-

MetaTrader 4 Brokers

The top MT4 brokers in AU

-

MetaTrader 5 Brokers

The best MT5 brokers in AU

-

TradingView Brokers

The best TradingView brokers

-

cTrader Brokers

The top cTrader brokers in AU

-

Forex Trading Apps

Trade on the go from your phone

-

Copytrading Brokers

Copy professional traders

-

All Trading Platforms

Find a platform that works for you

Last Updated On November 20, 2023

75-90% of retail traders lose money trading Forex and CFDs. You should consider whether you understand how CFDs and leveraged trading work and if you can afford the high risk of losing your money. We may receive compensation when you click on links to products we review. Please read our advertising disclosure. By using this website you agree to our Terms of Service.

Our verdict on FBS

FBS is a low-risk ASIC-regulated international broker with a range of low-deposit accounts, including a low-cost entry-level account, and a decent range of trading platforms.

However, some drawbacks are FBS’ high withdrawal fees and the limited range of tradable assets. Otherwise, FBS provides a welcoming environment for beginner traders, with an excellent selection of educational and market analysis materials, and 24/7 customer support.

| 🏦 Min. Deposit | AUD 5 |

| 🛡️ Regulated By | CySEC, ASIC, FSCA, FSC |

| 💵 Trading Cost | USD 7 |

| ⚖️ Max. Leverage | 30:1 |

| 💹 Copy Trading | No |

| 🖥️ Platforms | MT4, MT5 |

| 💱 Instruments | Cryptocurrencies, Energies, Stock CFDs, Forex, Indices, Metals |

Overall Summary

Account Information

Trading Conditions

Company Details

Pros

- Tight spreads

- Low minimum deposit

- Excellent education

- Excellent market analysis

Cons

- Limited range of assets

- Extreme leverage

Is FBS Safe?

With strong local and international regulation, FBS is a safe broker for Australians to trade with.

