Forex trading in Australia is a popular form of investment. It is completely legal and Australian Forex traders are protected by the Australian Securities and Investments Commission (ASIC). This beginner’s guide is intended to help Australian residents learn how the Forex market works and how to get started trading.

What is Forex Trading?

Forex trading, derived from Foreign Exchange, is the process of exchanging one currency for another. Also called FX trading, Forex trading is a standard in international business and is used by financial institutions and investment banks to make profits and hedge their other investments. Forex trading is also a popular form of investment for private citizens – called retail Forex traders – in Australia and around the world.

How does the Forex market work?

The Forex market is the largest and most liquid financial market in the world, with a trading volume in 2019 of approximately 6.6 trillion USD every day. Forex trading is the buying and selling of currencies on this market. A Forex trader will buy a currency at the current market price and sell it again at a target price in the future. Because currency prices are always changing, the purchase and the sale price will be different, and the difference between the two prices will be the trader’s profit or loss.

It is only because of this market volatility that Forex traders can make a profit. Even though the Forex market operates 24 hours a day, market volatility tends to peak during the regular opening hours of the stock markets in Sydney, Tokyo, London and New York. The highest volume of trading generally occurs at the overlap of the London and New York opening hours, and this is when Forex traders are most active. It closes for a weekend period when trading will be paused and then resumed the moment the market opens again.

Major Markets Sessions – Sydney Time

How do I start trading Forex?

The only way for retail traders to access this international market is via an intermediary called a Forex broker. A Forex broker will provide the trading software and market access for their clients, so a trader can do market research and buy and sell currencies. These are our top four choices of brokers for beginner traders.

Broker | Broker Score | ASIC License | Regulators | Min. Deposit | Beginner Friendly | Cost of Trading | Trading Platforms | Total # CFDs | No. of FX Pairs | Trading Commission | Compare | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

4.68 /5 Read Review | 424008 |     | AUD 100 | 30:1 | Excellent | USD 7 | MT4, MT5, markets.com | 1009 | 56 | Fees Included in Spread | ||

| 4.61 /5 Read Review | 414530 |     | AUD 100 | 30:1 | Excellent | USD 10 | MT4, MT5, cTrader, TradingView | 1275 | 100 | From 7 USD / lot - Razor Account | |

| 4.59 /5 Read Review | 406684 |     | AUD 100 | 30:1 | Excellent | USD 9 | MT4, MT5, Avatrade Social, AvaOptions | 872 | 55 | Fees Included in Spread | |

| 4.56 /5 Read Review | 335692 |     | AUD 200 | 30:1 | Excellent | USD 8 | MT4, MT5, cTrader, TradingView | 1744 | 64 | 7 USD / lot - Raw Spread Account | |

| 4.45 /5 Read Review | 443670 |     | AUD 5 | 30:1 | Excellent | USD 6 | MT4, MT5 | 1554 | 57 | Fees Included in Spread |

How does Forex Trading work in Australia?

In Australia, Forex trading is regulated by the Australian Securities and Investments Commission (ASIC). ASIC is responsible for protecting Australian residents from financial fraud and ensuring a healthy, competitive financial marketplace. It oversees any company that provides a financial service including Forex brokers, banks, hedge funds, insurance companies and the Australian Stock Exchange.

ASIC is known as one of the toughest and smartest regulators in the world. When the UK and EU introduced restrictions on Forex trading in 2018, ASIC waited and collected evidence from all stakeholders in the Australian Forex trading community before acting.

One of the key turning points in ASIC’s investigation was the publication of Report 626 in August 2019, which showed that complaints against Forex and CFD brokers were accelerating fast, making up a third of all complaints received by ASIC in 2019. The report also showed that the CFD trading industry was growing rapidly, with turnover doubling from A$11 trillion in 2017 to A$22 trillion in 2019. Most worryingly for ASIC, the data showed that financial inducements to start trading were provided to over 225,000 traders between 2017 and 2018 (almost a quarter of all traders) and that Forex traders who had fallen into negative balance owed over A$33 million to their brokers in 2o18.

A follow-up report from 2020 found that during a volatile five-week period in March and April 2020, the retail clients of a sample of 13 CFD issuers made a net loss of more than $774 million. It also found that more than 15,000 retail client CFD trading accounts fell into negative balance in this period, owing a total of $10.9 million to their brokers.

From March 2021, ASIC introduced a set of new restrictions to protect Australian retail traders from further heavy losses, bringing the Australian Forex industry broadly into line with the EU and the UK.

