For over a decade, FxScouts has been reviewing forex brokers and providing in-depth analyses. Our extensive research and unique testing methodology ensures that all broker reviews are accurate and fair, with hundreds of thousands of data points generated annually. Since 2012, we’ve tested over 180 brokers across global and Australian markets. Our team of professionals are frequently cited in global and regional media, shaping market conversations and trends.

-

MetaTrader 4 Brokers

The top MT4 brokers in AU

-

MetaTrader 5 Brokers

The best MT5 brokers in AU

-

TradingView Brokers

The best TradingView brokers

-

cTrader Brokers

The top cTrader brokers in AU

-

Forex Trading Apps

Trade on the go from your phone

-

Copytrading Brokers

Copy professional traders

-

All Trading Platforms

Find a platform that works for you

75-90% of retail traders lose money trading Forex and CFDs. You should consider whether you understand how CFDs and leveraged trading work and if you can afford the high risk of losing your money. We may receive compensation when you click on links to products we review. Please read our advertising disclosure. By using this website you agree to our Terms of Service.

- FP Markets - Best ECN Broker in Australia

- Pepperstone - Best ECN Broker with the Tightest Spreads

- ACY Securities - Best Trading Platforms

- Admirals - Best ECN Broker for Education

- Axi - Best ECN Broker on the MT4 Platform

- BlackBull Markets - Best ECN Broker for Pro Traders

- Fusion Markets - Low Cost ECN + 3 Copy Trading Platforms

Best ECN Forex Brokers in Australia

Broker | Broker Score | Official Site | Min. Deposit | Max. Leverage (Forex) | EUR/USD - Standard Account | Trading Cost - Standard Account | EUR/USD - Raw Spread | Trading Desk | Trading Commission | ASIC Regulated | Total CFDs | Currency Pairs | Platforms | Compare |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 4.40 /5 Read Review | Visit Broker > 79% of retail CFD accounts lose money | AUD 100 | 30:1 | 0.10 pips | USD 7 | 0.10 pips | ECN/DMA | 6 USD / lot - RAW Accounts | Yes | 10162 | 70 | MT4, MT5, cTrader, IRESS | |

| 4.61 /5 Read Review | Visit Broker > 89%74- of retail CFD accounts lose money | AUD 100 | 30:1 | 1.00 pips | USD 10 | 0.17 pips | NDD | From 7 USD / lot - Razor Account | Yes | 1275 | 100 | MT4, MT5, cTrader, TradingView | |

4.08 /5 Read Review | Visit Broker > N/A of retail CFD accounts lose money | AUD 50 | 30:1 | 1.00 pips | USD 10 | 0.30 pips | ECN/DMA | Fees Included in Spread | Yes | 2489 | 63 | MT4, MT5 | ||

4.28 /5 Read Review | Visit Broker > 76% of retail CFD accounts lose money | AUD 100 | 30:1 | 0.80 pips | USD 8 | 0.10 pips | STP | 1.8 - 3 USD per lot | Yes | 3996 | 82 | MT4, MT5, MT Supreme | ||

| 4.44 /5 Read Review | Visit Broker > 75.6% of retail CFD accounts lose money | AUD 0 | 30:1 | 1.00 pips | USD 10 | 0.00 pips | ECN/DMA | 7 USD / lot - PRO account | Yes | 188 | 70 | MT4 | |

4.28 /5 Read Review | Visit Broker > N/A of retail CFD accounts lose money | USD 0 | 500:1 | 0.80 pips | USD 8 | 0.18 pips | ECN/DMA | 6 USD / lot - ECN Prime | No | 26115 | 70 | MT4, MT5, WebTrader | ||

4.33 /5 Read Review | Visit Broker > 89% of retail CFD accounts lose money | USD 0 | 30:1 | 0 pips | USD 4.50 | 0 pips | ECN/DMA | 4.5 AUD / lot (EUR/USD) | Yes | 252 | 85 | MT4, MT5, cTrader |