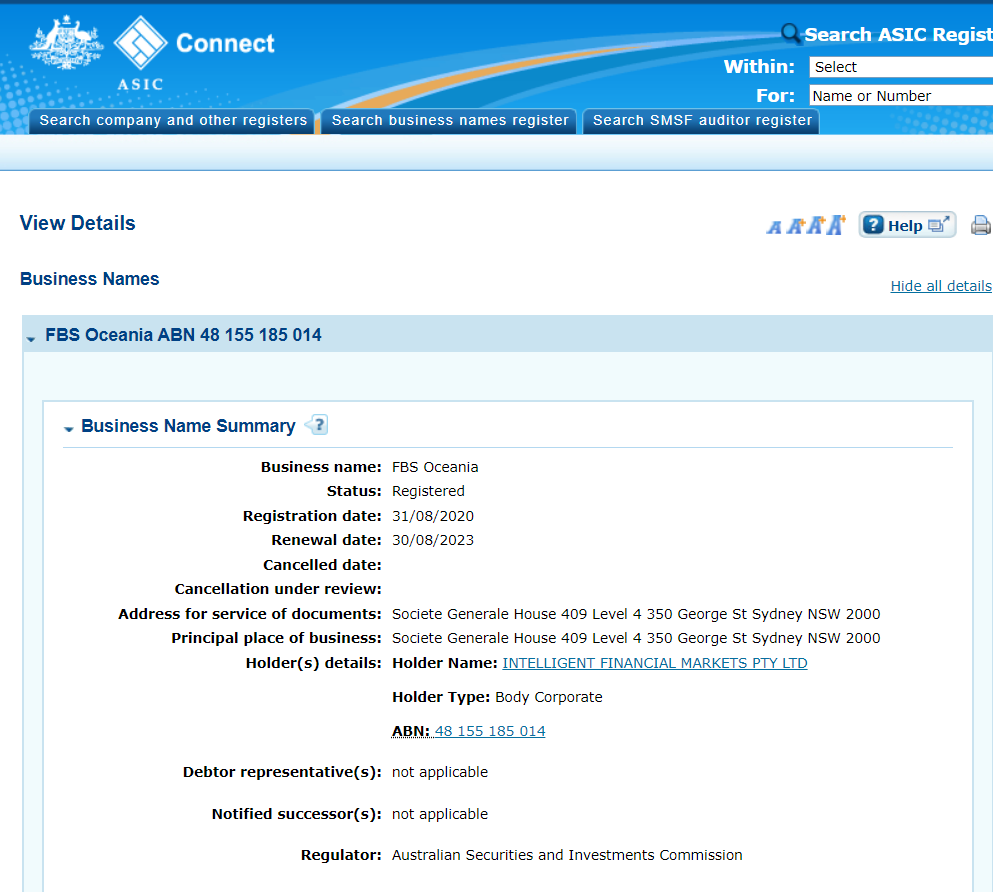

ASIC Regulated: Australian traders will be trading with the Australian subsidiary of FBS, which is licenced and regulated by the Australian Securities and Investment Commission (ASIC).

Safety Features: In early 2021, ASIC tightened its restrictions on CFD trading to protect traders better. Pepperstone clients in Australia will have a leverage limit of 30:1 for Forex trading and have negative balance protection, so they can never lose more money than they have in their trading accounts. ASIC regulations also prevent FBS from offering promotions or bonuses.

See below for FBS’ ASIC licence:

Company Details:

FBS’ Financial Instruments

The choice of financial assets offered by FBS is limited compared to other similar brokers.

Due to ASIC regulations, maximum leverage on all assets is low, though this will be the same for all ASIC-regulated brokers.

- Forex: FBS has only 37 currency pairs available for trading which is lower than the industry average. These include majors (EUR/USD, GBP/USD, and USD/JPY), minors (NZD/CAD, EUR/JPY, and USD/ZAR), and exotics.

- Share CFDs: FBS offers 96 share CFDs, which is limited compared to other large international brokers. The selection available includes some of the major US, UK, and European Exchanges.

- Indices: There are 12 indices available for trading at FBS, which is limited compared to what is available at other similar brokers. The most popular indices are those that combine the shares of some of the largest and globally acknowledged companies.

- Metals: FBs offers trading on 4 metals, which is very limited compared to what is commonly available at other brokers. Most other brokers offer between 5 and 10 metals. These include metals such as gold, silver, platinum, and palladium.

- Energies: FBS offers trading on five energies, which is, again, limited compared to what is on offer at other similar brokers.

- Cryptocurrencies: FBS offers trading on over 5 pairs, which is limited compared to other similar brokers, but, unlike traditional markets, crypto trading is available 24/7.

Accounts and Trading Fees

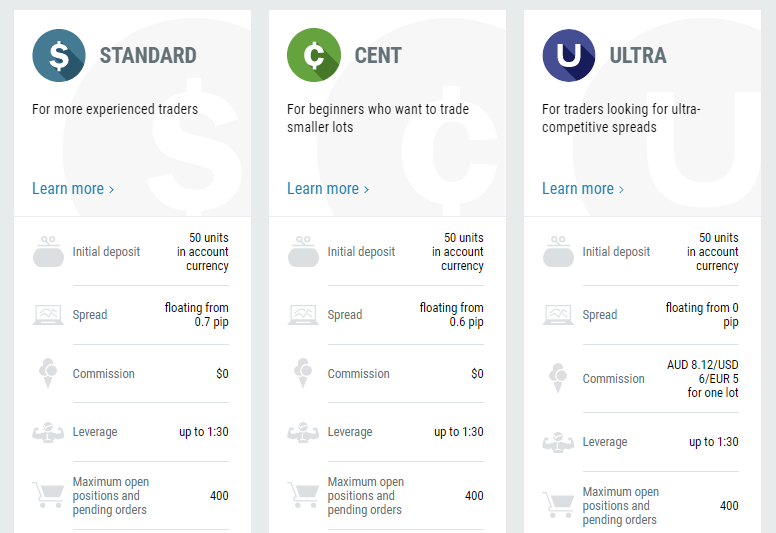

FBS offers three accounts, including two commission-free accounts and one ECN account, all with a low minimum deposit of only 50 AUD.

Trading Fees: FBS’s trading costs are about average on its two commission-free accounts and lower than other brokers on its Ultra Account.

See below for more details:

Cent Account

Cent accounts are suitable for beginner traders and allow trading micro-lots. The initial deposit is 50 AUD and spreads average at 1.1 pips (EUR/USD), which is around the industry average.

