All Trading Platforms

Find a platform that works for you

| 🏦 Min. Deposit | AUD 50 |

| 🛡️ Regulated By | CySEC, FCA, ASIC, FSA-Seychelles |

| 💵 Trading Cost | USD 10 |

| ⚖️ Max. Leverage | 30:1 |

| 💹 Copy Trading | Yes |

| 🖥️ Platforms | etoro |

| 💱 Instruments | Commodities, Cryptocurrencies, Stock CFDs, ETFs, Forex, Indices |

Last Updated On May 12, 2023

75-90% of retail traders lose money trading Forex and CFDs. You should consider whether you understand how CFDs and leveraged trading work and if you can afford the high risk of losing your money. We may receive compensation when you click on links to products we review. Please read our advertising disclosure. By using this website you agree to our Terms of Service.

Our verdict on eToro

Founded in 2007, eToro is an ASIC-regulated social trading broker. It remains the most popular social trading broker in Australia. eToro’s simple, well-designed trading platform places copy trading and its social network at the heart of its trading experience. However, these features are often more popular among beginners who haven’t yet developed advanced trading strategies.

eToro clients can only use eToro’s trading platform, so they will not have access to the automation tools available on common third-party platforms like MT4 and MT5. We were also disappointed by eToro’s high fees. These include currency conversion fees for deposits and withdrawals in currencies other than USD and a charge of 5 USD for each withdrawal. We also found eToro’s customer service to be generally non-responsive and we were let down by the lack of educational support.

Overall, eToro has many positive features for beginners and others who enjoy social trading, but more experienced traders may find eToro’s limitations and high non-trading fees difficult to overlook.

| 🏦 Min. Deposit | AUD 50 |

| 🛡️ Regulated By | CySEC, FCA, ASIC, FSA-Seychelles |

| 💵 Trading Cost | USD 10 |

| ⚖️ Max. Leverage | 30:1 |

| 💹 Copy Trading | Yes |

| 🖥️ Platforms | etoro |

| 💱 Instruments | Commodities, Cryptocurrencies, Stock CFDs, ETFs, Forex, Indices |

Overall Summary

Account Information

Trading Conditions

Company Details

Pros

- Well regulated

- Good for beginners

- Innovative trading tools

Cons

- Limited education

- Wide spreads

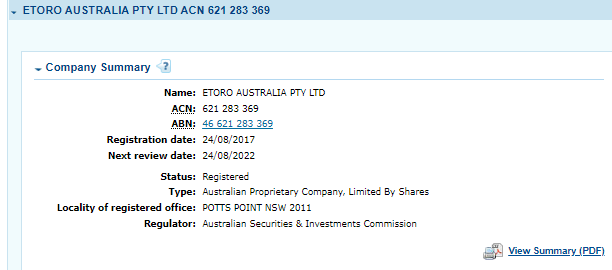

Is eToro Safe?

Regulated by the world’s top authorities, including the UK’s FCA, ASIC of Australia, and CySEC of Cyprus, eToro is considered a safe broker for Australian traders to trade with.

ASIC Regulation: Australian traders of eToro will be trading under the subsidiary, eToro Australia Pty Ltd, authorised and regulated by the ASIC:

Safety Features: Known as one of the strictest regulators in the world, ASIC has put in place a number of restrictions to protect traders. ASIC protects Australian clients by ensuring that eToro:

- Segregates client funds from its operating capital.

- Restricts leverage to 30:1 for Forex trading.

- Provides all clients with negative balance protection, meaning that traders can never lose more money than they have in their trading accounts.

- Does not offer promotions or bonuses.

In addition to complying with ASIC’s rules, eToro has purchased an insurance policy from Lloyd’s of London, which covers up to 1 million EUR, GBP, or AUD.

Company Details:

We confirmed each of the licences and regulations on the regulator’s online register. See below for details of eToro’s ASIC regulated entity:

eToro’s Financial Instruments

With over 2000 stock CFDs, 96 cryptocurrencies, and 31 commodities, eToro has a good range of financial instruments compared to other similar brokers.

See below for eToro’s range of instruments and corresponding leverage:

- Forex: eToro offers an average range of currency pairs for trading, including majors (EUR/USD, GBP/USD, and USD/JPY) and minors (NZD/CAD, EUR/JPY, and USD/ZAR), but no exotics.

- Stock CFDs: eToro offers a larger range of stock CFDs than most other brokers. The selection available includes some of the major US companies, including Apple, Amazon, Facebook, Microsoft, and Google, among others.

