For over a decade, FxScouts has been reviewing forex brokers and providing in-depth analyses. Our extensive research and unique testing methodology ensures that all broker reviews are accurate and fair, with hundreds of thousands of data points generated annually. Since 2012, we’ve tested over 180 brokers across global and Australian markets. Our team of professionals are frequently cited in global and regional media, shaping market conversations and trends.

-

MetaTrader 4 Brokers

The top MT4 brokers in AU

-

MetaTrader 5 Brokers

The best MT5 brokers in AU

-

TradingView Brokers

The best TradingView brokers

-

cTrader Brokers

The top cTrader brokers in AU

-

Forex Trading Apps

Trade on the go from your phone

-

Copytrading Brokers

Copy professional traders

-

All Trading Platforms

Find a platform that works for you

75-90% of retail traders lose money trading Forex and CFDs. You should consider whether you understand how CFDs and leveraged trading work and if you can afford the high risk of losing your money. We may receive compensation when you click on links to products we review. Please read our advertising disclosure. By using this website you agree to our Terms of Service.

- FP Markets - Best CFD Broker in Australia

- Pepperstone - Best ECN CFD Broker

- IG - Best CFD Broker for Weekend Trading

- AvaTrade - Best Mobile CFD Trading Experience

- XM - Best CFD Trading Education

- markets.com - Low Costs and 1500+ CFDs

- BlackBull Markets - Best Institutional CFD Trading Account

- Axi - Best ECN CFD Broker on the MT4 Platform

- Admirals - Best CFD Broker on the MT5 Platform

Best Brokers in Australia for Trading CFDs

Broker | Broker Score | Official Site | Min. Deposit | Max. Leverage | Total CFDs | Share CFDs | Commodity CFDs | Indices | Currency Pairs | Cost of Trading | ASIC Regulated | Regulators | Trading Desk | Platforms | Support Hours | Compare |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 4.40 /5 Read Review | Visit Broker > 79% of retail CFD accounts lose money | AUD 100 | 30:1 | 10162 | 10000 | 11 | 17 | 70 | USD 7 | Yes |      | ECN/DMA | MT4, MT5, cTrader, IRESS | 24/5 | |

| 4.61 /5 Read Review | Visit Broker > 89%74- of retail CFD accounts lose money | AUD 100 | 30:1 | 1275 | 1000 | 17 | 28 | 100 | USD 10 | Yes |        | NDD | MT4, MT5, cTrader, TradingView | 24/7 | |

| 4.69 /5 Read Review | Visit Broker > 71% of retail CFD accounts lose money | AUD 0 | 30:1 | 19295 | 13000 | 35 | 80 | 80 | USD 6 | Yes |         | Market Maker | MT4, L2 Dealer, ProRealTime | 24/5 | |

| 4.59 /5 Read Review | Visit Broker > 76% of retail CFD accounts lose money | AUD 100 | 30:1 | 872 | 625 | 25 | 33 | 55 | USD 9 | Yes |       | Market Maker | MT4, MT5, Avatrade Social, AvaOptions | 24/5 | |

| 4.45 /5 Read Review | Visit Broker > 75.33% of retail CFD accounts lose money | AUD 5 | 30:1 | 1554 | 1300 | 10 | 20 | 57 | USD 6 | Yes |      | Market Maker | MT4, MT5 | 24/5 | |

4.68 /5 Read Review | Visit Broker > 70.3% of retail CFD accounts lose money | AUD 100 | 30:1 | 1009 | 765 | 22 | 31 | 56 | USD 7 | Yes |      | Market Maker | MT4, MT5, markets.com | 24/5 | ||

4.28 /5 Read Review | Visit Broker > N/A of retail CFD accounts lose money | USD 0 | 500:1 | 26115 | 26000 | 18 | 10 | 70 | USD 8 | No |   | ECN/DMA | MT4, MT5, WebTrader | 24/5 | ||

| 4.44 /5 Read Review | Visit Broker > 75.6% of retail CFD accounts lose money | AUD 0 | 30:1 | 188 | 50 | 14 | 32 | 70 | USD 10 | Yes |       | ECN/DMA | MT4 | 24/7 | |

4.28 /5 Read Review | Visit Broker > 76% of retail CFD accounts lose money | AUD 100 | 30:1 | 3996 | 3429 | 29 | 43 | 82 | USD 8 | Yes |      | STP | MT4, MT5, MT Supreme | Business Hours |

What is CFD Trading?