ASIC-regulated Forex brokers are now subject to the following regulations:

- Leverage restrictions: 30:1 leverage on Forex, 2:1 leverage on cryptocurrency CFDs

- Negative balance protection: Traders can only lose what they have in their trading account and will never owe a broker money

- Ban on financial inducements: All bonuses and promotions (i.e. first deposit bonuses, tech giveaways, volume bonuses) are prohibited

- Ban on binary options: Binary options are a particularly risky form of speculation and are banned completely

ASIC has not followed suit with the EU and UK completely though. Crypto CFDs are still available to trade in Australia (they are banned in the UK) and Australian brokers do not have to publish risk warnings on their websites, as this was seen as an encouragement to trade in many cases.

Wholesale Clients/Professional Traders in Australia

Some of these protections (leverage limits, negative balance protection, binary options trading) can be waived by traders who meet the “wholesale investor” (professional trader) requirements. Wholesale clients must meet one of two of the following criteria:

- Wealth: A$2.5 million in net assets OR A$250,000 income for the past two years

- Sophistication: Two of the following

- A minimum of 40 Forex trades of A$100,000+ in the previous year (or 15 per quarter)

- Total portfolio assets of A$250,000+

- Worked as a professional in the financial sector for at least 1 year

Traders should be aware that wholesale clients also lose access to any dispute resolution mechanism and compensation schemes that must be offered by a broker to normal retail clients.

Offshore Forex Brokers

Australians are not required by law to trade with an ASIC-regulated broker, though it is recommended, and there are a few brokers without ASIC regulation (called “offshore brokers”) that offer their services to Australian residents. Trading with an offshore broker does mean that traders will have access to higher leverage and will be provided bonuses, but traders may also lose access to negative balance protection and other powerful protections such as dispute resolution and compensation schemes.

Unlike many offshore brokers, ASIC-regulated Forex brokers are required to keep their clients’ money separated from company operating funds and are audited on a regular basis to ensure that client funds are not misused. All ASIC-regulated brokers must also be managed by qualified directors and have strict capital adequacy measures to avoid bankruptcy.

AUD Trading Accounts

Australian Forex traders can also take advantage of the Australian dollar (AUD) Forex trading accounts. Most ASIC-regulated Forex brokers will also offer trading in AUD, as well as US Dollars (USD) or Euros (EUR). If an Australian trader has a USD trading account, they lose money in currency conversion every time they deposit or withdraw money. With an AUD trading account, there are no conversion fees. In addition, most AUD trading accounts are kept in Australian banks, so withdrawals and deposits are much faster.

Having your trading funds in a local bank also provides more security for Australian traders. In the event of broker bankruptcy or closure, ASIC can freeze the broker’s accounts and recover your funds.

Advantages of Forex Trading

The most obvious advantage is the potential for high returns and financial freedom. Many Forex traders dream of making enough money to quit their day jobs. But not everyone will be able to do this. Traders have to develop new skills such as market analysis, data analysis, charting and a knowledge of how economic news impacts the Forex markets. Other advantages that Forex trading has over other forms of investment:

- Accessibility: Being able to invest online, either on your phone or your home computer. Almost anyone can trade Forex.

- 24 Hour Market: Unlike stock exchanges, the Forex market is open 24 hours a day, 5 days a week.

- Leverage: Forex trading is leveraged trading. With a relatively small amount of money, leverage allows traders to open large positions and amplify their profits.

- Short Selling: Forex traders can easily sell a currency pair and profit when the price goes down.

- Low Initial Cost: Forex trading is relatively low-cost to get started. Most brokers will only require the equivalent of a 100 AUD deposit to open an account. Some brokers have no minimum deposit requirement at all.

Disadvantages of Forex Trading

The main disadvantage of Forex trading is the high level of risk involved. Latest figures showed that 63% of Australian Forex traders lose money and profitable trading takes skill, education, discipline, and caution. Even professional traders will lose money, as the markets are never completely predictable. The main risks in Forex trading are:

- Leverage: Yes, also an advantage (see above). But, while leverage will amplify your profits, it will also amplify your losses

- Unpredictable Volatility: In times of economic or political crisis currency prices can change quickly. Crisis events are often impossible to predict.

- Unregulated Brokers: Some brokers are unregulated, or poorly regulated. In the event of a dispute with an unregulated or poorly regulated broker, the trader is often powerless.

- High Trading Costs and Withdrawal Fees: Some brokers charge high trading fees or high withdrawal fees. High trading fees can turn a profitable trade into a losing trade. High withdrawals fees will also eat into profits.

