-

MetaTrader 4 Brokers

The top MT4 brokers in AU

-

MetaTrader 5 Brokers

The best MT5 brokers in AU

-

TradingView Brokers

The best TradingView brokers

-

cTrader Brokers

The top cTrader brokers in AU

-

Forex Trading Apps

Trade on the go from your phone

-

Copytrading Brokers

Copy professional traders

-

All Trading Platforms

Find a platform that works for you

Swissquote Broker Review

Last Updated On May 11, 2023

75-90% of retail traders lose money trading Forex and CFDs. You should consider whether you understand how CFDs and leveraged trading work and if you can afford the high risk of losing your money. We may receive compensation when you click on links to products we review. Please read our advertising disclosure. By using this website you agree to our Terms of Service.

Our verdict on Swissquote

A well-regulated broker, Swissquote is a good choice for experienced traders looking for excellent trading tools, a broad range of tradable assets, and flexible trading conditions on the Metatrader platforms. However, Swissquote’s initial and ongoing trading costs are significantly higher than the industry average.

Part of a larger Swiss banking group, Swissquote offers a range of non-brokerage financial services and is subject to considerably tighter regulation than most brokers. It offers trading on numerous assets, including indices, commodities, bonds, vanilla options, cryptocurrencies, metals, share CFDs, and over 130 Forex pairs – one of the largest sets in the industry.

Because Swissquote targets professional traders, minimum deposits are high, starting at 1000 USD on its entry-level account with spreads of 1.7 pips on the EUR/USD. Minimum deposits escalate quickly, with the Prime Account requiring a minimum deposit of 50,000 USD but still featuring relatively high ongoing trading costs. With higher trading volumes, traders can access the Professional Account, with bespoke trading conditions.

Swissquotes offers a broad range of trading platforms, including MT4, MT5, and its proprietary platform, Advanced Trader. It also provides free access to an excellent selection of trading tools, including Autochartist, Metatrader Master Edition, Trading View, and Trading Central. Most other brokers charge a premium for using these tools, which may justify why the minimum deposits on Swissquote’s accounts are so high.

Apart from the high trading costs, another drawback is the poor quality of Swissquote’s customer service, which is rarely available on live chat or email.

| 🏦 Min. Deposit | USD 1000 |

| 🛡️ Regulated By | FCA, MAS, BaFin, DFSA |

| 💵 Trading Cost | USD 13 |

| ⚖️ Max. Leverage | 100:1 |

| 💹 Copy Trading | Yes |

| 🖥️ Platforms | MT4, MT5, AdvancedTrader |

| 💱 Instruments | Bonds, Commodities, Cryptocurrencies, Stock CFDs, Forex, Indices, Metals, Vanilla Options |

Overall Summary

Account Information

Trading Conditions

Company Details

Pros

- Great platform choice

- Wide range of assets

Cons

- High minimum deposit

- Limited education

- Poor customer service

Is Swissquote Safe?

Yes, Swissquote is a safe broker for Australian traders to trade with. Although Swissquote is not regulated by ASIC in Australia, it maintains regulation from some of the world’s best regulators, including Switzerland’s FINMA, the FCA of the UK, Dubai’s DFSA, the MFSA of Malta, and the SFC of Asia.

Swissquote Group Holding company was founded in 1996 and is headquartered in Switzerland. Its subsidiaries are regulated in various jurisdictions by multiple authorities, including the Swiss Financial Market Supervisory Authority (FINMA), the Financial Conduct Authority (FCA) the UK, the Dubai Financial Services Authority (DFSA), the Securities and Futures Commission (SFC), the Malta Financial Services Authority, and the Monetary Authority of Singapore (MAS). Its parent company has a banking license, is listed on the Swiss stock exchange, and regularly discloses its financials. See below for a list of Swissquote registered companies:

- Swissquote Bank Ltd – Switzerland is authorised by the Swiss Financial Market Supervisory Authority (FINMA)

- Swissquote Ltd (London) is regulated by the Financial Conduct Authority, license: 562170.