Standard Account

Standard accounts are commission-free accounts with a minimum deposit of 50 AUD, and variable spreads that average at 1.1 pips (EUR/USD).

Ultra Account

The Ultra Account is the most suitable account for experienced traders. The variable spreads average at 0 pips on the EUR/USD, and a commission of 8.12 AUD/6 USD/5 EUR is charged per lot.

Demo Accounts

FBS offers free demo accounts, allowing traders to test out the Forex strategies with virtual money, using real market data. Using a demo account is a good way to learn how to trade. Demo accounts expire after 40 days, after which time they are automatically deleted. Clients can open a new one when this happens.

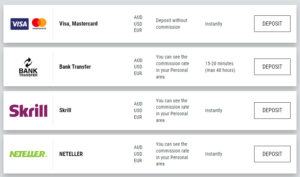

Deposits & Withdrawals

Although we were pleased to find that FBS charges no deposit fees, it charges high withdrawal fees for certain payment methods.

In line with Anti-Money Laundering policies, deposits and withdrawals at FBS cannot be made to/from third-party accounts.

Trading Account Currencies: Deposits to trading accounts can be made in most national currencies, which are subsequently converted into USD, EUR, orAUD.

While this is good for Australian traders with AUD accounts, it may still be better for traders that trade in large volumes (more than 10 lots a month) to open an account denominated in USD at a digital currency bank, especially for trading on assets such as the EUR/USD. This is because when trading a USD quoted currency pair with another currency, other than AUD, there will be a small conversion fee for every trade made. Additionally, FBS charges a conversion fee of 0,5%, which is expensive compared to other similar brokers.

Deposit and Withdrawal Fees: FBS does not charge for making deposits to a live trading account, but it charges fees for withdrawals under certain conditions. Deposits made via electronic payment systems are processed instantly, and deposit requests via other payment systems are processed within 1-2 hours.

See below for a list of FBS payment methods:

- Visa: Deposits are instant and free. Withdrawals take 15 – 20 minutes and may take as long as 5 -7 business days to reach your bank account. Withdrawals are charged at a 0.5 EUR commission.

- Local Bank Transfer: FBS allows deposits and withdrawals from and to banks across Australia. Traders can find the commissions charged by FBS for deposits and withdrawals in their personal trading area.

- Skrill: Deposits are instant and commission fees charged by FBS can be found in the Personal area. Withdrawals take 15 – 20 minutes to be processed, and a commission of 3.99 – 4.99% is charged, which is much more expensive than other similar brokers.

- Neteller: Deposits are instant and FBS’ commissions can be found in your Personal area. Withdrawals can take 15-20 minutes to be processed, and 4.99% and a minimum of 1 USD are charged per withdrawal, which is expensive compared to other similar brokers.

Overall, FBS provides a limited range of funding methods, is not transparent about the fees on deposits and withdrawals are expensive.

FBS’ Mobile Trading Apps

FBS’ trading platform selection is average compared to most other brokers, and only offers support for MT4 and MT5.

FBS MT4/MT5 Mobile Trading Apps

FBS offers support for MT4 and MT5 mobile trading apps for Android and iOS. Traders should be aware that there is some loss in functionality when compared to the desktop trading platforms, including reduced time frames and fewer charting options, but traders can close and modify existing orders, calculate profit and loss, and trade on the charts.

Other Trading Platforms

With both MT4 and MT5 available, FBS’ platform support is average.

MT4 and MT5

The advantage of brokers offering third-party platforms such as MT4 and MT5 is that traders can take their own customised versions with them should they decide to migrate to another broker. However, the in-house platforms available at other brokers are usually more beginner-friendly and easier to set up than MT4 and MT5.

Both MT4 and MT5 are available for Windows, Android, iOS, and web browsers.

Opening an Account at FBS

The account opening process is easy, hassle-free, and fast.

It took us about 5 minutes to open an account at FBS and once our documentation had been submitted our accounts were ready for trading immediately.

As an Australian trader, you are eligible to open an account at FBS as long as you meet the minimum deposit requirement of 50 AUD for all accounts.

Opening a live account at FBS is easy and fast. While FBS also offers Corporate Accounts and Joint Accounts we will focus on opening an Individual Account:

- Initially, you will need to click on “Open Account” and register your name and email address.

- Thereafter, you will choose between a Real or a Demo Account.