CFD trading is the buying and selling of CFDs. CFDs are financial derivatives that allow traders to speculate on the price movements of financial assets such as Forex, stocks, indices, commodities, and more, without actually owning or taking physical delivery of the assets. CFDs are contracts between an individual trader and a broker to pay the price difference of an asset between opening a trading position and closing a trading position. For example, if you think the price of crude oil will rise and open a buy position, but the price falls instead and you close your position, you will make a loss. CFD traders are not concerned with the value of an asset they are trading, only the difference in price between opening and closing a trading position.

How did we choose the top CFD brokers?

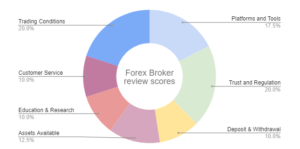

We have an experienced review team dedicated to evaluating CFD brokers, so you don’t have to. Our team of experts meticulously examines each broker in 7 different areas using over 200 individual metrics. We invest hundreds of hours annually researching and scrutinising brokers to ensure that we only recommend the best in the Forex industry.

Of these seven areas, we always prioritise regulation and costs. These are our priorities because traders want to know that their broker is trustworthy and isn’t overcharging them. Brokers are constantly altering the products they offer, and we keep our reviews updated with the latest data. You can find out more about our in-depth review process here.

FP Markets – Best CFD Broker in Australia

FP Markets is an Australian CFD broker offering thousands of CFDs to trade, including 60+ Forex pairs, shares, metals, indices, commodities, and cryptocurrencies (Bitcoin, Etherium, Ripple, Bitcoin Cash and Litecoin). Both MT4 and MT5 are available with ECN pricing, ensuring low spreads and fast execution. But for the full range of FP Market’s CFDs the IRESS trading platform offers direct exchange access and leverage of 20:1 on 10,000 global stocks.

MT4 and MT5 trading accounts can be opened with a minimum deposit of 100 AUD. Average spreads on the RAW Account are 0.1 pips (EUR/USD) and commission on this account is 6 USD round turn, making the total trading costs at the low end for the industry. IRESS trading accounts require higher minimum deposits, starting at 1000 AUD for the Standard Account. IRESS trading accounts also attract a brokerage rate, IRESS platform fee and an ASX Live Data fee unless a minimum monthly commission is reached.

FP Markets also offers a range of trading tools including VPS, Autochartist and copy-trading via Myfxbook AutoTrade. For beginners, the Traders Hub gives beginner CFD traders the education they need to get started and includes video tutorials and trading courses.

Pepperstone – Best ECN CFD Broker

Pepperstone is the leading ASIC regulated ECN/STP Forex and CFD broker with CFD trading on 180+ instrument including Forex, indices, shares, commodities, cryptocurrencies, and currency indices. Pepperstone’s two ECN accounts offer market execution with some of the tightest spreads in the industry – the Razor Account has spreads from 0 pips for the EUR/USD and 7 USD commission.

Pepperstone also offers fixed spreads on its indices CFDs, after-hours trading for US shares, and crypto basket trading – indices of the world most highly traded cryptocurrencies.

Pepperstone’s award-winning, 24-hour support provides the foundation for its excellent customer service, where personalised assistance is available via several methods. For beginners interested in CFD trading with an ECN broker, Pepperstone’s also has one of the better education sections offered by a market execution broker.

IG – Best CFD Broker for Weekend Trading

| 🏦 Min. Deposit | AUD 0 |

| 🛡️ Regulated By | ASIC, BaFin, MAS, CFTC |

| 💵 Trading Cost | USD 6 |

| ⚖️ Max. Leverage | 30:1 |

| 💹 Copy Trading | Yes |

| 🖥️ Platforms | MT4, L2 Dealer, ProRealTime |

| 💱 Instruments | Bonds, Commodities, Cryptocurrencies, Digital 100s, Stock CFDs, ETFs, Forex, Indices, Interest Rates |

IG is the world’s largest CFD broker by revenue and it offers a single commission-free CFD trading account. Forex trading is commission-free, and spreads start at 0.6 pips on the EUR/USD. IG also offers over 17,000 other instruments to trade from its single account. These include commodities, indices, cryptocurrencies, ETFs, over 13,000 shares, options, interest rates and bonds. Unique to IG is its weekend trading product line: 24/7 trading available on major Forex pairs, eight cryptocurrencies (including Bitcoin) and the main global indices such as FTSE 100 and HS50.