- Swissquote MEA Ltd (Dubai) is authorised and regulated by the Dubai Financial Services Authority (DFSA) and possesses a category 4 license.

- Swissquote Asia Ltd (Hong Kong) is licensed under the supervision of the Securities and Futures Commission (SFC) and holds a type 3 license.

- Swissquote Financial Services (Malta) Ltd is under the Malta Financial Services Authority’s supervision and holds a category 4a license.

- Swissquote Pte. Ltd (Singapore) holds a Capital Markets Services license granted by the Monetary Authority of Singapore (MAS).

Australians will be trading under the subsidiary, Swissquote Bank Ltd, authorised and regulated by the Financial Market Supervisory Authority (FINMA). A top-tier regulator, FINMA is an independent regulatory body with authority over Switzerland’s financial institutions, including banks, insurance companies, exchanges, and investment schemes. It also reports to the Swiss Federal Department of Finance and is headquartered in the capital city, Bern.

Unfortunately, Swissquote does not specifically mention on its website the segregation of client capital and the offering of negative balance protection for traders. However, as per regulation, Swissquote complies with these requirements. FINMA also requires Swissquote to restrict the leverage it offers to traders, limiting it to 1:100.

Additionally, traders receive up to 100,000 CHF in investor protection per account should the company be liquidated.

Considering the high level of regulatory oversight, the fact that Swissquote is listed on the Swiss stock exchange, and the high level of investor protection, we deem Swissquotes a safe and trustworthy broker for Australian traders.

Trading Fees

Swissquote’s trading fees are higher than other similar brokers.

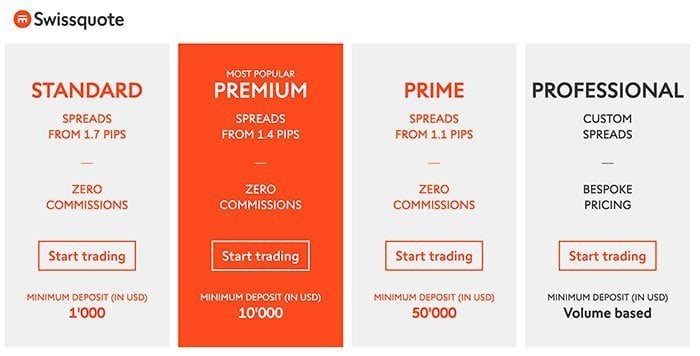

A markets maker, Swissquote offers four live accounts with higher minimum deposits linked to tighter spreads on the Metatrader 4, Metatrader 5, and Advanced Trader platforms (click here for more on Swissquote’s platforms).

Swissquote’s accounts were assessed to compare the costs to those of other brokers. The costs were evaluated based on the trading fees on one lot (100 000 USD) on the EUR/USD, including the spread and commission.

When making this calculation, we use one lot of EUR/USD as a benchmark as it is the most commonly traded currency pair and it usually has the tightest spread.

Trading Cost Formula: Spread x Trade Size + Commission = Cost in Secondary Currency (USD):

As you can see from the table above, all trading costs are included in the variable spreads, which get wider or tighter depending on trade volume and market volatility.

The Standard Account commences with a minimum spread of 1.7 pips or 17 USD per 1.0 standard lot, which is significantly higher than the costs on other brokers’ entry-level accounts. Premium Account-holders still face a spread of 1.4 pips or 14 USD, while the Prime Account lists spreads of 1.1 pips or 11 USD per lot of EUR/USD traded. Additionally, the minimum deposits on these accounts are significantly higher than other similar brokers. By any measure, these trading costs represent an uncompetitive offer.

The trading costs on Swissquotes’ Professional account are lower than the other accounts, but this requires very high trading volumes and high minimum deposits, making it inaccessible to most traders.

Swap Fees

Another important cost to consider is the swap rate charged on positions held overnight. Interest is paid (or received) for each night a position is held. Swissquotes publishes the swap fees alongside each instrument on its website. for example, the swap fees for a short position of EUR/USD is 0.00000358, and a long position is 0.00003942.

