For over a decade, FxScouts has been reviewing forex brokers and providing in-depth analyses. Our extensive research and unique testing methodology ensures that all broker reviews are accurate and fair, with hundreds of thousands of data points generated annually. Since 2012, we’ve tested over 180 brokers across global and Australian markets. Our team of professionals are frequently cited in global and regional media, shaping market conversations and trends.

-

MetaTrader 4 Brokers

The top MT4 brokers in AU

-

MetaTrader 5 Brokers

The best MT5 brokers in AU

-

TradingView Brokers

The best TradingView brokers

-

cTrader Brokers

The top cTrader brokers in AU

-

Forex Trading Apps

Trade on the go from your phone

-

Copytrading Brokers

Copy professional traders

-

All Trading Platforms

Find a platform that works for you

75-90% of retail traders lose money trading Forex and CFDs. You should consider whether you understand how CFDs and leveraged trading work and if you can afford the high risk of losing your money. We may receive compensation when you click on links to products we review. Please read our advertising disclosure. By using this website you agree to our Terms of Service.

2024 Best Forex Brokers in Australia Compared

Broker | Broker Score | Official Site | Min. Deposit | Cost of Trading | Platforms | Beginner Friendly | Regulators | Compare |

|---|---|---|---|---|---|---|---|---|

| 4.40 /5 Read Review | Visit Broker > 79% of retail CFD accounts lose money | AUD 100 | USD 7 | MT4, MT5, cTrader, IRESS | Excellent |      | |

| 4.61 /5 Read Review | Visit Broker > 89%74- of retail CFD accounts lose money | AUD 100 | USD 10 | MT4, MT5, cTrader, TradingView | Excellent |        | |

| 4.45 /5 Read Review | Visit Broker > 75.33% of retail CFD accounts lose money | AUD 5 | USD 6 | MT4, MT5 | Excellent |      | |

| 4.59 /5 Read Review | Visit Broker > 76% of retail CFD accounts lose money | AUD 100 | USD 9 | MT4, MT5, Avatrade Social, AvaOptions | Excellent |       | |

| 4.69 /5 Read Review | Visit Broker > 71% of retail CFD accounts lose money | AUD 0 | USD 6 | MT4, L2 Dealer, ProRealTime | Excellent |            | |

4.68 /5 Read Review | Visit Broker > 70.3% of retail CFD accounts lose money | AUD 100 | USD 7 | MT4, MT5, markets.com | Excellent |      | ||

4.28 /5 Read Review | Visit Broker > N/A of retail CFD accounts lose money | USD 0 | USD 8 | MT4, MT5, WebTrader | Excellent |   | ||

| 4.33 /5 Read Review | Visit Broker > 76% of retail CFD accounts lose money | AUD 5 | USD 7 | MT4, MT5 | Excellent |     | |

| 4.44 /5 Read Review | Visit Broker > 75.6% of retail CFD accounts lose money | AUD 0 | USD 10 | MT4 | Excellent |       | |

4.28 /5 Read Review | Visit Broker > 76% of retail CFD accounts lose money | AUD 100 | USD 8 | MT4, MT5, MT Supreme | Excellent |      | ||

4.33 /5 Read Review | Visit Broker > 89% of retail CFD accounts lose money | USD 0 | USD 4.50 | MT4, MT5, cTrader | Excellent |    |

Best Forex Brokers in Australia for 2024

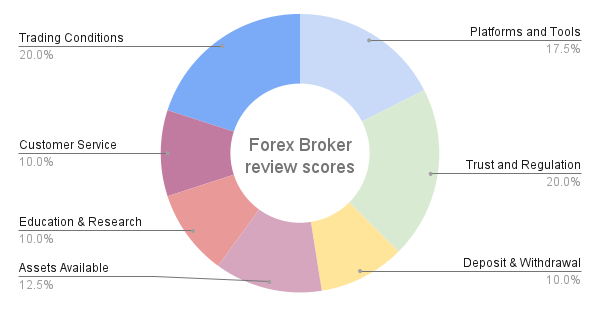

At FxScouts, we have an experienced review team dedicated to evaluating Forex brokers. Our team of experts meticulously examines each broker in 7 different areas, amassing an enormous amount of data in the process. With over 200 individual metrics analysed, we invest hundreds of hours annually researching and scrutinising brokers to ensure that we only recommend the best in the Forex industry.

