For over a decade, FxScouts has been reviewing forex brokers and providing in-depth analyses. Our extensive research and unique testing methodology ensures that all broker reviews are accurate and fair, with hundreds of thousands of data points generated annually. Since 2012, we’ve tested over 180 brokers across global and Australian markets. Our team of professionals are frequently cited in global and regional media, shaping market conversations and trends.

-

MetaTrader 4 Brokers

The top MT4 brokers in AU

-

MetaTrader 5 Brokers

The best MT5 brokers in AU

-

TradingView Brokers

The best TradingView brokers

-

cTrader Brokers

The top cTrader brokers in AU

-

Forex Trading Apps

Trade on the go from your phone

-

Copytrading Brokers

Copy professional traders

-

All Trading Platforms

Find a platform that works for you

75-90% of retail traders lose money trading Forex and CFDs. You should consider whether you understand how CFDs and leveraged trading work and if you can afford the high risk of losing your money. We may receive compensation when you click on links to products we review. Please read our advertising disclosure. By using this website you agree to our Terms of Service.

Introduction to Equity Trading

Equities, also known as stocks or shares, are issued by companies to raise capital which they can use to invest in their business. In return for the money they pay for these equities, investors get a stake in the company and a share in its profits in the form of dividends, as well as the ability to vote at general shareholder meetings. Once the shares have been issued in what is called the “primary market”, they are traded on stock exchanges, or the “secondary market”, where their price moves in response to a wide variety of factors.

There are a huge number and variety of shares listed on the world’s major stock markets, ranging from small, newly-formed businesses to long-established giants whose brands are household names. They cover all economic activities and regions. The total worldwide value of equity trading in the second quarter of 2021 was US$37.7 trillion, so the market in many stocks is vast and highly liquid, i.e. it is easy to buy and sell stocks.

What is equity trading?

Equity prices fluctuate, sometimes significantly, throughout the day; shares in very large companies are traded around the clock on the world’s major stock exchanges. It is possible to make a living buying and selling equities. All you need is an account with a broker and a laptop, desktop or mobile device to access the broker’s platform.

The platform links buyers and sellers. It allows you to buy and sell a range of financial instruments, including equities and offers a variety of tools that can help you trade. These include news feeds providing live information on companies, politics and economics (i.e. anything that might influence stock prices), as well as educational material and the ability to create or access charts that can highlight patterns and signals suggesting it might be a good time to buy or sell a stock.

Drivers of equity prices

Earnings or profits

Profitability and the outlook for profit growth are among the key factors influencing share prices. Companies are required to produce regular reports showing their recent profits (also called earnings), current cash flow, and performance forecasts. These reports are scoured by investors and can have a significant impact on the share price. Investors and analysts also follow external influences for clues as to the direction of future profit growth.

Economic factors

Movements in the price of oil, for example, will clearly have an important impact on the share price of a major oil producer. A sharp rise in the oil price will provide a significant boost to profit growth, while a decline will have the opposite effect. But lower oil prices will be good for other companies. Shares in a road haulage business might go up, for example, if oil prices fall, because that would reduce one of its main costs, thus boosting profits. New product launches, changes in government regulation, faster economic growth and lower interest rates can also influence share prices.

Some sectors, for example, are particularly sensitive to the economic environment. Housebuilders are among these “cyclical” businesses. Faster economic growth is likely to lead to a strong job market and higher wages. That, in turn, encourages consumers to feel confident about their future and makes them more likely to take on significant debt, such as a mortgage, boosting demand for housing. The same goes for cars, holidays (boosting the travel business) and the restaurant business.

Conversely, some companies are focused on basic goods that people tend to buy whatever the economic environment. These products include the likes of toothpaste, shampoo, household cleaners, food stuffs, and utilities such as energy. Companies in these consumer-staple sectors are sometimes described as “steady eddies” because they produce reliable if modest growth year in, year out, and they generally return a relatively large amount of cash to shareholders in the form of dividends. For this reason, they are regarded as good “income” stocks. The price of these companies’ shares is likely to prove relatively stable whatever the economic environment, so investors refer to them as “defensive” stocks.