- Commodities: eToro offers an excellent range of commodities, as most brokers offer trading on between 5 – 10 commodities. These include gold, silver, platinum, petroleum, oil, and softs such as cocoa, wheat, sugar, and cotton.

- Indices: eToro offers an average range of indices compared to other similar brokers, and includes the likes of the UK 100, SPX 500, NASDAQ 100, and the US DOLLAR.

- Cryptocurrencies: With 96 crypto pairs available for trading, eToro offers a wider range than is available at most other brokers, including crypto/crypto pairs, as well as crypto/fiat pairs (USD, EUR, JPY, and more). Crypto assets include Ethereum, Bitcoin, Litecoin, and Ripple, among others. Leverage on cryptocurrency trading is up to 2:1. eToro also offers 24/7 support for crypto trading.

- ETFs: eToro offers trading on a wider range of ETFs than most other brokers, including the iShares JP Morgan and iShares NASDAQ 100.

Overall, eToro offers a wide range of financial instruments but really stands out for its cryptocurrencies, commodities, and ETFs.

eToro’s Accounts and Trading Fees

eToro’s trading conditions are broadly similar to other brokers, with a single account type and relatively wide spreads.

Trading Fees: eToro’s account has a minimum deposit requirement of only 50 USD, making it accessible to most traders. Although the CFD trading account is commission-free, spreads start at 1.0 pips on the EUR/USD, which is wider than other similar brokers. Most other good brokers have an average spread of 0.9 pips (EUR/USD).

eToro Account Trading Costs:

Professional Account: Retail clients can elect to become professional traders by successfully passing a test to determine their suitability. This allows access to higher leverage but the waiving of certain protections such as the Investor Compensation Funds and recourse to the Financial Ombudsman Service.

eToro Club and Tiers: Although there is only a single account type, with higher minimum deposits, traders gain access to the eToro Club – which operates a tier system: The higher the tier, the more rewards, and advantages you receive. These include free market analysis, access to the Trading Signals platform, free withdrawals, access to a dedicated Customer Success Agent, analyst consultations, and more. See below for more details:

eToro’s Deposits and Withdrawals

eToro’s withdrawal fees are higher than other similar brokerages, and while it does not charge a fee for deposits, it charges high currency conversion fees for deposits in anything other than USD.

A well-regulated broker, eToro ensures that all Anti-Money Laundering rules and regulations are followed, and as such, all non-profit withdrawals are returned to the deposit source. It is important to note that traders must withdraw up to 100% of the deposit to a credit or debit card.

Accepted Deposit Currencies: Extraordinarily, the eToro client portal allows traders to deposit funds in 21 currencies, including AUD. However, it charges currency conversion fees for deposits in currencies other than USD. For example, if a trader deposits in AUD via bank transfer, a 50 pip fee will be applied (which is around 0.46% of the deposit amount). The same fee is also charged when withdrawing to AUD.

High Non-trading Fees: While no fees are charged for depositing money, a 5 USD fee is charged on all withdrawals, no matter the amount. This is a much higher fee than is charged at other similar brokers. eToro also charges an inactivity fee of 10 USD per month after three months of inactivity, and as mentioned above, charges high currency conversion fees. Traders should be aware of these fees because they can significantly affect profitability.

See below for a list of payment methods:

- eToro Money: Available in AUD, deposits, and withdrawals are processed instantly, but you must have funds available on your eToro Money account balance.

- Bank transfer: Available in USD, EUR, AUD, and GBP, deposits take 4 – 7 days to be processed but are free. There is no maximum deposit amount.

- Credit card/Debit card: Available in a range of currencies, including USD, EUR, GBP, and AUD, deposits are instant and free. The maximum deposit allowed is 40,000 USD.

- PayPal: Available in a range of currencies, including USD, EUR, GBP, EUR, and AUD, deposits are instant and free. The maximum deposit allowed is 10,000 USD.

- Skrill: Available in USD, EUR, and GBP, deposits are instant and free. Maximum deposits are 10,000 USD.

- Neteller: Available in USD, GBP, and EUR, deposits are instant and free. The maximum deposits allowed are 10,000 USD.

- Rapid Transfer: Available in USD, GBP, and EUR, deposits are instant and free. The maximum deposit amount is 5,500 USD.

Another downside to eToro’s withdrawals is that traders cannot withdraw less than 30 USD from their trading accounts, and withdrawals take around 2 business days to be processed, which is longer than other similar brokers.