How to compare Australian ECN brokers

ECN brokers use high-speed communication to find the best pricing available from a pool of liquidity providers in their network and execute trade orders as quickly as possible. The more liquidity providers How many liquidity providers an ECN broker uses varies, and this should always be considered alongside how fast an ECN executes trades, the more liquidity providers an ECN broker has access to, the better pricing the trader will receive. When comparing ECN brokers, always consider:

Trading cost: Australian Forex traders seek out ECNs brokers because of their low trading costs. Trading costs on ECN accounts are a combination of the spread and a commission. Trading costs for one lot of EUR/USD at ECN brokers will range from 6 USD to 18 USD, depending on the broker’s trading conditions. Bear in mind that not all ECN brokers will have lower trading costs than brokers with a dealing desk.

Execution quality: A combined metric used to discuss execution speed, slippage and rejection rate, execution quality describes the connection between the broker and the market and will directly impact the level of control a trader has over their positions. The best Australian ECN brokers will have fast execution speeds, which leads to less slippage in pricing between when the order is executed and when it is opened, and less order rejection due to unavailable counterparties. Better execution quality will always produce fewer unintentional losses.

The number of liquidity providers: ECN brokers do not operate a dealing desk and are never counterparty to client trades. Instead, it uses its network to place trades directly with liquidity providers, also called execution venues. The more liquidity providers an ECN broker has access to, the more competition there will be for its client’s trades, leading to tighter spreads and lower overall trading costs. Some ECN brokers will only have a single liquidity provider, which defeats the purpose of an ECN completely – as there is no competition for a trader’s business and trading costs will be higher than they should be. Avoid these types of ECN brokers.

Tradable Assets: A good ECN broker will offer clients a larger number of FX Pairs and other CFD assets to trade. Having a limited set of trading assets can negatively affect the traders, as they would miss out on trading opportunities.

Regulation: Regulators monitor the activities of the broker and the trading desk. Unregulated ECN brokers are dangerous as there is no way of telling if they are ECN brokers without making a deposit and opening a trade. Brokers regulated by the FCA (UK), ASIC (Australia) or MAS (Singapore) have better reputations for enforcement and thus ensure their member ECN brokers strictly follow protocols designed to protect clients and their trades.

Trading tools: Leading ECN brokers will offer traders a free Virtual Private Server (VPS) service, guaranteeing high-quality execution around the clock. Other trading tools offered by the best ECN brokers include indicator packages to assist with automated trading and in-platform market analysis tools such as Trading Central or Autochartist.

FP Markets – Best ECN Broker in Australia

While not a pure ECN broker, FP Markets does provide ECN pricing – it streams its pricing directly from its liquidity providers. This provides its clients with tight ECN spreads but higher quality execution than many true ECN brokers, featuring less slippage or rejections. With average spreads for EUR/USD at 0.1 pips, GBP/USD at 0.2 pips and USD/JPY at 0.1 pips, FP Markets’ Forex pricing is comparable with Pepperstone and other industry-leading ECN brokers. Commission is also low at 6 USD per lot round turn and the minimum deposit is only 100 AUD.

Winner of the 2020 Best Broker in Australia Award, FP Markets supports MT4 and MT5 on 60+ FX pairs, metals, indices and commodities to trade. And with an Equinix server cluster, most trades are executed in under 40 milliseconds, faster than other ECN brokers. This makes FP Markets an excellent broker for scalping and EA trading on the Metatrader platforms.

Pepperstone – ECN Broker with the Tightest Spreads

A world-renowned Australian broker, Pepperstone offers MT4, MT5 and cTrader support, ASIC regulation and two simple accounts with ECN execution. Most orders are executed in less than 50 milliseconds, which is ideal for scalpers and clients who run MT4’s expert advisors.

Pepperstone offers two accounts, both with tight floating spreads and ECN execution. The Standard Account is commission-free with spreads on the EUR/USD starting at 1.00 pips. The Razor Account charges a commission of 7 AUD round turn but the average spread on the EUR/USD is 0.10 pips – about as close as traders can get to true market prices as possible.