Then there are new companies exploiting emerging trends. These tend to require a lot of cash for capital investment and tend to lose large amounts of money in their early years. They are often found in highly competitive sectors where a lot of entrepreneurs are chasing the pot of gold at the end of the rainbow, so their share price tends to be highly volatile, reflecting a binary outlook: they could prove wildly successful or they could disappear without trace.

A good current example is those companies that are seeking to corner the quick-commerce sector, which has exploded during the COVID-19 pandemic. The German-based business Delivery Hero, for example, aims to deliver goods in as little as 10 to 15 minutes. Demand is exploding: the company recently forecast revenues in a range of €6.1 billion to €6.6 billion for 2021, compared with €2.8 billion (US$3.38 billion) last year.4 The firm (which currently operates in about 50 countries) and others like it are investing heavily in relatively small warehouses in city centres to serve local customers ordering online.

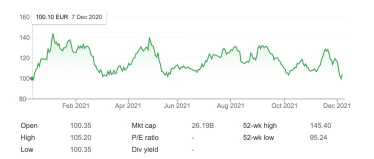

As can be seen in Figure 1, Delivery Hero’s share price has swung wildly in 2021, reaching as low as €95.24 and as high as €145.40 as investors and traders try to gauge the outlook for the company.

Figure 1: Delivery Hero share price, 2021

The political environment

Politics is another key influence on share prices. This has been highlighted by the COVID-19 pandemic, as governments have introduced tight restrictions on people’s movements to try to contain the virus. Confining people to their homes has led to exploding demand for the services of technology companies such as Google, Amazon and Microsoft, while the share prices of travel companies such as airlines have collapsed.

On a more prosaic level, government regulators often intervene in markets simply to protect consumers, and this may weigh on profit growth. Governments may limit the extent to which companies in the energy sector, for example, can increase their prices.

Takeover bids

Merger and acquisition activity can also have a profound impact on share prices. Companies grow either naturally or through acquisition, and acquiring a company has the appeal of delivering growth very quickly. When a company launches a takeover bid, it normally does so by offering a premium on the current share price in order to conclude the deal as quickly as possible, before other suitors emerge. So, if you buy shares in a company that you think could become a takeover target, and a bid materialises, you could be sitting on a very healthy profit.

The various ways of trading equities

There are a variety of ways in which traders can seek to exploit movements in share prices, as well as simply buying shares on the stock market. These include using Contracts for Difference (CFDs, which are discussed in detail in the next section), options, futures, exchange-traded funds (ETFs) and other funds.

An option is an agreement between two parties to facilitate a potential transaction involving an asset at a preset price and date. However, while the buyer of an option has the right to purchase or sell a specific quantity of the underlying asset (a stock in this case) at a predetermined price and time in the future, they are not obliged to do so. Options are available on most individual stocks in the US, Europe and Asia.

There are two types of option: “call” options (where the owner of the option has the right to buy the underlying asset) and “put” options (where the owner of the option has the right to sell the underlying asset).

For example, imagine you buy a call option on Microsoft with a strike price of US$350 and an expiration date of 16 January. This option would give you the right to purchase 100 shares in Microsoft at a price of US$350 by 16 January, and you would clearly only wish to exercise the option if Microsoft is trading above US$350 at that time.

You pay a price (known as a premium) to buy an option, and this represents your total risk, because you cannot lose more than you pay for any put or call option.

Imagine a trader buys a call option on ACME stock with a strike price of US$25. They pay US$150 for the option. On the option’s expiration date, ACME’s share price has risen to US$45. The buyer/holder of the option exercises their right to purchase 100 shares of ACME at US$25 a share (the option’s strike price), and then immediately sells the shares at the current market price of US$45 each.

The trader paid US$2500 for the 100 shares (US$25 x 100) and they sold the shares for US$4500 (US$45 x 100). That means their profit amounts to US$1850 (US$4500 minus US$2500 = US$2000, minus the US$150 premium paid for the option).

Alternatively, you could trade via a futures contract, which is an agreement to buy or sell something (like a particular stock or commodity) at a future date. All contracts are closed each day, and traders make a profit based on the difference between the price at which they buy the contract and the price at which they sell it.

