-

MetaTrader 4 Brokers

The top MT4 brokers in AU

-

MetaTrader 5 Brokers

The best MT5 brokers in AU

-

TradingView Brokers

The best TradingView brokers

-

cTrader Brokers

The top cTrader brokers in AU

-

Forex Trading Apps

Trade on the go from your phone

-

Copytrading Brokers

Copy professional traders

-

All Trading Platforms

Find a platform that works for you

What Is A Trading Plan?

A trading plan is going to help you decide on how Forex trading fits into your life.

- Define who you are as a trader

- Get consistency in your trading style

- Establish when to trade

- Pinpoint trading strategies

- Help you reach your goals.

How To Create A Trading Plan

Your trading plan will define you as a trader. Developing a trading plan will give you a chance to think about what kind of trader you are, and what that trader does differently. Different types of traders will rely more on one set of tools than another, trade at different times of the day, and hold trades for longer periods. If you will excuse the analogy, this is similar to when a chef starts their cooking career. Before they can choose their recipes, they first need to understand what a chef’s lifestyle is like, and the recipes their chosen cuisine will dictate. Creating a trading plan will consider the trader profile that suits your trading style, and how that dictates the kind of trades you make, and the time of day you make them. If you’re planning to generate an income from trading, creating a trading plan is the first step before making your initial trade.

Know Your Trader Profile

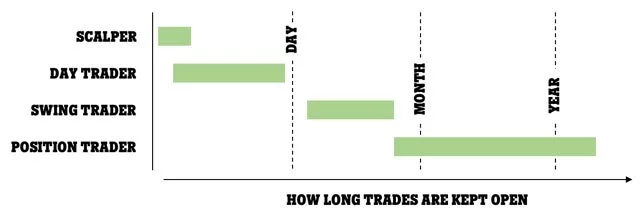

Trader profiles are very different and will dictate what type of trader are you going to become.

- The Scalper – the scalper, often keeps trades open for a brief period and trades the market in times of very high volatility.

- The Day Trader – the day trader closes all positions at the end of every day, with each day as a different trading day.

- The Swing Trader – this swing trader will keep trades open for days at a time and makes a profit from wide swings in the market.

- The Position Trader – The position trader who holds positions open the longest of all traders. Once an investment is made, the position could be kept open for months or even years.

Know What Is Expected

Each of these trader profiles is different – with a different set of goals, risk aversion, and time commitment. While each of these traders is placing trades on the market, what makes them most different from each other is the length of time they leave their trades open.

The Day Trader: Day trading is slightly less risky than scalping and ideal for those who like to see their profit at the end of every day. This strategy is not for newcomers, and not for traders who hope to leave their trades unattended while at work. This option is also good for traders who can not trade every day of the week but can still commit a full day to their trading.

The Swing Trader: Swing trading is a better setup for the beginner trader. Progress will be visible in your account over a couple of days. Swing trading is an opportunity for a trader to set up fewer but better trades, which suits a trader who is still learning. If you are making longer trades, hoping to make a profit from swings in the market, make sure you have a well-funded account so you don’t get a margin call by your broker at a time when closing your trade could mean a loss on your account.

The Position Trader: Position trading is for someone who has limited time, and more ideal for those who spend long hours commuting that can be used for research. The downside of position trading is that much of the time your capital is going to be locked up in trades, so it limited your ability to jump on explosive trends to make a quick profit.

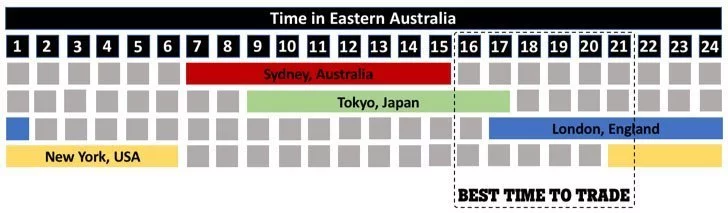

Decide When To Trade

Every trader will trade preferred currency pairs which will dictate the markets and thus the time of day they will trade. To turn a profit from Forex trading, there is needs to be the volatility of prices on the market. The market opens, and the major sessions will create the volatility needed to find profitable trading opportunities. The FX Market is open over the five-day work week, so it is important to match your trading plan with the markets that are open. The most common period Eastern Australians trade is between 4 pm and 10 pm as this gives traders the opportunity to trade the close of the Tokyo session, the open of the London session and the open of the New York session.

Executing on your Trading Plan

Develop Positive Habits

It is important to develop positive habits in Forex trading, as they put the trader in the right frame of mind. Successful trading is all about repeating the same profitable techniques, without emotions getting in the way of a process.

Know Your Trading Strategy

Your trading plan will define the rules by which you trade. This will include when to enter and exit trades, which timeframes to trade, if to chase the market and how to establish your appetite for risk. Articles on strategy can be found in our education section, but perhaps best to start with these Forex trading tips for beginners.

Risk Management

Risk management is the cornerstone of a successful trading plan. While risk management has a lot to do with the strategy you trade with, it also has to do correctly assessing position size, and risk to reward ratio. Money management can be broken into three parts.

- Plan your risk exposure, or how much your willing to risk on any one position. It’s generally advised not to risk more than 1-2% of your trading capital on any given trade.

- Manage your stop losses, so if the market goes against your position, your trading platform will automatically close your trade and limit your losses.

- Diversify your trades. Some currency pairs are correlated, and it is import to spread portfolio risk around.

Fine-tune Your Trading Plan

Fine-tuning your trading plan is critical. This includes backtesting your strategy, keeping records so you can track trading performance over time. Use this to adjust your strategy when necessary, as this adjustment is vital to profit from markets that are constantly changing. Revisit your trading plan every 3-6 months depending on the amount of time you have been able to set aside for trading. As you get more experienced, you might want to start trading shorter periods or expand the set of currency pairs that you are trading. Regardless of if you update your plan or not, a trader should continually come back to make sure that your results are in line with the plan.

Stay updated

This form has double opt in enabled. You will need to confirm your email address before being added to the list.