-

MetaTrader 4 Brokers

The top MT4 brokers in AU

-

MetaTrader 5 Brokers

The best MT5 brokers in AU

-

TradingView Brokers

The best TradingView brokers

-

cTrader Brokers

The top cTrader brokers in AU

-

Forex Trading Apps

Trade on the go from your phone

-

Copytrading Brokers

Copy professional traders

-

All Trading Platforms

Find a platform that works for you

These are the top seven tips for new traders to become more organised and profitable. In order to start trading as a successful trader, you will need to learn how to:

- Prepare your trading plan for your trading session.

- Protect your capital by planning your trade size.

- Use technology to help you and know your tools.

- Use a stop loss to protect against trades going against you.

- Keeping your trades simple will make them more profitable.

- Choose a broker with good trading conditions and market analysis.

- Be disciplined and patient.

Let’s look at these seven areas in a bit more detail.

How to Start Forex Trading

Tip #1: You Must Have a Trading plan

You need to have a reliable trading plan and a strict trading routine if you want to succeed in Forex trading. If you have been trading for a while but still aren’t making the profits you expect, it’s likely because you’re not using an effective trading plan.

Trading on intuition, without the support of a trading plan, is a recipe for disaster. You have to look at Forex trading like running a business. Every successful trader has an effective trading plan with a solid structure that can guide them through the day-to-day fluctuations in the market.

Having a trading plan will also help traders manage the emotional drive many beginners have, which can hijack the inexperienced trader in stressful trading situations.

Tip #2: Protect Your Capital

Traders should engage defensively with the market and not risk more than 2% of their trading account capital. Warren Buffett summed up this trading tip well: “Rule No.1 never lose money. Rule No.2 never forget rule number one.” This strategy will protect traders from making a single bad trade that affects their account balance to the point that the future of their account is jeopardised.

Tip #3: Use Technology to Your Advantage

In a fast-moving trading environment like the Forex market, a trader needs to use the right tools to help them be more effective. If you are a chart trader, you should use tools to help you faster identify and trade price patterns.

If you are trading the fundamentals and news releases, you should be keeping a close eye on market news feeds and event calendars to plan your day. This is done to ensure that you are trading from news as it comes out, rather than trading reactively based on market movements.

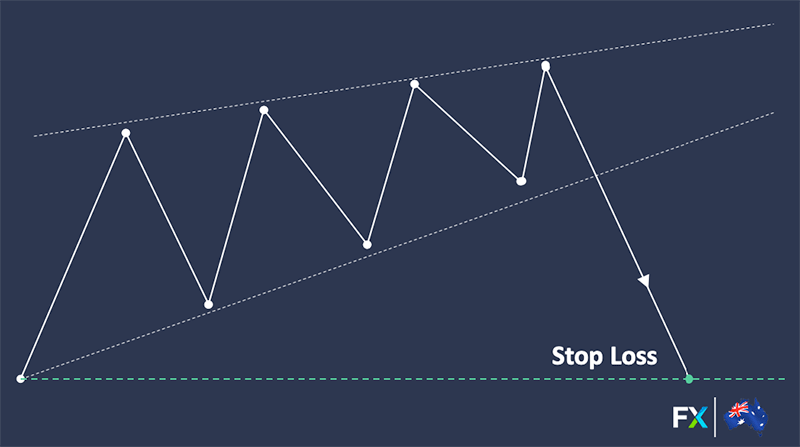

Tip #4: Use a Stop Loss

You should develop a good habit of using stop-loss orders so you can protect your capital. This way you’ll be better prepared and can handle the losing trades much easier because you know the amount you could potentially lose on each position before entering the trade.

A stop-loss will help most when the market moves fast and you become indecisive. In moments like these, a stop-loss order will work to your benefit by closing your loosing trade and keeping your losses small.

Tip #5: Keep it Simple

Having a simple strategy will help traders get better results. Relying on too many data sets can be detrimental to your effectiveness lead to indecision.

Simplicity does not mean limiting yourself to specific data but extends to the currency pairs traded, and the markets monitored. Start small, and once you feel comfortable trading these areas, then start looking for other smart opportunities. This staggered approach will make your trading career a more painless process.

Tip #6: Choose Your Broker Carefully

Choosing a reliable broker is an important step in getting started. When evaluating Forex brokers using a published review process that focuses on:

- Regulation and reputation

- Trading conditions

- Trading platform choice

- CFD assets available

- Deposit and withdrawal processes

- Education and market analysis material

We summarise the results of our research in our State of the Forex Market Report, where each broker is scored in each of these categories and overall. Be sure to choose a broker which is reliable, offers good trading conditions, and suits your trading needs.

Minimum requirement for choosing a broker: The broker you’re doing business with needs to be regulated and have the proper licenses from major regulatory bodies. In Australia, the regulatory body is called ASIC, and you broker having this regulation is one way to be safe in your trading and to make sure your funds won’t be stolen or lost in a bankruptcy. Here are our choice of leading ASIC Regulated brokers.

Tip #7: Be Patient

The occasional trader will choose to start trading Forex because they think it’s an easy way to make money. Forex trading is more often the opposite of a get rich quick scheme, and a profitable trading career will need patience and discipline. Succeeding in this business will come after a long time, with trading success rarely happening immediately.

The best advice for new traders is to be patient, and always use a demo account to get started.

Conclusion

Having the discipline to follow these tips on a day-to-day basis will make the difference between profit and loss. Read through the rest of the education section for other in-depth articles to help you get started.

Stay updated

This form has double opt in enabled. You will need to confirm your email address before being added to the list.