You could also trade the stock market using ETFs. These replicate a financial instrument such as a stock index. There is a huge range of ETFs in the market. So, you could trade ETFs that replicate the FTSE 100 or S&P 500 indices, or a particular segment of the market, such as shares in hydrogen companies.

Why trade equity CFDs?

Contracts for Difference (CFDs) are one of the most popular ways of trading shares, and it is easy to see why given all the advantages they offer. CFDs allow traders to bet on short-term price movements in a wide variety of financial assets, from currencies to shares to commodities, without actually owning or taking physical delivery of the assets. They are contracts between a buyer (such as an individual trader) and a seller (such as a broker, investment bank or spread-betting firm), under which the two parties agree to exchange the difference in the value of an underlying financial instrument between the time the contract opens and the time it closes – often over less than one day.

CFDs benefit from several features that make them uniquely valuable to individual traders.

Convenience

A CFD is known as a derivative product, because it derives its price from an underlying instrument or product. CFDs allow you to trade the underlying asset (e.g. the Microsoft share price) without taking physical ownership of the stock.

Maximise your potential gains through leverage

Moreover, CFDs are leveraged products, so you don’t have to deposit the full value of a trade to open a position. The deposit is called your margin, and CFDs tend to come with high levels of leverage, which translates into low margin requirements. So, if your broker offers you 50:1 leverage on a US$50,000 CFD position in Microsoft, you will be required to deposit only US$1000 into your account to open the full US$50,000 contract. This means that you can gain significant exposure to Microsoft or any other stock for only a fraction of the amount you would need to buy the stock outright.

For example, imagine that a trader believes the price of ACME is about to go up. They enter into a contract with a CFD broker, agreeing to buy US$50,000 in an ACME stock CFD contract. But the broker lets the trader put up just 5 per cent of the US$50,000 overall value of the contract, or US$2500. (In this example, the broker is offering 20:1 leverage.) The price of ACME’s stock increases by 10 per cent during the day, so the overall value of the contract rises to US$55,000, giving the trader an overall profit of US$5000, or double their US$2500 outlay.

Profit from falling and rising markets

You can use CFDs to bet that the price of a stock will rise (called going “long” in the jargon) or that it will fall (a “short” position). The latter involves selling CFDs you don’t actually own and then buying them after the price falls so that you can complete the contract you made to sell them at the higher initial price.

Suppose you believe the price of ABC stock will fall. You agree to sell a US$50,000 ABC stock CFD contract in the belief that you will be able to buy it back later in the day at a lower price. Again, you do so using the 20:1 leverage offered by the broker, so your initial outlay is just US$2500. By the end of the trading day, the price of ABC has indeed fallen, and the CFD contract is now worth US$45,000. That is when you step in and buy to fulfil your earlier agreement to sell the contract at US$50,000. Again, you have made US$5000, or double your initial outlay.

Moreover, there are no limits on using CFDs to short financial instruments. By contrast, some markets in particular instruments have rules that prohibit shorting or require the trader to borrow the instrument before selling short, or have different margin requirements for short and long positions, making it difficult to balance positions.

Flexibility

You can close a position at any time during the trading day. This means that you can hold a position for as long as you want, be it seconds, minutes or hours. You can even hold a position overnight, although there will be a charge for doing so.

Moreover, many brokers offer a variety of options when it comes to trade size, allowing a wide range of traders to access the market. This includes beginners and casual traders seeking to experiment with investment strategies while limiting their risk by focusing on small trades.

Ability to hedge

Most people are familiar with the term “hedging your bets” and understand that it involves offsetting risks. Well, it means exactly the same thing in the financial world and is derived from the age-old idea of using a hedge – or fence – as a means of protection. In this instance, you can use CFDs as a way of offsetting your trading positions with balancing trades in case your beliefs about whether those initial positions are likely to rise or fall prove wrong.

CFDs are ideal hedging tools because you can use them to bet that an instrument will rise or fall at a relatively low cost. So, you can take a long position in ABC stock that will profit should the price rise, while taking out a short position that will prove profitable should the price fall. In other words, instead of selling ABC stock at a loss should your expectation of the price moving higher prove wrong (and draining your limited financial resources in the process), you can open an additional short position that will generate earnings to help offset any losses from your initial position.