Pepperstone also offers a package of Smart Trader Tools for MT4, a suite of 28 expert advisors and indicators to help improve trade execution and management. In addition, all traders users will get access to Autochartist – a powerful pattern recognition plugin that automatically identifies trading opportunities based on price trends.

Admirals – Best ECN Broker for Education

Admirals offers two ECN accounts on the MT4 and MT5 platforms with tight spreads, low commissions and low minimum deposits. In addition, Admirals offers all traders world-class education and free Trading Central access.

Admirals Markets offer two ECN accounts on MT4 and MT5. The Zero.MT4 account has spreads from 0 pips with commission varying between 1.8 to 3.0 USD per lot. The cost of trading 1 lot of EUR/USD with the Zero.MT4 account is 5 USD round turn, which is at the lower end of what similar ECN brokers can offer. Admirals’ MetaTrader Supreme edition for both MT4 and MT5 offers improved trading widgets, charts, and indicators when compared to standard MetaTrader.

Admirals has an excellent education suite, starting with the free Zero to Hero program where beginners can learn to trade in 20 days. The accompanying webinars Admiral publishes are detailed and helpful, and the overall onboarding experience is welcoming, responsible and genuinely educational. With intermediate and advanced trading education for experienced traders and access to Trading Central delivering trading insights, quality learning material is front and centre for all clients.

Axi – Best ECN broker on MT4

| 🏦 Min. Deposit | AUD 0 |

| 🛡️ Regulated By | FCA, CySEC, ASIC, DFSA |

| 💵 Trading Cost | USD 10 |

| ⚖️ Max. Leverage | 30:1 |

| 💹 Copy Trading | Yes |

| 🖥️ Platforms | MT4 |

| 💱 Instruments | Commodities, Cryptocurrencies, Stock CFDs, Forex, Indices, Metals, WTIs |

Built by traders, for traders, Axi is an ASIC and FCA regulated ECN broker with full MT4 Support, great trading tools and simple account options