The IG Academy has structured courses for beginner, intermediate and advanced traders and daily classroom-style lessons. Market analysis across all CFD assets is updated regularly by the IG Markets research team of finance professionals.

AvaTrade – Best Mobile CFD Trading Experience

AvaTrade is an internationally regulated, beginner-friendly CFD broker offering trading on Forex, cryptocurrencies, commodities, indices, stocks, bonds, vanilla options, and ETFs. The AvaTradeGO app provides one of the best mobile trading experiences: All 1000+ CFD instruments offered by AvaTrade are available in the app, as is the AvaProtect tool, which protects traders from losses for a limited time. Other app highlights include a market trends monitor, zoom function and seamless synchronisation with AvaTrade’s webtrader.

Avatrade single account features some of the tightest spreads for a commission-free account with a 100 AUD minimum deposit – as low as 0.7 pips on the EUR/USD. Maximum leverage is set at 1:400 on MT4 and MT5, which include EAs, indicators, scalping, hedging, and provides free access to the integrated Trading Central dashboard for both platforms.

XM – Best CFD Trading Education

An FCA regulated CFD broker with tight spreads over three simple account types, XM offers trading on Forex, shares, commodities, indices, precious metals, and energies. XM stands out for its educational support and market research. XM’s research team provide frequent market updates across all CFD classes in an easy-to-understand manner, highlighting trading opportunities and technical insight. Webinars are available 7 days a week in 19 languages and educational videos cover basic, intermediate, and advanced trading concepts.

All XM accounts have a max leverage 1:30, negative balance protection, and minimum deposits start from 5 GBP. XM also has a strict no-requotes/rejection policy, which means that all trades are always filled at the price expected. Platform support is offered for MT4 and MT5 but MT4 users will only be able to trade Forex, stock indices, precious metals, and energies.

Markets.com – Low Costs and 900+ CFDs

Markets.com is a well-regulated broker founded in 2010, offering trading on an extensive range of financial instruments, including over 60+ Forex pairs and 700+ share CFDs. Other instruments include stocks, an impressive amount of cryptocurrencies (e.g. Bitcoin, Ethereum and Ripple) commodities and over 30 major market indices.

The minimum deposit requirement to open an account on MT4, MT5 or Markets.com proprietary platform is 100 AUD. It also boasts excellent trading conditions with spreads starting at 0.6 pips on the EUR/USD, and leverage is up to 30:1.

While Markets.com offers a wide variety of trading tools through its proprietary platform, they unfortunately lack support for popular third-party tools such as Autochartist and Trading Central. However, traders will likely be pleased with the comprehensive education section, as well as a wide scope of excellent tools for research and analysis.

BlackBull Markets – Best Institutional CFD Trading Account

BlackBull Markets is an ECN-only broker providing direct market access on the MT4 platform. BlackBull Markets offers three account types, the ECN Standard, ECN Prime and ECN Institutional.

All BlackBull Markets accounts offer CFD trading on Forex, indices, commodities, precious metals, and energy, but professional and institutional traders will appreciate the features on the ECN Institutional Account. The institutional account has a minimum deposit of 20,000 USD, spreads starting from 0.0 pips and leverage of 500:1.VPS access is complementary, and a customised MAM/PAMM platform and 24/6 dedicated technical support are both available.

BlackBull Markets is a true ECN/STP broker and does not operate a dealing desk. Equinix servers based in New York (NY4), London (LD5) and Tokyo (TY3) allow for lightning-fast market access, while Straight Through Processing prevents slippage and failed executions.