Of these 7 areas, we always prioritise regulation and costs. These are our priorities because traders want to know that their broker is trustworthy and isn’t overcharging them. Brokers are always altering the products they offer, and we keep our reviews updated with the latest data available. You can find out more about our in-depth review process here.

These are Best Forex Brokers for Australia in 2024, as recommended by our experts.

Others Also Visit

FP Markets – Award-Winning Broker with Low-Cost Trading and Advanced Tools

FP Markets excels in offering a competitive trading environment, with low-cost options and advanced tools suitable for both beginners and experienced traders.

Trading Instruments:

- Access to Forex, commodities, precious metals, indices, cryptocurrencies, and over 10,000 global shares through the IRESS platform.

Trading Platforms and Tools:

- MT4, MT5, and IRESS platforms.

- Free Autochartist, VPS services, and the Traders Toolbox for an enhanced trading experience.

Fees and Trading Conditions:

- Standard Account and Raw Account, both with a 100 AUD minimum deposit.

- Raw Account offers spreads from 0.10 pips (EUR/USD) and a 6 AUD (RT) commission.

Regulation and Security:

- Regulated by ASIC (AFS License Number 286354) since 2005 and CySEC in the EU.

- Negative balance protection, segregated operational and client funds, and leverage restrictions as per ASIC regulations.

Pepperstone – High-Speed Execution and Vast Trading Options

Pepperstone offers lightning-fast trade execution and a wide range of trading instruments, making it perfect for scalpers and expert advisor users.

Trading Instruments:

- Over 1,000 instruments, including Forex, commodities, cryptocurrencies, and indices.

Trading Platforms:

- MT4, MT5, and cTrader with seamless integration with TradingView for advanced charting and analysis.

Fees and Trading Conditions:

- Standard Account with spreads starting at 1.00pips and no commission.

- Razor Account with spreads from 0 pips for the EUR/USD and a 7 AUD commission.

Regulation and Security:

- Regulated by ASIC (AFS License Number 414530), BaFin in Germany, and the FCA in the UK.

- Negative balance protection and leverage restrictions of 30:1 for non-professional clients.

XM – Comprehensive Beginner Education for a Confident Trading Start

XM shines with its exceptional educational resources and market analysis, ensuring new traders have a solid foundation to build upon.

Trading Instruments:

- Forex, stocks, commodities, equities, precious metals, energies, and shares available for trading.

Trading Platforms:

- MT4 and MT5 platforms with four live account options to cater to different preferences.

Education and Support:

- Live education sessions, daily Q&A segments, instructive videos, Forex webinars, platform tutorials, and Forex seminars in 19 languages.

Regulation and Security:

- Well-regulated market maker with 99.53% of all trading orders executed in under one second.

AvaTrade – Seamless Mobile Trading Experience with Advanced Protection

AvaTrade delivers an exceptional mobile trading experience with the AvaTradeGO app, featuring advanced tools and AvaProtect for temporary loss protection.

Trading Instruments:

- 1,000+ CFDs, including Forex, commodities, stocks, cryptocurrencies, indices, bonds, vanilla options, and ETFs.

Trading Platforms:

- AvaTradeGO app syncs with both MT4 and MT5 desktop trading platforms.

- Advanced tools: Place orders, set price alerts, and create watchlists.

Fees and Trading Conditions:

- Spreads as low as 0.9 pips on the EUR/USD with a 100 AUD minimum deposit.

- Educational videos and customer support accessible within the app.

Regulation and Security:

- Regulated by ASIC (AFS License Number 406684) and multiple top-tier regulators.

- Innovative risk-management features like AvaProtect for temporary loss protection.