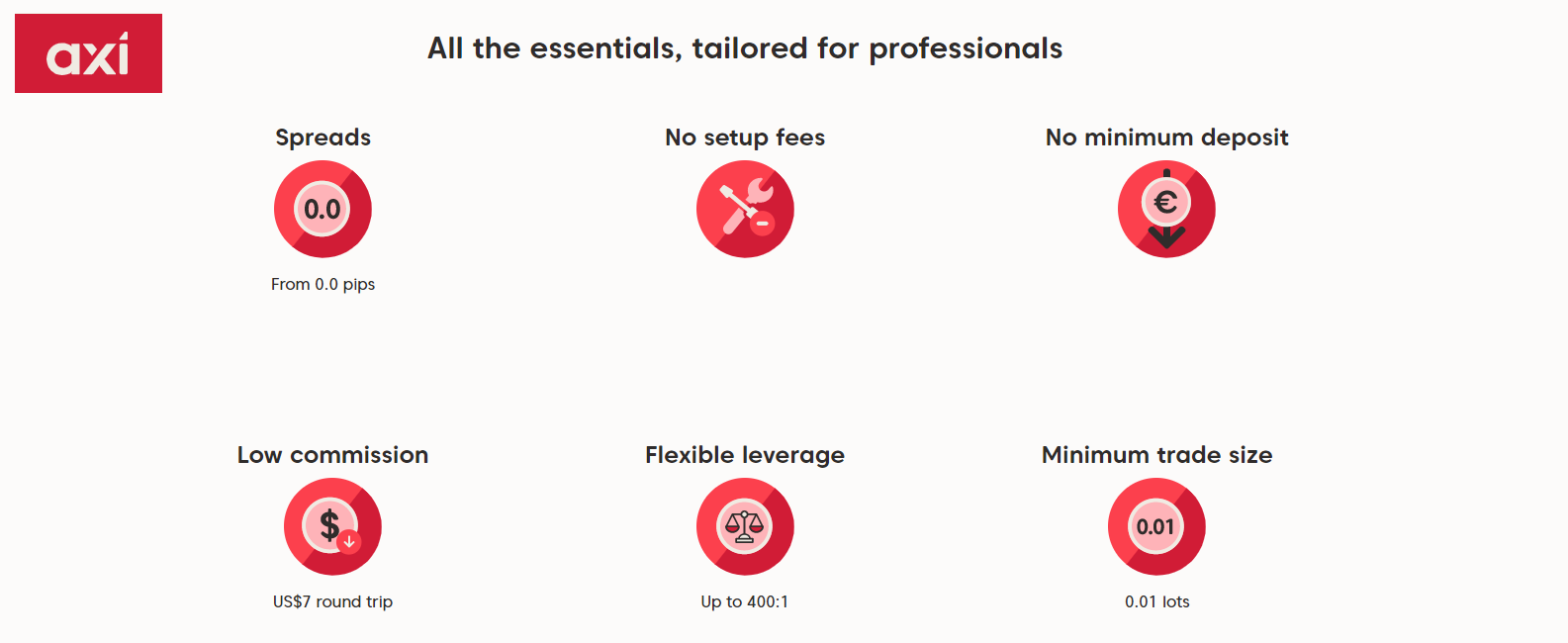

Axi provides the leadings ECN MT4 experience offering a range of tools for MT4, where the highlight is the MT4 NexGen plugin. MT4 NexGen offers a sentiment indicator, a correlation trader, a more intuitive terminal window, and an automated trade journal. In addition, Axi’s pricing model connects to over 20 liquidity sources, so traders experience fewer slippages and requotes. Spreads on the Pro Account start at 0 pips (with a 7 USD commission).

Apart from MT4 NexGen, traders at Axi have access to a range of tools. These include AutoChartist, the powerful automated technical analysis tool, and PsyQuation, an AI diagnostic that tracks your trading style and coaches you into more profitable trades. VPS hosting is also available, along with all the trading algos you wish to install to your MT4.

BlackBull Markets – Best ECN Broker for Pro Traders

For Australian traders looking for a professional-grade ECN/STP broker, BlackBull Markets ticks many boxes. Equinix servers and STP execution prevent slippage and the Institutional Account features spreads down to 0 pips, negotiable commission, and FIX API.

BlackBull Markets offers three account types, the ECN Standard, ECN Prime and ECN Institutional. While the Standard and Prime Accounts offer decent trading conditions, pro traders will be interested in the institutional account, which has a minimum deposit of 20,000 USD and spreads starting from 0.0 pips.

BlackBull Markets offers free VPS services to any clients who are interested. The only requirements are a BlackBull Markets Prime account and a minimum of $2,000 deposit with 20 lots traded per month. Bank wire withdrawals are free of charge for Australian bank accounts and take 1-3 days to process.

Fusion Markets – Low-Cost ECN + 3 Copy Trading Platforms

Founded in 2017 in Melbourne, Fusion Markets is an ASIC-regulated ECN broker with exceptionally low trading costs, MT4 and MT5 support, and no minimum deposit requirements. Alongside an excellent range of market analysis materials, Fusion Markets also offers no less than three different copy-trading solutions.

Its own Fusion+ copy trading platform is only available in a proprietary trading platform, but it also offers Duplitrade and Myfxbook Autotrade – one of the largest Forex social trading communities in the world.

In terms of ECN trading, Fusion Markets is one of the lowest-cost brokers in the world. EUR/USD spreads start at 0 pips on its Zero Account with a very low commission of 4.5 AUD. The only drawbacks are a relatively limited number of CFDs (though 85 Forex pairs, many more than most brokers) and no education to speak of, so beginners will have to educate themselves elsewhere.

What are ECN Brokers?

ECN brokers connect traders to a network of liquidity providers, unlike Market Maker brokers which operate a dealing desk and take trades on to their own books.

ECN stands for Electronic Communication Network. An ECN broker sits at the centre of this communication network, like a spider in a web. In Australia, the other members of the network are liquidity providers like AA rated Australian banks, hedge funds and other brokers.

