-

MetaTrader 4 Brokers

The top MT4 brokers in AU

-

MetaTrader 5 Brokers

The best MT5 brokers in AU

-

TradingView Brokers

The best TradingView brokers

-

cTrader Brokers

The top cTrader brokers in AU

-

Forex Trading Apps

Trade on the go from your phone

-

Copytrading Brokers

Copy professional traders

-

All Trading Platforms

Find a platform that works for you

What is Leverage in Forex Trading?

Leverage is the concept of borrowing money to increase the volume of a CFD trade and thus significantly increase the potential profit. Leverage is a double-edged sword, however. On the one hand, it helps trade larger volumes and grows our account balance quicker, but on the other hand, it can also amplify your losses, and you can lose significant amounts of capital on a few bad trades.

An Example of Leverage

Assume that you have an account balance of $10,000 and your broker offers you the standard 1:100 leverage. A leverage of 1:100 means that you can control $1,000,000 worth of buying power ($10,000 x 100) with only $10,000. In this example, you decide to only buy $100,000 worth of EUR/USD at a rate of 1.1800. Since our position size is only $100,000, or 10 times more than our account balance, we are ultimately just using effective leverage of 1:10. After we bought EUR/USD, the exchange rate moves up to 1.2000, and you decide to close your trade, making a 200 pips profit.

The total profit is $2000 (200 pips x $10/pip).

If you have not used leverage, and only used your $10,000 to buy a small EUR/USD position, your total profit after EUR/USD had rallied 200 pips would have only been $200. Your 1:100 leverage has allowed you to earn ten times more than you would have if you were trading without leverage.

Depending on your account type and your risk profile, you can trade smaller or bigger position sizes and use a different level of leverage. If you want to understand how to size your trades correctly, you should be familiar with the concept of Margin Trading. Leverage and margin are intrinsically tied together.

What is Margin in Forex Trading?

In Forex trading, if you’re using leverage, you’re not required to own the entire position size of what you’re buying and selling. You only have to deposit enough money to cover possible losses. This deposit is called the Margin. The margin is the amount of money that your Forex broker will require you to put up to open a trade.

Calculating Margin: Leverage

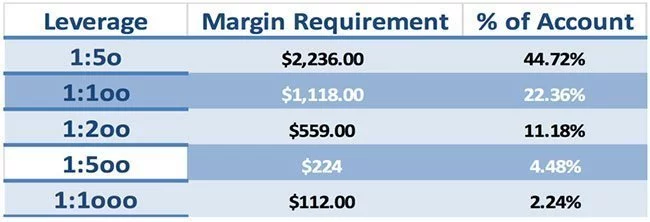

Margin is inversely proportional to leverage and can be expressed as a percentage of the full amount of the position.

Margin = 1/Leverage

Example 1: A 50:1 leverage ratio means a margin requirement of 1/50 = 0.002 = 2% margin requirement. Example 2: A 100:1 leverage ratio means a margin requirement of 1/100= 0.001 = 1% margin requirement. Let’s assume that you have a balance of 5,000 USD in your trading account. You decide to trade one lot (100,000 USD) of the USD/EUR pair. The table below shows your margin size relative to varying amounts of leverage:

As you can see, with 1:50 leverage you use almost half of your account balance as the margin. This doesn’t leave you with much capital to make additional trades, especially if your trade performs poorly and you lose your investment. Equally, lower margin requirements mean more money in your account to use for other trades. The higher the leverage used, the smaller your margin will be. It’s important to note that no matter the leverage, the margin requirement can vary significantly depending on which currency pair you are trading. This is because margin is always calculated in the base currency and then converted to your account currency.

Calculating Margin: Examples

Before you place a trade, you should have a rough idea of the margin requirement. This will get easier to approximate the more experience you have with trading. To calculate the margin accurately, you can use the following formula as long as the base currency is the same as your account currency:

Margin Requirement = (Position Size) / Leverage

Let’s consider the following example:

- Buying AUD/USD

- Position Size = 300,000 (3 lots)

- Account Leverage = 1:100

- Account Currency: AUD

Margin Requirement = 300,000 / 100 = 3000 AUD

So you need to have at least 3000 AUD in your account as collateral to open that position. Otherwise, your order will be rejected due to insufficient margin. Let’s now compare the margin needed for two different currency pairs and see how this can cause significant variations: Example 1:

- Pair: GBP/AUD

- Position Size: 100,000 (1 Lot)

- Leverage: 1:100

- Account Currency: USD

- Margin Requirement = USD 1246.1

Example 2:

- Pair: AUD/USD

- Position Size: 100,000 (1 Lot)

- Leverage: 1:100

- Account Currency: USD

- Margin Requirement = USD 692.6

In Example 1 (GBP/AUD) the margin requirement is almost double that for Example 2 (AUD/USD), despite the leverage and position size being the same – lets find out why. Lets looks at Example 1 first: The GBP/AUD is a cross pair not involving USD – our account currency. For currency pairs not quoted in your account currency, you need an additional calculation:

Margin Requirement = [(Position Size) / Leverage] * Base/Account Currency Exchange Rate

Instead of using the GBP/AUD exchange rate to calculate our margin we use the Base/Account Currency exchange rate (GBP/USD). The base currency from the GBP/AUD pair is the GBP, while our account currency is USD, so we need the rate of GBP/USD (1.2461) to calculate the margin requirement in USD. So the formula above looks like this:

Margin Requirement = [100,000 / 100 ] * 1.2461

therefore

Margin Requirement = 1246.1 USD

Now, let’s look at Example 2: Even though the USD is one of our currency pair, it is not the base pair – that is AUD. So we have to convert the position size from AUD to USD, our account currency. The AUDUSD exchange rate is 0.6926 so our formula looks like this:

Margin Requirement = [100,000 / 100 ] * 0.6926

therefore:

Margin Requirement = 692.6 USD

Conclusion

Having a good understanding of margin requirements is essential to trading because it directly affects the size and number of trades that you can safely make. The lower your leverage, the higher your margin requirements will be, and you will need to put up more money as collateral to open a position. Finally, always be aware that trading a pair with a base currency that is not your account currency can drastically alter your margin size. Before you open this type of trade always calculate the margin requirements first.

Stay updated

This form has double opt in enabled. You will need to confirm your email address before being added to the list.