- Next, you will have to fill in your full name, phone number, email address, and date of birth. You will also have to choose your base currency, platform, and leverage.

- Once this step is complete, FBS needs at least two documents to accept you as an individual client:

- Proof of Identification – current (not expired) coloured scanned copy (in PDF or JPG format) of your passport.

- If no valid passport is available, a similar identification document bearing your photo such as an ID card or driving licence will work.

- Once this step is complete, you will need to make at least the minimum required deposit for your chosen account via one of FBS’ deposit methods.

- Your documents will be checked by the verifications department within 48 hours. Any deposits will be credited to the account only after your documents have been approved and your personal area is fully activated.

- We advise you to read FBS’ risk disclosure, customer agreement, and terms of business before you start trading.

Overall, the account opening process at FBS is hassle-free and accounts are generally ready for trading in 48 hours.

Trading Tools

FBS’ trading tools are limited compared to other similar brokers, and it doesn’t offer technical analysis tools such as Autochartist or Trading Central.

Under its trading tools section, FBS lists an Economic Calendar, a Trading Calculator, and a Currency Converter, which are all fairly standard.

Overall, FBS offers a limited number of trading tools compared to other large international brokers.

Trading Tools Comparison:

FBS for Beginners

FBS is one of the better brokers for beginners – the education section is comprehensive and well-structured, and the market analysis is up-to-date and well explained. Unusually, customer service is available 24/7 – a welcome development, where the norm is 24/5. This is extremely beneficial for beginner traders who will likely set up trading accounts on weekends.

Educational Material

FBS offers a good selection of educational materials compared to most other brokers, and it is suitable for both beginners and more experienced traders alike.

The education section at FBS is well-structured and well-organized, and all material is free. Education is split into five sections:

- Forex Guidebook – the core of the education section, this is one of the better guides to Forex trading we have seen. It is split into chapters for Beginner, Elementary, Intermediate, and Experienced traders. This guidebook will be useful in some form for almost all readers.

- Tips for Traders – a frequently updated blog with useful posts covering various aspects of trading in an erudite and informal format. Recent blog posts include Triple Screen Trading Strategy and Bill Williams Fractals Indicator.

- Webinars – includes a schedule and register of upcoming webinars. FBS holds webinars weekly from its office in Moscow, and registration is a simple procedure.

- Video Lessons – as you would expect, this is a collection of short videos covering various aspects of Forex trading – good for those who prefer watching to reading, but not as comprehensive as the Guidebook

- Glossary – FBS offers a good glossary of Forex terms.

Overall, the education section at FBS is more comprehensive than the material that is available at other brokers.

Education Comparison:

Analytical Material

FBS’ market research is average compared to most other large international brokers.

The FBS Market Analysis is broken down into technical analysis and fundamental analysis. The technical analysis is somewhat limited, but the fundamental analysis is more detailed and offers Forex traders basic coverage of key topics.

Market analysis materials at FBS is free of charge for all visitors, and is divided into three separate sections:

- Forex News – A regular news feed of the day’s important events that will have fundamental effects on Forex trades. It is concise, updated frequently, and is well written.

- Daily Market Analysis – Here you will find short analytical articles on the day’s events, which is very useful for new traders.

- Forex TV – a collection of videos on everything from suggested trading plans for the week ahead to historical webinars. The trading plans, in particular, are beneficial for new traders.

Overall, FBS offers a range of market analysis materials that are useful for traders of all experience levels, but it is not as comprehensive as what is offered by other brokers.

Customer Service

Available 24/7, FBS’ customer support is better than that offered by other brokers.

Customer service is available in multiple languages, 24/7 – which is exceptional for an industry where the standard is 24/5. Support is available by email, live chat, and social media, in 14 different languages.

We found the customer service responsive, polite, and resourceful. They were able to answer all our questions satisfactorily.

Safety and Industry Recognition

Regulation: The FBS CFD trading platform was founded in 2009 by investors who were interested in trading research and technical analysis. Today, FBS is an international brand present in over 150 countries with over 27 million traders on its books. The brand unites several companies offering trading on Forex and CFDs. The companies include FBS Markets Inc. (licensed by IFSC), Tradestone Ltd. (licensed by CySEC), Intelligent Financial Markets Pty Ltd. (licensed by ASIC), and TRADE STONE SA (PTY) LTD. (licensed by FSCA). See below for more details:

- Intelligent Financial Markets Pty Ltd is regulated by ASIC, license number: 426359.