IG – Best CFD Trading Account with Unmatched Market Access

| 🏦 Min. Deposit | AUD 0 |

| 🛡️ Regulated By | ASIC, BaFin, MAS, CFTC |

| 💵 Trading Cost | USD 6 |

| ⚖️ Max. Leverage | 30:1 |

| 💹 Copy Trading | Yes |

| 🖥️ Platforms | MT4, L2 Dealer, ProRealTime |

| 💱 Instruments | Bonds, Commodities, Cryptocurrencies, Digital 100s, Stock CFDs, ETFs, Forex, Indices, Interest Rates |

IG offers the best CFD trading account with access to an extensive range of instruments, backed by a trusted reputation and world-class educational resources.

Trading Instruments:

- 19,000+ CFDs, including commodities, indices, cryptocurrencies, over 16,000 shares and ETFs, options, interest rates, and bonds.

Trading Platforms:

- Award-winning app and web trader platform, compatible with both low-cost trading accounts.

IG Academy:

- Detailed courses for beginner, intermediate, and advanced traders.

Fees and Trading Conditions:

- No minimum deposit requirements and spreads starting at 0.6 pips on the EUR/USD.

Regulation and Security:

- Regulated by ASIC (AFS License Number 220440) since 2001 and 16 other national authorities.

- Negative balance protection, segregated operational and client funds, and leverage restrictions as per ASIC regulations

Markets.com – Best Mobile Trading Platform

The Markets.com app provides a smooth and stable trading experience with low fees and many trading tools. With built-in advanced charting, traders can easily access trendlines, channels, pitchforks, and Fibonacci Retracements. In the chart view, traders can see their orders, related instruments, and open positions with a single click.

The app offers traders fast, commission-free trading with some of the lowest fees available. Spreads start at 0.60 pips on major FX pairs with no commission and leverage of 30:1. The large variety of tradeable instruments include 700+ global shares, 60+ currency pairs, 30 global indices, 22 commodities, 77 ETFs, 25 cryptocurrencies, and four government bonds.

- Effortless mobile trading

- 900+ CFDs with low fees

- Advanced trading tools

BlackBull Markets – Best Trading Conditions

BlackBull Markets is an ECN-only broker offing the best trading conditions to Australian clients on three ECN account types – ECN Standard, ECN Prime and ECN Institutional. The ECN Standard Account has no minimum deposit and no commission, with a minimum spread of 0.8 pips. The ECN Prime Account has a minimum deposit of 2000 USD and spreads start at 0.1 pips. A commission of 3 USD per lot traded is charged per side (6 USD round-turn). The institutional account has a minimum deposit of 20,000 USD and spreads starting from 0.0 pips. This account is specifically for professional traders and commission is negotiable. Leverage on all accounts is set at a maximum of 500:1

BLACKBULL MARKETS FEATURES

- Leverage of 500:1 for Australian traders (Blackbull Markets is based in New Zealand and not regulated by ASIC)

- True ECN/STP broker with no dealing desk

- Fast STP execution via Equinix servers based in New York, London and Tokyo

- Institutional account for professional traders with a negotiable commission.

FBS – Lowest Minimum Deposits and Tight Spreads

Who FBS is for: With three low-cost accounts, FBS will appeal to traders looking for low minimum deposits and low trading costs.

Why we like FBS: FBS’ strength is in its range of accounts, with trading conditions for all types of traders. Beginners will focus on its Cent Account with its 50 AUD minimum deposit and spreads starting at 0.6 pips (EUR/USD), while more experienced traders will be interested in the Ultra account with a 50 AUD minimum deposit, raw spreads, and an AUD 8.12/USD 6/EUR 5 commission. Other accounts include a Standard Account, also with a 50 AUD minimum deposit and commission-free trading with a spread of 0.7 pips (EUR/USD). Professional traders will appreciate the high leverage available of up to 500:1, priority service, and VIP analytics.

FBS drawbacks: FBS only offers the MT4 and MT5 trading platforms, which is limited compared to what’s available at other brokers. It also has a limited range of cryptocurrencies, and very few trading tools.