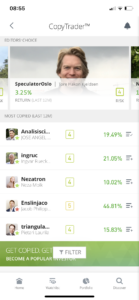

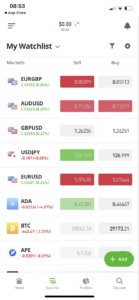

eToro’s Mobile Trading App

eToro’s mobile trading platform is well-designed and easy to use. The mobile app is available on both Android and iOS.

eToro created the first social trading system and is the largest social online trading broker in the market. Its mobile app offers support for an easy-to-use and fun copy trading service and Copyportfolios, which bundles together all tradable assets under one chosen market strategy to minimise long-term risk and create diversified investments.

We liked that the mobile app is highly customisable and has great functionality. We could trade from the charts, transfer, withdraw and deposit funds, search for instruments and create watchlists. We were also impressed that we could choose the layout of our watchlists and charts and that the latest market research was easily accessible:

|

|  |

A serious downside of its platform is the lack of support for auto trading systems available on other platforms. And, unlike other brokers, eToro does not offer support for third-party platforms such as MT4. A benefit of offering third-party platforms is that traders who decide to migrate to another broker will already be familiar with the platforms. On the flip side, in-house platforms such as the one offered by eToro are often more beginner-friendly and easy to use.

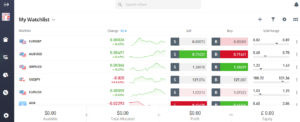

eToro’s Other Trading Platforms

eToro offers a limited selection of trading platforms, only offering support for its in-house crowd trading platform. However, eToro’s crowd trading platform is user-friendly and well-designed, making it a good choice for beginner traders.

eToro Platform

We found that like the mobile app, the web trader platform has a clean and intuitive interface and excellent functionality – it is easy to search for various instruments, and there is access to four order types, including market, limit, stop-loss, and trailing stop-loss orders. Additionally, we were able to easily set price alerts and notifications, and we could decide how we wanted to view our portfolio reports.

To aid traders who commonly trade the same pairs, eToro’s platform gives traders a customisable dashboard overview of different currency pairs.

Its unique bespoke web trader platform also offers full support for eToro’s CopyTrader, and CopyPortfolios, two unique social trading tools.

Overall, eToro offers one of the best social trading experiences in the world, but its offering would be enhanced by support for third-party platforms such as MT4.

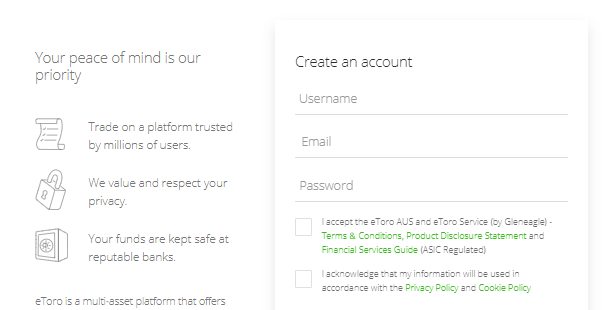

Opening an Account at eToro

We found that eToro’s account-opening process is seamless and hassle-free compared to other brokers, and we were pleased that our trading account was ready for trading within a day.

We tested the account opening process, which took approximately 10 minutes to complete, and once our documentation had been submitted, our accounts were ready for trading within a day.

How to open an account at eToro:

- On the front page of the website, we clicked on a button marked “Join Now” or “Trade Now.”

- We were directed to a page that required us to enter all our personal data.

- Before submitting this information, we were required to agree with all eToro’s Terms and Conditions, and privacy policy.

- As part of the Know Your Customer (KYC) process, we were also required to provide confirmation of residence (e.g. a valid utility bill dated within the last 6 months), as well as proof of identity such as a valid passport, or another form of officially issued photo ID.

- Lastly, as a final step of the KYC process, we were required to fill in a questionnaire to ascertain our level of trading knowledge.

Once our documentation had been submitted, our accounts were ready for trading within a day.

You can follow your verification status on the eToro platform. Verified accounts have a green tick next to the username on the user’s profile.

eToro’s Trading Tools

eToro offers a limited selection of market analysis and sentiment tools, but it offers excellent copy trading tools.