The other disadvantage is the time needed to trade profitably. The best time to trade Forex in Australia is overnight from Monday to Friday. This is also the time most people are asleep. Forex trading can be a time-consuming activity and many beginner Forex traders don’t have the time or energy to spend in front of their home computers half the night.

Tips for Beginner Forex Traders

Before we get into the detail of how to trade Forex, here are some quick tips for beginner traders:

- Understanding how the Forex market works is essential. Without education, Forex trading is just gambling.

- Always use a demo account before you start trading with your own money

- Take courses on technical analysis, data analysis and market economics.

- If you are going to spend a lot of time trading a single currency pair, learn what moves that currency pair’s price and when these price changes happen.

- Always use a reputable and regulated Forex broker. Be sure to read the client contract terms and fine print.

- Be aware that most bonuses offered by Forex brokers cannot be withdrawn. These can only be used to supplement your trading account.

- Make sure that your chosen Forex broker offers negative balance protection. Without negative balance protection, you may end up owing your broker money after a heavy loss.

- Develop a trading strategy and test it with a demo account before you try it in the live market.

- Think carefully about how much money you want to put in your trading account. Never use more than you can afford to lose.

- Only ever risk a small percentage of your account balance at a time. Even if your trading strategy has a 70% win rate, if you risk a quarter of your money with every trade it only takes a small run of bad luck to wipe your account out.

- Use a stop-loss. It’s better to lose a small amount and try again tomorrow than lose everything.

- All Forex traders lose money, even professionals. When you make a losing trade don’t lose your discipline or discard your trading strategy. Consistency is essential.

Important Forex Trading Terms

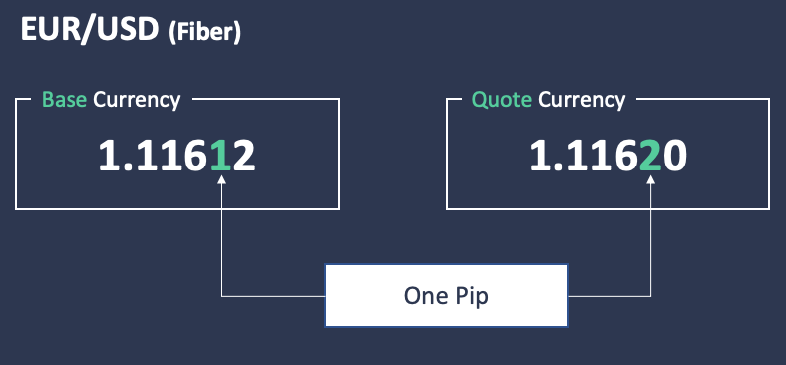

- Pips: Pip stands for “Point in percentage”. In Forex trading, pips represent the fourth decimal place of a currency pair, except for the Japanese Yen where the pip represents the second decimal place. Pips are a unit of measure used to analyse price changes in a financial asset. The term is commonly used across all financial markets as a standard unit of measurement.

- Spread: The spread is the difference between the purchase price and the sale price of a financial asset and is measured in pips (see above). In Forex trading, the spread can be fixed or variable with variable spreads being more common.

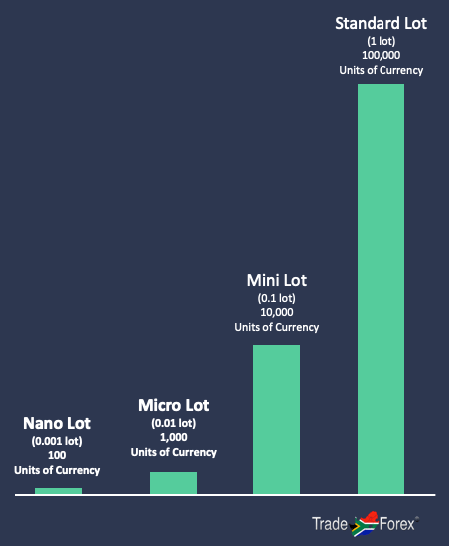

- Lots: Lots are a standard unit for measuring trade volume in Forex trading. 1 lot represents 100,000 units of a currency pair: 1 lot of EUR/USD is €100,000 of the pair. One mini lot is 10,000 units of a pair and a micro lot is 1000 units of the pair.

- Margin: Your margin is your deposit made to hold open positions. It is a portion of your account capital that is held in reserve, like a deposit, representing a percentage of the total value of your trades.