Every time a client places a trade with an ECN broker it collects prices from the members of this network and presents the trader with the tightest spread it could find to fulfil the volume requirement. Because the liquidity providers in this network are competing for your trade, ECN brokers have very tight spreads which can approach 0 pips.

Do ECN Brokers Charge a Commission?

Most Australian ECN brokers do not make any money from the spread. Instead, they will charge a commission for every trade, which is their fee for routing your trade to a liquidity provider in their network. Traditional brokers (Market Makers) have wider spreads because they charge their fee in the spread.

Are ECN Brokers Expensive?

No, ECN brokers are not expensive to trade with and most ECN brokers have a lower cost of trading than the industry average. Even so, some of the best market makers in Australia (such as IG Markets or AvaTrade) will have trading costs as low as the best ECN brokers.

Is there a Conflict of Interest when Trading with an ECN Broker?

Australian traders may prefer to trade with ECN brokers because there is no conflict of interest between trader and broker. Most market maker brokers will trade against their clients in their role as the counter-party, which means the broker makes money when their clients lose.

Because ECN brokers only act as an intermediary for a trade, they do not make money when traders lose. In fact, the reverse is true. Over time, successful traders pay more in commission to an ECN broker, so ECN brokers want their clients to be profitable.

Do ECN Brokers have Slippage and Requotes?

ECN Brokers have a higher risk of slippage and requotes. Because ECN brokers rely on liquidity providers to match their client’s trades, these trades are not always posted instantly. This can be a problem at times of high volatility – usually after a large event or data release – or at times of low liquidity – such as when most of the markets are closed. This also means that the market can move past your stop-loss orders, and your losses may exceed your expectations.

What Trading Platform can I use with an ECN Broker?

ECN Brokers usually offer MetaTrader 4 (MT4), MetaTrader 5 (MT5) or cTrader. The best ECN brokers will offer all three platforms.

MT4 is the most popular trading platform in the world and is famous for its automated trading via trading robots and signals, but it does not natively support share CFD trading.

MT5, on the other hand, does support share CFD trading, has a wider range of chart tools and lines than MT4 and has a more sophisticated back-testing facility.

cTrader is an ECN-only platform with a more modern interface than either of the MetaTrader platforms, cTrader also features automated trading through custom-made cBots and indicators.

Most ECN brokers will not offer their own trading platforms and prefer to support one or more of the third-party platforms listed above.

What are the Minimum Deposits at ECN Brokers?

The last thing to be aware of with ECN brokers is that they generally require a larger minimum deposit – setting up and maintaining an ECN brokerage is an expensive business and traders will be charged more as a result. ECN Brokers require higher minimum deposits.

Should Beginner Traders use an ECN Broker?

Serious beginners should not be afraid of using a good Australian ECN broker. ECN brokers have a reputation for being more complex and less beginner-friendly than market maker brokers: ECN trading costs are more complicated to calculate, ECN spreads are always variable and can fluctuate wildly at times, ECN trades are more susceptible to rejections and requotes, and ECN brokers tend to require higher minimum deposits and provide less Forex education. All these things can put some beginner traders off, but ECN brokers usually offer lower ongoing trading costs and some of the best Australian ECN brokers will have excellent Forex education and low minimum deposits.

Which is the Best ECN Broker in Australia?

Axi is the best ECN broker in Australia. With competitive pricing on raw spreads, high liquidity, and fast execution Axi won our Award for Best ECN Broker of 2020.

Axi also has a detailed and well-structured course for beginners and leading market analysis for all clients. Axi combines exceptional ECN trading conditions with world-class regulatory oversight. Read our full Axi review here.

All Australian Brokers with ECN Trading Accounts

Here is our list of all ASIC-regulated brokers with ECN trading accounts that we have reviewed – sorted by overall score.