- FBS Markets Inc is regulated by IFSC, license IFSC/000102/124; Address: 2118, Guava Street, Belize Belama Phase 1, Belize.

- Tradestone Ltd. is authorised and regulated by the Cyprus Securities and Exchange Commission of the Republic of Cyprus, with company registration number 353534.

- FBS Markets Pty Ltd is regulated by the FSCA in South Africa Licence number 50885.

Overall, FBS is considered a safe broker to trade with, and Australian traders will benefit from local protection.

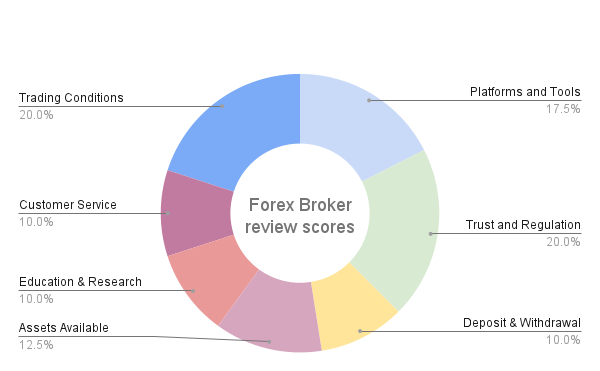

Evaluation Method

We value transparency and openness in the way we review the partners. To bring transparency to the forefront, we have published our review process. Central to that process is the evaluation of the broker’s reliability, the broker, the platform offering of the broker, and the trading conditions offered to clients, summarised in this review. Each one of these is graded, and an overall score is calculated and assigned to the broker.

FBS Disclaimer

Trading Forex is risky, and each broker is required to detail how risky the trading of Forex CFDs is to clients. FBS would like you to know that: CFD’s are complex instruments and come with a high risk of losing money rapidly due to leverage. 76.2% of retail accounts lose money when trading CFD’s with this provider. You should consider whether you understand how CFD’s work and whether you can afford to take the high risk of losing your money.

Overview

FBS is a large online international broker with three live accounts with average trading conditions, but accounts that are suitable for both beginners and experienced traders. It offers low minimum deposits and micro-lot trading on its entry-level accounts, and low spreads on accounts with a commission per trade. It also charges extremely high withdrawal and currency conversion fees. FBS offers support for MT4 and MT5 and no trading tools to speak of, however, it provides excellent educational and market analysis materials, and exceptionally, its customer support is available 24/7.

Editorial Team

Chris Cammack

Head of Content

Chris joined the company in 2019 after ten years experience in research, editorial and design for political and financial publications. His background has given him a deep knowledge of international financial markets and the geopolitics that affects them. Chris has a keen eye for editing and a voracious appetite for financial and political current affairs. He ensures that our content across all sites meets the standards of quality and transparency that our readers expect.

Alison Heyerdahl

Senior Financial Writer

Alison joined the team as a writer in 2021. She is the Senior Editor for FXScouts. She has a medical degree with a focus on physiotherapy and a bachelor’s in psychology. However, her interest in forex trading and her love for writing led her to switch careers. She has a passion for Forex trading and over a decade of editorial experience researching Forex and the financial services industry, producing high-quality content. She hosts a weekly podcast, “Let’s Talk Forex,” alongside her colleague, Chris, and has produced over 100 Forex educational videos for the FXScouts YouTube channel. She also writes weekly technical analyses and has tested and reviewed over 100 Forex brokers.

Ida Hermansen

Financial Writer

Ida joined our team as a financial writer in 2023. She has a degree in Digital Marketing and a background in content writing and SEO. In addition to her marketing and writing skills, Ida also has an interest in cryptocurrencies and blockchain networks. Her interest in crypto trading led to a wider fascination with Forex technical analysis and price movement. She continues to develop her skills and knowledge in Forex trading and keeps a close eye on which Forex brokers offer the best trading environments for new traders.

Compare Brokers

Find out how FBS stacks up against other brokers.

Stay updated

This form has double opt in enabled. You will need to confirm your email address before being added to the list.