Axi – Low-Cost MT4 Trading, Great Tools

| 🏦 Min. Deposit | AUD 0 |

| 🛡️ Regulated By | FCA, CySEC, ASIC, DFSA |

| 💵 Trading Cost | USD 10 |

| ⚖️ Max. Leverage | 30:1 |

| 💹 Copy Trading | Yes |

| 🖥️ Platforms | MT4 |

| 💱 Instruments | Commodities, Cryptocurrencies, Stock CFDs, Forex, Indices, Metals, WTIs |

Who is Axi for: Traders who only use the MT4 trading platform and want an ECN broker with great trading tools but aren’t too bothered about trading shares.

Why we like Axi: Axi, formerly AxiTrader, stands out for three reasons: First off, it’s an MT4-only broker, so if you want to use any other trading platform, you can look away now. Secondly, it’s an ECN broker with low fees, no minimum deposit requirement, and two simple accounts, one with commission and one without. Finally, it has a fantastic collection of trading tools that it offers for free to its clients. While the MT4-only policy may seem like a drawback, it does allow Axi to focus on making its MT4 trading experience as profitable as possible. This includes Axi’s MT4 NexGen plugin, which includes an advanced sentiment indicator, a correlation trader, and an automated trade journal. And while the fees on its accounts aren’t the lowest available, they are below the industry average. The Pro Account, in particular, is good value, with spreads averaging 0.1 pips on the EUR/USD and a 7 AUD commission. Beginners and experienced traders alike will really appreciate Axi’s selection of powerful and free trading tools, including Autochartist, MyFxbook, and PsyQuation. Autochartist is a tool that automatically identifies trading opportunities, MyFxBook is one of the world’s most popular copy-trading platforms, and PsyQuation is an AI trade diagnostic that helps traders learn from their mistakes.

Axi drawbacks: The main and most obvious drawback here is Axi’s insistence on only providing support for the MT4 trading platform. Apart from putting some traders off, this also results in a smaller range of trading assets and Axi only recently added a handful of share CFDs to its product line-up. That said, Axi does have a good range of cryptocurrencies to trade.

Fusion Markets – Low Trading Fees and Great Range of Trading Platforms

Established in 2017, Fusion Markets stands out as a top broker for traders seeking low trading costs, a great choice of trading platforms, and excellent trading tools. With two affordable accounts on MT4, MT5, and the cTrader platform, Fusion Markets’ Zero Account has spreads that start at 0 pips on EUR/USD with a small commission of just 4.5 USD (round turn) – one of the lowest in the industry.

Beyond the competitive pricing, Fusion offers 24/7 support, instant free withdrawals, and top-tier market analysis tools. Regular traders even benefit from free VPS hosting. However, a notable drawback is the lack of educational resources, forcing beginners to self-educate elsewhere.

Which is the Best Broker in Australia?

The best brokers in Australia are well-regulated and offer a low-cost, user-friendly trading platform suitable for both beginners and experienced traders. Following rigorous testing, we believe that FP Markets is the best broker for Australian traders. FP Markets is regulated by some of the toughest global authorities, including ASIC of Australia, providing security and confidence for its clients. FP Markets’ trading costs are low, with a required minimum deposit of 100 AUD on both the Standard Account and the Raw Account. FP Markets’ Raw Account is particularly great value with spreads starting at 0.10 pips (EUR/USD) with a 6 AUD (RT) commission. Traders can trade on MT4, MT5, or its IRESS trading platform, which offers trading on over 10,000 stock CFDs and a great range of trading tools..

Which Forex Broker has the Best Platform?

ASIC-regulated since 2010, Pepperstone offers some of the best trading platforms in the industry, including MT4, MT5, and cTrader. All of Pepperstone’s platforms offer automated trading, strategy backtesting, customisable charting, and a range of indicators, and integrate with Autochartist and Smart Trader Tools. TradingView, a relatively new platform, offers even more advanced charting abilities, including custom timeframes, over 100,000 custom-built indicators, and integrated financial analysis.