Broker | Broker Score | ASIC License | Regulators | Min. Deposit | Beginner Friendly | Cost of Trading | Trading Platforms | Total # CFDs | No. of FX Pairs | Trading Commission | Compare | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 4.56 /5 Read Review | 335692 |     | AUD 200 | 30:1 | Excellent | USD 8 | MT4, MT5, cTrader, TradingView | 1744 | 64 | 7 USD / lot - Raw Spread Account | |

| 4.44 /5 Read Review | 318232 |     | AUD 0 | 30:1 | Excellent | USD 10 | MT4 | 188 | 70 | 7 USD / lot - PRO account | |

4.43 /5 Read Review | 424700 |     | AUD 0 | 30:1 | Excellent | USD 11 | MT4, MT5, ThinkTrader | 4150 | 46 | 7 USD / lot - ThinkZero Account | ||

| 4.40 /5 Read Review | 286354 |     | AUD 100 | 30:1 | Excellent | USD 7 | MT4, MT5, cTrader, IRESS | 10162 | 70 | 6 USD / lot - RAW Accounts | |

4.35 /5 Read Review | 428901 |     | AUD 50 | 30:1 | Excellent | USD 6 | MT4, MT5, ProTrader | 900 | 46 | 6 USD / lot - ECN Account | ||

| 4.33 /5 Read Review | 426359 |     | AUD 5 | 30:1 | Excellent | USD 7 | MT4, MT5 | 254 | 37 | 6 USD / lot - ECN Account | |

4.33 /5 Read Review | 385620 |    | USD 0 | 30:1 | Excellent | USD 4.50 | MT4, MT5, cTrader | 252 | 85 | 4.5 AUD / lot (EUR/USD) | ||

4.08 /5 Read Review | 403863 |   | AUD 50 | 30:1 | Standard | USD 10 | MT4, MT5 | 2489 | 63 | Fees Included in Spread | ||

| 3.64 /5 Read Review | 417482 |     | USD 50 | 30:1 | Standard | USD 22 | MT4 | 285 | 83 | On select STP/ECN Accounts |

What is the difference between an ECN Broker and a Market Maker Broker?

When you place a trade with an ECN broker, the counter-party to your trade will be a liquidity provider from the broker’s network. When you place a trade with a market maker broker, the broker themselves will be the counterparty to your trade. Market Makers create an artificial market for their clients – hence the name.

Market Makers are also known as dealing desk brokers, as all trades will be filled at the rates set by the broker’s internal dealing desk. This business model, which means a market maker will always profit from their clients’ losses, generates an inherent conflict of interest that many traders are cautious of.

Currently, most well-regulated market makers are well regarded in the industry, despite the conflict of interest, and they go to great lengths to ensure their clients are not being unfairly treated. These would be brokers like IG Markets, FxPro, AvaTrade, XM and eToro.

But, Market Maker brokers are not a common choice for experienced Forex traders in Australia. Traders are limited to trading with one counter-party who is always trading against you and never on the open market with dynamic spreads.

However, if you do want instant execution of your trades and you don’t want to pay a commission, a trusted market maker is a good idea.

How to Identify an ECN Broker?

There are a few ways to check: ASIC-regulated ECN brokers will describe their execution model in their legal documents, ECN brokers will always have variable spreads, ECN brokers will not have any trading restrictions (trade size, stop-loss limits, scalping or hedging bans), and traders with an ECN broker will experience both negative and positive slippage.

Read the Broker Agreement

All regulated brokers are required by law to publish a Client Agreement and Order Execution Policy stipulating their execution methods. Some ECN brokers will also act as Market Maker in certain circumstances, so this is not always a foolproof method of determining a broker type. See below for an extract from Pepperstone’s execution policy showing that they are an ECN broker.

Check that Spreads are Variable

ECN’s offer tight spreads and charge a commission per trade, and the spreads will also be variable. Fixed spreads are only offered by Market Makers, as they are not taken from a live and dynamic market. Below you can see that Axi publishes its live spreads on its website, these are variable and are taken from their network of liquidity providers.