You can also use CFDs to insure against a rise or fall in any investment you have other than CFDs. Suppose, for example, you have a standard portfolio of shares in global equities that you wish to keep invested for the long term. Now imagine you anticipate that global equities will soon encounter turbulence and fall sharply before correcting. You could sell all the shares in your portfolio in the belief that you’ll be able to buy them back at a much lower price. But that could prove costly in terms of transaction expenses and taxes, and it is risky: global equities might rise sharply and you might not then be able to buy them back at a lower cost.

Alternatively, an investor fearing a market correction could short-sell an equivalent amount of CFDs in the same shares, enabling them to take advantage of the short-term downtrend. At the same time, the investor continues to hold the shares within the investment portfolio in the belief that they will thrive in the long term.

Trading vs investing in equities

Large institutions such as pension funds and insurance companies invest heavily in equities. They also employ armies of analysts to follow individual companies and sectors and to try to forecast their outlook.

Institutional and individual investors buy shares for two main reasons: to benefit from capital appreciation and/or to receive income in the shape of dividends. The latter are regular payments that companies make to shareholders out of their profits. Many investors adopt a “buy and hold” approach, i.e. they find a company they like and invest in its shares for the long term. This article is concerned with traders, rather than investors, i.e. those who believe they can spot anomalies in share prices that have been overlooked by other investors and make a profit in the short term.

Advantages of equity trading

- The stock market is vast, consisting of hundreds of thousands of companies located all around the world and involved in every field of economic activity.

- The costs involved can be relatively low if you use instruments such as CFDs or options to trade stocks, and there are lots of brokers to choose from.

- It is relatively easy to understand the ways in which you can trade the market. A vast amount of information is available to would-be traders, ranging from basic guides on how to get started, to videos and books outlining potentially profitable trading strategies. Most good newspapers carry financial information pages featuring movements in the stock market as a whole and prices for some individual stocks, or you can take out a subscription to a specialist publication such as the Financial Times or Wall Street Journal.

- You can trade from your living room using a fairly basic computer if you download the appropriate trading software, and it is relatively easy to set up an account with a broker.

- If you trade CFDs, you can also exploit the concept of leverage, where you make use of borrowed money to increase your potential profits – although you should be aware that leverage also dramatically increases your risk. There are methods you can use to contain risk, but that is a topic for another article.

Disadvantages of equity trading

Commitment

Stock trading requires a considerable commitment. It takes time to learn how to trade profitably, and when you start to trade you may have to spend many hours per day on your computer screen following and researching what is happening in the market – and why – in preparation for your trading day. When that day is finished, you will need to analyse what happened and why your trading activities succeeded or failed, so that you can apply the lessons learnt to the next day’s trading. There could be days when you lose money and it is easy to become disheartened. There is certainly no guarantee of success.

Stock trading can also be risky. You may lose money or you may simply find that it is not something you like or have the temperament for. You have to be patient, for example, when waiting for opportunities to arise, and the market can experience bouts of extreme volatility that you may find highly stressful.

Leverage

Leverage is a double-edged sword. Suppose, using the earlier example, you agree to buy US$50,000 in a stock CFD contract, and the broker lets you put up just 5 per cent of the overall contract value, or US$2500. However, this time the share price falls by 10 per cent, so the overall value of the contract drops to US$45,000. Now you have turned your US$2500 outlay into a whopping US$5000 loss.

Moreover, if the capital in your account falls below a certain level, you may be subject to a “margin call”, where the broker asks you to put up additional funds to balance the account. If you fail to do so, the broker may close your positions, so crystallising your losses.

You can protect against potential losses to a certain degree. Brokers such as CMC Markets, for example, incorporate negative-balance protection into retail accounts, so your losses will be limited to the value of the funds in your account.

Constant monitoring

You need to be alert to changes in your position at all times. Market volatility and rapid changes in price – which could arise outside normal business hours if you are trading international markets – can cause the balance of your account to change quickly. If you do not have sufficient funds in your account to cover these situations, your positions will be automatically closed.