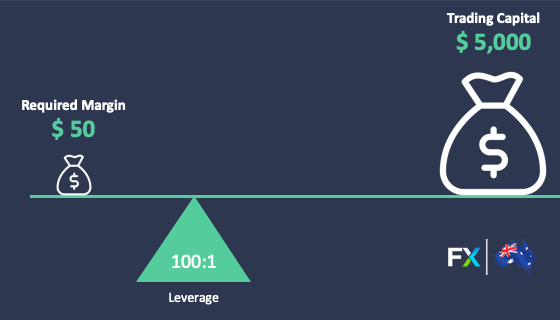

- Leverage: Leverage is a term used by investors and traders to describe borrowing money from a broker to open a larger position in the market. With leverage, Forex traders can open positions many hundreds of times larger than the value of their capital. While leverage will amplify gains, it all also amplifies losses and needs to be managed carefully.

- Negative Balance Protection: This is a form of insurance. With leveraged trading, a bad loss can send your trading account negative. In this case, the trader will owe the broker the negative balance. Many brokers offer negative balance protection so traders never owe a broker money.

- Major Pairs: The major pairs are the most traded currency pairs in the world. There are 7 major currency pairs:

-

- EUR/USD (Euro/United States dollar) – the most traded pair

- USD/JPY (United States dollar/Japanese yen)

- GBP/USD (Great British Pound/United States dollar)

- AUD/USD (Australian dollar/United States dollar)

- USD/CAD (United States dollar/Canadian dollar)

- USD/CHF (United States dollar/Swiss franc)

- NZD/USD (New Zealand dollar/United States dollar

-

- CFDs: CFD is an acronym for Contract for Difference. CFDs are derivative instruments in which the value of the instrument is based on an underlying asset. When trading CFDs (whether Forex, indices, commodities or shares) neither the CFD broker nor the trader ever own the underlying asset.

Components of a Forex Trade

A Forex trade has four main components – the asset, the size of the trade, the price, and the direction (buy or sell). Each of these is unique and affects the profitability of the trade.

Currency as an Asset Class

There are many different CFD asset classes, of which currencies or Forex is one. Currency CFDs are unique in that currencies are traded in pairs, meaning that as you buy one side of the pair, you are selling the other.

When trading AUD/USD, the trader is buying Australian Dollars and selling US Dollars simultaneously.

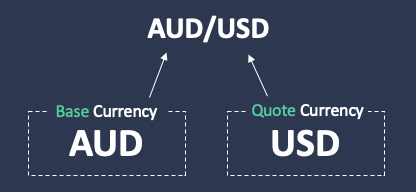

The Asset: Currency pairs

In Forex trading, the asset is always a set of two currencies called a currency pair. Currencies are quoted in pairs, as the two currencies in a pair are bought and sold simultaneously. An example pair is the EUR/USD (Euro/U.S. dollar). The first currency of any pair is called the base currency and the second currency is called the quote currency. In the AUD/USD, the Aussie Dollar is the base currency and the US Dollar is the quote currency.

The Major Pairs

The major currency pairs are most commonly traded because they are the most volatile and they are highly liquid. The major pairs all include the USD as part of the pair.

The Minor Pairs

The minor currency pairs are not a fixed list like the majors. They are generally currency pairs that do not include the USD. Some examples might be:

- EUR/JPY – Euro / Japanese Yen

- GBP/AUD – British Pound / Australian Dollar

- AUD/NZD – Australian Dollar / New Zealand Dollar

The Exotic Pairs

The final group are called exotics and are generally pairs containing currencies from a well-developed economy and a developing economy. Examples could be:

- EUR/BRL – Euro / Brazilian Real

- GBP/ZAR – British Pound / South African Rand

- AUD/MYR – Australian Dollar / Malaysian Ringgit

The price: Forex quotes

The value of a currency is called a quote or a price. As currencies are quoted in pairs, the value of the quote currency is set in relation to the base currency.

For example, if the EUR/USD is priced at 1.1332, it means that 1 euro can be exchanged for 1.1332 US dollars. In Forex trading, the change in price of one currency relative to another is what generates a profit or loss.

Pips: Calculating price fluctuation

Price fluctuation (or the difference between two prices) is often measured and expressed as a value in pips. A pip is a small change in the value of a pair and is measured in the 4th decimal place; for example, if the EUR/USD trades at 1.1332, a one pip price increase would move the exchange rate to 1.1333.

There are exceptions to this rule, the most notable being Japanese yen quote pairs, such as USD/JPY, where a pip is a change in the 2nd decimal place.

Calculate It Yourself!

Quotes and Spreads: Ask price, bid price and trading costs

The value of a currency pair is expressed using a two-price quotation system: One price is for buying – or going long – and is called the ask price, this will be slightly above the market price. The other price is for selling – or going short – and is called the bid price, this will be slightly below the market price. The prices are set by your broker and the difference between the two is called the spread.