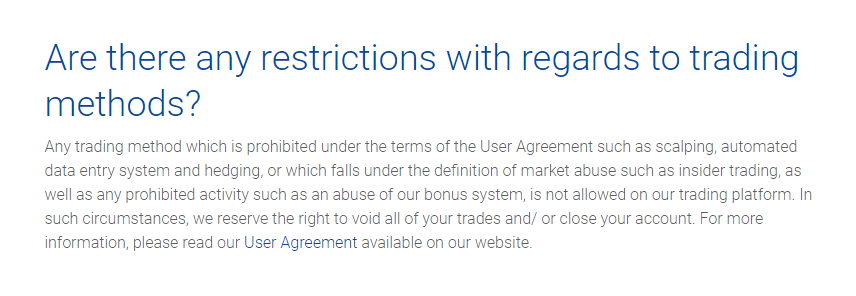

Look for Trading Restrictions

ECN brokers will never restrict your trading methods or trade size. This means that all automated trading, scalping, hedging and large order sizes (anything of 5 lots or over) will all be allowed. If a broker restricts any of these then it is not an ECN broker.

A good example of a broker with these restrictions is Plus500, a well-known market maker:

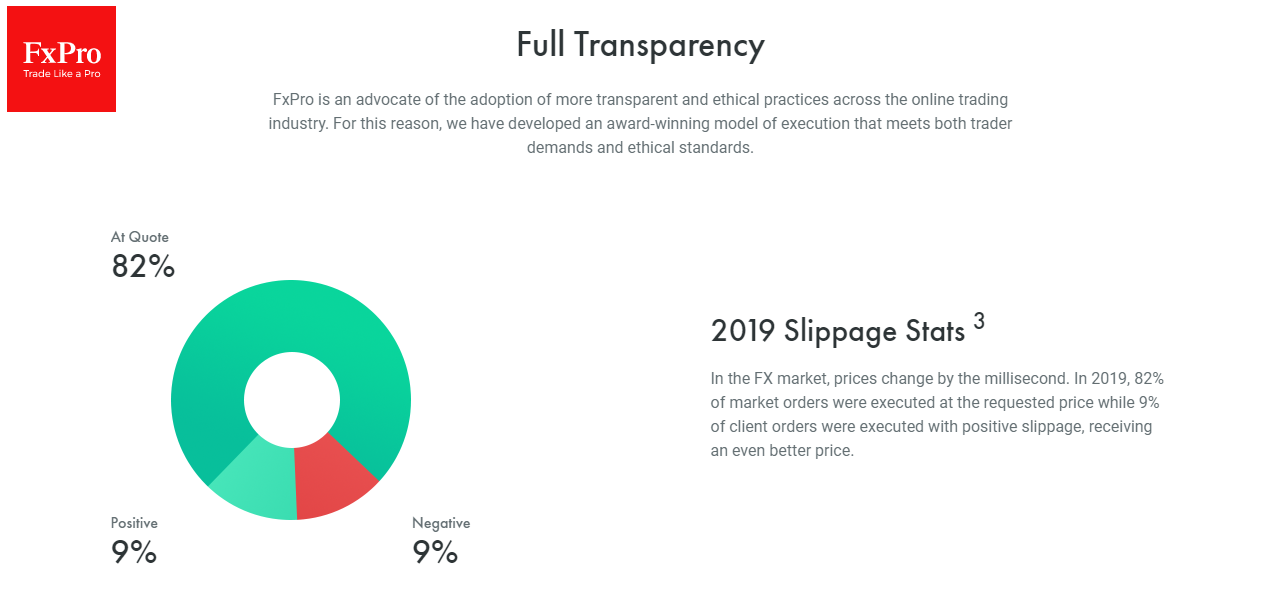

Slippage will be Positive and Negative

Slippage is the difference between the execution price and the order price at the time the order is submitted for execution. Slippage is a normal aspect of trading with ECN brokers, particularly for orders of a larger size and during times of thin liquidity and/or volatile market conditions.