Axi – Best ECN CFD Broker on the MT4 Platform

| 🏦 Min. Deposit | AUD 0 |

| 🛡️ Regulated By | FCA, CySEC, ASIC, DFSA |

| 💵 Trading Cost | USD 10 |

| ⚖️ Max. Leverage | 30:1 |

| 💹 Copy Trading | Yes |

| 🖥️ Platforms | MT4 |

| 💱 Instruments | Commodities, Cryptocurrencies, Stock CFDs, Forex, Indices, Metals, WTIs |

Axi is an Australian ASIC and FCA regulated ECN broker offering CFD trading on 140 Forex pairs, precious metals, commodities, indices, and cryptocurrencies. As an ECN broker, Axi offers tight spreads – down to 0 pips at times – and a commission of 7 USD is charged. No minimum deposit is required to open an account, but Axi does recommend starting with a minimum of 100 USD.

By exclusively supporting the MT4 platform, Axi offers a thoughtful and heavily customisable MT4 experience. Axi offers a range of tools as part of its MT4 NexGen package. These include a sentiment indicator, a correlation trader, a more intuitive terminal window, and an automated trade journal. Other tools include AutoChartist, a powerful automated technical analysis tool, and PsyQuation, an AI diagnostic that tracks your trading style and coaches you into more profitable trades. VPS hosting is also available, along with various trading algorithms to install on your MT4.

Admirals – Best CFD Broker on the MT5 Platform

Admirals, formerly Admiral Markets, is an Australian CFD broker offering market execution on four accounts, two of which focus on the MT5 platform – Trade.MT5 and Zero.MT5. Both MT5 trading accounts have a 100 AUD minimum deposit and attractive trading conditions. CFDs available to trade include 40+ FX pairs, 32 crypto CFDs, precious metals, energies, commodities, indices, shares, ETFs, and bonds.

The Trade.MT5 account has a minimum spread from 0.5 pips with no commission and the Zero.MT5 account has spreads from 0 pips with commission varying between 1.8 to 3.0 USD per lot. Admirals also offers the MetaTrader 4 Supreme Edition, which has advancements in technical analysis, improved trading widgets and trader terminal and new charts and indicators.

A Brief History of CFD Trading

CFD trading dates back to the late 1970s and early 1980s when financial derivatives first emerged as a means for traders to speculate on the price movements of financial assets.

CFDs quickly gained popularity among professional traders because they provide a flexible and cost-effective way to trade a wide range of financial assets. In the following years, the development of online trading platforms made CFD trading accessible to retail traders, and since then, the industry has grown rapidly.

What is the difference between CFD trading and traditional trading?

The main difference between CFD trading and traditional trading is that when you trade a CFD, you are speculating on a market’s price without taking ownership of the underlying asset. With traditional trading, you take ownership of the underlying asset and may receive dividends on a regular cycle.

There are other differences between the two types of trading, with some that give CFD trading an advantage and some that make CFD trading more risky.

What are the benefits of trading CFDs?

CFDs benefit from several features that make them valuable to individual traders:

Accessibility: CFD trading is often more accessible than traditional trading as it requires a smaller initial investment. For example, some CFD brokers have minimum deposit requirements of only 1 USD, which makes it easier for smaller investors to enter the market and start trading.

Leverage: Most CFD trading is leveraged trading, which means that traders only have to put up a small amount of capital to gain exposure to a large trading position. This is accomplished through the use of borrowed funds from the broker. For example, if a broker offers leverage of 20:1, the trader only has to put up 5% of the value of the trading position and can multiply his money 20 times over. Leverage can increase your profits, but it can also significantly increase your losses.

Profit from falling and rising markets: You can use CFDs to speculate that the price of an asset will rise (going “long”) or that it will fall (going “short”). Because CFDs are an agreement to pay the difference in the price of an asset, going short is very simple. You simply open a “sell” position and close it again once the price has fallen enough for you to make a profit.

Convenience: You can trade CFDs in many different assets without taking physical delivery, saving on storage, security and transportation costs. For example, you can trade CFDs in gold online and simply profit from price changes in the commodity without worrying about how you will store it securely.

Flexibility: You can close a position at any time during the trading day. That means you can hold a position for as long as you want, be it seconds, minutes or hours. You can even hold a position overnight, although there will be a charge for doing so. Many brokers also offer various options when it comes to trade size, allowing a wide range of traders to access the market.