Outstanding Trading Platforms and Features

IC Markets: Known for low-cost trading and a choice of three easy-to-use platforms (MT4, MT5, and cTrader), making it ideal for traders who prioritize cost efficiency.

XM: The ultimate choice for comprehensive beginner education, offering an exceptional range of educational and market analysis resources, including live sessions, webinars, and Forex seminars.

AvaTrade: Best mobile trading experience with its AvaTradeGO App, offering cross-platform compatibility, and unique features like AvaProtect for temporary loss protection.

IG: Best CFD trading account, offering a wide range of instruments, including over 16,000 shares, and a world-class trading platform with access to the IG Academy for learning and improvement.

Importance of Third-Party Reviews and User Feedback

When choosing a Forex broker, it’s crucial to consider not only the financial aspects but also the personal fit. Third-party reviews and user feedback play an essential role in evaluating brokers, as they provide valuable insights from real traders’ experiences. Always consider these sources when making your decision to ensure you select a broker that meets your unique needs and preferences

Is Forex Trading Legal in Australia?

Forex trading in Australia is legal and regulated by the Australian Securities and Investments Commission (ASIC). ASIC requires all Forex brokers operating in the country to hold a valid license and adhere to strict standards, including:

- Timely deposits and withdrawals

- Segregation of funds

- Negative balance protection

- Leverage restrictions

- Capital adequacy to prevent defaults

As well as ASIC, other top-tier global regulators include FCA and CySEC. Whether you decide to use a broker regulated by the FCA or not, it’s important to remember that choosing a regulated broker is the best way to ensure your protection as a Forex trader.

Why is ASIC Regulation Important for Australians?

Regulation by ASIC in Australia is essential for protecting your money and ensuring a fair and transparent trading experience.

When trading Forex, you want to be confident that your broker is operating legally and ethically and that your funds are being handled safely. Regulated Forex brokers must adhere to strict standards set by regulatory bodies, which include requirements for capital adequacy, segregation of client funds, and ongoing reporting and compliance. This means that your funds are protected, and your trading experience is fair.

Unregulated brokers are not forced to hold to the same standards. This can lead to a higher risk of fraud or unethical practices, which can result in financial losses for traders. Choosing a regulated Forex broker gives you peace of mind and security, knowing that your investments are protected and your trading experience is fair.

Scam Brokers and Reporting Regulatory Violations

If you are unsure about the reliability of your Forex broker, you can check our list of brokers to avoid. If you believe you have been scammed by your broker, the first thing to do is warn others and tell your story. You can contact ASIC’s misconduct department here and ask them to investigate. We also have a report a scam broker form which we use to gather information so that we get the word out. Your personal details will not be shared externally.

Do I Need a Broker to Trade Forex?

Yes, you will need a broker to trade Forex. Connecting traders to the Forex market is an expensive and technically complex business. Most Forex brokers form a bridge between the global Forex market and Forex traders; these are called market makers. Market makers buy up large trading positions from the Forex market, which they sell to traders in smaller trade sizes.

Other brokers act as a go-between, taking orders from traders and sending them straight to the global Forex market. These are called ECN brokers or DMA brokers. Both types of Forex brokers require a lot of money to set up and need teams of highly qualified technicians to maintain their trading platforms.

How do Forex Brokers Make Money?

Market markers only make money from the spread – the difference between the buying and selling price of the currency pair. These brokers will be the counterparty to any trade, so they make money when clients lose trades.

ECNs have tight spreads but profit from commissions, which are charged whenever a trade is opened or closed. This type of broker makes money whether a client wins or loses.

Which Forex Brokers are Best for Beginner Traders in Australia?

The best brokers for beginners are ASIC-regulated and have no minimum deposit requirement, ensuring security and a low cost of entry. Also important are low fees and negative balance protection, as these both help to lower risk. Responsive and knowledgeable customer support is essential. Customer service should be available 24/5 via email, live chat, and telephone, though 24/7 is better. Last but not least, beginners should look for a broker with a high-quality education section; this should feature articles, video tutorials, frequent webinars, advanced trading strategies, and chart analysis.