MT4/MT5 traders can easily access swap rates from their platform by following these steps:

1. Right-click on the desired symbol in the Market Watch window and select Symbols.

2. Select the desired currency and then click on Properties located on the right side.

3. Scroll down until you see Swap Long and Swap Short.

Overall, the pricing environment at Swissquotes is very expensive.

Non-trading Fees

Swissquotes charges higher non-trading fees than other brokers.

Some of the most overlooked trading costs are the non-trading fees that are charged by brokers. These fees can significantly affect your profitability and so should be carefully scrutinised.

While Swissquotes does not charge Australians for deposits, fees are charged for withdrawals, and it charges an inactivity fee.

For example, Australians are charged a fee of 20 AUD for online withdrawals. It also charges an inactivity fee of 10 account currency units per month after six months of account dormancy.

Overall, these non-trading costs are higher than other similar brokers.

Opening an Account at Swissquote

Swissquote’s account-opening process is fully digital, but clients may experience long waiting times.

All Australians can open a trading account at Swissquote, but need to meet the following minimum deposit requirements:

- Standard Account: 1,000 USD

- Premium Account: 10,000 USD

- Prime Account: 50,000 USD

- Professional Account: You have to contact Swissquote to apply for this account

Swissquote offers both corporate and individual accounts, but we will focus on opening an individual account:

- Click on the “open your account” button at the top of the page.

- Traders will be directed to register an account and fill in their personal information (including name, marital status, address, and contact details).

- The next step requires clients to fill in a client profile, including employment status and tax residency.

- Clients are then required to fill in a form with their financial information, in addition to their preferred platform, and starting minimum deposit.

- Once the application form has been completed, traders will be directed to authenticate the account. This requires confirming one’s identification via video or sending the documents to Swissquote by post.

- Once this step is complete, traders will be able to start trading. We advise that you read Swissquote’s risk disclosure, customer agreement, and terms of business before you start trading.

Overall, the account-opening process is mostly digital, but traders may have to wait a while to confirm their identity. Additionally, unlike other brokers, Swissquote does not require traders to undergo an evaluation to assess their suitability for trading, which is an oversight on Swissquote’s part.

Swissquote’s Accounts

Swissquote offers four live accounts, a broader range than most other brokers, and its accounts are more suitable for professional traders.

Swissquotes offers trading on multiple assets, including Forex, precious metals, stock indices, commodities, and bonds (click here for more on Swissquote’s financial assets). Swissquote offers four different live account options in addition to a demo account. The minimum deposits on these accounts are higher than other market maker brokers, but in line with what experienced or professional traders might expect to pay.

With such high minimum deposits, Swissquote does not cater to beginner traders. We define beginner traders as inexperienced traders who have never traded before or have been trading for less than a year. Beginners often do not want to risk trading large sums of money, and will generally not be able to trade full-time during the workweek. Swissquote’s entry-level account has a high minimum deposit of 1,000 USD, making it unsuitable for beginner traders.

Experienced traders generally prefer paying higher minimum deposits in exchange for tighter spreads. While higher minimum deposits result in tighter spreads at Swissquote, the ongoing trading costs remain uncompetitive. Most other brokers will have an average spread of 0.9 pips (EUR/USD), even on their entry-level accounts. Swissquote’s top account requires a minimum deposit of 50,000 USD but offers spreads at 1.1 pips on the EUR/USD.

The minimum trade sizes vary, depending on the account, and leverage is up to 100:1. The maintenance margin on all accounts is 100%, and the Stop-Out levels are at 30%. Swissquotes allows hedging, scalping, and copy trading. Accounts are denominated in 15 currencies, including EUR, USD, JPY, GBP, CHF, CAD, AUD, TRY, PLN, SEK, NOK, SGD, XGD, HUF, and CZK (click here for more on Swissquote’s base currencies). See below for account details:

Standard Account

The Standard account is Swissquote’s entry-level account with a minimum deposit of 1000 USD. Spreads are wide, starting at 1.30 pips, minimum trade sizes are 0.01 lots, and no commissions are charged on trades.

Premium Account

Swissquotes’ most popular account, the Premium account requires a minimum deposit of 10,000 USD. It is a commission-free account with spreads starting at 1.4 pips, which is still wider than other similar brokers. The minimum trade size on this account is 0.1 lots.