Ability to hedge: Most people are familiar with the term “hedging your bets” and understand that it involves offsetting risks. Well, it means precisely the same thing in the financial world and is derived from the age-old idea of using a hedge – or fence – as a means of protection. In this instance, you can use CFDs to offset your trading positions by balancing trades in case your beliefs about whether those initial positions are likely to rise or fall prove wrong.

Exposure to a vast range of financial assets: You can use CFDs to gain exposure to thousands of underlying financial instruments worldwide from just one trading platform.

Why is CFD trading risky?

Like any other type of financial trading, CFD trading involves a high degree of risk. Some of the key risks associated with CFD trading include the following:

Market volatility: CFD markets are known for their volatility. Markets are influenced by political and economic events, and sudden shifts in these events can lead to rapid and substantial price movements.

Volatility can widen spread and costs: Severe volatility in markets or a particular product can cause brokers to widen spreads, affecting the prices paid by the trader when entering and exiting positions, potentially negatively impacting trades and increasing losses.

Leverage: CFD traders can use high levels of leverage to gain access to large trading positions, and while this can magnify potential gains, it can also magnify losses.

Constant monitoring: You must always be alert to possible changes in your position. Market volatility and rapid price changes – which could arise outside regular business hours if you are trading international markets – can cause the balance of your account to change quickly.

Lack of regulation: There are many unregulated CFD brokers in operation, which increases the risk of scams and unethical practices by some market participants.

Liquidity risk: CFD markets can experience periods of low liquidity, resulting in difficulty exiting a trade at an acceptable price.

Lack of ownership: Because you don’t own the underlying asset, you can’t gain from the benefits of ownership, such as the income provided at set periods by shares or bonds (like dividends).

It’s important for forex traders to educate themselves on the risks involved in CFD trading and to develop a solid risk management plan to help mitigate these risks.

What is the role of a broker in CFD trading?

A CFD trading broker is an intermediary between traders and the financial markets. The primary role of a CFD broker is to provide access to a wide range of financial instruments, such as stocks, indices, commodities, and currencies, that traders can buy or sell using CFDs.

The broker also provides traders with the platform, tools, and resources needed to analyse market trends, place trades, and manage their investments. In addition, brokers offer traders leverage to benefit from larger trading positions with only a small amount of capital. The broker may also provide other services, such as educational resources and customer support.

What CFD financial instruments can I trade?

Below are the most common financial assets you can gain exposure to via CFDs.

Currencies (Forex): Currencies are traded in pairs against each other, such as the US dollar against the euro. There are hundreds of currency pairs available to trade via CFDs. The global market is vast, with around $6.6 trillion traded daily in foreign exchange markets.

Shares: You can buy CFDs in most major global stocks. Like the forex market, the global share market is vast so you can choose from a huge number of highly liquid shares.

Indices: These provide a representation of an overall market. For example, a collection of different stocks are grouped together, and an average price is taken for all of these stocks, creating the price of the index. Well-known examples include the Dow Jones and the S&P 500 in the US.

Cryptocurrencies: You can trade various popular cryptocurrencies with leverage, from Bitcoin and Ethereum to TRON and NEO. The global cryptocurrency is growing rapidly, but prices are highly volatile, magnifying the potential for large profits and losses. One of the key advantages of cryptocurrency CFDs is that you don’t own the underlying assets, preventing the risk of loss due to a cybersecurity breach.

Commodities: Using CFDs, you can gain exposure to a diverse range of commodities, from oil to gold to copper. Commodities are hugely liquid and are subject to a range of influences, from global supply and demand, to political announcements and the economic cycle.

Bonds: Effectively, IOUs issued by governments, companies and other entities, the bond market, also known as the fixed income market, because of the regular set payments these instruments provide, is another of the world’s biggest financial markets.

Interest rates: You can use CFDs to bet on the future direction of interest rates in a wide range of major global markets. The advantages of interest CFDs include relatively attractive margins of 20% and low spreads compared to other products.

Common CFD Trading Strategies

Once you have signed up with a broker, you should always open a demo account to practice trading on their trading platforms in real market conditions and form a trading strategy.

A trading strategy outlines the rules for entering and exiting a trade and includes creating a risk management plan to prevent high losses. It is crucial to thoroughly research and test a strategy before using it in live trading. There are many different CFD trading strategies, and traders often use a combination of technical and fundamental analysis to inform their decisions.