Market volatility and gapping

Financial markets can be very volatile and the prices of financial instruments can rise or fall precipitately at times, jumping to a much lower or higher price rather than moving gradually. This is called gapping and it can have a significant impact on traders.

For example, traders may use stop-loss orders to limit losses. This involves specifying a price at which your position closes out if an instrument’s price goes against you. When gapping occurs, however, those stop-loss orders may be executed at unfavourable prices – either higher or lower than you may have anticipated, depending on the direction of your trade.

It is easy to take on too much risk

Because the cost of trading equity CFDs is low, due to leverage, it is easy for investors to be lulled into a false sense of security and take on more trades than is prudent. This can leave them overexposed to the markets at any given time, such that their remaining capital would be insufficient to cover losses across the portfolio. If multiple positions go wrong, it can spell financial ruin for those who adopt a less than cautious approach to CFD trading.

Equity trading fees

There are a number of fees and costs associated with trading stock CFDs. As explained earlier, when you open a CFD trade you must pay a portion of its full value up front. This deposit is called the margin, and the percentage you have to pay on the overall value of the trade will affect the affordability of your trading.

Commission and spread

The costs of CFD trading include the commission charged by the broker and the spread, i.e. the difference between the bid and offer prices at the time you trade.

A commission (normally around 0.10 per cent) is charged when you buy or sell a CFD on shares. The commission charge varies depending on the country where the share product originates.

However, commissions are not charged on other products, such as CFDs on foreign currency, indices, cryptocurrencies, commodities (e.g. gold) and treasury instruments.

The spread is the way the broker earns money when dealing in non-share CFDs. It is simply the difference between the price at which you can buy a CFD and the price at which you can sell that same CFD at the same moment. The price at which you buy (bid price) is always higher than the price at which you sell (ask price), and the underlying market price will generally be in the middle of these two prices. Trading spreads add costs to a trade and will fluctuate along with an asset’s price and trading volume.

Financing charge

If you hold a long position, you will also be charged interest to hold that position overnight. This is referred to as a financing charge and is calculated as the current overnight interest rate charged by the major banks plus 2 to 3 per cent. If you hold a short position overnight, you will receive a payment of the current overnight interest rate minus 2 to 3 per cent.

For example, the broker IG says that for long positions it charges 2.5 per cent above the relevant interbank rate, so if the relevant interbank 1-month rate is 0.5 per cent, you would be charged 3.0 per cent. For short positions, traders receive the relevant interbank rate minus 2.5 per cent. So, if the interbank rate is greater than 2.5 per cent, IG will credit your account. But if the interbank rate is less than 2.5 per cent, your account will be debited. As an example, if the relevant interbank 1-month rate was 0.5 per cent, you would be charged 2.0 per cent (annualised).

Weekend fees

You will be charged extra if you keep a position open over the weekend, as opposed to overnight.

Withdrawal fee

Some brokers may charge a fee to withdraw money. eToro, for example, says that it charges US$5 for withdrawals “to cover some of the expenses involved in international money transfers”. The fee may vary depending on the currency involved. Some brokers may offer a set number of free withdrawals per month.

Conversion fees

Some brokers will charge a fee to convert one currency into another. eToro gives an example of around a US$10 cost to convert a deposit of £2000 into US dollars.

Inactivity fee

A fee may be charged if an account goes unused for a set period. One broker, for example, charges a US$10 monthly inactivity fee on any remaining available balance if there has been no login activity for more than 12 months.

Equity trading strategies

News trading

This strategy involves trading based on news and market expectations, both before and following news releases. You will have to act quickly and be able to make a quick judgement on how to trade a new announcement or piece of data. You will also have to be able to judge whether the news is already factored into the stock price and whether the news matches investor expectations.

The advantage of this strategy is that corporate economic and political news happens all the time, so there are always possible trading opportunities. The disadvantage is that you need considerable expertise in how markets operate and how to interpret data and news.

End-of-day trading

According to the broker CMC Markets, this style of trading requires less time commitment than other trading strategies because there is only a need to study charts at their opening and closing times.