Prime Account

Swissquote’s professional trading account, the Prime Account has a minimum deposit of 50,000 USD, standard leverage up to 100:1, and spreads of 1.1 pips, which is still wider than the spreads on other brokers’ entry-level accounts. The minimum trade size on this account is 1 lot.

Professional Account

The Professional account is a fully customisable account option, where the minimum deposit is adjusted depending on the volume traded. A commission of 5 USD round turn/lot is charged on trades. Custom spreads and pricing can be discussed with your account manager.

Demo Account

A free demo account is available on all three platforms, offering access to over 130 financial instruments with no obligation or risk. Traders receive up to 100,000 USD of virtual funds to practice trading strategies. Demo accounts are available for 30 days, which is unusual, as most other brokers have unlimited demo accounts.

Overall, compared to other similar brokers operating in Australia, Swissquote’s initial and ongoing costs are high. The minimum deposit on the entry-level account is higher than at other brokers and spreads are wider than average across all the account types.

Deposit and Withdrawal Fees

Swissquote offers a limited number of payment methods compared to other brokers, and while deposits are free, Swissquote charges high fees for withdrawals.

A well-regulated broker, Swissquote ensures that all Anti-Money Laundering rules and regulations are followed, and as such, all withdrawals are returned to the deposit source. Swissquote offers two funding methods, limited to bank wire transfer and credit card/ debit cards. Australians are not charged fees for deposits, but a withdrawal fee of 20 AUD applies for online payments. Credit and debit cards are processed instantly or within two hours, and bank transfers are processed within one day. Withdrawals must be made from within the ePortal. See below for more details:

Overall, Swissquote has a limited number of funding methods, and it charges high withdrawal fees.

Base Currencies (Trading Account Currencies)

Swisquote offers a wide range of trading account currencies compared to other brokers, and offers accounts denominated in AUD.

Swissquote offers trading in fifteen base currencies, including EUR, USD, JPY, GBP, CHF, CAD, AUD, TRY, PLN, SEK, NOK, SGD, XGD, HUF, and CZK.

Having accounts denominated in AUD is an advantage for Australians who will likely have bank accounts denominated in AUD. This means that traders will not have to pay currency conversion fees on deposits and withdrawals. Conversion fees can make trading expensive, and affect profitability.

However, it is still better for traders that trade in large volumes (more than 10 lots a month) to open an account denominated in USD at a digital currency bank, especially for trading on assets such as the EUR/USD. This is because when trading a USD quoted currency pair with another currency account, there will be a small conversion fee for every trade made.

Overall, Swissquote offers a broader range of base account currencies than most other brokers, and offers accounts denominated in AUD.

Trading Platforms

Swissquote’s trading platform support is better than other similar brokers.

Swissquote supports the MetaTrader Suite of platforms in addition to its proprietary platform, the Advanced Trader. The platforms are compatible with Swissquote’s excellent trading tools, including Autochartist, Trading Central, Trading View, and the Metatrader Master Edition.

Metatrader 4

While not the most beginner-friendly software, MT4 has been the industry-standard platform for trading Forex and CFDs since 2005. Its intuitive interface and user-friendly environment provide essential tools and resources for successful online trading.

MT4 allows hedging and copy trading and access to various plugins, including Autochartist, MetaTrader Master Edition, and Trading Central. Features of the MT4 platform include automated trading and backtesting, and access to thousands of Expert Advisors. Traders can also create their indicators or choose between 30 built-in indicators, over 2000 free custom indicators, and 700 paid indicators. Other features of Swissquote’s MT4 platform include:

-

A built-in library of more than 50 indicators and tools to streamline the analysis process.

-

An impressive array of analytical tools, available in nine timeframes for each financial instrument.

-

Live price streaming on live accounts and demo accounts 128-bits encryption for secure trading

-

Algorithmic trading, which allows any trading strategy to be formalised and implemented as an Expert Advisor.