Some common strategies include:

- Trend following: This strategy involves identifying the direction of the market trend and taking trades in the same direction.

- Breakout trading: This strategy involves entering a trade when the price of an asset breaks out of a defined range, with the expectation that the price will continue to move in that direction.

- Swing trading: This strategy involves taking advantage of short-term price movements, typically holding positions for a few days to a week. Swing traders use technical analysis and trend-following indicators to identify and enter trades, with the goal of riding the price swings for maximum gain.

- Scalping: This high-frequency trading strategy involves taking advantage of small price movements in short time frames, such as a few minutes or seconds.

- Day trading: Day trading involves opening and closing positions within the trading day. Many traders think that day trading and scalping are similar, but day traders open and close substantially fewer setups than scalpers.

- Position trading: This is a longer-term trading strategy that involves holding positions for several weeks or months.

Risk Management Strategies for CFD Trading

Creating a successful risk-management strategy takes time, education, and patience, but there are a few simple ways to minimise your risk:

- Use low leverage levels: Smaller amounts of leverage applied to each trade affords more breathing room and help traders avoid larger capital loss. A highly leveraged trade can quickly deplete your trading account if the trade goes against you.

- Setting stop-losses: A stop-loss is an automated order placed with a broker to buy or sell once the CFD instrument reaches a certain price. A stop-loss order limits a trader’s loss on a trade.

- Diversification: Diversify your portfolio by spreading your trades across different markets, instruments, and timeframes to help reduce your overall risk exposure.

- Position sizing: It is important to only risk a small percentage of your trading capital on any given trade. This can help reduce the impact of individual losses on your overall portfolio.

- Staying up-to-date: Keeping abreast of market news and economic events can help you stay ahead of potential market movements and make informed trading decisions.

- Emotional control: Emotional control is key in trading, as fear and greed can often drive poor decision-making. Stick to your trading plan, and keep calm and focused to make more rational and effective trading decisions.

Forex Risk Disclaimer

Trading Forex and CFDs is not suitable for all investors as it carries a high degree of risk to your capital: 75-90% of retail investors lose money trading these products. Forex and CFD transactions involve high risk due to the following factors: Leverage, market volatility, slippage arising from a lack of liquidity, inadequate trading knowledge or experience, and a lack of regulatory protection. Traders should not deposit any money that is not considered disposable income. Regardless of how much research you have done or how confident you are in your trade, there is always a substantial risk of loss. (Learn more about these risks from the Australian regulator, ASIC or the UK’s regulator, the FCA).

Our Rating & Review Methodology

Our overall Forex Rankings report and Directory of CFD Brokers to Avoid are the result of extensive research on over 180 Forex brokers. These resources help traders find the best Forex brokers – and steer them away from the worst ones. These resources have been compiled using over 200 data points on each broker and over 3000 hours of research. Our team conducts all research independently: Testing brokers, gathering information from broker representatives and sifting through legal documents. Learn more about how we rank brokers.

Editorial Team

Chris Cammack

Head of Content

Chris joined the company in 2019 after ten years experience in research, editorial and design for political and financial publications. His background has given him a deep knowledge of international financial markets and the geopolitics that affects them. Chris has a keen eye for editing and a voracious appetite for financial and political current affairs. He ensures that our content across all sites meets the standards of quality and transparency that our readers expect.

Alison Heyerdahl

Senior Financial Writer

Alison joined the team as a writer in 2021. She has a medical degree with a focus on physiotherapy and a bachelor’s in psychology. However, her interest in forex trading and her love for writing led her to switch careers, and she now has over eight years experience in research and content development. She has tested and reviewed 100+ brokers and has a great understanding of the Forex trading world.

Ida Hermansen

Financial Writer

Ida joined our team as a financial writer in 2023. She has a degree in Digital Marketing and a background in content writing and SEO. In addition to her marketing and writing skills, Ida also has an interest in cryptocurrencies and blockchain networks. Her interest in crypto trading led to a wider fascination with Forex technical analysis and price movement. She continues to develop her skills and knowledge in Forex trading and keeps a close eye on which Forex brokers offer the best trading environments for new traders.

Stay updated

This form has double opt in enabled. You will need to confirm your email address before being added to the list.