It’s best to see the spread as a broker’s fee for using its trading platform. The spread is measured in pips and is often the largest component of your trading costs. The spread is typically different for each currency pair and is influenced by factors like the pair’s liquidity, the broker’s mark-up and the broker type. Some brokers offer very tight spreads, often based on the raw interbank rate, and in these cases you will pay commission on every trade.

Here is an example of a 1-pip spread on the EUR/USD pair:

- Bid price:1.1332

- Ask price:1.1333

The spread is the ask price minus the bid price = 0.0001 = 1 pip.

Trade size: Lots, mini lots, micro lots and nano lots

The size or volume of a trade is measured in lots. This is similar to how stocks (equities) are measured in shares and gold, which is measured in ounces.

One standard lot is 100,000 units of a currency pair. So, if you buy one standard lot of the EUR/USD, you’re entering a trade worth 100,000 euro (which is more than USD 100,000).

One mini lot is 10,000 units of a pair. A mini lot of the EUR/USD is worth 10,000 euro.

One micro lot is 1,000 units of a pair. A micro lot of the EUR/USD is worth 1000 euro. In most cases, a micro lot is in most cases the smallest trade you can place, though some brokers will offer nano lots of for smaller account types.

Leverage: Amplifying exposure but increasing risk

Trading with leverage involves borrowing money from a liquidity provider to greatly increase the size of your trade. A trader will place a small deposit, known as the margin, and the rest of the trade value will be leverage. Your profit or loss will be based on the full value of the trade, not just your margin.

Most CFDs are traded with leverage because they allow traders to open much larger positions than their account balance would normally allow.

Using high leverage can increase your profit potential considerably but will also considerably increase your risk. Traders who use excessive leverage are exposing themselves to significant losses.

Here is an example to demonstrate how leverage can be used to place larger trades with less capital:

Let’s say you have a small trading account of USD 100. You have access to leverage of 1:500. You place a trade of 0.1 lots (one mini lot) on the USD/JPY pair. One mini lot is 10,000 units of the pair, which means the value of your trade is USD 10,000. Although the notional value of the trade is USD 10,000, only USD 20 of your account is engaged in opening the trade because 1:500 leverage means that you need to put down only 0.2%* of the notional amount of the trade.

*This example doesn’t consider the extra margin required to sustain a position with a floating loss.

High levels of leverage are the primary reason for large losses by retail traders. A June 2018 study by ASIC showed that “63% of clients who trade CFD over currency pairs lose money” and promoted further investigations into leverage by the regulator. It also noted that “Complex product features, such as the high leverage offered in CFDs—as high as 500-to-1 for foreign exchange CFDs—or the high likelihood of cumulative losses inherent in binary options, have contributed to retail clients’ financial losses and can often be misaligned with their needs, expectations and understanding“.

Following these findings, ASIC released a Product intervention: OTC binary options and CFDs in August 2019, which has will “impose conditions on the issue and distribution of OTC CFDs to retail clients including imposing leverage limits“. Further information is expected in 2020, but the likely outcome will be a restriction in leverage offered to retail traders who have not applied for professional status.

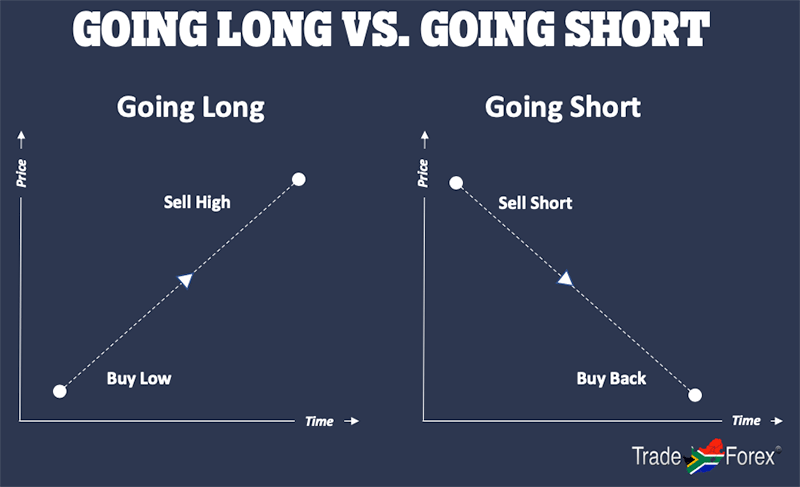

Trade direction: Going long or going short

We touched on going long and going short earlier, but let’s look at what we mean in more detail.