-

Customisable alerts

-

Access to MetaTrader market and MQL4 community

While MT4 has great customizability, the platform feels outdated, and some of the features may be hard to find. In addition, only the basic orders are available, including Market, Limit, Stop, and Trailing Stop.

Metatrader 5

Continuing its predecessor’s reputation, the MT5 platform provides traders with everything they need to trade the financial markets. It incorporates all of the key features of MT4 and an optimised environment for algorithmic trading using Expert Advisors (EAs). As with MT4, the platform allows hedging and copy trading and access to tools such as Autochartist, MetaTrader Master Edition, and Trading Central. Other features of Swissquote’s MT5 platform include:

-

38+ preinstalled technical indicators

-

44 analytical charting tools

-

3 chart types

-

21 timeframes

-

Additional pending order types

-

Detachable charts

-

Trailing stop

-

Depth of Market

-

An integrated Economic Calendar.

Advanced Trader

Advanced Trader is a JavaScript platform compatible with both PC and Mac. The platform supports conditioned orders, and features advanced charts analyse tools, FX Insider, and an economic calendar. Other features include 50+ intelligent charting tools, 80+ technical indicators, and a synchronised layout for multiple charts.

Significantly, the order inputs are by notional value rather than by lot size. Advanced Trader offers a FIX API connection, and hedging on request, but it does not support EAs (Expert Advisors). It also does not support most of the plugins available on the Metatrader platforms, nor the MetaTrader Master Edition. However, unlike the Metatrader platforms, those using Advanced Trader have access to Trading View.

In addition to the traditional order types, traders can execute more complex orders that are not available on other platforms, including:

- Order Cancels Other (OCO) – This feature combines a stop order with a limit order. When one is executed, it automatically cancels the other.

- IF-DONE – A two-step order in which the second step cannot be executed until the conditions of the first are met.

- If – OCO – A variation on the IF-DONE order in which an OCO is placed after the order has been executed.

Advanced Trader is also highly customisable, easy to use, and easy to set up.

Overall, Swissquote ensures its clients have a competitive edge by maintaining three excellent trading platforms. Additionally, it offers a broad range of excellent trading tools which integrate seamlessly with MT4, MT5, and the Advanced Trader platforms.

Mobile Trading

Swissquote’s mobile trading platforms are excellent compared to other similar brokers. It offers mobile versions of MT4 and MT5, and its own proprietary mobile version of the Advanced Trader platform.

Swissquote offers support for MT4, MT5, and the Advanced Trader mobile trading apps for Android and iOS.

MT4/MT5 Mobile Trading

Traders should be aware that there is some loss in functionality when compared to the desktop trading platforms, including reduced time frames and fewer charting options, but traders can close and modify existing orders, calculate profit and loss, and trade on the charts.

Advanced Trader

The Advanced Trader is available as a mobile application. It offers all the features of the desktop version of the platform, allowing traders to open and close trades, and trade on the charts.

Trading Tools

Swissquote offers an excellent range of trading tools compared to other similar brokers.

Swissquote offers a set of premium tools, including Autochartist, Metatrader Master Edition, Trading View, and Trading Central. These tools help traders find trading opportunities by analysing the markets for patterns. It also offers FIX API for traders who deposit over 50,000 USD.

Autochartist

Autochartist is a powerful tool for traders who actively spend time looking for trading opportunities and technical trading patterns. Autochartist continuously scans the market looking for patterns and sends alerts based on three main technical analysis options: regular chart patterns, Fibonacci patterns, and Key levels.

Swissquotes provides a step-by-step tutorial video that shows traders how to find and set trades using Autochartist.

MetaTrader Master Edition

The ultimate evolution of the MT4/MT5 platform, MetaTrader Master Edition boasts 12 advanced tools and 15 new indicators. It provides a correlation matrix that helps traders manage portfolio risk, and stealth order functionality that allows traders to close all positions simultaneously. It also enables traders to access all activity on the trading account on one terminal.