Social and Copy Trading Tools

- CopyTrader

CopyTrader is eToro’s social trading feature. Traders can browse through the profiles of other eToro traders, checking their monthly and annual performance. eToro also applies a risk score to each trader in addition to other stats available for each profile. Users can then allocate a portion of their capital to copy other traders. Each user remains in full control of their trading and may exit positions at their discretion; however, traders cannot close part of their position, only the full amount.

- CopyPortfolios

CopyPortfolios provides a similar service but bundles together all tradable assets under one chosen market strategy to minimise long-term risk and create diversified investments. A type of investment platform, eToro’s investment committee professionally manages copied portfolios and creates investment strategies. Traders should note that the minimum investment amount for CopyPortfolios is 5,000 USD.

Clients should be aware that the quality of the investment advice coming from the eToro community varies and should be considered unreliable until it has been well vetted.

Overall, eToro offers an excellent selection of proprietary copy trading tools compared to other similar brokers but lacks support for tools that aid market analysis, such as Trading Central and Autochartist.

Trading Tools Comparison:

eToro’s Research and Market Analysis

eToro provides a limited selection of research and market analysis materials compared to other similar brokers.

eToro provides a newsfeed with relevant market movements that is updated daily by its team of in-house market analysts. Most other analytical content comes from the members of the eToro community. The news feed is a central component of eToro’s trading platform and is an unfiltered list of trading ideas and accompanying graphs. Be aware that this analysis is community-created content and should be viewed with deep skepticism.

One drawback is that there is a limited selection of fundamental data available on the platform.

Overall, eToro’s market analysis materials are poor compared to those of other large international brokers.

Education

eToro’s educational materials are limited in scope, providing only a demo account and some basic videos on investing.

Although eToro offers a unique social trading platform to help beginner traders get started, its educational materials are limited compared to other similar-sized market makers.

eToro hosts a short course titled The Complete Guide to FinTech that teaches traders the basics of trading – especially trading on the eToro platform. It is more of an overview than an in-depth course, and much of the content covers asset classes other than Forex.

eToro also hosts a blog that is updated daily with various trading tips, though these mainly focus on eToro’s platform. Webinars are held infrequently and tend to be more focused on market conditions than the rest of the educational material.

Overall, the education section could be improved with a greater variety of materials in addition to providing sections for beginner and more experienced traders. Beginner traders would also benefit greatly from being able to attend webinars on CFD trading basics and risk management.

Education Comparison:

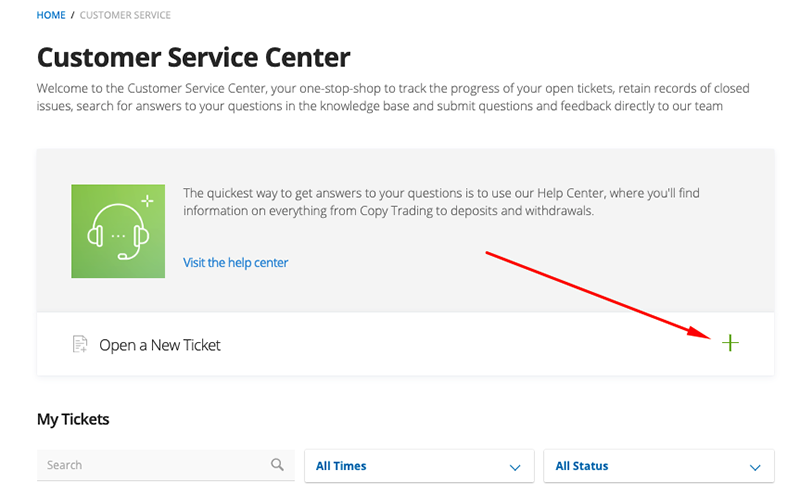

Customer Support

eToro’s customer support is available 24/5, but it is mostly unresponsive.

Available 24/5, eToro’s customer support is available in 21 languages. Since 2017, it has used a ticketing system for all client support requests. Be aware that there is no phone or chat support available, and the response times are known to be painfully long, often exceeding 48 hours and even up to 14 days. However, customers who deposit more than 5,000 USD will receive the services of a dedicated Customer Success Agent.

Overall, customer service is unresponsive, but eToro provides a comprehensive FAQ section.

Safety and Industry Recognition

Regulation: Founded in 2007 and headquartered in Israel, eToro is an international CFD broker with over 13 million clients worldwide. It is regulated by many top-tier authorities, including the Australian Securities and Investments Commission (ASIC), the Cyprus Securities and Exchange Commission (CySEC), the Financial Conduct Authority (FCA) of the UK, and the Financial Services Authority (FSA) Seychelles. See below for details:

- eToro (Europe) Ltd., eToro’s European subsidiary, is a Financial Services Company authorised and regulated by the Cyprus Securities Exchange Commission (CySEC) under licence number: 109/10.