CFD traders can speculate on whether an asset will increase or decrease in value and can profit either way. Profiting from the decreasing value of an asset is unique to CFD trading.

Long is the term used for buying, where the trader speculates that the price of the base currency will rise relative to the quote currency. In simple terms, you will make money from a long (buy) position if the price of the currency pair rises.

Short is the term for selling, where the trader speculates that the price of the base currency will fall relative to the quote currency. In simple terms, you will make money from a short (sell) position if the price of the currency pair declines.

Example – trading 1 micro lot on the EUR/USD

Let’s say your trading account which is funded with USD 1000 and your account’s leverage is 1:100. The EUR/USD currency pair is trading at 1.20000. You speculate that the EUR will increase in value against the USD and you buy 1 micro lot at 1.20000. You set a stop loss at 1.19000 (100 pips below your entry price) and a take profit at 1.23000 (300 pips above your entry price). One micro lot (0.01 lots) is worth EUR 1,000, which is equivalent to USD 1200 in this scenario. As your account’s leverage is 1:100, only USD 12 of your account is used to open the position*.

*Extra margin is required to sustain a floating loss.

If your trade is correct

The euro strengthens against the U.S. dollar and hits your profit target at 1.23000. The 1000 euro you initially bought for USD 1200 is sold for USD 1230, which means you’ve made a profit of USD 30.

Another way to calculate your profit is to multiply the number of pips you’ve made by the pip value of a micro lot, which is USD 0.10 on the EUR/USD. So, 300 pips multiplied by USD 0.10 gives you a profit of USD 30.

If your trade goes wrong

The euro weakens against the U.S. dollar and hits your stop loss at 1.19000. The 1000 euro you initially bought for USD 1200 is sold for USD 1190, which means you’ve lost USD 10 on the trade.

Another way to calculate your loss is to multiply the number of pips you’ve made by the pip value of a micro lot, which is USD 0.10 on the EUR/USD. So, 100 pips multiplied by USD 0.10 gives you a loss of USD 10.

Volume and Size of Trade

The size of a trade is the amount of capital invested in a single trade. Risk management tells us that trade size should always be connected to relative certainty of winning the trade, and basic trading guidelines.

As a rule of thumb, traders should never risk more than 2% of their account balance in a single trade. If a trader has an account balance of 500 AUD, then never risk more than 500 AUD x 0.02 = 10 AUD in a single trade.

While it is tempting for novice traders to think of trade size in Dollar amounts, experienced traders will advise considering trade size as a percentage of your account balance. Always keep it below 2%.

What is a Forex Trading Platform?

Some beginners assume that a Forex trading platform (also “trading platform” or “Forex platform” or just “platform”) is the same thing as a Forex broker. This is not true. Forex trading platforms are the software used to make trades, whereas Forex brokers are the companies that connect trading platforms to the Forex market.

- Forex trading platforms are the software used to make trades on the Forex market

- Forex brokers connect trading platforms to the Forex market

Which is the Best Forex Trading Platform?

Many traders believe that MetaTrader 4 (MT4) is the best trading platform because it is the most popular. Some traders think that MetaTrader 5 (MT5) is the best because it is newer and has more functions. Some traders think that cTrader is the best because it is easy-to-use but is very customisable.

Some Forex brokers also have their own platforms. They are usually web-based and are better suited to beginner traders as they have a simplified interface and fewer customisation options. The main problem with a broker’s own trading platform is that it can only be used with that one broker, whereas MT4, MT5 and cTrader can be used with many different Forex brokers.

MetaTrader 4

Metatrader 4 (MT4) is the most popular Forex trading platform in the world and is supported by most Forex brokers in Australia. It is a third-party trading platform, which means that traders can use the same MT4 platform with different Forex brokers.

- MT4 is a high-speed and customisable trading platform, complete with a charting suite where charts can be overlaid with indicators from MT4’s library.

- MT4 allows users to build or buy expert advisors (or trading robots) and use them to automate their trading.

- MT4 is available on mobile, tablet, in a web browser and as a downloadable application.

MetaTrader 5

MetaTrader 5 (MT5) is the most recent version of the MetaTrader Forex trading platform. Unlike the basic version of MT4, MT5 allows trading on exchange-listed assets like stocks and ETFs. Though still not as popular as MT4, MT5 is supported by a growing number of Forex brokers.

- MT5 has more features than MT4 and comes with an Economic Calendar, Depth of Market indicator and an embedded chat function,

- Aso features unlimited chart windows, 80 built-in indicators and 12 more time-frames than MT4.