End-of-day trading involves buying or selling near the close of the market, when it becomes clear that the price is going to “settle”. The strategy focuses on studying the current day’s price compared with the previous day’s price movements, and using that as a guide to how the market is likely to move. Traders can use various tools to limit their overnight risk, such as setting a take-profit order or a stop-loss limit.

Technical analysis

Some traders believe that prices for stocks (and other financial instruments) move in particular patterns. They rely on indicators to determine when a trend is taking hold and then trade on the basis that that trend will continue.

Technical-analysis traders begin by seeking to understand where the price is heading according to the fundamentals of supply and demand. (For example, if we are in a period of rising interest rates, the price of stocks, in general, will probably fall, since those higher borrowing costs will cool economic activity.) They then use charts that detail previous highs and lows, trend lines and patterns.

When the price of a stock is rising, a significant previous high above the current level will be an obvious target, as will an important previous low when the price is falling. Also, in an uptrend, a line on the chart connecting previous highs will act as resistance when above the current level, while a line connecting previous lows will act as support – with the reverse true in a falling market.

Swing trading

Swing trading is a style of trading that focuses on short-term trends in a stock (or other financial instruments) over a period of a few days to several weeks. Swing traders rely on technical analysis to find trading opportunities and then focus on taking small gains and cutting their losses quickly. If this is done consistently over time, relatively small gains can compound into excellent annual returns.

Swing traders should focus on the most actively traded stocks that show a tendency to swing within broad, well-defined limits. It’s a good idea to focus on a select group of stocks and ETFs, and monitor them daily, so that you understand the price action they generally exhibit.

According to the investment broker Fidelity, there are a number of ways to capitalise on market swings. The company says that some traders opt to trade after the market has confirmed a change of direction, and trade with the developing momentum. But others, it adds, may “choose to enter the market on the long side after the market has dropped to the lower band of its price channel—in other words, buying short-term weakness and selling short-term strength”. Both approaches, says Fidelity, can be profitable if implemented with skill and discipline over time.

Momentum trading

This strategy can be deployed across a range of financial instruments, including stocks. According to CMC Markets, it is a strategy that is very popular with short-term traders. It runs counter to the old stock-market adage that you should “buy low and sell high”, focusing instead on buying high and selling even higher.

Momentum trading focuses on price action and price movements, seeking to capitalise on a new directional trend, rather than fundamental factors such as company results or economic growth. For example, if a stock suddenly surges upwards after the company announces unexpectedly strong profit growth, a momentum trader might try to buy shares and ride the stock’s price higher.

Equity trading tips

Traders can make consistent profits from trading stocks, but preparation is key. Follow these tips and you will maximise your chances of trading equities successfully.

Use a demo account

All good brokers offer demo accounts where you can practise trading using virtual money. You can learn how the market works, how to place buy and sell orders, and how to deploy strategies, etc. at no risk to yourself. Do this for as long as you can. If you are consistently making a profit, it might be time to sign up for a real account.

Educate yourself

Good brokers offer lots of educational material on their platforms. There is also much material on the internet – including videos and examples of trades – that can help you learn all you need to know to trade successfully.

Don’t get emotional

Trading can be very stressful. Using a demo account can help you to decide whether the stress of losing money is for you or not. It is important to keep your cool when the market turns against you and know when to exit a position and accept your losses.

How to begin trading equities

All you need to do to start trading equities is to find a broker that you like and open an account. This is simple and can be done online. You will be asked to provide proof of identity and a deposit.

You can use either an onshore broker regulated in Australia or an offshore broker. You are likely to be better protected if you use an onshore broker, since they will be regulated by a reputable authority such as the Australian Securities and Investments Commission (ASIC) in Australia. If things go wrong and your broker is registered in a country thousands of miles away, it might be difficult to gain legal redress.

However, there are advantages to using an offshore broker. The main advantage is that you won’t be subject to the same restrictions as when using an Australia-based broker regulated by ASIC.

There are things you should consider whether you use an ASIC-registered broker or one based offshore. These include:

- The trading experience – is the trading platform easy to use, what kind of support do they offer, and are there tools that can help with research, etc?