- eToro (UK) Ltd, a Financial Services Company authorised and regulated by the Financial Conduct Authority (FCA) under the license FRN 583263.

- eToro AUS Capital Pty Ltd. is authorised by the Australian Securities and Investments Commission (ASIC) to provide financial services in Australia under AFSL 491139.

- eToro (Seychelles) Ltd. is licenced by the Financial Services Authority Seychelles (“FSAS”) to offer broker-dealer services under the Securities Act 2007 License #SD076.

While eToro complies with all the rules set out by the regulators, in 2013 it was fined 50,000 EUR by CySEC for operational flaws. CySEC did not reveal the details of these operational weaknesses, and eToro has since taken steps to rectify the issues. All the necessary documents are published on its website, and it is regularly evaluated by external auditors.

Industry Recognition:

eToro has collected multiple awards for its innovative platform and has received worldwide recognition as a financial technology industry leader.

Overall, because of eToro’s strong commitment to regulation and regulatory processes that are designed to protect client funds and legal operations on the platform, we consider eToro a safe broker with which to trade.

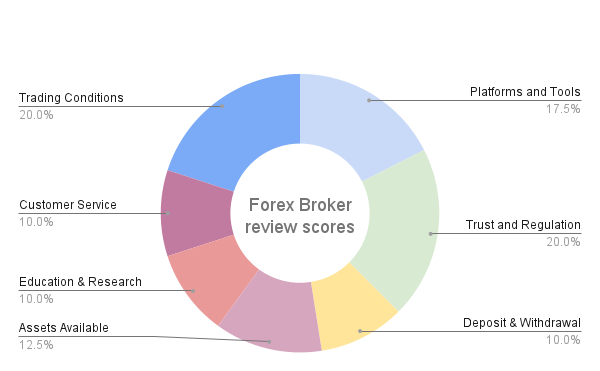

Evaluation Method

We value transparency and openness in the way we review the partners. To bring transparency to the forefront, we have published our review process. Central to that process is the evaluation of the reliability of the broker, the platform offering of the broker, and the trading conditions offered to clients, which are summarised in this review. Each one of these is graded, and an overall score is calculated and assigned to the broker.

eToro Risk Statement

Trading Forex is risky, and each broker is required to detail how risky the trading of Forex CFDs is to clients. eToro would like you to know that: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 77% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Overview

eToro is popular for its unique approach to social trading that appeals to younger, novice traders. But it falls short when it comes to educational and market analysis materials; spreads are not competitive, and non-trading fees are much higher than other market makers. However, many traders are willing to overlook these flaws for the unique social trading experience and easy-to-use trading platform offered at eToro.

Editorial Team

Chris Cammack

Head of Content

Chris joined the company in 2019 after ten years experience in research, editorial and design for political and financial publications. His background has given him a deep knowledge of international financial markets and the geopolitics that affects them. Chris has a keen eye for editing and a voracious appetite for financial and political current affairs. He ensures that our content across all sites meets the standards of quality and transparency that our readers expect.

Alison Heyerdahl

Senior Financial Writer

Alison joined the team as a writer in 2021. She is the Senior Editor for FXScouts. She has a medical degree with a focus on physiotherapy and a bachelor’s in psychology. However, her interest in forex trading and her love for writing led her to switch careers. She has a passion for Forex trading and over a decade of editorial experience researching Forex and the financial services industry, producing high-quality content. She hosts a weekly podcast, “Let’s Talk Forex,” alongside her colleague, Chris, and has produced over 100 Forex educational videos for the FXScouts YouTube channel. She also writes weekly technical analyses and has tested and reviewed over 100 Forex brokers.

Ida Hermansen

Financial Writer

Ida joined our team as a financial writer in 2023. She has a degree in Digital Marketing and a background in content writing and SEO. In addition to her marketing and writing skills, Ida also has an interest in cryptocurrencies and blockchain networks. Her interest in crypto trading led to a wider fascination with Forex technical analysis and price movement. She continues to develop her skills and knowledge in Forex trading and keeps a close eye on which Forex brokers offer the best trading environments for new traders.

Compare Brokers

Find out how eToro stacks up against other brokers.

Stay updated

This form has double opt in enabled. You will need to confirm your email address before being added to the list.