- MT5’s new scripting language is a more efficient language for building EAs

Unfortunately, MT5 is not backwards compatible with MT4, so any trading robots made for MT5 will not work in MT4 and vice versa.

cTrader

Launched in 2011, cTrader offers high-speed execution and is easier to use than MT4 and MT5. Like MT4 and MT5, cTrader is a third party trading platform, so traders can use their version of cTrader with multiple Forex brokers. cTrader Automate also lets traders build trading robots to automate their trading. Other cTrader features are:

- Detailed trade analysis, including the Analyse Tab, which provides an overview of the performance of your account

- Advanced platform customisation with cTrader Automate (formerly cAlgo)

- The ability to add multiple take-profit orders.

- Comprehensive educational videos available within the platform.

Most Forex brokers who offer cTrader don’t make money from the spread and will instead charge a commission per trade. Trading robots built for MT4 and MT5 will not function in cTrader.

Other Forex Trading Platforms

Some Forex brokers (like eToro or XTB) operate their own trading platforms and will not provide support for MT4, MT5 or cTrader. But most brokers with their own trading platforms will also support one of the third-party platforms. Broker’s own trading platforms tend to be easier to use for beginner traders as they have fewer functions, less customisability and simpler interfaces.

What affects currency exchange rates?

Like all markets, currency prices are set by supply and demand. But the constant shifts in supply and demand of the dozens of frequently traded currencies makes the Forex market more complex than most. Happily, there are a few indicators that traders can use to help them predict price movement.

Central Bank Economic Policy

National economic policy, set by central banks such as the Bank of England in the UK or the Federal Reserve in the USA, can have major effects on currency prices. Following the 2008 crash, some central banks engaged in quantitative easing or increasing the supply of money in circulation, which causes a currency’s price to drop. On the other hand, raising interest rates (usually used to combat inflation) will cause a currency’s price to increase as this leads to higher investor demand.

If economic policy changes without warning it can create major fluctuations in currency value. In 2015 the Swiss National Bank (SNB) abruptly scrapped the Swiss Franc’s peg to the Euro with no warning. This resulted in a huge increase in the value of the franc versus the euro – moving from 1.2 CHF/EUR to 0.86 within hours of the news.

Current Events

Current events can also affect the price of a currency. The Brexit debacle in the United Kingdom is a perfect example: Large investors like to move money into strong, predictable economies; so Brexit uncertainty caused institutional investors to move their capital out of the country, decreasing demand for the GBP and causing it to lose value. Once it appeared that the British Parliament had successfully agreed on a Brexit deal, the value of the GBP rose again.

You can see this effect anywhere you look in the world, if a good piece of economic news appears about a nation-state, its currency will increase in value. If the news is negative, the currency’s value will decrease. As a rule, the better health a country’s economy is in, the stronger and more stable its currency will be.

Trading Strategy

There are a few common strategies in Forex trading, the strategy that works for you will be dependent on your personality and lifestyle.

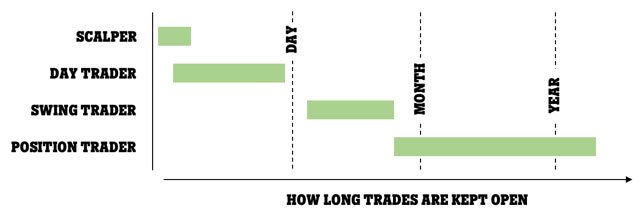

- Scalping: Scalping is when you open and close trades very quickly in times of very high volatility. The goal is to make lots of small profits over the course of the period of volatility. Scalping can be effective but requires a lot of free time and close attention to detail.

- Day Trading: Day traders open and close all their positions in a single day. Each day is treated as a new market. This trading strategy is less time-consuming than scalping but does require the skilful use of stop-loss and take-profits to be profitable.

- Swing Trading: Swing traders will often keep trades open for days or weeks at a time, making a profit from the general swings in the market. This is even less time-consuming than day trading but requires a good understanding of the normal movements of the currency pair being traded.

- Position Trading: Position traders keep their trading positions open the longest of all. This type of trade makes decisions based on economic fundamentals and can keep trades open for months or even years. While position trading is the least time-consuming trading strategy it requires a deep knowledge of global economics and extreme patience.

All trading strategies will require you to engage in market analysis in order to be successful. Market analysis can be grouped into two general types; fundamental analysis and technical analysis.

Fundamental Analysis

Fundamental analysis is the study of macroeconomic trends and their effects on price, this form of analysis requires a sound knowledge of economics and current events. In the broadest sense, Fundamental traders try to buy currencies from stronger economies at a low price and sell currencies from underperforming economies.