For more detail and to see which brokers we recommend for new traders, check out our dedicated page on the best brokers for beginners.

Which Forex Brokers have the Best Demo Accounts?

The brokers with the best demo accounts understand that beginners should not be forced into trading real money and that experienced traders should be able to test strategies as long as they want to. So the best demo accounts are not time-limited and replicate real market conditions as closely as possible. Beginners looking for a demo account will want a broker with good education, so they can learn about Forex trading as they practice.

For more detail and to see which brokers we recommend for demo trading, check out our dedicated page on the best demo accounts.

Which Trading Platforms do the Best Forex Brokers Offer?

The best Forex brokers generally offer Metatrader 4 (MT4), MetaTrader 5 (MT5), and cTrader. These are third-party trading platforms which you can install on your computer. They are fully customisable and have advanced charting tools, research tools, and options for automated trading or copy trading. Some brokers also have their own trading platforms, which are usually accessed via a browser or on your mobile phone. For more details on trading platforms and how they work, check out our guide on trading platforms.

Recent updates

- May 3, 2023: Specified information regarding Financial Regulation

- April 10, 2023: Revised reviews to provide a balance between detailed information and easy scanning, making the content more accessible for readers

- April 10, 2023: Reinstated more detailed comparison table based on our readers feedback

- April 5, 2023: Removal of Go Markets after multiple complaints about problems withdrawing trading profits from the broker

- March 14, 2023: Implementation of simplified comparison table

- February 17, 2023: Overhaul of the entire page content

Forex Risk Disclaimer

Trading Forex and CFDs is not suitable for all investors as it carries a high degree of risk to your capital: 75-90% of retail investors lose money trading these products. Forex and CFD transactions involve high risk due to the following factors: Leverage, market volatility, slippage arising from a lack of liquidity, inadequate trading knowledge or experience, and a lack of regulatory protection. Traders should not deposit any money that is not considered disposable income. Regardless of how much research you have done or how confident you are in your trade, there is always a substantial risk of loss. (Learn more about these risks from the Australian regulator, ASIC or the UK’s regulator, the FCA).

Our Rating & Review Methodology

Our overall Forex Rankings report and Directory of CFD Brokers to Avoid are the result of extensive research on over 180 Forex brokers. These resources help traders find the best Forex brokers – and steer them away from the worst ones. These resources have been compiled using over 200 data points on each broker and over 3000 hours of research. Our team conducts all research independently: Testing brokers, gathering information from broker representatives and sifting through legal documents. Learn more about how we rank brokers.

Editorial Team

Chris Cammack

Head of Content

Chris joined the company in 2019 after ten years experience in research, editorial and design for political and financial publications. His background has given him a deep knowledge of international financial markets and the geopolitics that affects them. Chris has a keen eye for editing and a voracious appetite for financial and political current affairs. He ensures that our content across all sites meets the standards of quality and transparency that our readers expect.

Alison Heyerdahl

Senior Financial Writer

Alison joined the team as a writer in 2021. She has a medical degree with a focus on physiotherapy and a bachelor’s in psychology. However, her interest in forex trading and her love for writing led her to switch careers, and she now has over eight years experience in research and content development. She has tested and reviewed 100+ brokers and has a great understanding of the Forex trading world.

Ida Hermansen

Financial Writer

Ida joined our team as a financial writer in 2023. She has a degree in Digital Marketing and a background in content writing and SEO. In addition to her marketing and writing skills, Ida also has an interest in cryptocurrencies and blockchain networks. Her interest in crypto trading led to a wider fascination with Forex technical analysis and price movement. She continues to develop her skills and knowledge in Forex trading and keeps a close eye on which Forex brokers offer the best trading environments for new traders.

Others Also Visit

Stay updated

This form has double opt in enabled. You will need to confirm your email address before being added to the list.