Slippage can both positively and negatively impact your trading position. If you find that you are only experiencing negative slippage, then your broker is not using an ECN execution method. Another well known ECN broker is FxPro, which is dedicated to full transparency and always publishes its slippage statistics, see below for its 2019 figures:

Summary

So, while ECN brokers do not have the inherent conflict of interest present with market makers, a commission will always be charged on your trades. ECN accounts will also require a higher minimum deposit – putting them out of reach for many beginner traders.

Are ECN brokers objectively better than market makers? This is not necessarily the case. All brokers we work with are trustworthy and well-regulated and broker choice is always down to personal preference. Whether you go with an ECN broker or a market maker, if you choose one from our list of the best in Australia you will be in good hands.

FAQs

What is the difference between an ECN Account and a Standard Account?

ECN Accounts will have tighter spreads than a Standard Account, but you will have to pay a commission per trade. Standard Accounts will not have any commission, but spreads will be wider.

How do ECN Brokers Make Money?

ECN Brokers make money by charging traders a commission per trade. Because they pass pricing on directly from their liquidity providers, they do not charge a fee in the spread.

Which is better, ECN Brokers or ECN/STP Brokers?

ECN/STP brokers are better because they will have less slippage and a faster execution speed than a pure ECN broker.

STP (Straight Through Processing) is the method of the transaction – with STP your order is sent directly to the counterparty through the Financial Information Exchange (FIX) protocol. The FIX protocol decreases trade execution time, reduces slippage, and ensures that traders get the best available pricing.

The STP protocol can be used by market-maker brokers as well as ECN brokers, and some brokers use a hybrid formula, where they will sometimes be the counterparty, and other times use an external liquidity provider. While this does lead to less slippage, it does mean that some trades will have a conflict of interest.

In most cases choosing a hybrid broker is the best way to go, as they will give you the most options.

Forex Risk Disclaimer

Trading Forex and CFDs is not suitable for all investors as it carries a high degree of risk to your capital: 75-90% of retail investors lose money trading these products. Forex and CFD transactions involve high risk due to the following factors: Leverage, market volatility, slippage arising from a lack of liquidity, inadequate trading knowledge or experience, and a lack of regulatory protection. Traders should not deposit any money that is not considered disposable income. Regardless of how much research you have done or how confident you are in your trade, there is always a substantial risk of loss. (Learn more about these risks from the Australian regulator, ASIC or the UK’s regulator, the FCA).

Our Rating & Review Methodology

Our overall Forex Rankings report and Directory of CFD Brokers to Avoid are the result of extensive research on over 180 Forex brokers. These resources help traders find the best Forex brokers – and steer them away from the worst ones. These resources have been compiled using over 200 data points on each broker and over 3000 hours of research. Our team conducts all research independently: Testing brokers, gathering information from broker representatives and sifting through legal documents. Learn more about how we rank brokers.

Editorial Team

Chris Cammack

Head of Content

Chris joined the company in 2019 after ten years experience in research, editorial and design for political and financial publications. His background has given him a deep knowledge of international financial markets and the geopolitics that affects them. Chris has a keen eye for editing and a voracious appetite for financial and political current affairs. He ensures that our content across all sites meets the standards of quality and transparency that our readers expect.

Alison Heyerdahl

Senior Financial Writer

Alison joined the team as a writer in 2021. She has a medical degree with a focus on physiotherapy and a bachelor’s in psychology. However, her interest in forex trading and her love for writing led her to switch careers, and she now has over eight years experience in research and content development. She has tested and reviewed 100+ brokers and has a great understanding of the Forex trading world.

Ida Hermansen

Financial Writer

Ida joined our team as a financial writer in 2023. She has a degree in Digital Marketing and a background in content writing and SEO. In addition to her marketing and writing skills, Ida also has an interest in cryptocurrencies and blockchain networks. Her interest in crypto trading led to a wider fascination with Forex technical analysis and price movement. She continues to develop her skills and knowledge in Forex trading and keeps a close eye on which Forex brokers offer the best trading environments for new traders.

Stay updated

This form has double opt in enabled. You will need to confirm your email address before being added to the list.