Fundamental traders are often reliant on scheduled news events that alter currency price. A good example is the Non-Farm Payroll (NFP) report in the United States; the NFP is released on the first Friday of every month and details how many jobs have been added or lost in the US economy. It’s generally seen as a good bellwether of US economic health and if the figure is higher or lower than expected then we will see increased volatility in the Forex market.

Fundamental analysis can be tough for traders unfamiliar with finance data but for traders who have a firm grasp of the financial news, and understand macroeconomics, this is a very successful approach.

Technical Analysis

Technical analysis is the prediction of future price action based on historical price data. Technical traders make heavy use of charts and will often rely on a variety of tools and indicators to help them identify trends and patterns. Almost all technical analysis is based on Dow Theory, a set of principles laid down in the 19th century by Charles Dow to describe and predict the movement of the stock market.

The most common form of technical analysis is price action trading, which is essentially the analysis of the actions of all the other market participants. Price action traders believe that market psychology is the main driver of price: They believe that there are many reasons for price movement, but that ultimately, its traders’ reactions to developments.

Technical analysis can be tough to learn, but once you have a good understanding of the basics it can be used in any financial market, not just the Forex market.

Analytical Tools

All good traders will use a combination of fundamental and technical analysis to find opportunities in the Forex market and there are several great tools we recommend to get you started:

- Autochartist: is a lightweight technical analysis tool that can be plugged directly into your trading platform. It analyses trends in price action and highlights trading opportunities based on automated technical analysis across a huge number of Forex pairs. Here is our list of brokers that include support for Autochartist for all clients.

- Trading Central: A more robust analysis database that contains over 8,000 assets, including stocks, commodities and Forex pairings. Analysis, both technical and fundamental, provides data and commentary on each asset. Here is our list of brokers that include support for Trading Central for all clients.

- TradingView: An intuitive and advanced financial visualisation platform and active social network for traders and investors. In addition, TradingView offers a huge number of HTML5 charts, stock screeners, hundreds of pre-built technical analysis indicators and a built-in news feed. Here is our list of brokers that include support for Trading View for all clients.

Whatever form of analysis you focus on, these tools will help you find your feet and do a lot of the hard work for you – especially on the technical side. Once you get to grips with technical analysis you will probably want to start customising your platform with indicators and algorithmic trading bots that can automate your trading strategy.

Frequently Asked Questions

Is Forex Trading Legal in Australia?

Yes, Forex trading is legal and regulated in Australia. It is legal to trade with both local Forex brokers and brokers based overseas (offshore brokers).

Is Forex Trading Taxable Income in Australia?

Yes, Forex trading profits are taxable in Australia. This is also true if you are trading with a Forex broker based overseas.

Is Forex Trading a Scam?

No, Forex trading is not a scam. But unfortunately, there are quite a few scammers in Australia who take advantage of beginner Forex traders. Luckily, there are a few easy ways to avoid being scammed.

- Never give money to anyone you meet over social media (Facebook, Instagram, etc.)

- Learn to trade yourself, don’t give money to anyone to trade for you

- Make sure your Forex broker is regulated. You can check the ASIC register here.

- If it sounds too good to be true, it probably is. Don’t trust brokers or individuals that guarantee returns.

Conclusion

Some of these terms and concepts might be tricky to understand at first but it won’t take you long to get it when you see it in action. The best way to learn the basics of Forex trading is to practice on a demo account and place a few trades. We still have plenty of good information waiting for you! Take a look at the articles below to further develop your skills and knowledge…

Essential reading

- These 7 tips for beginners is a must-read for any aspiring Forex trader.

- How to create Forex trading plan

Expect to learn a lot before trading profitably. You need to learn how to operate the software, do analysis, and manage the risk in the account. We have an education section to continue reading and explore many of the principles to succeed in trading. Here are the articles most relevant to getting a good start.

- Pips are used for measuring changes in currency value. But how?

- Leverage can be used to grow your profits. Learn to calculate leverage needed

- Charts – Understanding Bar Charts, Volume & Time Comparisons

- How should I manage my risk with Stop Loss and Take Profit?

- Pivot points are a change in the direction of the market. Learn more about them for your trading.

Risk in Forex Trading

Trading CFDs comes with significant risk, and if you are concerned about losing any of the money that you are depositing, then don’t trade Forex. Forex trading is not a get rich quick scheme and requires dedication and study.

As a trader, you will need to develop a trading plan, understand risk management, and have a goal with what you want to achieve. Don’t start depositing money until you are sure you want to give this a good shot. Every trader loses trades that they were sure they would win, so expect the unexpected and have a plan for when your trades fail.