Trading Central

A third-party tool, Trading Central allows traders to build trading strategies from within the MT4 and MT5 platforms and identify opportunities in real-time. In combination with Trading Central’s Daily Market Report, it allows traders to make trading decisions based on expert analytics. It displays forecasts, commentaries, and key levels, in addition to helping traders identify important changes in supply and demand lines to determine when to enter/exit the market. Trading central is one of the most popular trading tools on the market, and Swissquote does well to offer it to its traders.

Trading View

Trading View is free of charge for traders who open an account on the Advanced Trader platform. It is an excellent tool for researching, charting and screening any instrument. Additional features of Swissquote’s TradingView tool include:

• 50+ intelligent charting tools

• 80+ technical indicators for the analytically-minded

• Synchronised layout for multiple charts

FIX API

The Financial Information eXchange (FIX) protocol is an international standard for electronic trading to enable greater connectivity among market participants. It is for institutional partners looking to deliver competitive FX pricing to their customers and private traders with custom platforms looking for optimal connectivity. Data includes historical price quotes and other trading information, which will allow traders to get real-time data from the markets to either assist with trading decisions or as a part of algorithmic trading. Note that to use the FIX API, traders have to deposit at least 50,000 USD into their trading accounts.

Overall, Swissquote offers a much more comprehensive set of trading tools than is available at other similar brokers.

Swissquote’s Financial Assets

Swissquotes offers one of the largest financial asset offerings in the world, with over 3,000,000 instruments on its books. However, the Forex and CFD division is more limited, but still sufficient for most traders.

Swissquotes offers trading on multiple instruments, including Forex, commodities, indices, bonds, options, and cryptocurrencies (click here for more on CFD trading). See below for more details:

-

Forex pairs: Swissquote offers 130 Forex pairs to trade, including majors, minors, and exotics such as USD/ZAR and ZAR/JPY. This is a substantial offering compared to other brokers. The maximum leverage is 1:100 on currency pairs.

-

Vanilla Options: Swissquote offers trading on 46 vanilla options, a broader range than is offered at other brokers. Maximum leverage is up to 1:100 on options.

-

Precious Metals: Swissquote offers trading on 12 precious metals, including silver and gold crosses with both the EUR and USD as well as palladium and platinum futures. This is a broad selection of metals compared to other brokers. Maximum leverage is 1:50 on gold but falls to 1:10 on palladium futures.

-

Indices: Swissquote’s FX platforms also allow you to trade on the movements of all the main European and American stock indices, as well as Japan’s. Most of these CFDs are available both as Forward (with an expiration date) or Spot/Synthetic (no expiration date, overnight rollover/swap interest applies). There are 26 indices available for trading, a broader range of indices compared to other brokers. Maximum leverage is 1:50.

-

Shares: Swissquote offers 4 of the main global stocks, including the FTSE100 London, NYSE Euronext Paris, Deutsche Börse (XETRA), and SIX Swiss Exchange. This is limited compared to the share CFD offering of other brokers, and leverage is up to 1:5.

-

Commodities: Swissquote offers 11 commodity futures to trade, including energies such as oil, natural gas, and heating oil. Maximum leverage is 1:25 on commodities.

-

Bonds: Swissquote offers CFD trading on the three most popular Bonds in the world – Gilts, Bunds, and the US T-Bonds. Maximum leverage is 1:25.

-

Cryptocurrencies: Swissquote offers trading on 12 cryptocurrencies, but these are not listed in the CFD product guide. Due to the nature of these assets, cryptocurrencies are not traded with leverage.

Overall, Swissquote offers a much broader range of CFD products compared to most other brokers, including specialty CFDs such as bonds, vanilla options, and cryptocurrencies.

Education Material

Swissquote’s educational materials are adequate but not as good as the best brokers in this space.

The education section at Swissquote consists of Courses, Webinars, Seminars, and a Trading Glossary. Although the webinars are available in multiple languages, the courses, videos and ebooks are only available in English.

The Courses includes 31 x 2-3 minute videos on the following topics:

- Introduction to Forex

- Introduction to CFDs

- Technical Analysis

- Fundamental Analysis

- Risk Management

- MetaTrader

- Advanced Trader

Webinars are available in English, French, German and Arabic, and will help deepen your knowledge on specific markets, products, and advanced tools on the trading platforms.