- Trading costs and transparency – these can vary widely from broker to broker. Some charge a fixed commission regardless of how much you trade, while others charge a fee based on trading volume (the higher the volume, the greater the commission). Other brokers don’t charge a commission but instead charge a spread fee. It is also important to be aware of the hidden fees some brokers charge, such as inactivity fees, monthly or quarterly minimums, and fees associated with calling a broker on the phone.

- Customer service – you can trade 24 hours a day, five days a week, but does the broker offer 24-hour support? Is help available instantaneously online or via the phone, or do you have to wait for a response? You can check by calling the broker at different times of the day before signing up.

- Minimum deposit – this can vary from just US$1 to US$300, but most brokers let you open an account with around US$100.

- Maximum leverage – there is a standard 30:1 ratio for Australian forex brokers regulated by ASIC, but offshore brokers can offer higher levels of leverage. Some provide a 500:1 ratio.

FAQs

How do you trade equities online?

Simply sign up with a broker and you can begin trading equities via their platforms, which are accessible through mobile and web-based apps.

What moves equity markets?

A whole range of factors move markets: from company-specific news concerning the health of the underlying business, management changes, the launch of new products and the fortunes of competitors, to wider developments such as the general state of the economy and society. New technological developments can also create opportunities for new businesses and threaten existing firms.

When can I trade equities?

You can trade around the clock, five days a week, across the major global markets, such as the New York, London, Hong Kong and Tokyo stock exchanges.

How do you trade or invest in equities?

You can trade in or invest in equities either directly (by buying the stock itself) or through other instruments, such as options, futures and CFDs. Or you can trade the whole market or a particular segment of it via ETFs.

Can you short equities?

Yes, you can profit from falling stock prices through CFDs.

How much leverage can you apply to equity trades?

Usually, around 30:1, although offshore brokers may offer higher levels of leverage.

What’s the minimum amount needed to trade equities?

You can open an account with US$100 or even less in some cases.

Forex Risk Disclaimer

Trading Forex and CFDs is not suitable for all investors as it carries a high degree of risk to your capital: 75-90% of retail investors lose money trading these products. Forex and CFD transactions involve high risk due to the following factors: Leverage, market volatility, slippage arising from a lack of liquidity, inadequate trading knowledge or experience, and a lack of regulatory protection. Traders should not deposit any money that is not considered disposable income. Regardless of how much research you have done or how confident you are in your trade, there is always a substantial risk of loss. (Learn more about these risks from the Australian regulator, ASIC or the UK’s regulator, the FCA).

Our Rating & Review Methodology

Our overall Forex Rankings report and Directory of CFD Brokers to Avoid are the result of extensive research on over 180 Forex brokers. These resources help traders find the best Forex brokers – and steer them away from the worst ones. These resources have been compiled using over 200 data points on each broker and over 3000 hours of research. Our team conducts all research independently: Testing brokers, gathering information from broker representatives and sifting through legal documents. Learn more about how we rank brokers.

Editorial Team

Chris Cammack

Head of Content

Chris joined the company in 2019 after ten years experience in research, editorial and design for political and financial publications. His background has given him a deep knowledge of international financial markets and the geopolitics that affects them. Chris has a keen eye for editing and a voracious appetite for financial and political current affairs. He ensures that our content across all sites meets the standards of quality and transparency that our readers expect.

Alison Heyerdahl

Senior Financial Writer

Alison joined the team as a writer in 2021. She has a medical degree with a focus on physiotherapy and a bachelor’s in psychology. However, her interest in forex trading and her love for writing led her to switch careers, and she now has over eight years experience in research and content development. She has tested and reviewed 100+ brokers and has a great understanding of the Forex trading world.

Ida Hermansen

Financial Writer

Ida joined our team as a financial writer in 2023. She has a degree in Digital Marketing and a background in content writing and SEO. In addition to her marketing and writing skills, Ida also has an interest in cryptocurrencies and blockchain networks. Her interest in crypto trading led to a wider fascination with Forex technical analysis and price movement. She continues to develop her skills and knowledge in Forex trading and keeps a close eye on which Forex brokers offer the best trading environments for new traders.

Stay updated

This form has double opt in enabled. You will need to confirm your email address before being added to the list.