Seminars are held regularly in various locations. They present an opportunity for traders worldwide to broaden their trading horizons and discuss strategies with the most renowned experts in the field. However, Swissquote has put these on hold for the time being.

Lastly, Swissquotes provides a trading glossary explaining all the various trading terms.

Overall, Swissquote provides a solid education for traders starting out in the forex trading space.

Analysis Material

Swissquote’s analysis materials are excellent compared to other brokers.

Swissquote is an execution-only broker. Execution-only means that they don’t offer advice on trading strategies.

However, the Research Section of the website issues market analysis and news on subjects that affect the currency market – including in-depth fundamental and technical analyses.

Swissquote offers quality market commentary on its website under the Newsroom section. It consists of Morning News and Themes Trading and includes daily research updated by a team of in-house analysts, a regular podcast, a magazine available to subscribers, and a blog. Swissquote also offers a Daily Market Brief and a Daily Market Outlook.

Customer Support

Customer support is available via phone, email, and chat. Note that support is only available during business hours, five days a week. Toll-free numbers for some countries are available for phone contact, and the service centre is opening during office hours from 9 am to 6 pm UK time. Support is offered in 6 languages.

For the purposes of this review, the live chat feature was rarely available, even during business hours. Additionally, the support agents were most unhelpful – providing one-word answers about topics such as regulation, leverage, and other topics. Overall, it was a very frustrating and disappointing experience. It is clear that Swissquote is not focused on providing a welcoming environment for beginner traders.

Evaluation Method

We value transparency and openness in the way we review the partners. To bring transparency to the forefront, we have published our review process that includes a detailed breakdown of the Swissquote offering. Central to that process is the evaluation of the reliability of the broker, the platform offering of the broker and the trading conditions offered to clients, which are summarised in this review. Each one of these is graded, and an overall score is calculated and assigned to the broker.

SwissQuote Disclaimer

Trading Forex is risky, and each broker is required to detail how risky the trading of Forex CFDs is to clients. Swissquote would like you to know that: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 79% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money

Overview

Swissquotes is a leading market maker broker in the Forex & CFD trading space with excellent regulation. Targeting mainly professional traders, its minimum deposit requirements are high, but spreads are wider than the industry average. Swissquotes offers support for a wide range of platforms and premium tools and allows all trading strategies, including hedging, scalping, and copy trading. One drawback for beginner traders considering Swissquotes is that customer support is only available during business hours, five days a week, and the quality of the service is poor.

Editorial Team

Chris Cammack

Head of Content

Chris joined the company in 2019 after ten years experience in research, editorial and design for political and financial publications. His background has given him a deep knowledge of international financial markets and the geopolitics that affects them. Chris has a keen eye for editing and a voracious appetite for financial and political current affairs. He ensures that our content across all sites meets the standards of quality and transparency that our readers expect.

Alison Heyerdahl

Senior Financial Writer

Alison joined the team as a writer in 2021. She is the Senior Editor for FXScouts. She has a medical degree with a focus on physiotherapy and a bachelor’s in psychology. However, her interest in forex trading and her love for writing led her to switch careers. She has a passion for Forex trading and over a decade of editorial experience researching Forex and the financial services industry, producing high-quality content. She hosts a weekly podcast, “Let’s Talk Forex,” alongside her colleague, Chris, and has produced over 100 Forex educational videos for the FXScouts YouTube channel. She also writes weekly technical analyses and has tested and reviewed over 100 Forex brokers.

Ida Hermansen

Financial Writer

Ida joined our team as a financial writer in 2023. She has a degree in Digital Marketing and a background in content writing and SEO. In addition to her marketing and writing skills, Ida also has an interest in cryptocurrencies and blockchain networks. Her interest in crypto trading led to a wider fascination with Forex technical analysis and price movement. She continues to develop her skills and knowledge in Forex trading and keeps a close eye on which Forex brokers offer the best trading environments for new traders.

Compare Brokers

Find out how Swissquote stacks up against other brokers.

Stay updated

This form has double opt in enabled. You will need to confirm your email address before being added to the list.